Ryan Fletcher

Bombardier (OTCQX:BDRBF) is one of the companies that I have been following for years. Admittedly, for a long time it has been a non-preferred name to hold for investors, in my view. The main reason was the erosion of the company financials because of the C Series, now Airbus A220, and the agreement with Airbus (OTCPK:EADSF) would never repay Bombardier in a reasonable way due to the way the agreement was structured. The result was a failed turnaround that ended in Bombardier taking itself to the chopping block, transforming itself from a transportation company to a business jet manufacturer.

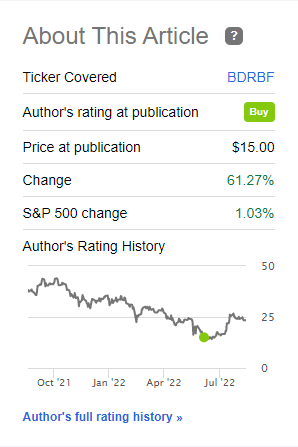

Bombardier stock shows major outperformance

Performance Bombardier since publication (Seeking Alpha)

Initially I was not really a big fan of Bombardier transforming itself into a business jet manufacturer. In February 2021, I issued a Hold rating on Bombardier not necessarily because of its product but mostly because of the scalability of its business combined with debt maturities and the economic outlook. However, since then Bombardier shares took off doubling in value and in June I marked Bombardier stock a buy on strong margin expansion and in little over two months shares gained 61% compared to a 1% gain for the broader markets. So, this might have been one of the easiest 60% gains I have written about in the past decade.

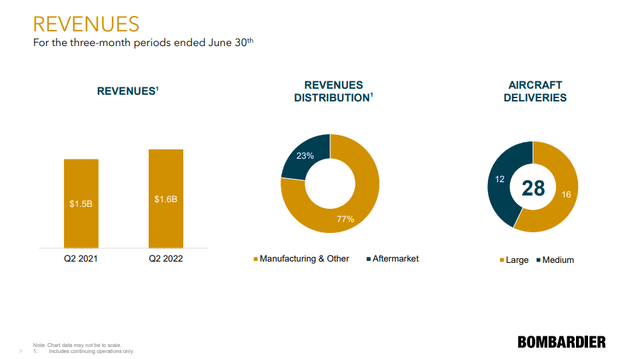

Bombardier Revenues Contract, Earnings Improve

Q2 2022 revenues Bombardier (Bombardier)

Last quarter Bombardier saw its revenues contract due to lower delivery numbers. In the second quarter we saw revenues grow year-over-year by 2%. Manufacturing revenues were down by 2% on lower deliveries partially offset by higher medium size jet deliveries. The improvement in revenues was primarily driven by a 22% improvement in Services revenues as flight activity driving services demand remained high.

As Bombardier is increasing its focus on after-sales support, with planned expansions and openings in London and Miami Florida and inauguration of the Melbourne facility this year, we see that services already are enabling the growth for Bombardier. Ideally, we would like to see growth for manufacturing as well but that’s a bit tougher as Bombardier has focused its business on medium and large business jets and so the reduction in manufacturing units and revenues are driven by this refocus, which Bombardier aims to eventually offset by improving the manufacturing mix.

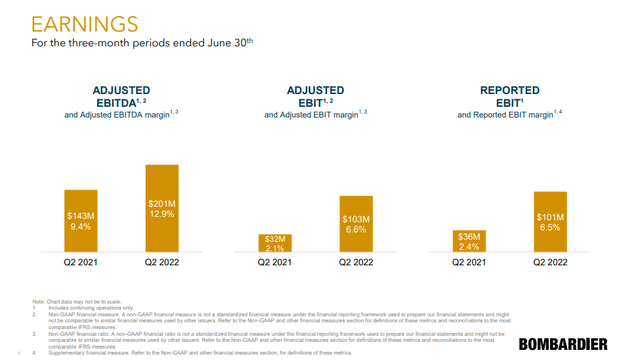

Q2 2022 earnings Bombardier (Bombardier)

The strength of the refocused business also is visible on an earnings level. Revenues improved by $33 million but adjusted EBITDA improved by $58 million showing the operational cost structure improving. Also the Adjusted EBIT and reported EBIT show significant improvement.

The significant improvement in earnings driven by strong revenues and even better cost control also result in improved cash flow. For the second quarter, free cash flow was $340 million up from $173 million in the first quarter. So, free cash flow generation was around $515 million for the first half of the year compared to $91 million in the first half of 2021. The free cash flow is a metric I have been eyeballing as Bombardier has a debt pile that needs to be reduced significantly, and for a very long time the problem for Bombardier was that without positive cash flow, we couldn’t see a sustainable debt reduction effort materializing while there was $9 billion in total debt.

Bombardier ended up divesting some of its businesses in an effort to reduce the debt, but the rest has to be carried by its business operations and that’s now going quite well. The company reduced its debt by $773 million since the start of the year of which $373 million was repaid in the second quarter also reducing its annualized earnings expenses by $60 million. Bombardier started the year with around $7.1 billion in debt and there is now $6.3 billion left showing an 11% reduction in debt year-to-date. I believe that shows that management is laser focused on debt reduction and more than the previous management knows how to get there using its core business.

The strong execution on top and bottom line also positively impacted the free cash flow which was $173 million, marking a $578 million improvement. Those who have followed my Bombardier coverage might remember that one of my concerns was the absence of positive free cash flow.

Bombardier currently has no debt maturing until 2024. That’s quite a difference from 2019 when there was $5.42 billion in debt maturing until 2024. Bombardier has $3.1 billion of debt maturing in the coming five years (2022 included) compared to $4.42 billion in 2019 and $3.4 billion in the previous quarter so that the debt reduction effort is showing traction.

There’s $6.3 billion in long-term debt, $1.4 billion in cash and cash equivalents and $0.4 billion in restricted cash putting Bombardier in a $4.5 billion net debt position. So, the business jet maker is on the right track but does require continued strong cash flows to reduce its debt. Bombardier has guided for $825 million in adjusted EBITDA, its four-quarter rolling EBITDA is $742 million. That brings the current four quarter rolling leverage to 6, down from 7.7 and if EBITDA targets for 2022 are reached it would bring the leverage to 5.4 and likely better. Bombardier targets a net debt to EBITDA of 3x by 2025 on an adjusted basis and if we look at the progress made, I believe they can get there.

Things Are Looking Good For Bombardier

Bombardier Global 7500 (Bombardier)

I believe Bombardier is successfully refocusing its business. It stepped away from the small business jet segment earlier this year and is focusing on medium and large business jets. These jets do not have mature margins yet so there might be some margin pressure but most certainly there’s a strong product line up that will help Bombardier become a healthier business with a big role for expansion in after-market sales where Bombardier hopes that a better global services footprint will also positively reflect on sales for business jets.

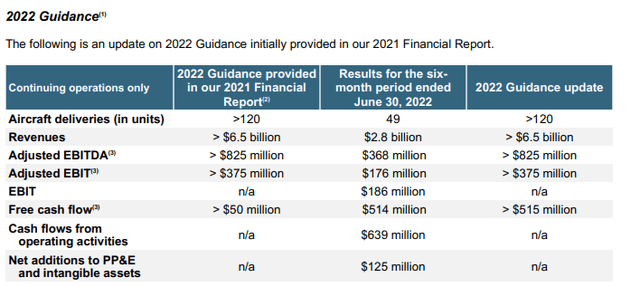

Bombardier Guidance 2022 (Bombardier)

For the full year, Bombardier kept most of its guidance intact but it significantly upped the free cash flow guidance from >$50 million to >$515 million and that’s a big boost to the guidance that I had been expecting. The guidance seems to leave little room for positive free cash flow in the second half of the year but it should be kept in mind that this higher than $515 million guide is likely conservative because of the uncertainties faced and it might in fact be much stronger than the $515 million implied as a minimum. This conservative guidance likely has to do with continued supply chain issues which are also felt by Bombardier.

For Q3, Bombardier is expecting stable EBITDA margins with flat year-over-year output with a big uptick in Q4 while for next year deliveries could be 15% to 20% higher based on demand. Bombardier is selling business jets two years ahead now. Most of the backlog developed during and after the pandemic which gave Bombardier a strong position for pricing with airlines being in recovery mode, and the business jet manufacturer is shielded against inflationary cost pressures on new airplane contracts.

Additionally, Asia Pacific flight activity is snapping back which provides a good outlook for services and eventually business jet sales. Bombardier hinted that at a backlog of three years it could become more difficult to secure sales. So we could see production hikes to keep the medium business jet backlog at two years and for large jets it would be two to three years. So, I would say there’s some upward pressure on the production rates due to strong sales momentum and despite concerns about the economy that sales momentum might prevail.

Conclusion: Bombardier stock continues to be a Buy

Bombardier is tracking extremely well on its operational performance that allows the company to reduce its debt significantly. In the first quarter we observed strong performance with even stronger free cash flow generation in the second quarter. For 2022, I believe we’re going to see continued improvement in the company’s performance resulting in a significant improvement in the leverage and it would be extremely strong to see that leverage go from 7.7 to around 5.0 or better.

While I had concerns about previous turnaround plans from Bombardier, this one is looking realistic and more importantly management has really been thoughtful about it. The company didn’t just present some rosy figures and best-case scenarios to appease investors, but it made a plan focused on business jets and services and made debt reduction its prime target and it executes on that plan and they are performing extremely well. As a result, I think shares continue to be a buy and even a strong buy as its services sales ramp up further, margins on young business jets platforms mature and output is set to increase making a 3x debt-to-EBITDA by 2025 achievable.

Be the first to comment