(Bloomberg) — While equity markets are on a relentless march higher amid optimism around stronger economic growth and cooling inflation, most investors aren’t convinced the gains will last, according to Bank of America Corp’s (NYSE:) latest global fund manager survey.

About 66% of participants in the bank’s February survey said stocks are seeing a bear market rally — signaling they expect them to return to new lows. That’s even as the share of investors expecting a global recession fell to 24%, down from a peak of 77% in November. Pessimism around economic growth is at its lowest in a year, while 83% of fund managers see inflation easing further over the next 12 months, the survey showed.

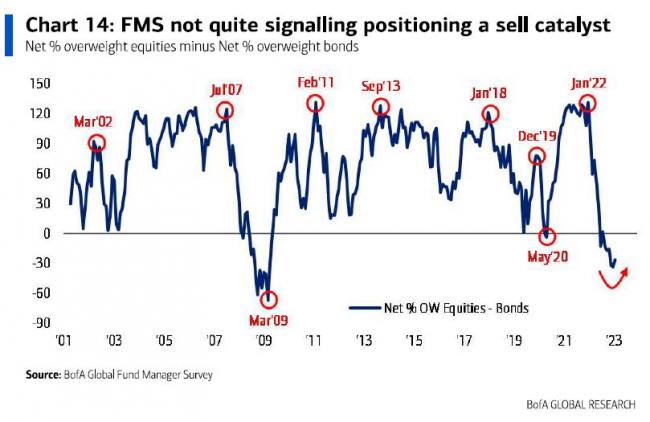

Still, strategist Michael Hartnett said positioning is light enough to avoid a drop in stock prices just yet. About 31% of investors are now underweight equities, compared with a peak of 52% in September, but that’s still a higher proportion than the historical average. Meanwhile, allocations to cash eased this month and are now at levels seen just before the start of the war in Ukraine last February, Hartnett said.

After sinking into a bear market last year, US and European stocks have rallied in 2023 as signs of easing inflation spurred bets that central banks would ease up on rate hikes. Optimism about a reopening in China as well as lower natural gas prices in Europe have also lifted investor sentiment. Still, some strategists including JPMorgan Chase & Co.’s Marko Kolanovic remain cautious about the outlook for stocks, saying they don’t yet reflect the possibility of a recession.

Read More: JPMorgan’s Kolanovic Urges Investors to Ditch Stocks for Bonds

Hartnett — who was broadly negative on equities in 2022 — last week recommended selling the above 4,200 points, about 1.5% above its last close. Equities face their next big test today, when US inflation data will provide clues on the Federal Reserve’s policy outlook.

Bank of America’s survey — which was conducted from Feb. 2 to Feb. 9 and canvassed 262 fund managers with $763 billion under management — showed profit expectations were improving, but remained bearish.

Participants still see stagflation as the most likely macro backdrop, with 83% expecting below-trend growth and above-trend inflation in the next 12 months.

Other highlights include:

- Biggest tail risks are inflation remaining high, worsening geopolitics, deep global recession, staunchly hawkish central banks and a systemic credit event

- About 68% of participants expect China reopening to have an inflationary impact

- Exposure to EM stocks has jumped, with the 3-month rise in allocation being the most on record

- Investors are underweight defensives versus cyclicals for the first time since April

- Most crowded trades: long China equities, long IG bonds, long US dollar, long US Treasuries, long ESG assets, long oil and long EM bonds

Be the first to comment