David Ryder/Getty Images News

For Boeing (NYSE:BA), the order and delivery picture has been somewhat mixed in recent months. Boeing is having success booking orders, but on the delivery side we see that Boeing 737 MAX deliveries are underwhelming and Boeing 787 deliveries remained absent. Each month, I provide an update on the order activity for Boeing and Airbus. I do this on a monthly basis as that’s the smallest timescale on which it’s possible to extract useful data on orders, deliveries and cancellations. Using this timescale, we’re able to more accurately detect trends and inform readers.

In this report, I will be analyzing the orders, deliveries and cancellations processed by Boeing in May. For this analysis, I will be using a set of data analytics tools developed by The Aerospace Forum.

Boeing wins wide body orders

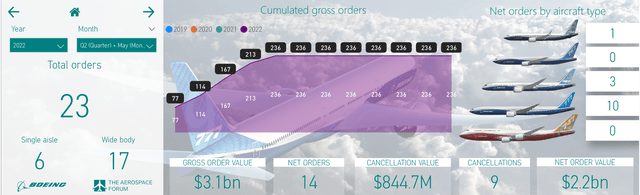

Boeing Commercial Airplane orders May 2022 (The Aerospace Forum)

During the month, Boeing received a total of 23 orders consisting of six single-aisle orders and 17 wide-body orders marking a sequential decline of 23 units:

- American Airlines (AAL) ordered one Boeing 737 MAX.

- Bain Capital Griffin International ordered five Boeing 737 MAX aircraft.

- EVA Air ordered one Boeing 777F.

- Lufthansa (OTCQX:DLAKF) ordered two Boeing 777Fs, seven Boeing 777-8Fs and seven Boeing 787-9s.

As noted, gross order inflow declined for the second months in a row. While there are recession risks and inflationary pressures that add uncertainty to the demand profile, the reduction is not necessarily related to macro pressures. Next month, the Farnborough International Airshow will take place and it’s possible that Boeing is saving up some order announcements to be made during the show. So, the lower order inflow is not a reason for concern.

During the month, the following changes were made to the order book:

- AerCap selected Rolls Royce turbofans for one of its Boeing 787-9s on order.

- Akasa Air cancelled orders for five Boeing 737 MAX aircraft.

- CES Leasing Corporation was identified as the customer for one Boeing 777F.

- Norwegian Air Shuttle (OTCPK:NWARF) cancelled orders for four Boeing 787-9s.

- Southwest Airlines (LUV) was identified as the customer for four Boeing 737 MAX aircraft.

Boeing 777-8F in Lufthansa colors (Boeing)

In April, we saw quite an attractive mix driven by the order from Lufthansa. The Boeing 737 MAX, Boeing 777, Boeing 777X and Boeing 787 all booked orders. So, that’s something that Boeing as well as investors can be pleased with. As always, we also consider the cancellations and on the cancellation front there was some interesting activity as an order from Norwegian for four Boeing 787-9s was cancelled as expected but the airline still has one order in backlog. Separately, Akasa Air cancelled orders for five Boeing 737 MAX aircraft.

The cancellation almost certainly is the result of the sale-and-leaseback transaction between Akasa Air and Bain Capital Griffin International:

During the month, Boeing received 23 orders and nine cancellations, bringing its net order tally to 14 orders valued at $2.2 billion. In the same month last year, Boeing received 73 orders but had to scratch 53 orders from the books, bringing its net orders to 20 units valued at $1.8 billion. So, year-over-year, the net orders were lower but the mix was more attractive resulting in a higher base value for the net orders.

Year-to-date, Boeing received 236 orders and 65 cancellations, bringing its net orders to 171 units valued $13.6 billion. In comparison, last year, Boeing booked 380 orders and 283 cancellations, bringing its net orders to 97 units valued at $9.6 billion. The numbers show that gross order inflow has declined, but so have the cancellations resulting in higher net orders as the higher gross order inflow last year was likely a function of the cancellations. With a ~40% increase in order value (measured by base value), Boeing is having a good year so far.

Boeing also updated its ASC606 adjustments tally, which is a tally in which Boeing lumps orders that have a purchase agreement but also several other check boxes that need to be ticked in order to count the aircraft orders to the backlog or not. During the month, we saw the tally increase by five units. This was driven by orders for five Boeing 737 MAX now considered to be doubtful to be delivered.

If all ASC 606 adjustments result in cancellations, which definitely is not always the case, Boeing would have to scratch an additional 950 aircraft from its books.

Boeing deliveries are not taking off

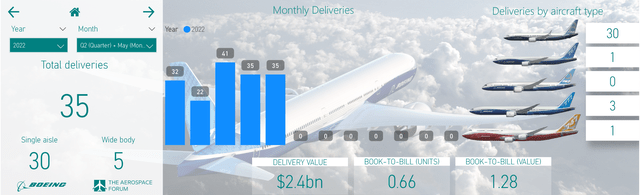

Boeing Commercial Aircraft deliveries May 2022 (The Aerospace Forum)

Month-over-month Boeing’s delivery numbers remained equal with 35 deliveries, valued at $2.4 billion and consisting of 30 single-aisle aircraft and five wide-body aircraft:

- Boeing delivered 30 Boeing 737s consisting of 29 Boeing 737 MAX aircraft and one Boeing P-8A.

- Boeing delivered one Boeing 767-2C used as the base aircraft for the KC-46A tanker.

- Boeing delivered three Boeing 777-300Fs.

- Boeing delivered a Boeing 747-8F to Atlas Air.

- There were no deliveries for the Boeing 787 program.

During the month, deliveries stabilized. What remains is that Boeing 737 MAX deliveries are not meeting expectations. For the inventory of Boeing 737 MAX jets to be depleted at an acceptable rate, we need to see delivery rates far above the production rate and that’s currently not happening. In the first quarter, Boeing managed to deliver just 15 units from its inventory. That’s the number I would actually have expected to be delivered on a monthly basis as a minimum. So, Boeing is not meeting expectations there and it likely won’t be able to positively surprise in the second quarter either. It remains to be seen whether the current delivery rates allow Boeing to meet airline delivery schedules. For instance, Air Canada expects to have six MAX aircraft delivered in the second quarter but only half of them have been delivered by the 22nd of June. Boeing could deliver the remaining three aircraft in a quarter-end delivery surge but overall the quarter-end surges show how Boeing is battling to meet the schedules.

Year-over-year delivery numbers increased from 17 to 35, and value ticked up from $1.4 billion to $2.4 billion. So, we’re seeing an uptick in deliveries and value and interesting to note is that just like this year, Boeing saw stable deliveries in the same month last year. A similar surge in deliveries as observed last year would indicate deliveries to be 93 deliveries in June and that is something I do not see happening.

Year-to-date, there have been 165 deliveries valued at $10.9 billion compared to 111 deliveries valued $9 billion. So, we do see an increase in deliveries and delivery value, but not the delivery volumes you would like to see, given that Boeing has a big pile of jets awaiting delivery. The Boeing 787 is still not back for Boeing, but we are expecting deliveries there as soon as July. Overall, Boeing is highly dependent on the Boeing 737 MAX, but delivery volumes on that program are not satisfactory.

The book-to-bill ratio for the month was 0.66 and 1.28 in terms of value reflecting a heavy weight of the more valuable wide body aircraft in the order mix relative to the deliveries. For the year, we have a book-to-bill of 1.4 in terms of units and 1.7 in terms of value, driven by strong order inflow, while deliveries are mediocre at best.

Conclusion

During the month, the highlight certainly was the order from Lufthansa which included orders for the Boeing 777, Boeing 787 and Boeing 777X. Boeing will most definitely be happy with those orders as especially the Lufthansa fleet was dominated Airbus widebodies and years ago the German airline was interested in the freighter variant of the Airbus A350.

The struggles are mostly on the delivery side. The Boeing 737 MAX is not showing any sign of appreciable delivery ramp up. Supply chain challenges and labor shortages might be playing a role, but one would have expected Boeing to have a better battle plan to unwind its inventories. Year-over-year, there’s growth in the MAX deliveries. There’s no doubt about that but the ramp up is just not coming along as fast as is desirable. At this stage, the biggest concern going forward are the significant supply chain displacements in an already complex supply chain system.

Going forward, the positive for Boeing will be the delivery resumption of Boeing 787 aircraft. That program also is subject to a ramp up, which might be disappointing, but I do believe that Boeing will be able to unwind that inventory in an efficient way.

Be the first to comment