Stephen Brashear/Getty Images News

Last month Boeing (NYSE:BA) stock prices surged as the US jet maker posted delivery figures at the highest level since March 2019 and that positive momentum continued. Share prices continued to increase and are now trading 20% higher compared to the time of publishing the June orders and delivery numbers.

In this report, I will have a look at the orders, deliveries, cancellations and other book adjustments for the month of July. For this I use the TAF Boeing Orders and Deliveries monitor developed by The Aerospace Forum. Each month, I provide an update on the order activity for Boeing and Airbus (OTCPK:EADSF) (OTCPK:EADSY). I do this on a monthly basis as that’s the smallest timescale on which it’s possible to extract useful data on orders, deliveries and cancellations. Using this timescale, we’re able to more accurately detect trends and inform readers.

Big Momentum For Big Boeing 737 MAX

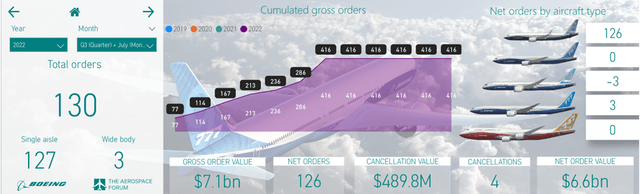

Boeing Commercial Airplane orders July 2022 (The Aerospace Forum)

During the month, Boeing received a total of 130 orders consisting of 127 single-aisle orders and three wide-body orders marking a sequential increase of 80 units:

- Delta Air Lines (DAL) ordered 100 Boeing 737 MAX 10 aircraft.

- Qatar Airways ordered 25 Boeing 737 MAX 10 aircraft.

- American Airlines (AAL) ordered two Boeing 737 MAX aircraft.

- Air Canada (OTCQX:ACDVF) ordered two Boeing 777Fs.

- FedEx Express (FDX) ordered one Boeing 777F.

The following changes were made to the order book:

- Air Lease Corporation was identified as the customer for one Boeing 737 MAX.

- ANA Holdings was identified as the customer for 20 Boeing 737 MAX aircraft.

- A/S Maersk Aviation Holdings was identified as the customer for one Boeing 767-300F.

- Nineteen orders for the Boeing 777X were transferred from ANA Holdings to All Nippon Airways.

- BOC Aviation cancelled orders for three Boeing 787-9s.

- CES Leasing Corporation was identified as the customer for two Boeing 777Fs.

- ICBC Leasing was identified as the customer for two Boeing 737 MAX aircraft.

- Lynx Air was identified as the customer for 29 Boeing 737 MAX aircraft.

- Minsheng Leasing was identified as the customer for 14 Boeing 737 MAX Aircraft.

- Southwest Airlines was identified as the customer for four Boeing 737 MAX aircraft.

- An unidentified customer cancelled orders for one Boeing 737 MAX.

Boeing 737 MAX 10 Delta Air Lines (Delta Air Lines)

July was definitely the month of the Boeing 737 MAX and more particularly the biggest variant of the MAX 10, which faces some regulatory hurdles. With big orders from Delta Air Lines and Qatar Airways for the Boeing 737 MAX placed during the airshow, Boeing saw support for the biggest member of the MAX family. Interesting to note is that the order announcements from the Farnborough Airshow would suggest that 160 orders would be added to the books, but less were added during the month. We traded the shortfall back to absence of the order announcements from 777 Partners for 30 Boeing 737 MAX 200s and 5 orders from AerCap (AER) for the Boeing 787-9. It could be that some elements of the contracts still need to be finalized before Boeing can add them to the backlog. For example, from the AerCap deal it is known that the deal was set up and announced in less than 24 hours with a simultaneous agreement to place the aircraft with a customer. Besides the orders announced at the Farnborough Airshow, Boeing logged orders for three Boeing 777Fs demonstrating the strength of that platform on the freighter market.

In July, Boeing’s orders were heavily tilted toward the Boeing 737 MAX which should not come as a surprise keeping in mind the continued delays on the wide body programs and the differences in demand recovery between single aisle focused markets and wide body focused markets. An uptick in widebody orders might come once Boeing has its programs better aligned to serve customers on a more reliable timeframe and the first steps for that are set with the resumption of Boeing 787 deliveries.

In the order book, we also saw some changes as BOC Aviation cancelled orders for three Boeing 787-9s and an unidentified customer cancelled orders for one Boeing 737 MAX, while a flurry of customers was identified including Lynx Air, All Nippon Airways and Minsheng Leasing.

During the month, Boeing received 130 orders and 4 cancellations, bringing its net order tally to 126 orders valued at $6.6 billion. In the same month last year, Boeing received 31 orders but had to scratch 17 orders from the books, bringing its net orders to 14 units valued at $1.6 billion. So, year-over-year, the net orders were increased driven by lower cancellations and the Delta Air Lines order for the Boeing 737 MAX 10.

Year-to-date, Boeing received 416 orders and 104 cancellations, bringing its net orders to 312 units valued $20.5 billion. In comparison, last year, Boeing booked 630 orders and 373 cancellations, bringing its net orders to 257 units valued at $19.6 billion. The numbers show that gross order inflow has declined and cancellations have improved, resulting in an 18% decline in net orders and a 5% increase in base value for the aircraft. Interesting to note is that net orders have significantly increased, but the value of the orders is slightly higher but not to the same extent driven by the Boeing 767 platform sales for the USAF tanker program.

Boeing also updated its ASC606 adjustments tally, which is a tally in which Boeing lumps orders that have a purchase agreement but also several other check boxes that need to be ticked in order to count the aircraft orders to the backlog or not. During the month, we saw the tally decrease by 31 units. This was primarily driven by the orders some orders previously earmarked as doubtful to be filled now being added back to the backlog.

If all ASC 606 adjustments result in cancellations, which definitely is not always the case, Boeing would have to scratch an additional 836 aircraft from its books.

Boeing’s Aircraft Deliveries Tumble

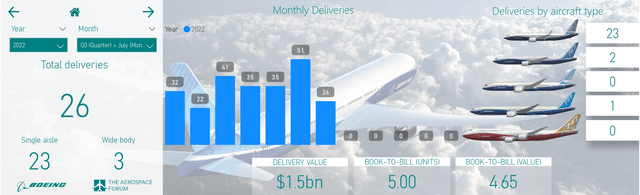

Boeing commercial aircraft deliveries July 2022 (The Aerospace Forum)

Month-over-month Boeing’s delivery numbers dropped from 51 units to 26 aircraft, valued at $3.2 billion consisting of 44 single-aisle aircraft and seven wide-body aircraft:

- Boeing delivered 23 Boeing 737s, all of which were for the Boeing 737 MAX.

- Boeing delivered two Boeing 767-300Fs.

- Boeing delivered one Boeing 777F.

- There were no deliveries for the Boeing 747 program.

- There were no deliveries for the Boeing 787 program.

During the month, a big sequential decline in deliveries was observed and this does not come as a big surprise as I pointed out the following in my report covering the June deliveries:

Share prices of Boeing saw a nice pop following the release of the order and delivery numbers and the news that Boeing reached a production rate of 31 aircraft per month on the Boeing 737 MAX program. The increase in deliveries is nice, but we have yet to see whether that will be a sustained rate, and looking at quarter-end delivery figures history suggests that’s not the case.

Interesting to note is that deliveries were down across all commercial aircraft programs with exception for the Boeing 787 which still was not cleared for a delivery resumption in July and the Boeing 747 program which is winding down. Another point to take note of is the fact that during the month, Boeing delivered no military derivatives of commercial aircraft platforms which could affect Defense results if no in-quarter catch up takes place.

Year-over-year delivery numbers decreased from 28 to 26, and the value went down slightly from $1.8 billion to $1.5 billion. So, we’re seeing deliveries being lower sequentially as well as year-over-year, which at this point mostly reflects supply chain and labor issues.

Year-to-date, there have been 242 deliveries valued at $15.7 billion compared to 184 deliveries valued $14.1 billion. So, we do see a significant increase in deliveries and delivery value, but not the delivery volumes you would like to see, given that Boeing has a big pile of jets awaiting delivery. The Boeing 787 was still not back for Boeing in July, but deliveries did commence in August. Overall, Boeing is highly dependent on the Boeing 737 MAX, but delivery volumes on that program are not satisfactory on a consistent level.

The book-to-bill ratio for the month was 5 and 4.65 in terms of value reflecting a strong order inflow reflecting strong order inflow but the book-to-bill is also disfigured because of the disappointingly low delivery volumes. For the year, we have a book-to-bill of 1.7 in terms of units and 1.8 in terms of value, driven by strong order inflow, while deliveries are mediocre at best.

Conclusion: Boeing Stock A Buy For The Longer Term

During the month, we saw meaningful orders such as the Boeing 737 MAX 10 orders from Delta Air Lines end up in the order book. However, interesting to note is that some orders that were announced as firm orders were not yet fully finalized to be counted towards the backlog. That always makes it extremely valuable to cover air show orders as well as month-to-month order and delivery numbers.

What should also be noted is that following the June order and delivery report, Boeing stock surged as deliveries hit the highest levels since March 2019. However, this month we are seeing that the surge was not sustained and the surge can be attributed to the usual quarter-end flow we see as Boeing pushes aircraft to customers before finalizing the quarter. As I pointed out last month, the 7.4% increase in share prices was not a rational one and this month we are seeing why and in a rational market we would see share prices soften on the low delivery figures in the same way prices surged on higher delivery figures. However, I also recognize that order and delivery numbers are not always what make the share prices move and currently we are seeing a lot of optimism regarding the return of the Boeing 787 in the delivery mix, which I believe is a big deal for Boeing in an effort to significantly improve the delivery flow not necessarily on the short term but definitely on the longer term with associated balance sheet repair. That improvement is an incremental process, so it might be too slow for some investors, but with the ingredients added for balance sheet repair, the current reduction in deliveries is not changing my buy on Boeing shares.

Be the first to comment