How To Be Boeing Chairman In A Crisis mcKensa/iStock via Getty Images

DISCLAIMER: This note is intended for US recipients only and, in particular, is not directed at, nor intended to be relied upon by any UK recipients. Any information or analysis in this note is not an offer to sell or the solicitation of an offer to buy any securities. Nothing in this note is intended to be investment advice and nor should it be relied upon to make investment decisions. Cestrian Capital Research, Inc., its employees, agents or affiliates, including the author of this note, or related persons, may have a position in any stocks, security, or financial instrument referenced in this note. Any opinions, analyses, or probabilities expressed in this note are those of the author as of the note’s date of publication and are subject to change without notice. Companies referenced in this note or their employees or affiliates may be customers of Cestrian Capital Research, Inc. Cestrian Capital Research, Inc. values both its independence and transparency and does not believe that this presents a material potential conflict of interest or impacts the content of its research or publications.

The Boeing Company – Background

If you’ve not been watching Boeing (NYSE:BA) stock lately, allow us to catch you up. The stock ripped it up in 2016-18, moving from around $100 in early 2016 to an all-time high of around $440 a little over two years later. Boeing Corporation stock benefited from the generally increasing market like for US-domiciled and US-manufacturing industrial base during the prior America-First White House. It also benefitted from not having airplanes go awry and not having anyone look too closely at the accounts (which may be audited and declared legal but are certainly arcane) or the cashflow statement (because at that time there was enough getting paid out to lenders and dividend hounds to not have to look too closely).

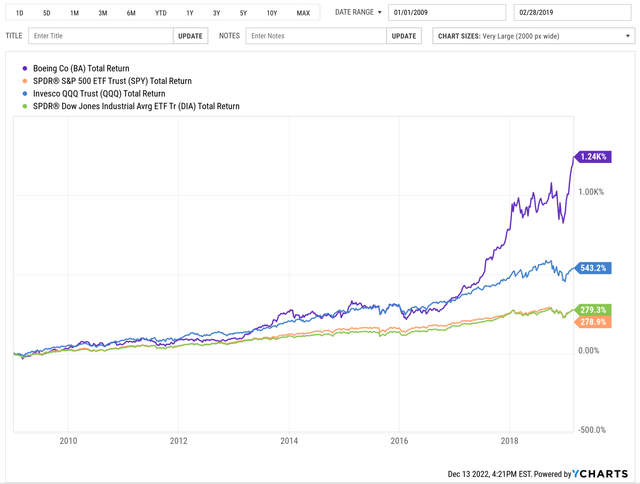

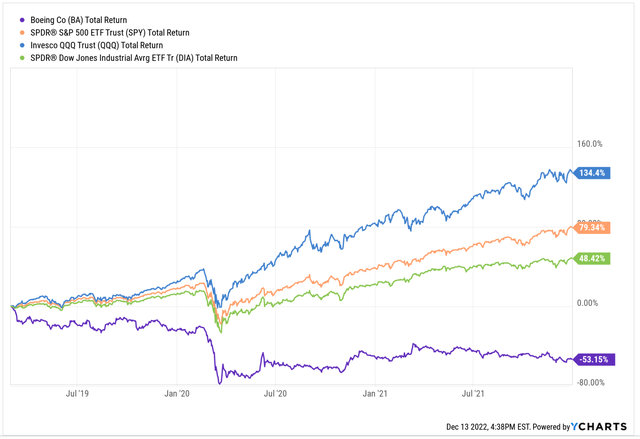

In the decade following the financial crisis, a decade of easy-money made in the major indices (you just did nothing and played golf and the money arrived!), Boeing stock made them all look pedestrian. Here’s BA vs. SPY vs. QQQ vs. DIA on a total return basis.

BA vs. Market Indices, 2009-19 (Ycharts.com)

Then six things happened, and they were not unconnected. One, airplanes started to malfunction with significant loss of life. Two, airplanes got grounded.

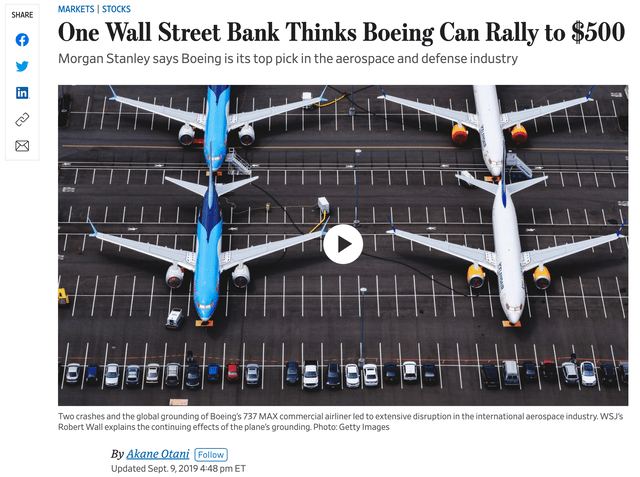

These first two things dented but didn’t cause huge damage to the stock. Indeed Wall Street was still high on the name. Here’s the Wall Street Journal in September 2019.

Wall Street Journal – “MS BA to $500?” (Wall St Journal)

Then fundamentals hit – leading to points three through six.

Oh – as an aside – if you want to know when fundamentals really matter? It’s when cashflow dries up.

Point three is that with planes grounded and not certified, cash stopped flowing from customers to Boeing. Four, as a result Boeing needed to raise a lot of cash and to increase their debt headroom. Five, folks started looking a little more closely at the balance sheet and cashflow statement. And yea verily, six, the stock did duly plummet.

From Q1 2019 through the Covid crisis and up to the market peak around last year’s end, Boeing was left in the dust by the indices.

So, in summary? Urgh. What a mess. And along the way management did very little to help themselves, help to rehabilitate the company, take any ownership of the loss of life, etc. Boeing did dispense with its CEO but replaced him with the Chairman, who logically can either only be (1) also culpable for the company’s and stock’s woes in this period, on account of being Chairman throughout, or, (2) making a claim to be not culpable because despite being Chairman he wasn’t in fact looking at the numbers or safety stuff or anything like that. Clearly there’s no good choice between (1) and (2), but, Calhoun remains CEO, so for now that is simply that. The company had to raise its mandatory retirement age to keep Calhoun in the seat, so, either he is the very best CEO the company could have, or he knows too much to have to spend more time with his family.

BA Stock Key Metrics

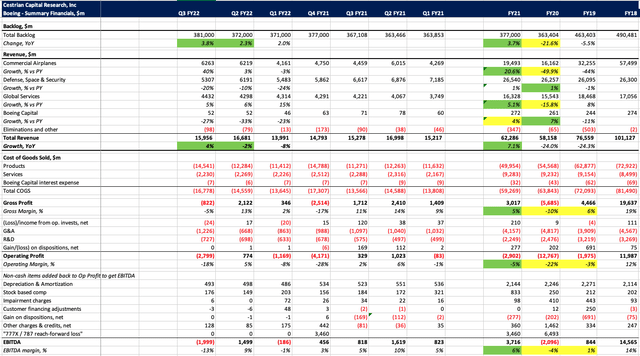

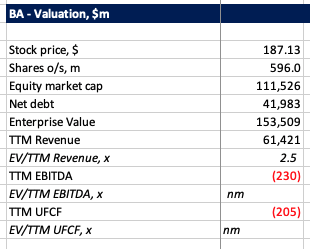

With Calhoun in the pilot’s seat, Boeing’s fundamentals have levelled out and show some signs of improving, but they are hardly solid. In addition, speaking for our firm which has a particular strength in fundamental analysis, it takes a long time to plow through Boeing’s SEC reports in order to try to make sense of them. And when you finally do, what you see isn’t very pretty still.

Take a look.

BA Fundamentals (Company SEC Filings, YCharts.com, Cestrian Analysis) BA Fundamentals II (Company SEC Filings, YCharts.com, Cestrian Analysis)

Let’s step through some, er, highlights.

- Backlog stands at $381m as of Q3; it’s growing year on year, and the rate of growth is accelerating these last couple quarters. That’s good. It’s still only around three-quarters the size of the backlog in December 2018 though.

- FY12/21 full year revenue growth was down 39% on FY12/18 (the final year before trouble hit), which is bad. Revenue did grow 7% vs. FY12/20, but since that was peak Covid crisis and this company has travel-derived revenue, perhaps we shouldn’t get too excited about this. As of Q3, TTM revenue stands a little below that FY12/21 level.

- Operating losses remain large; EBITDA, which we use to standardize how we measure leverage in this kind of business, is still woefully low even after a wall of addbacks which flatten EBITDA vs. operating profit.

- Unlevered pretax free cashflow (after capex and change in net working capital) remains abysmal. TTM UFCF at Q3 was still moderately negative (about minus $200m). Not since FY12/18 has the company generated positive annual FCF. Perhaps the company will chalk up breakeven or better in FY12/22.

- The balance sheet is weighed down by $42bn of net debt. On negligible EBITDA and negative cashflows. In any other business, lenders would be calling the loan and/or agitating for improved terms until such time as the company was forced to make some kind of debt-for-equity swap. But this isn’t any business. This is a national champion. Which cannot be allowed to go under – especially now folks in distant countries can very nearly buy a Chinese airliner instead of your Boeing or your Airbus. Not a time to be unpatriotic in Seattle.

Here’s the fundamental valuation:

BA – Valuation (Trading View)

Well, you wouldn’t buy this for the financial fundamentals. Would you?

OK, let’s take a look at the stock chart because the only thing supporting this stock right now is its own chart – which is to say, sentiment.

Boeing Price Targets

One rather helpful thing about Boeing’s absence of anything resembling cash flow is that it cannot be valued on fundamentals, so it has to be valued on technicals. And the emotion around the stock makes it particularly suited to Elliott Wave & Fibonacci level analysis because, really, all we are doing with Boeing is trying to measure sentiment and try to make money from it.

You can open a full page version of this chart, here. It encompasses the 2009 lows to the present.

BA Chart (TrendSpider, Cestrian Analysis)

Boeing stock bottomed in the Covid crisis lows, Q1 2020. And since then the stock has evidenced a dramatic recovery, following a fairly standard wave pattern. The first Wave 1 up and out of the Covid lows peaked in February 2021; the stock then put in a wave 2 down, troughing in May this year right around the 78.6% retrace of that Wave 1 up. In our Growth Investor Pro service here on Seeking Alpha we said to subscribers that we thought a good price zone in which to accumulate Boeing stock – meaning, to build up a position slowly over time – was that Wave 2 low (about $113) up to around the 61.8% Fib retracement of the Wave 1 (about $161). We suggested a stop-loss some little way below the Wave 2 low. And we said that the near term upside potential for BA stock was around $305, that being the 100% Fibonacci extension of that Wave 1.

Here for instance is a subscriber note we posted back in April this year.

Cestrian Capital Research, Inc (Temporary SEC Filing)

BA stock has moved up nicely off those lows and now sits at $187, fully 65% up from the May 2022 lows.

The stock is now in our ‘Markup Zone’ – meaning ‘Hold’ whilst other investors come in and bid the stock up. Momentum funds, for instance. That said, if you’re minded to buy or add to Boeing stock at these levels, we believe there’s solid upside opportunity still.

Based on the above chart we believe Boeing can strike a Wave 3 high of at least $306 and maybe as high as $350, which would be the 1.236 extension of Wave 1. So from here that’s between say 60%-90% upside. Risk management is a little more difficult up here, since the logical stop remains sub that $113 level – clearly too far down from here to be of any use. So if you like to use stops perhaps aim off from here by 10% or whatever level of risk you are prepared to take in pursuit of the material upside – and consider switching to a trailing stop if the stock does in fact move up from here.

Is BA Stock A Buy, Sell, Or Hold

We rate BA at ‘Hold’, but we believe there to be substantial upside ahead even buying at these levels. Just keep a weather eye on risk management which is trickier up here than at the lows.

Cestrian Capital Research, Inc – 13 December 2022.

Be the first to comment