Joe Raedle/Getty Images News

The highlight for Boeing (NYSE:NYSE:BA) this year most likely has been the delivery resumption of the Boeing 787. It is a widely anticipated milestone for Boeing, airlines, lessors as well as investors. This does not mean that everything is back to business as usual for the US jet maker. Far from that, Boeing had built an inventory of around 120 Dreamliners and it will take a while before that inventory will reduce significantly. Furthermore, since Boeing owes airlines compensation, I believe that it might take a while before we see the full accretive effect of the Dreamliner delivery resumption.

I covered the Dreamliner crisis from its very beginning and kept following that subject for roughly the past two years. And I believe that as Boeing turns a page on years of self-inflicted wounds removing a lot of confidence in the US jet maker, it is important to have a look at how that delivery flow is coming along. Detailed coverage shouldn’t end when the deliveries resume, I believe. In January 2021, I pointed out that Boeing was facing a forward loss on the program which indeed was announced a year later. It is now time to look at how deliveries are coming along, especially since there was a report from The Air Current that, after initially delivering four aircraft Dreamliner, deliveries would again come to a standstill.

Complexity With Boeing Dreamliner Deliveries

Lufthansa Boeing 787-9 (Lufthansa)

So, in this report I want to have a look at how many aircraft are delivered to assess the delivery pace, how many come from the pool of already produced jets and how many come fresh from Boeing’s assembly line. My analysis usually is driven by a strong core of data supporting our fact driven analysis. Initially I ran into some complexities on that end as Boeing did provide delivery numbers for its programs including the Dreamliner, but I observed that the deliveries to American Airlines (AAL) which marked the delivery resumption for the Boeing 787 was not in there.

At the time, I had no indication of the reason why those were not in there; but since the aircraft were ferried to Victorville, where Boeing carries out work on jets, I assumed that there was some sort of cabin outfitting going on. That or some accounting complexity, because these jets initially were on order by Boeing Capital Corporation and later on transferred to BOC Aviation for delivery to American Airlines.

Boeing confirmed the former is the case and provided further detail on the absence of the aircraft in the delivery tally to The Aerospace Forum. Our data shows that one aircraft was handed over on the 10th of August and the other one five days later. Both aircraft are undergoing post-delivery work in Victorville which made it impossible for Boeing to count the deliveries per the company’s accounting guidelines. Although contractually the aircraft were delivered, until the contracted work is completed, the deliveries are not added to the tally.

Boeing Dreamliner Deliveries Have A Cold Start

While deliveries do not match the number of aircraft handed over, I will in this case be looking at handed over aircraft and “treat” them as deliveries. So far, I have been able to track six aircraft being delivered (including three hand overs to American Airlines). These aircraft include three -8s, two -9s and one -10 for American Airlines, KLM Royal Dutch Airlines, Lufthansa (OTCQX:DLAKF) and WestJet.

So, you would say that the notion from The Air Current about things coming to a halt after four deliveries is not completely true. However, from the data I obtained it also became clear that 5 aircraft were reworked and one delivery was a conforming production meaning no rework was required.

In the first quarter, Boeing said that most of the inventories would be cleared by 2023 when it expected to have reduced the Dreamliner inventories from 115 to 0. A quarter later than number had been increased to 120 and I believe there would be slightly more than 120 aircraft in inventory before the deliveries resumed. The goal likely is still to deliver the aircraft by the end of 2023.

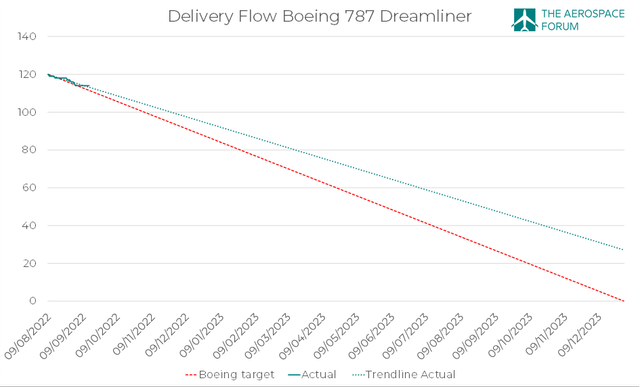

Boeing 787 delivery flow (The Aerospace Forum)

From that we can construct a trendline to assess how deliveries are currently progressing. For Boeing to clear its inventory it would need to deliver one Dreamliner every 4-5 days, which means around 6 deliveries from the pool each month. So far, however, the jet maker has only been able to deliver one aircraft every six days and over the past 11 days there seemingly have not been any deliveries. So, Boeing is a bit behind on a linearized schedule. I don’t want to say that there is an indication that Boeing will not be able to clear out its inventories by the end of 2023, but it does need to ramp up the deliveries and it is likely that as more rework is being completed that the ramp up should also be coming along nicely. At the same time, I do want to remind investors that the report from The Air Current basically pointed out that after a few fast deliveries things would be slowing down and that is actually what we have been seeing from the past 11 days. The positive is that in little over a month, Boeing reduced its inventories by 5% and that will help them getting to a healthier balance sheet and financial position. The current trend while slower than the linearized target also brings in around $700 million per month which is huge for Boeing. So, even if Boeing stays on the current slower trend there is a big jump in revenues and later on free cash recovery to be expected.

Conclusion: Time To Watch The Positives For Boeing Stock

My dive into the delivery numbers show that the delivery start is rather soft and is progressing by fits and starts. We currently have 6 deliveries to construct a trendline; so, admittedly, we have a very small set of datapoints to work with, but as I expand the delivery overview in the future, we should be getting a better impression of the delivery pace. What I think are important takeaways is that with a delivery every 6 days, Boeing would still generate over $700 million in revenues and provide some improvement in its cash flows, excluding cash variance on the earliest deliveries to render compensations.

I believe it is really time to watch the positives for Boeing now as the current delivery flow already supports a lot of improvement in Boeing’s financials. A delivery every five months from inventory equals a 4% reduction in its Dreamliners inventories and Boeing is also producing at a rate of two aircraft per month. If Boeing is able to deliver five aircraft from the pool and two fresh Dreamliners from the assembly line, it would get to a rate of seven aircraft per month, which was the rate Boeing was producing at when it concentrated Dreamliner production in South Carolina. If Boeing manages to get to a combined delivery rate of seven aircraft per month, it would add around $12 billion to revenues and provide a significant bump to cash flow. Currently there are concerns about the state of the global economy, but overall Boeing seems to be on a relatively good track to provide a meaningful boost to its results.

Be the first to comment