nycshooter

Introduction

The Boeing Company (NYSE:BA) is one of the largest airplane suppliers for global export and military purposes. Despite Boeing going through negative news over the years, it has found value in its stock price. As technical indicators show, Boeing is underway for early stock accumulation, boosting its price.

Fundamentals are looking strong based on estimates

Growth

Boeing’s growth has been relatively weak, and revenue has been negative due to the damaging 737 Max airplane scandal and other negative news. However, 2021 proved to be its strongest year for revenue growth and gross profit growth. Net income for 2021 was the same as for 2017.

|

Metric |

2017 |

2018 |

2019 |

2020 |

2021 |

|

Period |

FY |

FY |

FY |

FY |

FY |

|

Revenue growth |

-0.012 |

0.083 |

-0.243 |

-0.240 |

0.071 |

|

Gross profit growth |

0.257 |

0.133 |

-0.773 |

-2.273 |

1.531 |

|

Ebit growth |

0.762 |

0.166 |

-1.165 |

-5.464 |

0.773 |

|

Operating income growth |

0.762 |

0.166 |

-1.165 |

-5.464 |

0.773 |

|

Net income growth |

0.675 |

0.276 |

-1.061 |

-17.668 |

0.646 |

|

Eps growth |

0.766 |

0.327 |

-1.062 |

-17.643 |

0.646 |

Source: Financial Modelling Prep

Data

2022 has proven to be a solidly positive year for Boeing, even with a robust 20-day simple moving average. Only a few companies out there can have this kind of return.

|

Metric |

Values |

|

SMA20 |

17.00% |

|

SMA50 |

22.43% |

|

SMA200 |

10.22% |

Source: FinViz

Enterprise

The stock price for Boeing has declined since 2017, along with its market cap. However, despite the long-term scandal, it seems it is behind them with this year’s performance.

|

Metric |

2017 |

2018 |

2019 |

2020 |

2021 |

|

Symbol |

BA |

BA |

BA |

BA |

BA |

|

Stock price |

337.710 |

387.720 |

323.300 |

194.190 |

190.570 |

|

Number of shares |

602.721 M |

579.501 M |

567.857 M |

568.630 M |

568.630 M |

|

Market capitalization |

203.545 B |

224.684 B |

183.588 B |

110.422 B |

108.364 B |

|

Enterprise value |

205.763 B |

230.795 B |

201.247 B |

166.521 B |

158.682 B |

Source: Financial Modelling Prep

Estimate

Based on these future guidance estimates, 2022 has been the turnaround year for Boeing. It is possible to see some dividend strength for 2024 and 2025, but that is not predictable. Earnings per share seem to strengthen after next year with improved appreciation. Net profit should also enhance to continue a solid momentum to work off of into the next four years.

|

YEARLY ESTIMATES |

2022 |

2023 |

2024 |

2025 |

2026 |

|

Revenue |

66,693 |

81,585 |

92,859 |

99,852 |

107,530 |

|

Dividend |

0.00 |

1.45 |

3.04 |

4.02 |

1.00 |

|

Dividend Yield (in %) |

0.12 % |

0.82 % |

1.72 % |

2.27 % |

0.56 % |

|

EPS |

-7.83 |

3.61 |

6.91 |

8.73 |

11.27 |

|

Net Profit |

-3,546 |

3,062 |

5,290 |

6,687 |

8,923 |

Source: Business Insider

Technical Analysis shows the optimal time for entries.

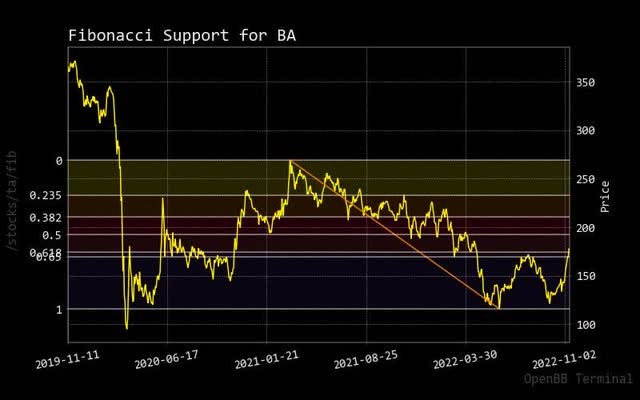

Fibonacci

Despite the short-term negative Fibonacci trendline, Boeing’s stock price is near recovery, which might be an excellent time to investigate taking positions. Moreover, based on estimated real growth, one could expect predictable returns if all is fulfilled as promised.

fbonacci boeing (custom platform)

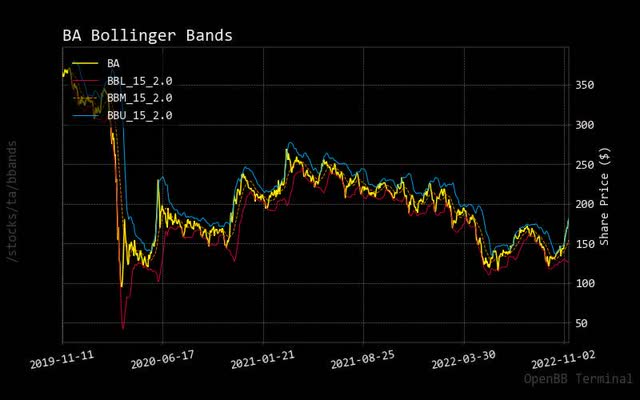

Bollinger Bonds

One positive sign for potential market entries is looking at Bollinger bands based on price breaking through the upper band. This pattern confirms that market entries are optimal for strong returns moving forward.

bollinger boeing (custom platform)

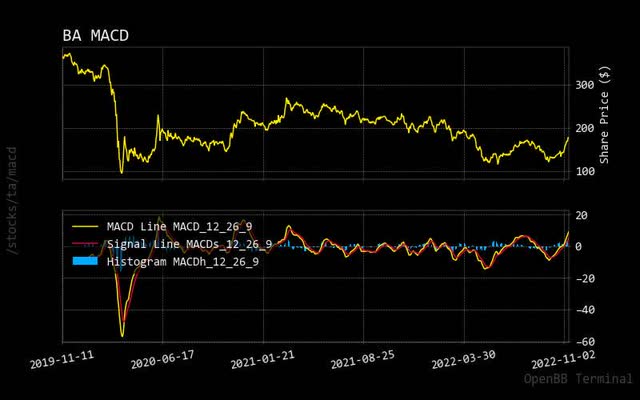

MACD

Another technical indicator that seems to confirm optimal market entry is to see how the Boeing stock price has broken through the zero line on the bottom panel of this chart.

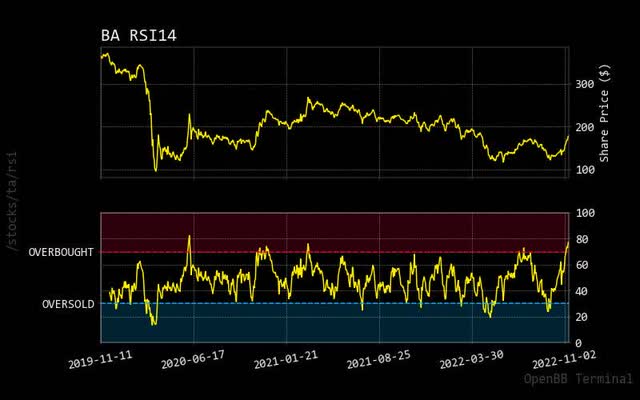

RSI

One temporary concern for the Boeing stock price is how it has crossed above the overbought condition of the relative strength indicator. This is said to be quick as more momentum builds into the stock as more analysts discover the fear of missing out state. As a result, there might be a temporary pullback with other long-term upward swings.

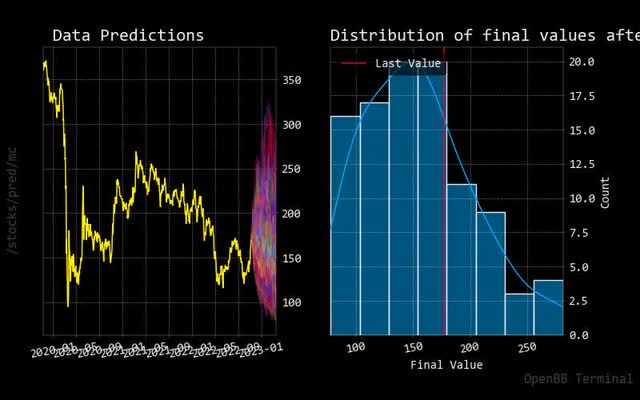

Prediction via AI

Monte Carlo

Monte Carlo simulation predicted paths show more upward momentum, which can raise higher expectations for Boeing’s stock price. It can also be confirmed that normalized distribution has evenly split price expectations.

monte carlo boeing (custom platform )

Regression

The red forecasted 30-day regression line shows moderate price moves up for Boeing stock. It is safe to say there will be a short-term moderation in the slope of the stock price, but it will continue to increase next year.

regression boeing (custom platform)

Risk adds to the Positive Narrative of Boeing Stock

Insider Activity

November seems to be a month where insider executives are buying up large shares for Boeing; this only confirms that there will be an expected strong return over the coming weeks.

|

Date |

Shares Traded |

Shares Held |

Price |

Type |

Option |

Insider |

Trade |

|

2022-11-03 |

13,666.00 |

13,666.00 |

158.27 |

Buy |

No |

CALHOUN DAVID L |

13666.0 |

|

2022-11-03 |

5,700.00 |

19,366.00 |

159.28 |

Buy |

No |

Hibbard Carol J. |

5700.0 |

|

2022-11-03 |

5,634.00 |

25,000.00 |

159.96 |

Buy |

No |

Arthur Michael A. |

5634.0 |

|

2022-11-03 |

1,285.00 |

2,917.00 |

157.09 |

Buy |

No |

Doniz Susan |

1285.0 |

Source: BusinessInsider

Price Target

There is a tighter-than-usual relationship between stock market analyst targets and actual Boeing stock price. Because this year has not had negative returns, it most likely means that it has been relatively predictable for Boeing to meet market analyst expectations.

target for boeing (custom platform)

Source: Business Insider.

Sustainability

Sustainability has been outperforming this year for Boeing. This is most likely due to the requirement of this rating to be a contractor of the US government being a military supplier.

|

Metric |

Value |

|

Social score |

19.72 |

|

Peer count |

21 |

|

Governance score |

7.87 |

|

Total esg |

34.68 |

|

Highest controversy |

4 |

|

ESG performance |

OUT_PERF |

|

Percentile |

77.96 |

|

Peer group |

Aerospace & Defense |

|

Environment score |

7.08 |

Source: Yahoo Finance

Conclusion

It seems Boeing is having its stock price move up in an accelerated way. This could be due to early stock accumulation with positive news and investors seeing this as a fear of missing out on an opportunity. As hinted by artificial intelligence and technical analysis, the stock price has met optimal conditions to allow market entries. Also, Boeing’s stock price should be able to maintain an appropriate level of value over the coming weeks to months based on its forward guidance estimates. As a result, it would be recommended to take positions, to buy, in hopes of a better return on Boeing stock.

Be the first to comment