Dimensions

Investment Thesis

BlueLinx Holdings (NYSE:BXC) delivered a very strong Q2 result, particularly when it came to its efforts to move more of its business’ exposure to higher value-added specialty products.

Also, given what investors had already largely expected about BlueLinx’s operating expenses raising on the back of the current high inflationary environment together with the rapid rise in mortgage rates, the fact that its EPS results come out so strongly was perhaps even a little surprising.

By my estimates, the stock is priced at approximately 3x this year’s EPS. This means that even if its earnings got cut in half in 2023, the stock would still only be priced at 6x earnings, which is still very cheap. I continue to rate this stock a buy, as I did here.

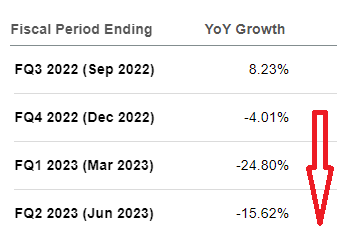

Revenue Growth Rates Dip Lower

BXC revenue growth rates

BlueLinx’s revenue growth rates for Q2 ended down 5.3% y/y. This was an improvement from the negative 12.3% in revenue growth rate that analysts had expected.

Moreover, not only did BlueLinx have to contend with lumber prices falling 50% at one point in the quarter, but it also was the most challenging quarter to compare against the same period a year ago.

So where does BlueLinx go from here?

BlueLinx’s Near-Term Prospects

BlueLinx Holding distributes residential and commercial building products. With its results on the back of its bigger, more stable peer, Builders FirstSource (BLDR), investors already had some form of a glimpse into the sector’s broad outlook prior to BlueLinx’s earnings.

Indeed, the bear case can be summarized as such, that the second half of 2022 and early 2023 will see, housing starts which will inevitably slow down and cause significant headwinds to BlueLinx’s near-term prospects.

Of this consideration, both the bulls and bears are in general agreement. Where bulls diverge is to the degree to which a housing slowdown could be on the cards.

What’s more, bulls believe that despite the overall uncertainty, at BlueLinkx’s present valuation, there could be some upside to be had from the stock, something we’ll soon discuss.

That being said, there’s really no denying that housing starts have had to be downward revised of late.

BLDR Q2 2022 results

Above we see Builders FirstSource’s recently downward revised guidance for single-family housing starts going from up mid-single digits previously to now down mid-single digits for the remainder of 2022.

And this general idea has to a large extent already been reflected in analysts’ revenue consensus estimates for the second half of 2022 and early 2023, as you can see below.

BXC revenue consensus

Not only are analysts expecting that Q4 will see negative revenue growth rates, but the start of 2023 looks particularly grim.

Profitability Profile Discussed

Meanwhile, despite all these concerns and uncertainties, BlueLinx continues to ooze profitability. To illustrate, Q2 2022 saw its free cash flow reach $96.8 million, up 113% y/y from $45.4 million in the same period a year ago.

Next, looking further ahead, BlueLinx’s Specialty products’ gross margin is expected to be in the range of 22% to 23%, practically unchanged from the 22.8% reported in Q2.

While its Structural product gross margins are expected to be around 18% to 19%, favorably benefiting from BlueLinx’s 900 basis points reversal charge to its cost of goods sold made to its Q2 results.

Altogether, I believe that the stock is attractively priced, as I’ll discuss next.

BXC Stock Valuation — Priced at 3x EPS

For the first half of 2022, BlueLinx’ reported $21.07. If analysts are vaguely correct about the second half of 2022, this means that full-year EPS could reach approximately $30.17.

This puts the stock priced at 3x this year’s EPS. Needless to say that this year is nearly over and investors are now having to price in 2023. And this is where the picture gets somewhat fuzzy.

However, I argue that even if BlueLinx was to see its EPS figures get cut in half, the stock would still only be priced at 6x EPS. I believe this is cheap enough for new investors considering the stock.

The Bottom Line

BlueLinx is under new management. And under this new management team, the focus has been on moving more of its business to Specialty products, which is a higher margin revenue stream, with its reduced exposure to lumber prices.

In fact, it must be said, this strategy appears to be working. Obviously, the bear case continues to be that BlueLinx’s just reported Q2 2022 results are backward looking. And the serious test for the company isn’t likely to start until the back end of 2022.

Nevertheless, despite all the uncertainty, I believe that paying 3x EPS for BlueLinx Holdings is a very attractive valuation.

Be the first to comment