Jenyateua/iStock via Getty Images

A lot of pundits are predicting a recession, and I tend to agree that the economy is likely to slow down in the second half of 2022. While that is likely to have an impact on broader asset classes, there are still attractively valued stocks out there. One of these is BlueLinx Holdings Inc. (NYSE:BXC), a small-cap building products distributor.

Investment Thesis

BlueLinx has had a favorable operating environment over the last couple of years as the building industry has been cruising along. The company used this period to deleverage the balance sheet and recently boosted the buyback program to $100M. In Q2, they used $60M to buy back shares, which should help EPS in a meaningful way. Despite the impressive recent operating results, shares trade at 2.4x earnings, which is too cheap in my opinion. If the economic environment continues to deteriorate, earnings will likely fall, but the cheap valuation leads me to believe that returns could still be impressive with just a small degree of multiple expansion.

The Business

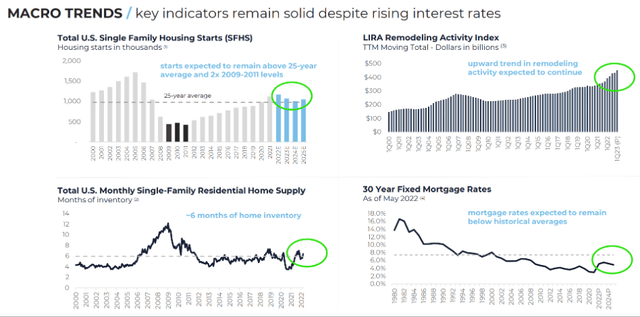

BlueLinx is a building products distributor that has locations across the U.S. Business has been booming over the last couple of years, and despite rising interest rates, the company has shown several reasons that they are still bullish today. From mortgage rates below the historical average to housing starts and remodeling activity, they still see a bright future for the business.

Housing Trends (bluelinxco.com)

The company’s product line is approximately a 60/40 split between specialty and structural products, respectively. When it comes to their end markets, they are fairly diversified between new homes, remodels, and commercial real estate. New homes account for 40%, remodels are at 45%, and commercial covers the last 15%. They have had an impressive two-year run with the business, and the share price has followed suit. Shares were trading in the single digits two years ago, and despite a massive run in the last couple of years, the earnings multiple is still dirt cheap.

Valuation

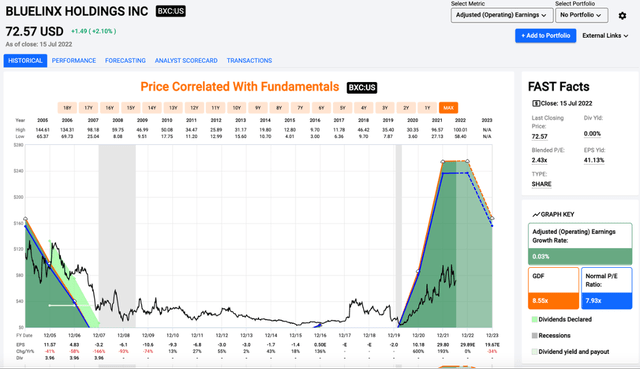

BlueLinx is one of the cheapest stocks I have seen. There is the potential risk that is a value trap, however. If business slows down, earnings could fall significantly. With the current projections for 2022, BlueLinx trades at a blended P/E of 2.4x. The company earned over $13 per share in Q1, and I’m curious to see what they earn in Q2. FAST Graphs is projecting just under $30 per share for the full year of 2022, which would mean a significant slowdown from Q1.

Price/Earnings (fastgraphs.com)

If we do see multiple expansion, shares could post impressive returns over the next couple of years. One of the other drivers for EPS is the buyback program. With the buybacks being done at such low multiples, they will have a significant impact on EPS, and if the economic environment holds up, the stock will march higher long term in my opinion. Not only is the valuation cheap, BlueLinx has used the last couple of years to shore up the balance sheet, and they have begun to return capital to shareholders in a meaningful way in the form of a huge buyback program.

Massive Buyback Program

Since my first article on BlueLinx, the company reported Q1 earnings and boosted their buyback program to $100M. For a company with a market cap of $700M, that is a massive program. In a recent investor presentation, the company stated that they repurchased $60M in Q2. I am curious to see what the company does in the next couple of quarters because they will finish the current buyback program in the second half of 2022 if they continue buying back shares at a similar rate. My guess is that they will boost the buyback program in the coming months, but the Q2 report should give us some insight on continued buybacks.

Conclusion

BlueLinx has seen massive returns over the last couple of years, going from the single digits to a $70 stock. It makes sense when you look at the explosion in EPS in 2020 and 2021. While the company could be negatively impacted by a significant recession, I still think the risk/reward is skewed to the upside with the dirt-cheap valuation. The company earned over $13 in Q1, and if the EPS doesn’t decline significantly, the company will continue to generate huge earnings relative to its market cap.

At 2.4x earnings with a massive buyback program, I think we will see impressive returns moving forward, especially if we get a little bit of multiple expansion. Unfortunately, I don’t have a lot of dry powder right now, but as that changes, BlueLinx will be on my short list of stocks to buy in the coming months.

Be the first to comment