Dima Berlin

Investment Thesis

The spinoff of 2seventy bio (TSVT) by bluebird (NASDAQ:BLUE) unlocked some value for investors who, at the time, saw the ticker hit rock bottom, trading near its cash per share ratio, as I note here in August of last year. Whether the spinoff is strategically worthwhile is another issue. After the transaction, both companies lost their manufacturing facility, product diversification, research, and operating synergies. In any case, this is all behind us now, and the focus turns to the new company’s valuation, which is likely less than what the management team would have liked.

The European Medicine Agency’s “EMA” decision to authorize two of BLUE’s therapies signals higher chances that its portfolio (3 drugs) will receive FDA authorization. December 2021 Post

Zynteglo and Skysona were both granted FDA approvals in August and September, respectively, and I expect lovo-cel to be given the green light in the second half of 2023, setting BLUE on the path of gaining clearance for all its portfolio, just as predicted in a prior post last December.

However, commercialization success is far from certain, as the company grapples with payors and physicians to adopt the most expensive drugs in the world. Any commercial success for BLUE (if any) will likely be short-lived as next-generation gene editing companies roll out their disruptive gene medicines (e.g., CRISPR-Cas9 therapies) that, unlike BLUE’s drugs, do not carry a significant risk of off-target effects.

Revenue Trends

This year has been transformative for BLUE, with the company gaining FDA approval for two of its three product pipelines, with a high probability of securing clearance for the third (more about this below). Investors have responded positively to this approval news and the bullish commentary from management. However, many shareholders have been slow to acknowledge the commercialization risk inherent in its product lines.

Due to the risks of BLUE’s gene therapy platform, the FDA limited the label of its Beta Thalassemia drug, Zynteglo, to patients who had previously failed on existing first-line treatments such as bone marrow transplants (BMT). This restriction further hampers BLUE’s efforts to commercialize Zynteglo to an already limited patient base.

Beta Thalassemia is a rare disease, and the majority of incidents are in the Middle East and South East Asia, where access to sophisticated health care is limited. Thus, it is unlikely that BLUE will derive any meaningful revenue from the Beta Thalassemia product in the near term. Europe is an adequate market for Zynteglo (which is why management tried to commercialize it there first). Still, as explained in the previous article, BLUE exited the European market, mainly consisting of public payors who refused to cover the drug.

All is not lost for BLUE. lovo-cel, the company’s answer to Sickle Cell Disease “SCD,” is virtually the same drug as Zynteglo, making an FDA approval a high probability (given the favorable regulatory decision for Zynteglo). SCD and B-Thal are blood diseases caused by a mutation in the globin gene, and both drugs work by inserting a healthy copy of this particular gene into the patient. From my understanding, management plans to file for a BLA in early 2023. After the submission, the FDA must review the application within six months, given the priority-review status of lovo-cel.

SCD is more prevalent in the US compared to B-thalassemia, with a patient pool of 100,000 individuals. Given the market size of SCD, I believe this could be a much more attractive platform for BLUE than Beta-Thal, which is limited to a small patient population. However, shareholders still have to wait and see the FDA label (if and when it is approved), which I believe will likely be limited to a second or third-line treatment similar to Zynteglo. The more worrying issue is the threat of next-generation gene therapies, which are safer than BLUE’s platform, whose projects have been inflicted by multiple clinical holds. For example, all companies developing gene therapies using the CRISPR platform have an SCD/B-Thal platform. Most of these utilize a strategy of knocking off the gene responsible for inhibiting fetal hemoglobin production. Once this gene is knocked-off, the body starts producing healthy (fetal) blood cells, reducing the need for blood transfusions and medications for both SCD and B-Thal patients. CRISPR Therapeutics (CRSP) is preparing to file a BLA for its B-Thal product in Q1 2023, which, as mentioned above, also works to treat SCD. Thus, I believe that by the time lovo-cel is authorized and marketed to physicians, a new and better treatment will be available, limiting its commercial appeal.

The commercial prospects of eli-cel (sold as Skysona) are also limited by an extremely small patient base and annual incidence. A school bus could comfortably hold the entire number of US CALD patients. Moreover, Skysona is not a treatment but rather a medicine to slow down the progression of the disease, and it is not 100% effective, making the $3 million therapy a hard pill to swallow for patients, payors, and physicians. It is doubtful that all 40 or so US patients with CALD have insurance that would cover Skysona, and even those insured might need more financial resources to pay the co-insurance, which amounts to $600,000, based on a standard 20% co-pay.

Financial Position

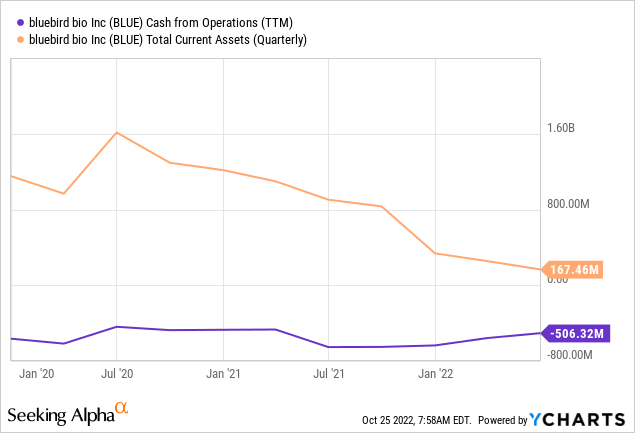

BLUE is pretty cash-strapped right now, with $130 million of cash as of the end of Q2. This is roughly the same amount they burned through in Q1 and a bit more than they spent in Q2. The company’s strategy seems to focus on cost-reduction, monetizing its priority review vouchers (2 PRVs worth between $160 – $200 million), commercialization of its pipeline, and as a safety net, an At-The-Market offering (ATM) that sold around $8 million worth of shares in Q2.

In April, Management announced a $160 million cost-cutting initiative, entailing a 30% reduction in headcount, which stood at 518 as of December 2021. I believe that staff made redundant are mostly R&D personnel, as opposed to sales staff, given the current strategic focus on commercializing its pipeline. Nonetheless, as discussed above, I don’t see significant earnings potential from its pipeline.

Until now, the new management has been prudent in terms of raising equity capital, but the leadership change manifested in the departure of the Chief Strategy & Financial Officer last month raised some uncertainty about financing strategy going forward.

Summary

Until now, BLUE’s management has exercised restraint when it comes to raising equity capital, preferring to conserve cash and invest in sales and commercialization activities in order to maximize the potential upside from its approved assets. Nonetheless, the company’s balance sheet remains quite weak, and commercialization challenges continue weighing on the stock, as mirrored in the 35% short interest at the time of writing. As a result, I see downside risk to current price over the next year or two, should current market conditions persist, given the dilution risk, as management finds itself in an increased need for capital to fund its speculative bid on its approved pipeline.

Be the first to comment