MF3d

Because of the real threat of climate change, on top of other issues associated with energy production like the impact that it has on health, moving in the direction of making energy as clean as possible is a worthwhile endeavor. It’s a moral issue, an environmental issue, and even a financial issue to make strides on this front. And one company dedicated to making energy cleaner is Bloom Energy (NYSE:BE). If current forecasts provided by management end up turning out right, the company could well create some significant value for its investors. At the same time, however, there are problems with the company from a fundamental perspective.

Although revenue is growing at a nice clip, profits are consistently negative. That picture continues to worsen. Perhaps the only saving grace is that the company is announcing some rather interesting moves that could go on to fuel growth further. But there is no doubt that this is a highly speculative play. If I were to base the company’s potential off of fundamentals alone, I would have to rate it a ‘strong sell’. But given recent developments, I do believe that investors who don’t mind accepting a great deal of risk might find this a decent prospect to consider. After all, it’s not just the historical performance of a company that matters; It also matters where that business is going in the future.

A clean energy play

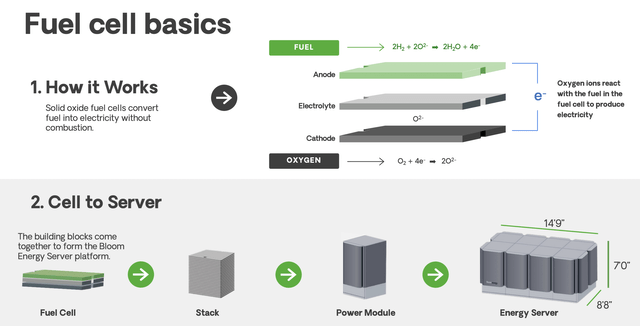

According to the management team at Bloom Energy, the company’s mission is to make clean, reliable energy affordable for everyone in the world. They are working on this in their own way, by creating the first large-scale, commercially viable solid oxide fuel-cell-based power generation platform. It would be helpful to dig a bit deeper into this specific technology. Management says that its fuel-flexible servers can produce biogas, hydrogen, natural gas, or even blended fuels in order to create power at significantly higher efficiencies than traditional, combustion-based resources. Conceptually, the actual process by which this occurs is fairly simple and straightforward. The company starts with a solid oxide fuel cell that converts fuel into electricity without any combustion process. This involves taking the fuel in question and using anodes, electrolytes, and cathodes so that oxygen ions can react with the fuel in the fuel cell in order to produce electricity. The company’s Bloom Energy Server platform is basically a set of fuel cells there can be stacked to create a power module that, in turn, can become one part of a larger energy server.

Bloom Energy

As I mentioned already, the company’s technology can use natural gas, hydrogen, or even biogas. Its same solid oxide platform powers fuel cells that can be used to create hydrogen. At the end of the day, the company’s activities are centered around a few different things. First and foremost, the company is focused on distributed electricity production. Using its stationary fuel cell solution, it’s able to deliver energy for utilities and other organizations. Management views its solution as particularly appealing for microgrid and primary power applications. This is because of the fact that each Bloom Energy Server is composed of independent 50-kilowatt power modules. Of course, when added together, they can have a larger impact, with a typical configuration producing up to 300 kilowatts of power. The modular nature of this technology makes it perfect for niche projects.

Under the second category, the company is centered around hydrogen generation. Using the same solid oxide platform as its Bloom Energy Server, the company incorporates its Bloom Electrolyzer in order to produce scalable and cost-effective hydrogen solutions. The nature of this technology makes it perfect for a variety of applications, such as utilities, the nuclear sector, and more. Management even claims that because of the high temperature the electrolyzer runs at, and the fact that large amounts of energy are typically needed to break up water molecules in order to produce hydrogen, that its offering can achieve this end goal by using less energy than alternative technologies. And finally, the company is also focused on the marine transportation space. According to management, the firm has adapted its fuel cell technology in order to focus on the decarbonization of the marine sector. its current platform has the ability to operate on liquefied natural gas, biogas, and blended hydrogen. The end goal is to power marine vessels without the kind of pollution that carbon-rich fuels currently result in. They also claim that there is a favorable byproduct of this in the form of reduced noise pollution.

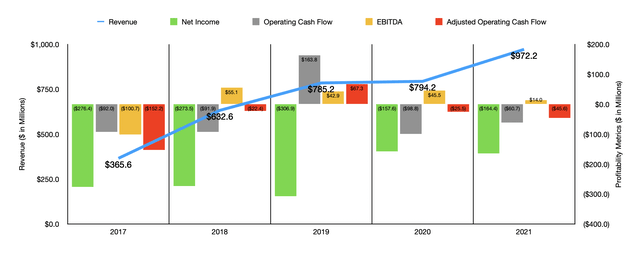

Author – SEC EDGAR Data

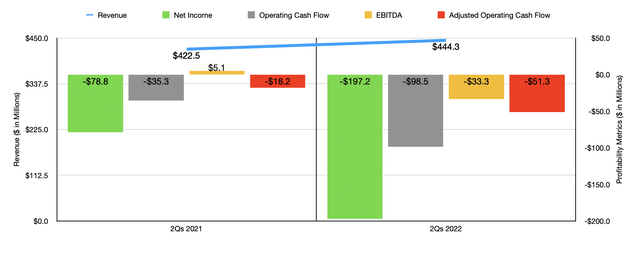

While all of this looks great at face value, the fundamental performance of the company has been somewhat mixed in recent years. On the positive side, revenue for the company expanded from $365.6 million in 2017 to $972.2 million last year. So far this year, growth continues, with revenue of $444.3 million generated in the first half of the 2022 fiscal year. That represents an increase of 5.2% over the $422.5 million generated the same time one year earlier. The company did just announce financial results for the second quarter of the year, with revenue of $243.2 million coming in stronger than the $228.5 million recorded just one year earlier. Revenue also beat analysts’ expectations to the tune of $14.9 million. After reporting this strong revenue beat, management did say that revenue for the year should come in between $1.10 billion and $1.15 billion. At the midpoint, that implies a year-over-year increase of 15.7%.

On the bottom line, unfortunately, things are not looking that great. The company has generated a net loss in each of the past five years, with the aggregate of those losses coming out to $1.18 billion. Operating cash flow improved between 2017 and 2019. But since then, cash flow has turned negative once again, coming in negative to the tune of $98.8 million in 2020 and $60.7 million last year. Even if we adjust for changes in working capital, operating cash flow in 2021 would have been negative to the tune of $45.6 million. The only metric that has been positive for the most part is EBITDA. This metric ultimately went from negative $100.7 million in 2017 to $55.1 million in 2018. But since then, it has struggled some, eventually declining to just $14 million in 2021.

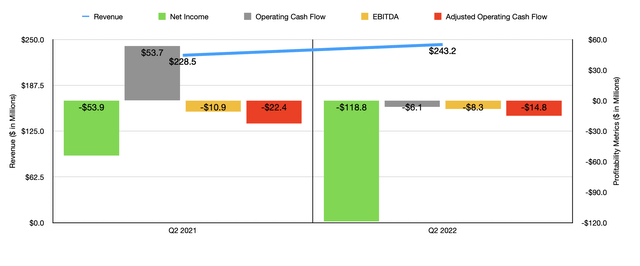

Author – SEC EDGAR Data

When it comes to the 2022 fiscal year, profitability for the company has looked pretty bad. In the latest quarter alone, the firm generated a net loss of $118.8 million. That compares to the $53.9 million loss achieved the same time one year earlier. Analysts were expecting a loss per share on a non-GAAP basis of $0.18, but the company missed this guidance by $0.02. Other profitability metrics also suffered. Operating cash flow fell from $53.7 million to negative $6.1 million. Though if we adjust for changes in working capital, it would have gone from negative $22.4 million to negative $14.8 million. Meanwhile, EBITDA improved slightly from negative $10.9 million to negative $8.3 million. For the first half of the year as a whole, the net loss of $197.2 million dwarfed the $78.8 million loss achieved the same period of 2021. Operating cash flow went from negative $35.3 million to negative $98.5 million. Even on an adjusted basis, it went from negative $18.2 million to negative $51.3 million. Over that same window of time, EBITDA turned from a positive $5.1 million to a negative $33.3 million.

Author – SEC EDGAR Data

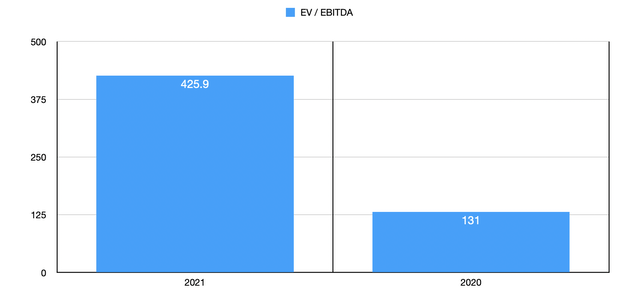

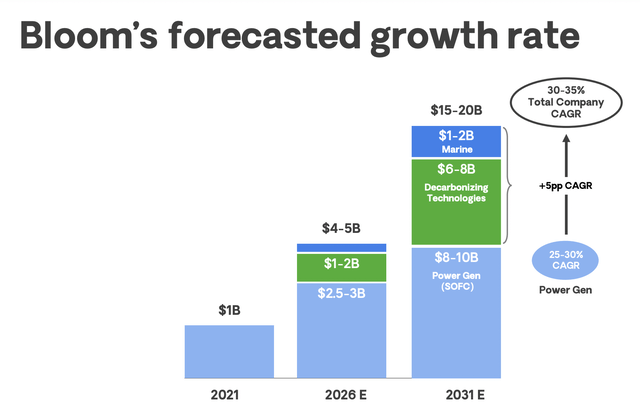

Based on all the data provided, the fundamental picture for the company looks far from great. Management currently anticipates positive operating cash flow this year. But there’s no telling to what extent that will occur. Using results for the 2021 fiscal year, the firm is trading at an EV to EBITDA multiple of 425.9, while using the 2020 figures would make this 131. Based on this data alone, the company should warrant a ‘strong sell’ rating. However, the firm currently has an extremely aggressive forecast for growth moving forward. Between now and 2031, they anticipate annualized revenue growth of between 30% and 35%. That would take the company from the $972.2 million in sales generated in 2021 to between $4 billion and $5 billion by 2026. By 2031, the company is forecasting revenue of between $15 billion and $20 billion. Between $8 billion and $10 billion of that would fall under the power generation category, while $6 billion to $8 billion would fit in the decarbonizing technologies space. That would leave between $1 billion and $2 billion for the marine category.

Author – SEC EDGAR Data

Forecasts are great, but you can forecast anything and have it turn out incorrect. Investors who are bullish about this particular firm, however, do have something to base their enthusiasm off of. For starters, the company continues to land interesting contracts. Perhaps the most notable is an expanded partnership with SK ecoplant, a company that serves as the primary distributor of its systems in the Republic of Korea. Its expanded partnership was announced in October of 2021 that involves purchase commitments of at least 500 megawatts of power for its Bloom Energy Servers between 2022 and 2025 on a take or pay basis. The partnership also involves the creation of hydrogen innovation centers in both South Korea and the US, and it was accompanied by an equity investment into Bloom Energy. The current estimated value of this arrangement is $4.5 billion. Though not as large, on August 9th of this year, the company also announced the initial results of its ongoing demonstration at the Idaho National Laboratory involving its solid oxide electrolyzer that includes steam and load simulations that replicate nuclear power station conditions. The pilot results of this test revealed that its product is producing hydrogen at 37.7 kWh per kilogram of hydrogen and with 88.5% lower heating value to DC. In all, the company claims that this translates to the production of hydrogen at a rate that is 45% more efficient than current alternative technologies.

Bloom Energy

Takeaway

Fundamentally speaking, Bloom Energy is not a great prospect to consider. The company is a little scary from a fundamental perspective and investors should be ready for tremendous volatility as a result. Having said that, recent catalysts are promising and it looks as though there is a real chance of the company continuing to expand at a nice rate for the foreseeable future. If this does come to pass, it could eventually achieve consistent positive cash flows that would warrant its current price. For investors who don’t mind that risk, it could make for a sensible investment. But for me personally, I feel a ‘hold’ rating is more appropriate.

Be the first to comment