Serenethos

Blink Charging (NASDAQ:BLNK) is moving forward with scaling its EV charging network via acquisitions and deployment of charging stations; although Blink is growing revenues at a tremendous rate, as seen in Q2, revenues still remain quite small at just above $11 million compared to rival ChargePoint’s (CHPT) $108 million. Blink is exposed to some near-term risks that raise the stakes at the moment given the current environment, such as a thin cash position and an inability to break-even. However, long-term tailwinds such as broader EV adoption and government funding do support a more positive take over the course of the decade as the industry growth pans out.

Brief Q2 Recap

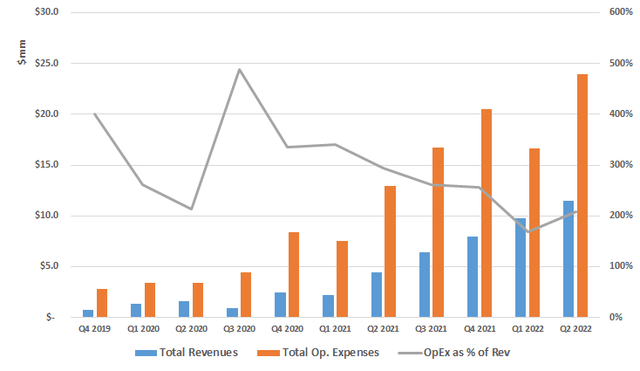

Blink’s Q2 results highlighted some positives and negatives for the charging operator. Revenues grew +164% y/y to $11.5 million for the quarter, boosting 1H revenues +223% y/y to $21.3 million. Charging stations contracted, deployed, or sold increased 73% y/y to 5,631 units. Service revenues jumped +154% y/y in part due to “greater utilization of chargers.” Blink said the record Q2 results were “highlighted by considerable organic growth complemented by the acquisitions of EB Charging in April and SemaConnect in June.”

On the other hand, Q2 also raised some red flags within Blink’s balance sheet and losses. Following the $200 million cash and stock acquisition of SemaConnect, Blink’s cash on hand dropped to $85.1 million. Net losses widened ~67% from $13.5 million to $22.6 million, as operating expenses jumped. While adjusted EBITDA margins showed some signs of improvement, margins still remain in excess of (130%), suggesting that Blink will find difficulty in scaling revenues quicker than expenses, or cutting costs to a degree where it can break-even over the next six to eight quarters. Blink’s CEO understands this concept, noting that profitability in the space is “unrealistic” in its current nature and that having “a long-term perspective” is necessary.

A Long Term Perspective

Taking that long-term perspective into account, the EV industry as a whole has multiple secular tailwinds ahead over the course of the decade.

The EV industry is showing signs of strength in August as vehicles sales ticked up in many nations around the world. Growth in EVs boosts demand for EV charging services and stations.

In the US, IHS Markit projected EV sales to rise to ~6% of the light-vehicle market for August, almost double the 3.3% share in August 2021. Leading OEMs witnessed strong growth, with Ford (F) reportedly seeing over 300% growth in EV volumes, and Tesla (TSLA) seeing 105% growth (and ~11% growth from July) to reach over 45,000 vehicle sales during the month.

Internationally, France posted the first monthly sales increase in 15 months in August, driven by a 24% increase in passenger BEVs to reach 13.5% market share. Total plug-in vehicle share reached nearly 21%. In Germany, plug-in vehicle sales snapped a five-month losing streak with 6% y/y growth in August to reach 28.5% market share – BEVs held 16.4% market share. China EV data showed sales of ~632,000 units in August (up ~12% from July), reaching a new monthly record and more than doubling from August 2021. NEVs accounted for 30% of total vehicle sales in China during the month.

Expanding EV charging infrastructure is crucial to support these trends of increasing EV volumes and market share gains. The Biden Administration, for example, has allocated $7.5 billion in funding over the course of 5 years to build out EV charging infrastructure to boost EV adoption – in Blink’s case, it has acquired ~$32 million in grants since January 2021. More funding may be on the way for Blink to fuel expansion efforts, as Biden on Wednesday announced the approval of the first $900 million in funding available to 35 states for EV charging purposes.

Blink’s Tailwinds

Aside from the two industry tailwinds – EV market share growth and government funding support EV charging network expansion and demand – Blink has a couple long-term tailwinds exclusive to its business model.

The acquisition of SemaConnect has significant boosted Blink’s charger and customer count, while simultaneously allowing for manufacturing capabilities to be scaled higher. SemaConnect added “12,800 active chargers and 151,000 registered users resulting in Blink’s total portfolio of over 51,000 chargers and over 423,000 registered users.” For ~20% of Blink’s market cap, the additional 12,800 chargers (or nearly 33% of Blink’s existing portfolio prior to the acquisition) added a tremendous ability to reach new customers and monetize new regions. The acquisition is likely to be immediately accretive and could push Blink’s revenues in Q3 up approx. +40% sequentially to $15 million.

Blink’s April acquisition of EB Charging to add over 1,150 chargers to its UK footprint also bodes well for international revenue growth, which is just about one-quarter of revenues so far. Blink’s presence across 19 countries opens the door for future geographic expansion and scaling within new and existing geographies.

SemaConnect’s acquisition could shape up to be a truly transformative acquisition for Blink, especially in terms of manufacturing and scaling Blink’s footprint. The acquisition adds “in-house manufacturing capabilities of more than 10,000 EV chargers today and scaling to 50,000 per year.” Compared to Q2’s 5,631 units, Blink has the capability to double sales via doubled production. This will boost revenues significantly – Blink grew product units by ~73% y/y in Q2, while product revenues increased ~175%. ARPU rose from ~$1,010 to ~$1,560. At 10,000 EV chargers, product revenues could be north of $16 million alone – putting Blink on track to reach $20 million in revenues, potentially as early as FQ4 if production allows.

Blink’s Headwinds

Aside from the accretive acquisitions and upside to revenues from expanding scale and geographic scope, among other factors, Blink has a handful of short to medium-term headwinds that could challenge shares.

As previously mentioned, Blink’s cash and cash equivalents are running very thin, especially after the SemaConnect acquisition. With just $85.1 million in cash, Blink will be needing cash by the end of 2022 or by Q1 2023 at the latest. With its ~$25 million quarterly cash burn rate, Blink could be near $40 million in cash by Q4, raising the stakes for an immediate funding event.

Another concern is Blink’s operating expenses. Total operating expenses continue to exceed revenues, which is expected as Blink works to scale rapidly and grow its footprint. However, the cause of concern here is the degree to which operating expenses exceed revenues – for Q2, operating expenses were over 200% of revenues, after dropping slightly in Q1. Again, operating expenses are necessary to grow the business, but Blink is showing a long road to break-even.

Comparing operating expenses to Blink’s gross profit reaffirms that difficult path to reaching break-even. Even with gross margin expanding to almost 23%, operating expenses are over 9x higher. With the need for continual spending to expand, it’s unlikely that Blink reaches break-even by 2027, likely needing at least $150 million in revenues per quarter to offset this spending. Assuming margins hold near 25-30%, gross profit equals out to ~$45 million – this allows operating expenses to just double, signifying that at some point in the future, Blink will have to rein in expenses while maintaining growth. At the moment, it’s simply too early over the next six to eight quarters to shift to a profitable focus while maintaining strong growth.

Keeping this in mind, Blink is likely to require more cash between 2024 and 2025, with cash burn rates likely still hovering between $100 million to $160 million per year.

Outlook

Plans to ban ICE vehicles – led by California and the EU aiming for a 2035 target – combined with billions in government funding to build out EV charging infrastructure factor in positively for Blink and the charging sector. EV sales are showing strength in August, with market shares growing. This secular shift is expected to gain pace over the next few years as more models hit the market. As such, EV charging demand is expected to grow significantly, serving as a long-term tailwind for Blink to grow revenues. Its acquisition of SemaConnect added a substantial manufacturing capability and existing network footprint, which could add an additional boost to revenues. However, Blink is running low on cash following that purchase, and likely will need more by Q1 2023 at the latest, and between 2024 and 2025, given its cash burn rate. Operating expenses and gross profit show Blink is still far away from breaking even, with revenues needing to grow significantly from current levels in order to offset such expenses. The need for cash and this challenging path to reaching operating profitability serve as near-term and medium-term headwinds for shares.

Be the first to comment