z1b

Asset management giant Blackstone (BX) boasts a portfolio of assets under management reaching nearly $1 trillion, made up largely of real estate. The asset manager partners with big money players like pension funds and insurance companies to provide strong returns and steady income.

Though Blackstone sometimes acquires individual real estate properties, such as The Bellagio in Las Vegas, it more often seeks opportunities to scoop up whole portfolios that will move the needle. This year, the company has set its sights particularly on acquisitions of real estate investment trusts (“REITs”).

So far in 2022, Blackstone has bought or agreed to buy:

- Preferred Apartment Communities (APTS) for $5.8 billion

- American Campus Communities (ACC) for $12.8 billion

- PS Business Parks (PSB) for $7.6 billion

- Resource REIT (non-traded) for $3.7 billion

That is about $30 billion of real estate!

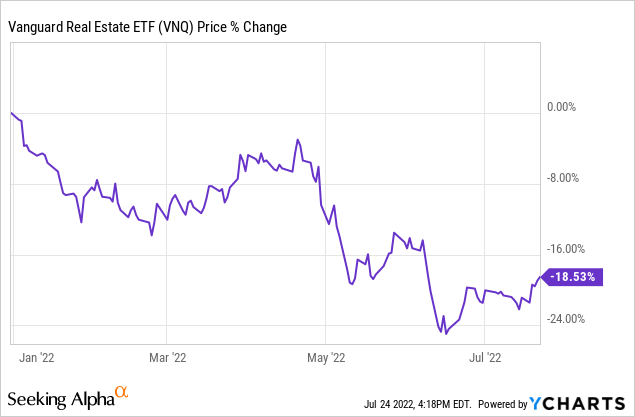

Clearly, as the Vanguard Real Estate Index (VNQ) has sold off along with the broader market this year, Blackstone believes that there is ample value to be found in REITs.

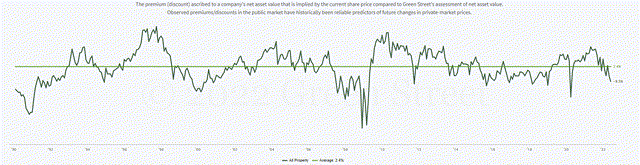

Indeed, according to Green Street Advisors, REITs are currently trading at an average discount to net asset value (“NAV”) of about 10%. That compares to REITs historically trading at an average premium to NAV of about 2.5%.

(“Net asset value” is akin to an adjusted book value for REITs using estimated market values for their real estate.)

And this is based on conservative estimates of property values. Using different valuation methods, real estate services firm Jones Lang LaSalle (JLL) recently posited that REITs’ discount to NAV is over 15%, commenting that a “sustained dislocation in public and private values could be a precursor of opportunities for fundamentals driven private market participants, leading to take-private M&A.”

This gives a hint as to why Blackstone has been hoovering up REITs like a vacuum this year. While commercial real estate itself is performing extraordinarily well this year and retaining its value, publicly traded REITs have shed around 20% of their value and now mostly trade at discounts to NAV.

Here’s what Blackstone CEO Steve Schwarzman had to say about their real estate strategies in the recent Q2 2022 earnings call (emphasis mine):

In real estate, while the public REIT index fell 17% in the quarter, our Core+ funds were up 2.3%. I’ll do that again for you. The index is down 17%, we were up 2.3%. And our opportunistic funds protected capital, down only 1%, so we only performed by 16% for our customers over the index.

For the first six months of the year, our real estate strategies appreciated 9% to 10% versus a 20% decline in the REIT index, equaling an outperformance of roughly 3,000 basis points. I don’t know many asset classes that perform — outperform indexes by 3,000 basis points.

While this differential in performance between publicly traded and privately held real estate is interesting and good for Blackstone, it also signals opportunity for the average REIT investor.

Simply put, REITs are cheap!

Clearly, that is Blackstone’s view. Hence, we find Blackstone’s President & Chief Operating Officer Jon Gray concluding that:

The best opportunities today are clearly in the public markets on the screen and that’s where we’re spending a lot of time.

And Blackstone’s financial capacity to continue scooping up undervalued REITs is massive. The asset management behemoth boasts roughly $50 billion in dry powder capital earmarked for global real estate, including a new real estate fund with over $24 billion in commitments from investors so far. There is no upper limit on the size of this new fund, so it could potentially grow significantly larger.

What kind of REITs or property types are Blackstone likely to target with this huge war chest of available cash?

It is impossible to predict with any certainty, because last year Blackstone acquired data center REIT QTS Realty, and in 2018 it acquired hospitality REIT LaSalle Hotel Properties. Clearly, the company will buy whatever it views as the most attractive viable deal.

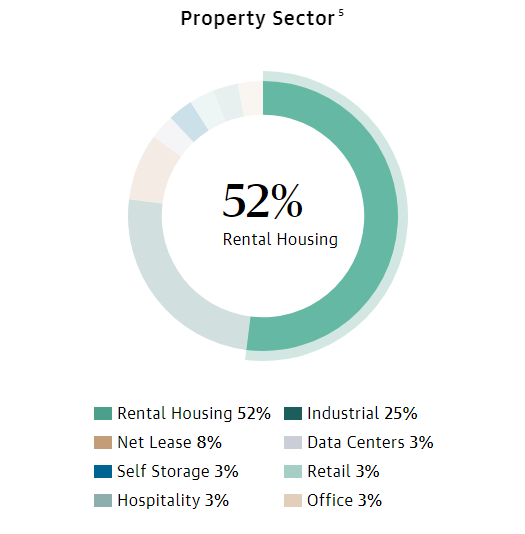

But in recent years, Blackstone’s REIT buying spree has been concentrated overwhelmingly in two real estate sectors:

- Residential rentals

- Industrial

These two property sectors now make up over 3/4ths of Blackstone’s primary real estate fund.

BREIT Portfolio

Let’s take a look at two potential buyout targets for Blackstone in these property sectors.

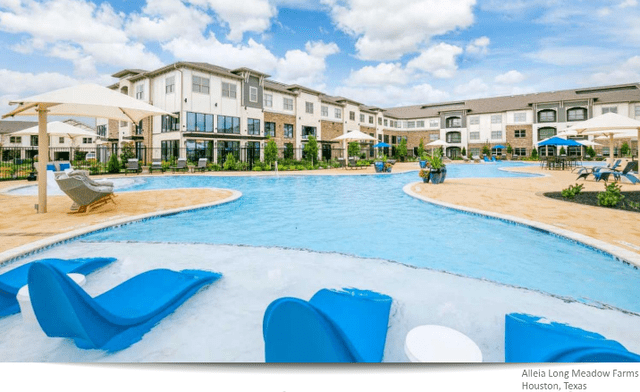

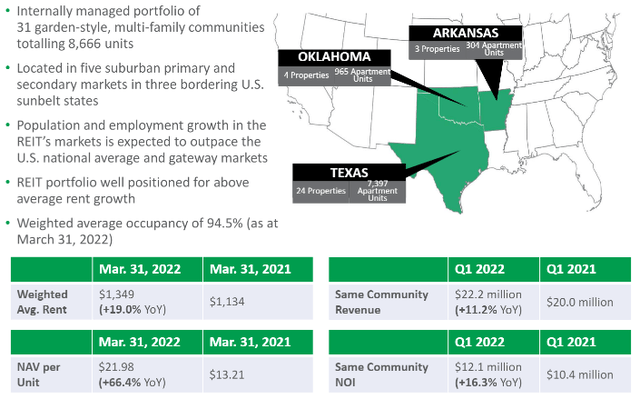

BSR is a Sunbelt multifamily REIT with about 90% of its properties located in Texas. The stock, however, is only traded over the counter in the US as well as on the Toronto Stock Exchange under the ticker symbol HOM.U. This is surely a huge factor in the discount at which BSR typically trades.

Currently, BSR trades at a particularly stark discount. At $16.50 per share (as of this writing), BSR trades at a remarkable 25% discount to its Q1 2022 NAV per share of $21.98.

This kind of discount would imply either that BSR’s property portfolio is sub-par, that its management is unskilled or conflicted, or that its balance sheet is weak, none of which are the case.

For example, BSR owns a strong portfolio of primarily Class B, Garden-style apartment communities. Here are some examples:

BSR Presentation BSR Presentation BSR Presentation BSR Presentation

These properties are overwhelmingly concentrated in Texas, especially Austin, Dallas/Fort Worth, and Houston.

And, as you can see from the metrics above, this portfolio has exhibited incredibly strong organic performance so far this year. In the first quarter, same-community net operating income surged 16.3% year-over-year on the back of rent growth for new leases of 17.4% and renewals of 9.0%.

Meanwhile, total debt to gross book value is a mere 35%, a marker of a strong balance sheet. And management is also skilled and motivated, as insiders own around 40% of the company.

The REIT’s quarterly dividend of ~$0.13 (paid monthly in $0.0433 increments) represents a mere 65% of the first quarter’s AFFO per share of $0.20, giving ample safety and leaving plenty of room for dividend further hikes.

Though the dividend yield of ~3.2% may seem low, it is actually quite high compared to the yields of its closest peers in the Sunbelt multifamily space:

- Mid-America Apartment Communities (MAA): 2.9%

- Camden Property Trust (CPT): 2.8%

- NexPoint Residential Trust (NXRT): 2.4%

With over 30% upside to fair value, it would not be surprising if Blackstone at least made an attempt to buy BSR.

STAG Industrial (STAG)

STAG is a ~$10 billion enterprise value industrial REIT specializing in higher yielding, single-tenant net leased properties largely in secondary and tertiary markets.

Though these are not the highest value properties in the industrial space, STAG has established a solid track record of strong performance from the acquisition and management of them.

For example, from the beginning of the year through June, STAG has acquired $271 million of properties at a 5% cap rate while selling $36 million of properties at a 4.4% cap rate. This implies that the REIT was able to sell properties at a significant gain from its original purchase price.

In July, we saw another example of this accretive capital recycling as STAG sold two properties for $82 million at a 5.2% cap rate after having purchased them several years prior at an average cap rate of 6.2%.

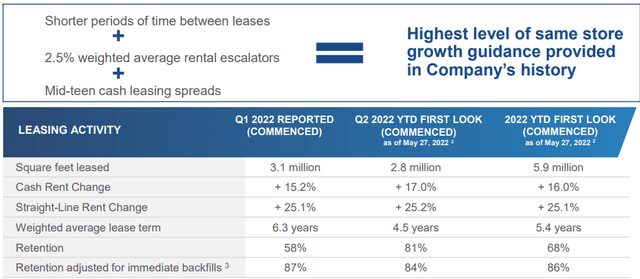

What’s more, the portfolio is performing quite well organically as well. For instance, in the first quarter of this year, cash same-store net operating income grew 4.8%, while the REIT has guided for same-store NOI to grow 4-5% for the full year.

Retention remains high, and rent growth for new and renewal leases is rising rapidly. Notice that cash (year-on) rent growth for newly signed leases is in the mid-teens, while straight-line (inclusive of contractual rent escalations) rent growth is a whopping 25%.

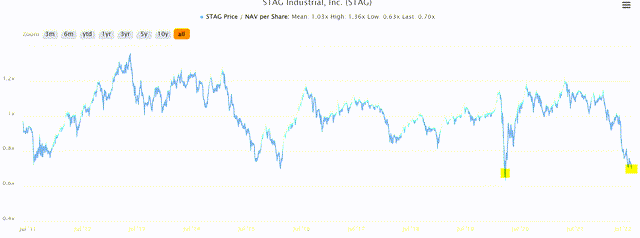

There are literally no signs of a slowdown yet for STAG’s industrial real estate, and yet the market has punished STAG with a ~35% selloff this year.

That has put STAG at a 30% discount to NAV, one of the steepest discounts in its history as a public REIT.

STAG Industrial Discount To NAV

STAG offers an attractive, 4.7% dividend yield with a payout ratio slightly below 70%. Plus, the REIT has over 40% upside to NAV.

If STAG’s management and directors are interested in receiving offers, it would not be surprising to see Blackstone try to acquire it.

Bottom Line

We do not believe it is a good idea to buy a REIT simply because it looks like an attractive buyout prospect for big-money asset managers and private real estate funds. That, for us at High Yield Landlord, is not enough on its own.

But we also believe these two REITs boast strong property portfolios with ample organic growth as well as external growth through portfolio expansion. They both have quality management teams with significant skin in the game. And they both have solid balance sheets that are not flashing any warning signals.

Even if Blackstone does not acquire BSR or STAG, we think both REITs will perform well in the future. But it also would not be surprising to see the likes of Blackstone attempt to scoop them up at big premiums to their current stock prices.

This is why they are today two of our largest holdings in our Core Portfolio.

Be the first to comment