Andrew Burton

Thesis

Leading global asset manager BlackRock, Inc. (NYSE:BLK) has had a fantastic month of recovery, as BLK outperformed the broad market significantly since our previous update.

We upgraded BLK to Strong Buy even as it fell toward its October lows. We highlighted that the pessimism has been building up to an extreme in the asset management industry, as Wall Street analysts slashed their earnings estimates.

Accordingly, BLK has surged nearly 30% from its October bottom, dwarfing the S&P 500’s (SP500) (SPX) 5.6% gain. It has also helped BLK regain its long-term uptrend momentum, as the market forced out weak holders at the worst possible moments.

However, investors looking to join the rapid surge now are urged to reconsider. We parse that its valuation is no longer attractive, and its momentum surge is due for a pullback.

Therefore, investors are encouraged to bide their time for the market to digest its recent momentum spike.

Revise from Strong Buy to Hold.

October CPI Print Could Suggest Peak Fed Hawkishness

The asset management industry has suffered over the past year as the market anticipated the Fed’s rate hikes to impact its fees and earnings growth. As a result, BLK formed its all-time highs in November 2021 even before the Fed went into its hiking overdrive to batter the equity and fixed-income market.

As a result, BLK underperformed the broad market from its November 2021 highs to its recent lows, as it lost nearly 50% of its value. Despite that, BLK maintained its valuation premium against other lesser asset managers, given its competitive moat and earnings leadership.

Therefore, yesterday’s CPI print could suggest that the market had already priced in maximum Fed hawkishness as it headed into the release. We had already anticipated a sustained market bottom in October.

The recent cagey positioning heading into the CPI release corroborated that the market had likely anticipated a worse-than-expected inflation print after August’s faux pas.

Leading asset managers like BlackRock are likely to be critical beneficiaries of a peak in the Fed’s terminal rates. Notably, the return of more robust investment sentiments could drive solid fund flows recovery, and the recovery of fee income due to higher AUMs. Also, it could lead to investors reallocating their portfolios toward higher-fee funds to leverage the market bottom.

Accordingly, our analysis shows that long-term buyers in BLK had already anticipated such a possibility as they came in to support BLK’s October lows nearly a month before the CPI release yesterday.

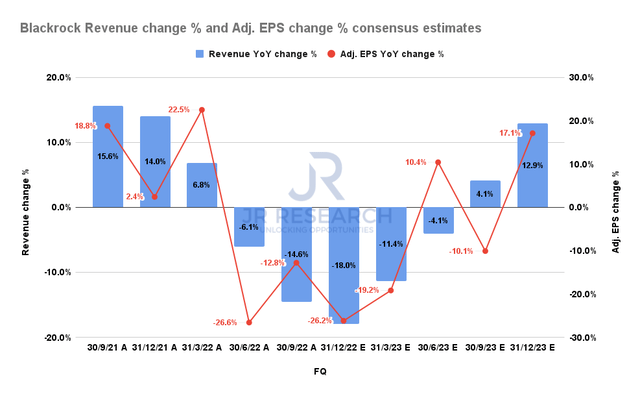

BlackRock Revenue change % and Adj. EPS change % consensus estimates (S&P Cap IQ)

Hence, we postulate that the slope of its revenue and earnings recovery as projected by the consensus estimates (bullish) is credible, in accordance with our base case of a mild-to-moderate recession.

Moreover, we believe there could be upside surprises to the revised estimates, if the market sentiments recover more favorably, as industry revisions suggested extreme pessimism heading into October.

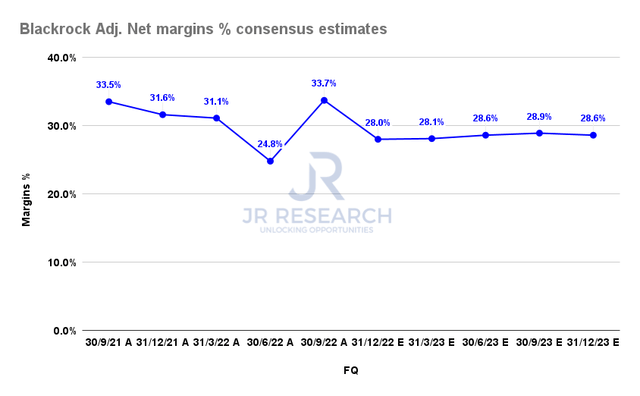

BlackRock Adj. Net margins % consensus estimates (S&P Cap IQ)

Notwithstanding, we don’t expect the feverish days of 2020/21 to return in the near term, as rates are likely to remain elevated for some time. As such, BlackRock’s adjusted net margins should normalize, into FY23.

Hence, we postulate that the recovery from its October lows was a consequence of significant pessimism baked into its earnings prospects due to worries about significant market volatility and global recession.

Is BLK Stock A Buy, Sell, Or Hold?

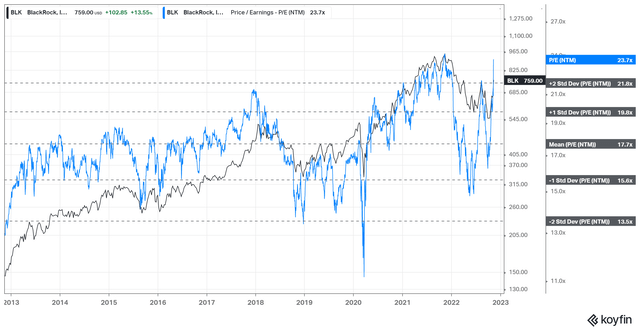

BLK NTM normalized P/E valuation trend (koyfin)

With the massive momentum surge from its October lows, BLKs valuation is no longer attractive. It last traded at an NTM normalized earnings multiple of 23.7x, well above its 10Y mean of 15.6x.

It’s also well above its peers’ median multiple of 13x (according to S&P Cap IQ data). While BLK has consistently traded above its peers, investors need to be wary of the bifurcation in its premium.

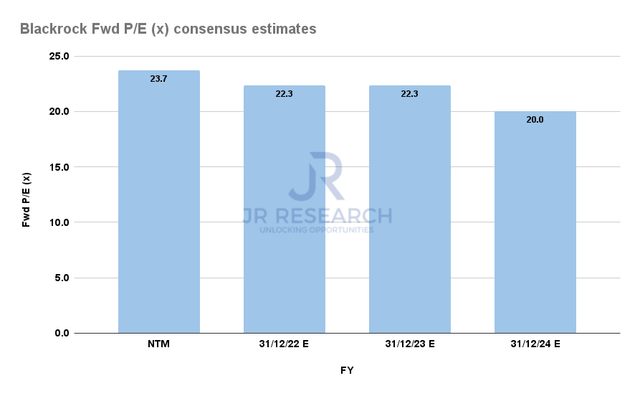

BLK Forward P/E consensus estimates (S&P Cap IQ)

Looking into 2024, the current projections suggest that the recovery in its earnings is likely to be tepid. As such, BLK last traded at an FY24 normalized P/E of 20x, still well above its 10Y mean.

Notwithstanding, we highlighted that there could be upside surprises to the revisions, as Street estimates were pretty downcast as they marked down the asset management industry significantly into October.

However, even if we applied a 15% upward revision to its FY24 adjusted EPS estimates, its P/E would fall only to 17.4x. Also, BLK has traded below the S&P 500’s weighted average P/E of 19.2x over time. Hence, we don’t expect BLK to be re-rated markedly higher from here.

It seems likely that the market has anticipated a pretty strong earnings recovery through FY24, reflected in its current valuation.

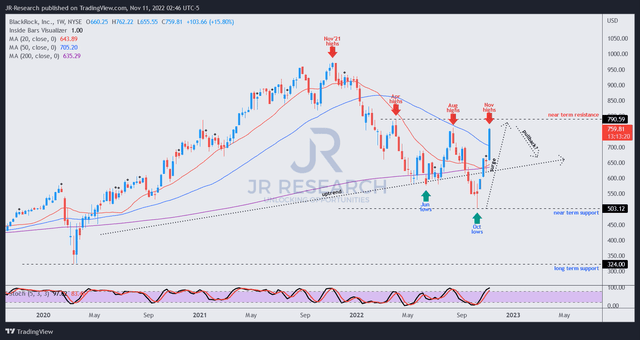

BLK price chart (weekly) (TradingView)

The rapid recovery from its October lows is emblematic of a momentum spike that we urge investors to be wary about chasing further from here.

BLK appears to be closing in against its near-term resistance, which has attracted strong sellers since April. Coupled with its spike, we are not satisfied with the reward/risk profile at these levels.

Therefore, we believe it’s prudent for investors to have some patience in biding their time for a deeper pullback toward its 200-week moving average (purple line) before adding more positions.

Revising from Strong Buy to Hold.

Be the first to comment