eugenesergeev/iStock via Getty Images

Introduction

BlackRock (NYSE:BLK) has grown significantly in recent years and has become the largest investment manager in the United States. The company provides services to institutional investors, pension investors, mutual funds, governments, sovereign wealth funds and banks.

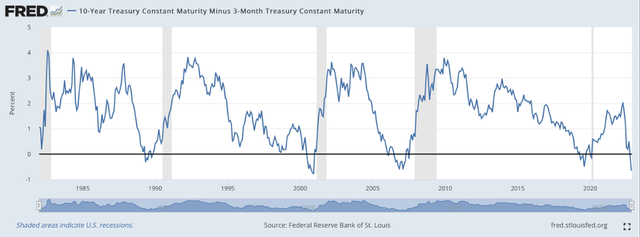

The stock price has fallen sharply since the beginning of the year, as have many other stocks. Currently, the stock price has rebounded, but risks remain.

BlackRock’s third-quarter results were mixed, with lower revenues and a year-over-year decline in earnings per share. The outlook is also not favorable. The yield spread is currently negative, pointing to a recession within now and 1 year. I warned readers of Seeking Alpha about this risk in my previous article, and now it is pretty certain that depressed times are coming.

Third Quarter Results Were Mixed

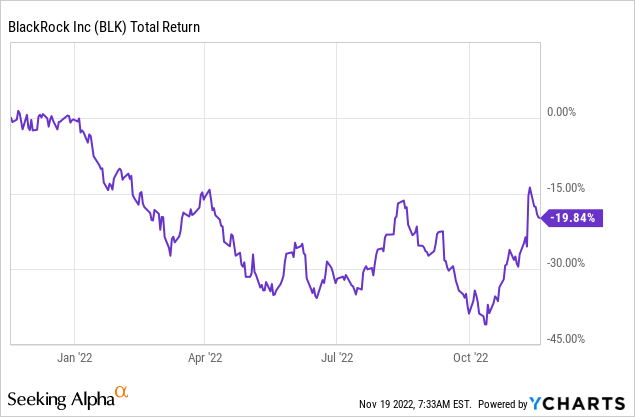

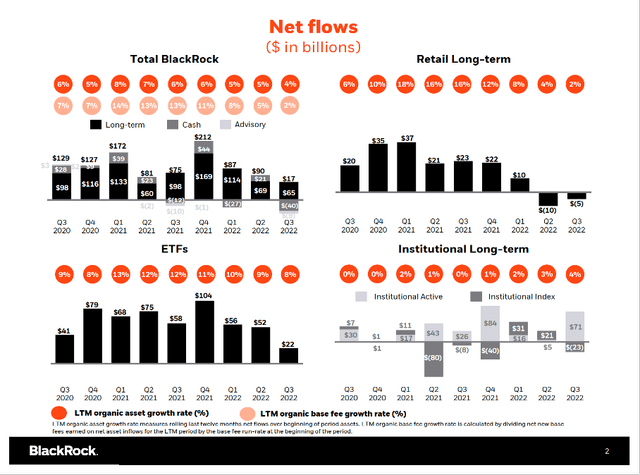

Third quarter results of fiscal year 2022 came in much higher than expected, with adjusted earnings per share of $9.55, down 13% year over year. Analysts expected adjusted earnings per share of $7.06. The higher than anticipated earnings per share was due to strong growth at Technology Services (Aladdin), a lower effective tax rate and a lower number of diluted shares due to share repurchases. During the quarter, $375M worth of shares were repurchased. Operating margin declined to 42% from 48% in 2020 due to inflationary cost pressures. Revenue declined 15% year-over-year in the third quarter, primarily due to the impact of significantly lower markets and a rise in the value of the dollar on average AUM and lower performance fees. During the quarter, total net inflows were $17B reflecting outflows of cash management and advisory AUM. Retail clients contributed net outflows of $4.9B and net inflows into ETFs during the quarter were $22.3B.

Business Results (BLK Third Quarter Investor Presentation)

High Risk Of Deep Recession

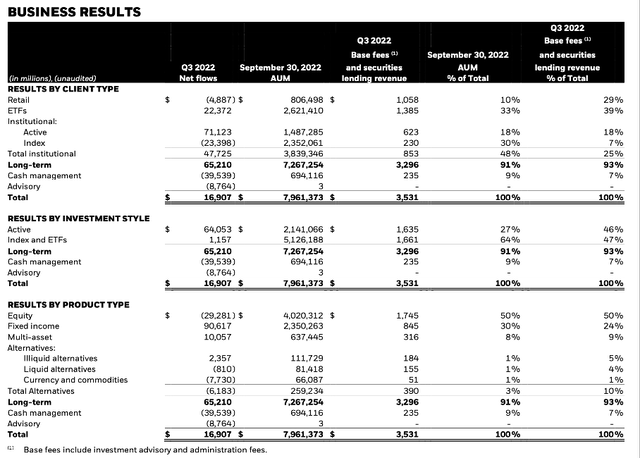

On Aug. 8, I wrote an article about an upcoming recession in the United States. In the first and second quarters of this year, GDP growth was negative for two consecutive quarters, indicating an economic recession. The yield curve is a good predictor of upcoming recessions and stock market crashes. Let’s take a look at the chart from my article:

Yield spread, yellow markings visualized by the author (FRED and author’s own visualization)

I colored the peak-to-trough of the S&P500 yellow when it exceeded 20%. The S&P500 has been in a bear market since the beginning of this year. The current peak-to-trough is at 19% after the recent rise of the S&P500.

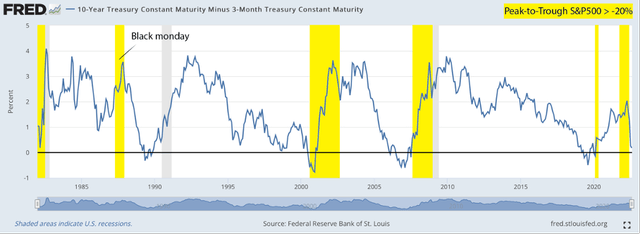

Does this mean the beginning of the bull market? I don’t think so. The yield spread is currently deeply negative:

Yield spread (FRED)

A negative yield spread indicates an upcoming recession between now and a year. The stock market also crashes by more than 20% after the yield curve went negative. Since the S&P500 is already falling, I expect a deeper decline for the coming period. As in the year 2000, the yield spread was deeply negative and the S&P500 gradually declined for 2 years.

What does this mean for BlackRock? Investors are watching the yield curve closely and may react to the market if the yield spread is negative. Mainly retail investors create a lot of volatility in the market because they act quickly in times of panic. Panic selling has strong negative effects on stock prices and bond prices.

If an economic recession occurs within a year, retail investors have less to spend, and corporate profits will fall. Stock valuations will be sky high. Then, investors panic and hit the sell button. Volatile markets hit Blackrock’s profits, bond markets tend to be highly volatile in times of an inverted yield curve. The upcoming economic recession is a devastating rock.

Weak Bond Markets Is A Significant Headwind For BlackRock

Volatile bond markets are a major headwind for BlackRock; 61% of actively managed assets are fixed income. Inflation, rising interest rates, liquidity and market volatility remain major uncertainties for investors – BlackRock’s clients. Net flows last quarter were the lowest in years.

Net flows (BLK 3Q22 Investor Presentation)

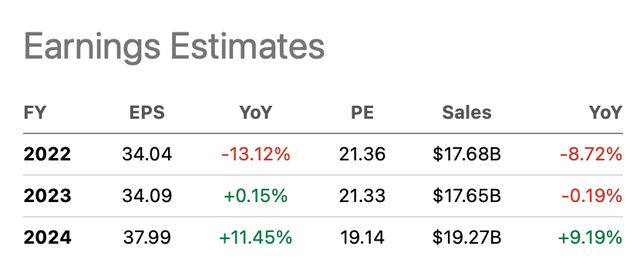

Earnings Expectations Are Bleak

I find the earnings and revenue projections meager. According to 12 analysts on the Seeking Alpha BLK Ticker page, revenue will decline an average of 9% in fiscal 2022. The projected decline in adjusted earnings per share is more significant with a projected 13% decline.

This is notable because BlackRock is known for its generous share repurchase program. The share repurchase program should increase earnings per share.

BlackRock suffered from a stronger dollar in the third quarter. Because inflation data came out more favorable than expected, investors expected the Fed to adopt a rather dovish policy. The dollar has since depreciated, which should increase BlackRock’s profits. Still, analysts’ expectations are bleak.

BlackRock Earnings Expectations (Seeking Alpha BLK Ticker Page)

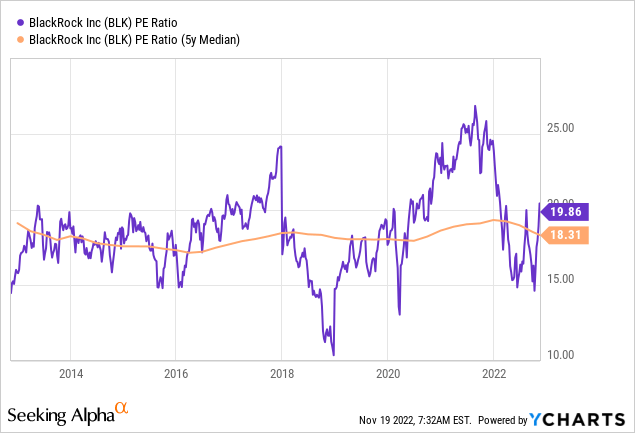

Valuation Is In Line

Looking at the stock’s valuation statistics, we see that BlackRock is valued slightly more expensively than the 5-year average based on the ratio of EV to EBIT.

The five-year average PE ratio is 18.3. If we multiply the average PE ratio by the expected earnings per share for fiscal year 2024 of $38, we arrive at a share price of $695. The current share price of $713 is higher than the expected share price for fiscal year 2024, so the stock price offers no margin of safety. Combined with moderate earnings expectations, I see no growth catalysts for BlackRock.

Conclusion

Third-quarter earnings were mixed, with both revenue and earnings per share lower YoY. Earnings per share came in higher than analysts had expected thanks to growth at Technology Services, a lower effective tax rate and share repurchases. Retail clients caused outflows at BlackRock. The outlook for BlackRock is bleak due to highly volatile near-term market conditions. The yield spread is negative and historically this points to an upcoming economic recession within now and a year. Revenue is expected to decline 9% for fiscal year 2022, and adjusted earnings per share will decline more sharply by 13% year over year. Analysts remain pessimistic for the coming years. At first glance, the stock’s valuation seems in line with its historical average. But if we multiply earnings per share for fiscal 2024 by the average PE ratio, we see that BlackRock is trading at a premium. There is no margin of safety.

Be the first to comment