Anton Vierietin/iStock via Getty Images

Thesis

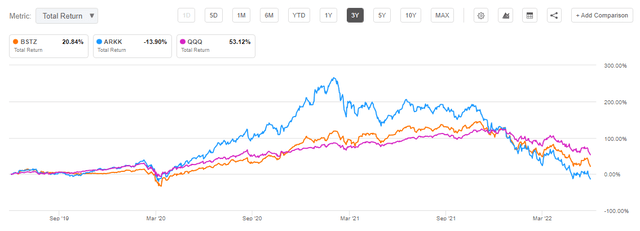

With a recession looming triggered by an incompetent Federal Reserve which has been late in raising rates and fighting inflation, all the market darlings from 2020 – 2021 are getting crushed. The Nasdaq is down more than -30% this year, the S&P 500 has entered bear market territory, the leading Crypto coins have experienced -17% drops over the weekend (yes they do trade when other markets are closed) and Cathy Wood’s ARKK is just getting smoked (down more than -60% year to date). BlackRock Science and Technology Trust II (NYSE:BSTZ), an admirable CEF from BlackRock, which correctly captured the growth zeitgeist last year, is not immune from this move either.

BSTZ is down almost -50% year to date and has become a macro play at this stage. It is not about BSTZ and its components, it is all about the Fed terminal rate and what will the market use as a risk free yield to discount the distant cash flows the component companies in BSTZ will generate sometimes in the future. Make no mistake – there is no V-shaped recovery in growth this time around and until inflation recedes and the market is comfortable yields have peaked we are going to have more weakness here. The 2021 growth party is over and old school companies that generate free cash flow now is what matters in 2022.

After a stellar performance in 2020 and 2021 BSTZ is losing altitude fast and will only start bottoming out when inflation is contained. In our view there is no soft landing in sight and we are going to enter a mild recession as the Fed chokes growth to fight inflation. Robustly set up and with a great management team BSTZ will rise again but it will take time. The cycle is turning and we are seeing a re-allocation of cash from speculative investments to more value oriented proposals. Sexy is out and boring is back. It will take 1-2 years for P/E ratios to normalize in the space, for the Fed to be back at lowering rates to stimulate the economy and for retail investors to experience FOMO again.

BSTZ, a technology equity CEF that had a stellar performance in 2020 and 2021 has closely mirrored the ARKK performance this year. The fund is now trading at a record -16.4% discount to NAV and will continue to be under pressure as capital leaves the speculative pockets of the equity markets. BSTZ is now a macro play for us with its valuation driven by peak inflation and the ultimate Fed Funds neutral rate which will be utilized to discount the future cash flows of the component companies.

CEF Analytics

- AUM: $1.6 bil

- Sharpe: 0.44 (since inception)

- St Dev: 31.3 (since inception)

- Premium/Discount: -16.4%

- Z-Stat: -2.58

- Dividend Yield: 11.5%

- Leverage Ratio: 0.26%

Performance

The fund is down more than -47% year to date, mirroring the ARKK performance:

YTD Performance (Seeking Alpha)

After a stellar 2020 and 2021 the fund is now up only +20% since inception in 2019:

Performance since Inception (Seeking Alpha)

An investor needs to keep in mind that innovative technology companies are a great investment thesis, but starting valuation points matter. Even if the company will be a game changer in its domain down the line, buying into something that is overvalued on day 1 will result in initial loses. The massive run-up in growth stocks was fueled by the zero rates environment triggered by the Fed actions, and as the Fed liquidity and balance sheet are withdrawn we are seeing the party end in the growth stock space.

This is not to say there is no future for the tech equity in BSTZ by any means, just that annual CAGRs are going to normalize, P/E ratios are going to come down and the vehicle will not post the type of returns seen in the past for some time to come.

Holdings

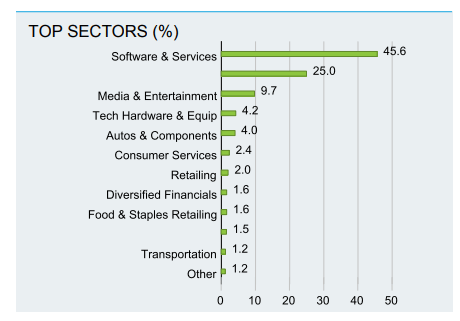

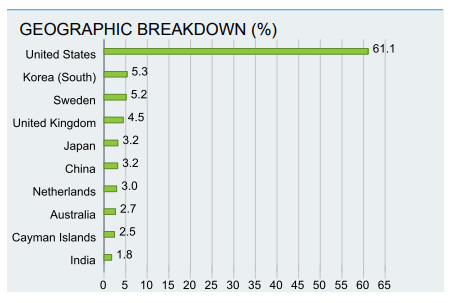

The fund focuses on technology equities around the globe:

Sectors (Fund Fact Sheet) Geography (Fund Fact Sheet)

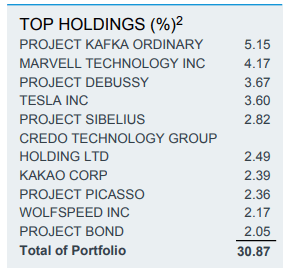

If we look at the fund’s top holdings we will notice there are quite a few private names present:

Holdings (Fund Fact sheet)

Project Kafka actually represents the fund’s investment in Klarna, a Swedish payments company:

Klarna was founded in 2005 in Stockholm, Sweden with the aim of making it easier for people to shop online. In the last 17 years, technology has evolved, excited and transformed the world around us, yet our mission remains as relevant as ever, to make paying as simple, safe and above all, smooth as possible.

Klarna is the leading global payments and shopping service, providing smarter and more flexible shopping and purchase experiences to 147 million active consumers across more than 400,000 merchants in 45 countries. Klarna offers direct payments, pay after delivery options and instalment plans in a smooth one-click purchase experience that lets consumers pay when and how they prefer to.

Source: Company Website

Klarna is valued using a more opaque valuation technique that relies on inputs such as the value assigned by the last round of funding. These sort of valuations are not always accurate as the market can change drastically and various investors have different views on the component companies. However the Klarna valuation is soon to become more visible with an IPO planned for 2022.

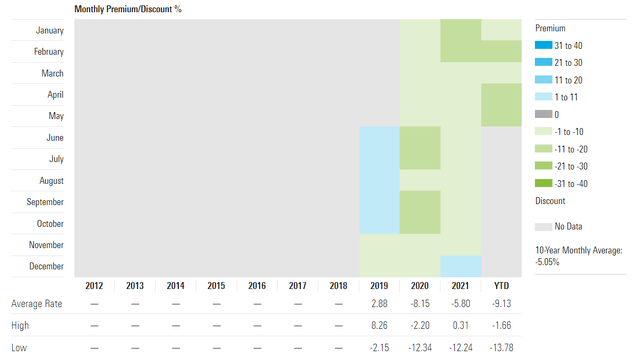

Premium/Discount to NAV

As the markets have clobbered BSTZ its discount to NAV has widened significantly:

As we see with any asset class, as the particular sector enters a risk-off environment we see the discount to NAV widen out. This is more pronounced for BSTZ due to the fact that a portion of its underlying collateral is more illiquid when compared to other equity CEFs.

We expect this discount to persist, and it will only become an opportunity to buy into when the stock bottoms out. Kindly keep in mind that discounts to NAV can persist for long periods of time.

Conclusion

BSTZ is an admirable CEF from BlackRock that managed to capture the investor’s clamoring for growth names, with an allocation tilted toward more illiquid private investments in the global technology space. With an astounding performance in 2020 and 2021 BSTZ outperformed the Nasdaq index. Nothing goes up in a straight line, and as capital leaves the Tech space BSTZ has suffered. Down almost -50% year to date BSTZ has seen valuations re-set in its portfolio as the Fed raises rates. We feel at this stage BSTZ is a macro play, with its performance ultimately dependent upon peak inflation and the neutral Fed Funds rate to be used in discounting the future cash flows of the component companies.

Be the first to comment