piranka/E+ via Getty Images

Thesis

The BlackRock Science and Technology Trust (NYSE:BST) is a closed-end fund focused on technology equities. The fund has income and total return as its objectives. As per the fund’s literature:

The Trust seeks to achieve its investment objective by investing, under normal market conditions, at least 80% of its total assets in equity securities of U.S. and non-U.S. science and technology companies in any market capitalization range, selected for their rapid and sustainable growth potential from the development, advancement and use of science and/or technology (high growth science and technology stocks), and/or potential to generate current income from advantageous dividend yields (cyclical science and technology stocks).

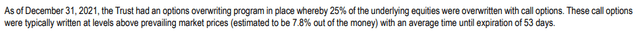

To note that the CEF also includes in its mandate the ability to write call options on the portfolio and actively employs this strategy, with 25% of the portfolio having calls sold against it as of December 2021:

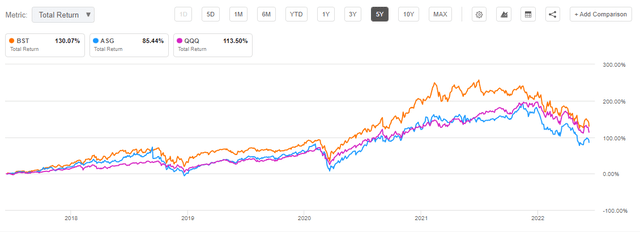

We like the ability of a CEF to employ a buy-write strategy because it allows a fund to monetize the high implied volatility in certain equities and provides the management team with another tool to outperform a static index. BST has outperformed the Nasdaq index on a five-year basis, and we believe that the ability to write covered calls has contributed in no small measure to this outperformance.

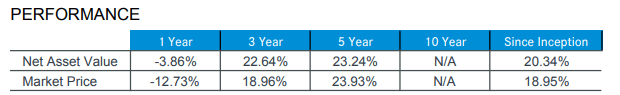

BST has an outstanding long-term performance, with annualized total returns of over 20% since inception (fund was started in 2014). The fund exposes a very good Sharpe ratio of 0.84 and a standard deviation of 19.8. The fund has outperformed the Nasdaq on a 5-year lookback and has matched the index performance year to date.

We feel the current BST performance is driven by macro factors, namely risk-free rates and the ultimate neutral Fed Funds level. Until inflationary pressures subside, we believe the tech sector will continue to be under pressure. With a -2.8% discount to NAV currently, BST is also nowhere near its wides for market price discount to net asset value. As the market experiences further weakness, we believe the discount to net asset value will continue to widen.

Macro View

With the latest CPI report showing inflation is once again re-accelerating, market participants have now increased their views on both the neutral Fed Funds rate as well as the pace of increases by the Fed. Analysts are once again starting to price in a 75 bps rate hike, with the July meeting being the targeted one. Volatility around rates and the ultimate neutral Fed Funds rate are not going to be firmed up until inflation starts easing. The Tech sector is the most susceptible one to the risk-free rate used to discount future earnings and will be impacted the most by the rise in rates. We have already seen a massive re-pricing year to date, with P/E ratios having declined and some tech names having experienced 70%+ drawdown, but we are not there yet. Ultimately it is not about the underlying company but about valuations, cost of opportunity and ability to generate free cash flow now, not in 5 or 10 years.

We believe there is a widely held misconception currently around technology stocks and the macro environment – many investors expect a V-shaped recovery that will magically take hold, as it expressed itself during the COVID pandemic. That could not be farther from the truth. We are witnessing a change in regime, where higher rates translate into fixed income actually generating yield, with institutional investors selling equities and allocating those amounts to fixed income and where commodity equities are going to experience a multi-year boom cycle.

In our minds, 2022 is different, and it represents a shift back to true cash flow generating businesses, helped in no small measure by rising rates. As Bridgewater’s CIO states

Roughly 40% of the US equity market can only survive essentially with new buyers entering the market because they’re not cashflow generating themselves. And that’s near a historic high, that’s like basically right in line with ’99, 2000.

Low rates, or better said zero rates, helped create an investment environment where growth was preferred over cash-flows. Many investors were looking to double their investments in very short periods of time via new buyers entering the same market, rather than a true generational innovation brought by the underlying companies. As with any secular shifts, it takes time for old beauty queens to settle into their new role, and seldom does one see a quick shift back to a trade that worked in the past. We fear we are going to witness the same movement here, where technology and growth stocks are going to derate via lower P/E ratios and will need 1-2 years to settle back into a more acceptable valuation range.

Holdings

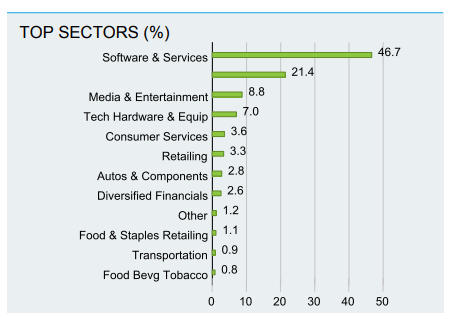

BST has a very technology focused portfolio:

Top Sectors (Fund Fact Sheet)

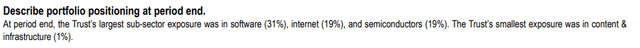

The top sub-sectors held by the fund are as follows per its annual report:

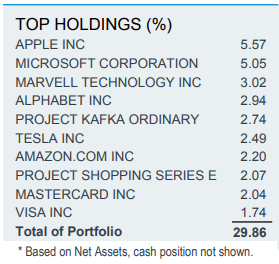

The fund’s top 10 holdings include Klarna, a Swedish digital payments provider:

Top Holdings (Fund Fact Sheet)

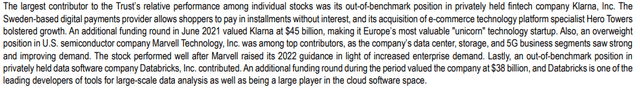

Klarna is identified as “Project Kafka Ordinary” in the above table. Please note that Klarna is a private investment, hence the shares are not traded on any exchange and the valuation is subject to more assumptions and inputs than an exchange traded equity. Klarna accounted for a substantial part of the fund’s positive performance in 2021:

Performance

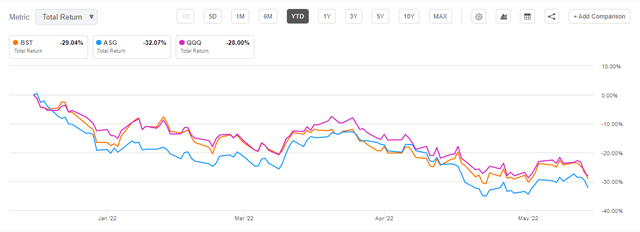

The fund is down almost -29% year to date:

YTD Performance (Seeking Alpha)

The fund has the same performance as the Nasdaq on a year to date basis, while another technology oriented CEF, the Liberty All-Star Growth Fund (ASG) is down -32%.

On a 5-year lookback range, BST has outperformed both the index and its competitor ASG:

5-Year Total Return (Seeking Alpha)

BST has outstanding long term results that speak very highly to the management team’s ability to generate alpha in the sector:

Performance (Fund Fact Sheet)

Premium/Discount

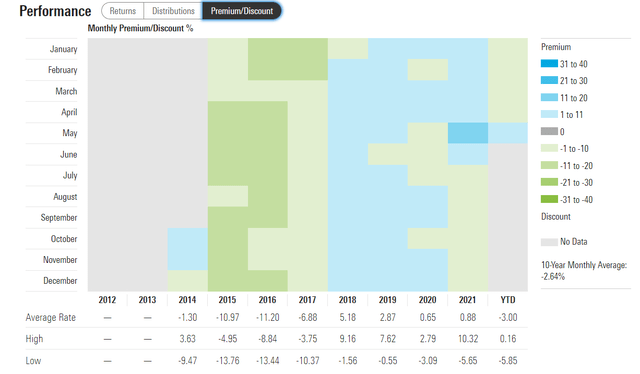

The fund is currently trading at a -2.8% discount to NAV, but is not close to historic low levels:

Premium/Discount Matrix (Morningstar)

We can see that at the beginning of the previous Fed tightening cycle in 2015/2016 the fund managed to trade at a historic discount to NAV of -11.2% (average for the year, not absolute discount to NAV).

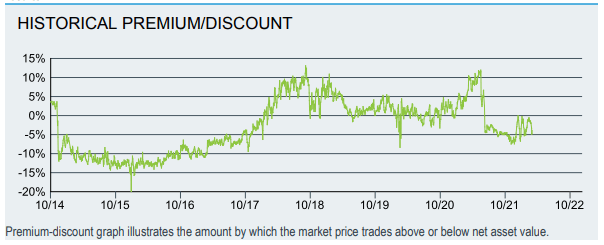

A better visual representation of the discount to NAV comes from the fund’s term sheet directly:

Historical Discount to NAV (Fund Fact Sheet)

As P/E ratios come down in the tech space and the market continues to sell-off, we expect the discount to NAV to continue to widen for the fund.

Conclusion

BST is a technology equities focused CEF. The ultimate bottoming out in price for the vehicle will be determined by risk-free rates and rates volatility. We expect the technology sector to continue to derate and expose lower P/E ratios as investors have more alternatives in the fixed income space and in free cash flow generating companies. We do not expect a V-shaped recovery in the tech equity sector, and we feel that the fund’s discount to NAV will widen out even further as the market sells-off. BST is a great long term fund, but we do not think the slide is over for the vehicle, and it will continue to be under pressure until we get some clarity around the ultimate neutral Fed Funds rate that will result in lower inflationary pressures.

Be the first to comment