da-kuk

Thesis

BlackRock Limited Duration Income Trust (NYSE:BLW) is a fixed income CEF from the BlackRock suite of closed end funds. The fund has current income and capital appreciation as its main goals and invests primarily in leveraged loans and high yield bonds. The CEF is currently trading at a -5% discount to NAV and has been captured by the recent fund manager announcement regarding shares repurchases:

BlackRock Advisors, LLC announced today that the Boards of Directors/Trustees of fifty BlackRock municipal, taxable fixed income, equity, and multi-asset closed-end funds (the “Funds”) have authorized the renewal of open market share repurchase programs (the “Repurchase Programs”). Under each Fund’s current Repurchase Program, each Fund may repurchase, through November 30, 2022, up to 5% of its outstanding common shares (based on common shares outstanding on November 18, 2021 or November 30, 2021, as applicable for each Fund)(1) in open market transactions

The Repurchase Programs seek to enhance shareholder value by purchasing Fund shares trading at a discount from their net asset value (“NAV”) per share, which could result in incremental accretion to a Fund’s NAV.

BLW being a CEF trading at a discount will directly benefit from this announcement. If we take a step back we need to understand why BlackRock is doing this – as a large asset manager, perception is very important for BlackRock. Persistent discounts to NAV for CEFs signal investor discomfort with the asset manager, and ultimately result in business divestitures as we have seen with the Delaware Asset Management CEFs. To combat this the asset manager does not have many options. Among them are share repurchases, fund liquidations or mergers. BlackRock is actively choosing the share repurchase programs so that it supports its CEFs trading at discounts.

The repurchases are not announced for fixed, distinct dates but are done on an ad-hoc basis:

The amount and timing of any repurchases under each Fund’s Repurchase Program will be determined either at the discretion of the Fund’s management or pursuant to predetermined parameters and instructions subject to market conditions. There is no assurance that any Fund will repurchase shares in any particular amounts. A Fund’s repurchase activity will be disclosed in its shareholder report for the relevant fiscal period. Any repurchases made under any Fund Repurchase Program will be made on a national security exchange at the prevailing market price, subject to exchange requirements and certain volume and timing limitations and other regulations under federal securities laws.

We think this is ultimately beneficial to investors since a good asset manager can choose discounted entry points to purchase back shares. Basically as it stands BlackRock can take advantage of a theoretical move in the BLW discount to -10% on the back of a risk-off move to undertake the share repurchases. This would create value for the fund since it can generate profits by buying shares at a -10% discount and retiring them at NAV, thus giving shareholders an extra 10% for the retired amount.

While the ultimate impact to BLW is small, we like this program and feel large, well run platforms expose this kind of behavior for CEF platforms, having maximum thresholds for discounts to NAV. We have seen that small platforms that do not manage this aspect for their funds ultimately close shop, as we have seen with the Delaware Management Company CEFs. As a retail investor in BLW you do not need to do anything, but it should provide more comfort that you bought into a well run platform.

Premium/Discount to NAV

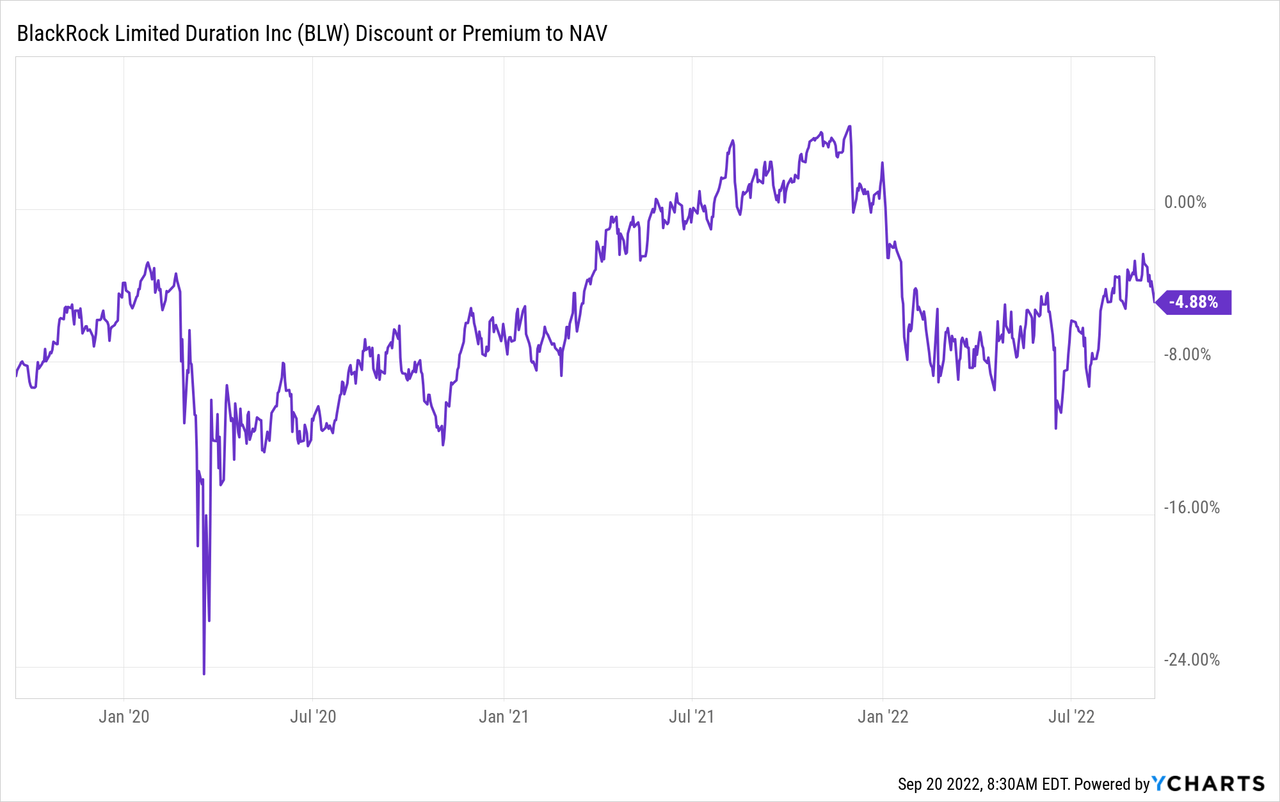

The fund tends to trade at discounts to NAV:

When a fund consistently trades at discounts to NAV share repurchase programs are welcomed “pull-to-par” instruments. The larger the share-repurchase, the better.

It seems that the BlackRock funds have a lower -10% threshold in terms of tolerable discounts. Once a fund exceeds that threshold or spends too much time around that level, the manager engages in actions to bring the discount back closer to flat NAV. It is a good policy for a large asset manager since the optics are never favorable when funds are persistently trading at large discounts.

Conclusion

The recently announced share repurchase program is a positive for BLW, albeit a small one. The program is symptomatic of a well run asset management platform that understands the need to combat excessive discounts to NAV for the suite of CEFs on the platform. One way to do so is to repurchase shares when the discount widens out significantly on the back of market dislocations. Such actions can have direct positive financial impacts to existing shareholders but even more importantly convey an active, involved asset manager that ensures the viability of the long term total returns produced by its funds. As a retail investor in BLW you do not need to take any action, but it should provide more comfort that you bought into a well run platform.

Be the first to comment