SDI Productions

Recently, I wrote a cautious article on the BlackRock Health Sciences Trust II (BMEZ), arguing that its combination of ‘next generation’ healthcare-stock portfolio combined with high-risk/high-return private investments may not be the right portfolio for the current environment. One reader asked how does BMEZ compare to the BlackRock Health Sciences Trust (NYSE:BME), its older and more established sibling fund?

The BME fund is also a health care focused closed-end fund. It has a strong long-term performance track record and pays a generous 5.9% distribution yield.

Although BME and BMEZ share similar names and structures, the two funds are managed in fundamentally different ways. BME focuses on large-cap, conservatively managed companies while BMEZ focuses on small- to mid-cap high-risk/high-reward opportunities. Investors need to be careful and not get the two mixed up.

Fund Overview

The BlackRock Health Sciences Trust is a closed-end fund (“CEF”) that provides current income and total returns through investments in the health care sector. The fund employs a call-writing strategy to enhance the fund’s distribution yield.

The BME fund has $590 million in assets and charges a 1.08% gross expense ratio.

Portfolio Holdings

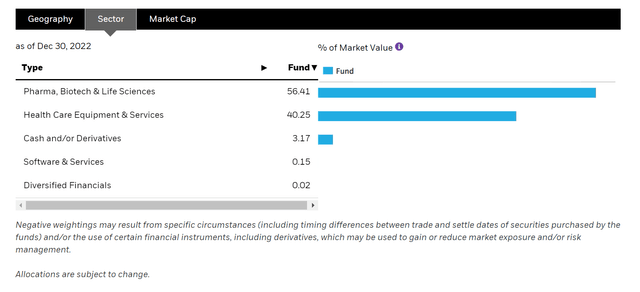

The BME fund is primarily invested in the Pharma, Biotech & Life Sciences sub-industry and the Health Care Equipment & Services sub-industry with 56.4% and 40.3% of the portfolio invested respectively (Figure 1).

Figure 1 – BME sector allocation (blackrock.com)

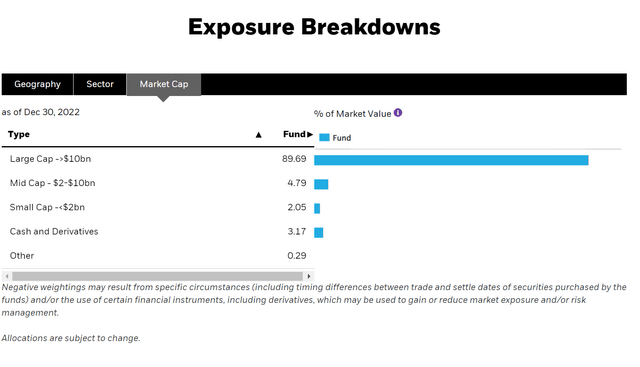

The BME fund primarily invests in large (89.7%) and mid-cap (4.8%) companies, although the fund does own a small number of private company holdings (Figure 2).

Figure 2 – BME market-cap allocation (blackrock.com)

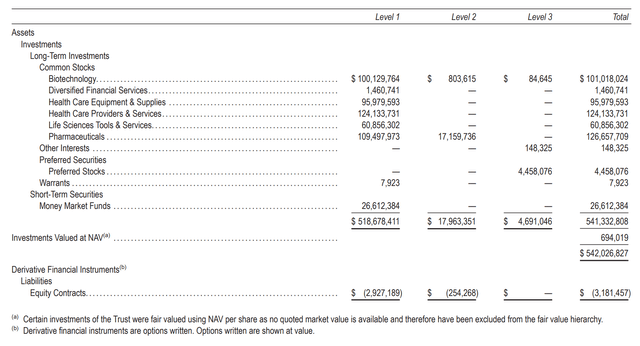

As of September 30, 2022, the BME fund had $4.7 million or 0.9% of its investments classified as Level 3 investments. Level 3 investments are typically investments made in private companies that cannot be valued using observable inputs (Figure 3).

Figure 3 – BME has less than 1% invested in private companies (BME Q3/2022 holdings report)

Returns

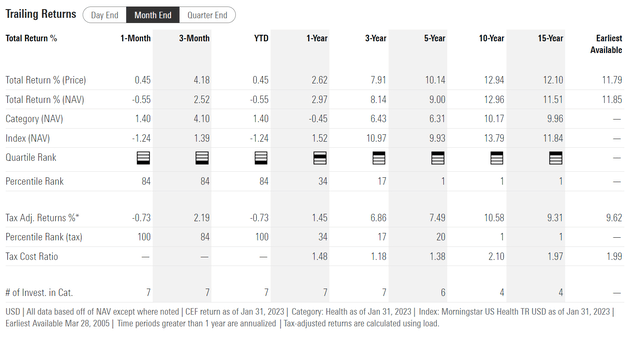

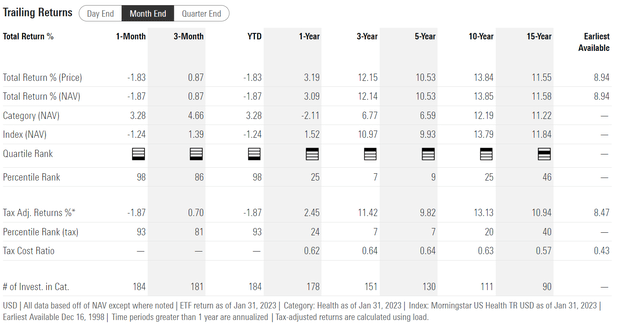

The BME fund has an enviable long-term track record, with 3/5/10/15 Yr average annual returns of 8.1%/9.0%/13.0%/11.5% respectively, to January 31, 2023 (Figure 4).

Figure 4 – BME historical returns (morningstar.com)

Although BME’s performance has been slightly lower than a low-cost sector ETF like the Health Care Select Sector SPDR Fund (XLV), which has returned 12.1%/10.5%/13.9%/11.6% respectively, an argument can be made that BME compensate investors by paying a generous distribution yield (Figure 5).

Figure 5 – XLV historical returns (morningstar.com)

Distribution & Yield

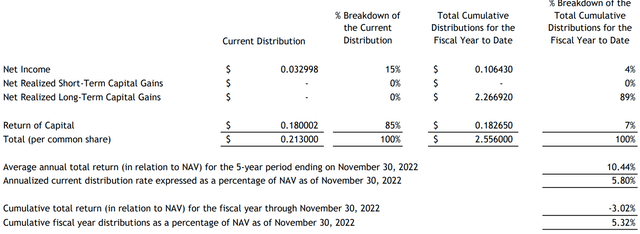

Speaking of BME’s yield, the BME fund pays a generous monthly distribution of $0.213 / share which annualizes to a 5.9% forward distribution yield.

Although BME’s distribution is mostly funded through realized capital gains and return of capital (“ROC”), I am not particularly concerned as the distribution rate is well supported by the fund’s long-term average annual returns (Figure 6).

Figure 6 – BME’s 2022 distribution funded mostly from ROC and realized gains (BME December Section 19a notice)

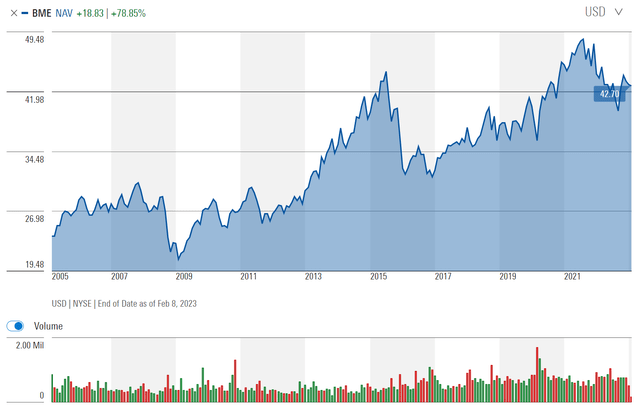

For example, we can see that BME’s NAV has been healthily growing since inception, meaning that although the fund may dip into ROC in poor performance periods to fund its distribution (like in 2022), over the long-term, the BME fund is not an amortizing ‘return of principal’ fund that relies on liquidating NAV to pay distributions (Figure 7).

Figure 7 – BME has a healthy growing NAV (morningstar.com)

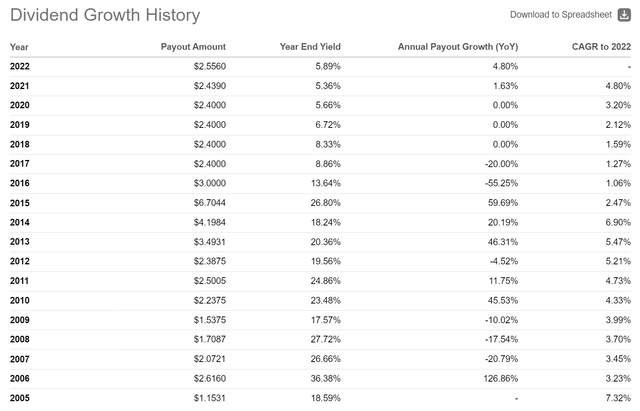

Likewise, BME’s distribution has grown at a steady clip, from $0.3844 / quarter when the fund was first started (equivalent to $0.128 / month) to the current monthly distribution of $0.213. The BME fund has also periodically paid a special distribution when it is warranted, including a $0.60 / share special distribution in 2016 and a $4.5494 / share special distribution in 2015 (Figure 8).

Figure 8 – BME distributions (Seeking Alpha)

BME vs. BMEZ

Although BME and BMEZ share a common management team, led by portfolio manager Erin Xie, the two funds are managed in fundamentally different ways.

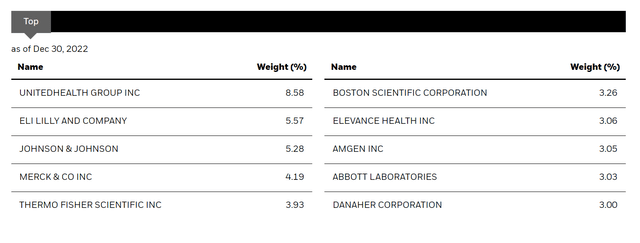

From my understanding, BME is more focused on large-cap, stable-growth health care companies such as UnitedHealth (UNH), Eli Lilly (LLY), and Johnson & Johnson (JNJ) that represent ~90% of BME’s portfolio (Figure 9).

Figure 9 – BME top 10 holdings (blackrock.com)

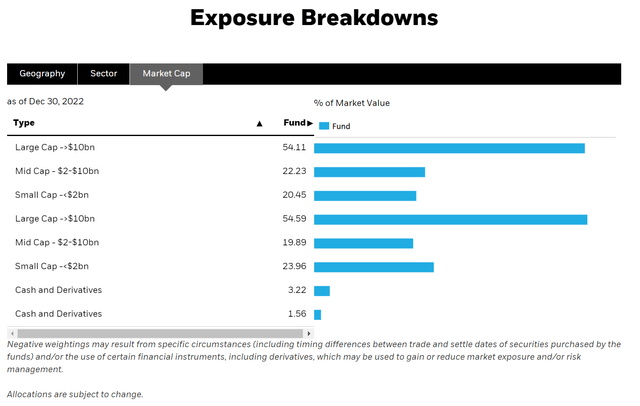

On the other hand, BMEZ is much more focused on ‘next generation’ health care companies that are typically smaller cap and higher growth. Figure 10 shows BMEZ’s market cap allocation.

Figure 10 – BMEZ market cap allocation (blackrock.com)

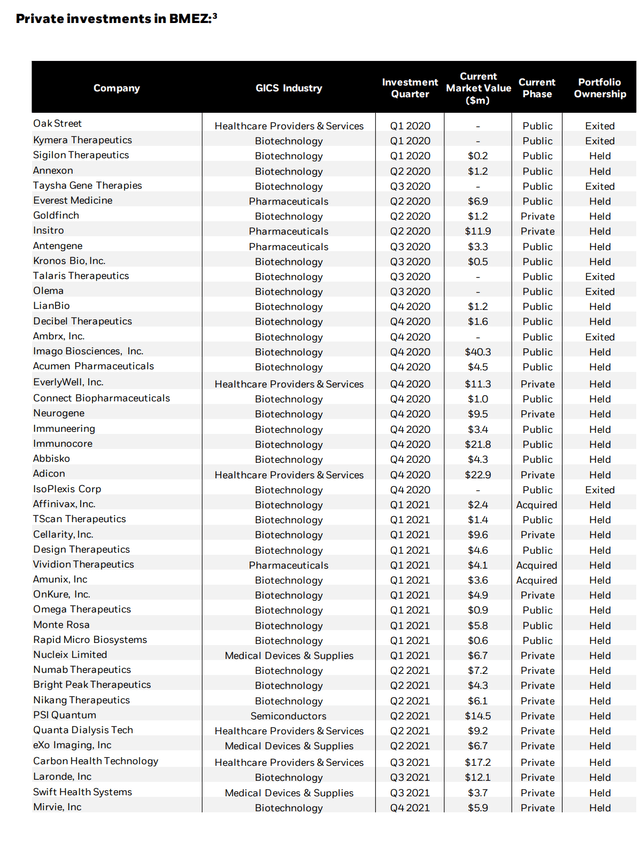

Another big difference between the two funds is the fact that BMEZ owns a relatively large portfolio of private investments, totalling 8.0% of the fund’s NAV as of December 31, 2022 (Figure 11). Private investments are high-risk/high-return opportunities that typically does well when risk appetites are high and the IPO markets are open. In contrast, as noted above, the BME fund holds less than 1% of NAV in private investments.

Figure 11 – BMEZ private investments (BMEZ quarterly update)

In effect, although both BME and BMEZ are structured as high-yielding CEFs, BME is a boring, conservatively managed large-cap health care fund, whereas BMEZ is a high-risk/high-reward small- to mid-cap health care fund.

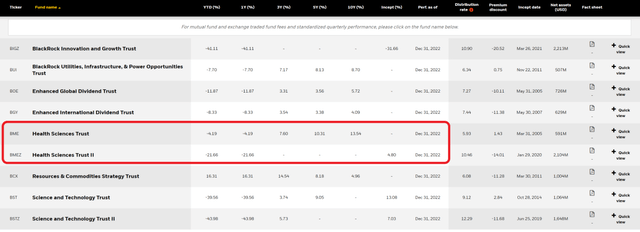

In a risk-off year like 2022, it is no surprise that the BME fund has significantly outperformed the BMEZ fund, with a -4.2% return vs. -21.7% for BMEZ (Figure 12).

Figure 12 – BME has outperformed BMEZ in 2022 (blackrock.com)

Conclusion

The BME fund is a health care focused CEF with a strong long-term performance track record. It pays a generous 5.9% distribution yield. The BME fund may appeal to income-oriented investors who do not mind trading off some total returns (vs. the XLV) for a higher distribution yield.

Although BME and BMEZ share similar names and structures, the two funds are managed in fundamentally different ways. BME focuses on large-cap, conservatively managed companies while BMEZ focuses on small- to mid-cap high-risk/high-reward opportunities. Investors need to be careful and not get the two mixed up.

Be the first to comment