tadamichi/iStock via Getty Images

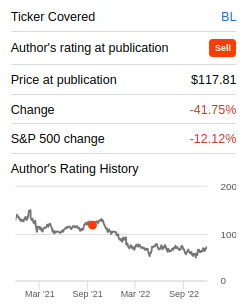

In our first article on BlackLine (NASDAQ:BL) we rated shares ‘Sell’ because of what we saw as massive over-valuation. This was in spite of the company having a very ‘sticky’ product and a powerful business model. We believe the company has a competitive business moat and a long growth runway, but despite of this we couldn’t justify the valuation. Since then shares have massively under-performed the market, and we thought it would be a good time to revisit the company to see if shares are attractive now.

Seeking Alpha

As a reminder, BlackLine is a financial management software company that provides cloud-based solutions for automating and streamlining financial processes. The company’s software is designed to help businesses improve efficiency, accuracy, and visibility in their financial operations. One of the key benefits of BlackLine’s solutions is that they are designed to be easy to use and integrate with other systems.

BlackLine has a strong track record of customer satisfaction, with many businesses reporting significant time and cost savings as a result of using the company’s solutions. The company has also received recognition from industry analysts and has won several awards for its products and services.

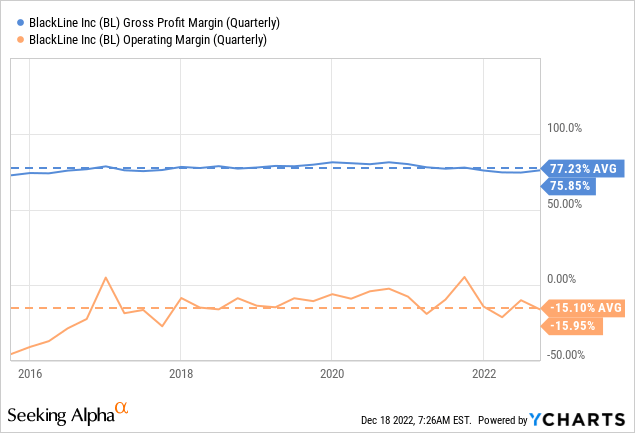

Financials

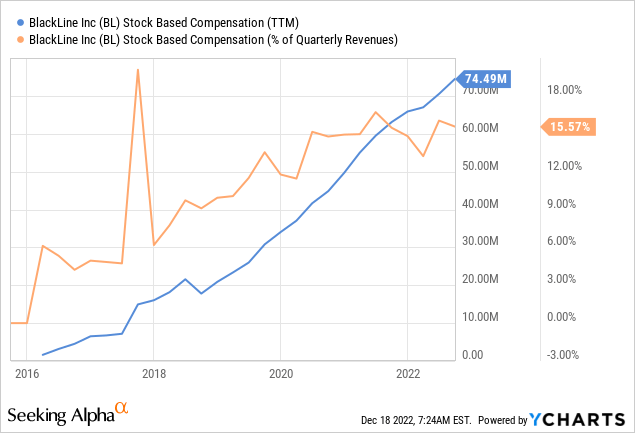

As a software company it is not surprising that BlackLine has very attractive gross profit margins. Using GAAP accounting however the company still has negative operating margins, in large part due to its aggressive use of stock-based compensation.

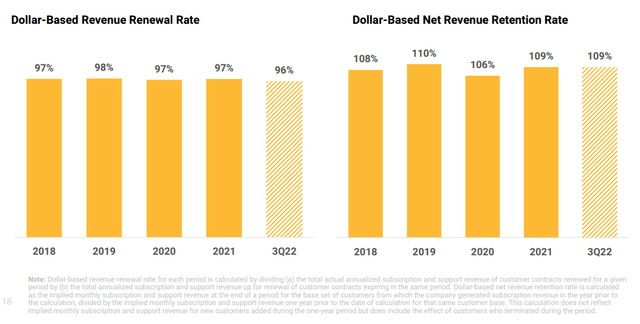

We believe BlackLine has a competitive product given its high renewal rate and net-revenue retention rate. Clearly most of its customers are staying with the company’s solution and spending more on it.

BlackLine Investor Presentation

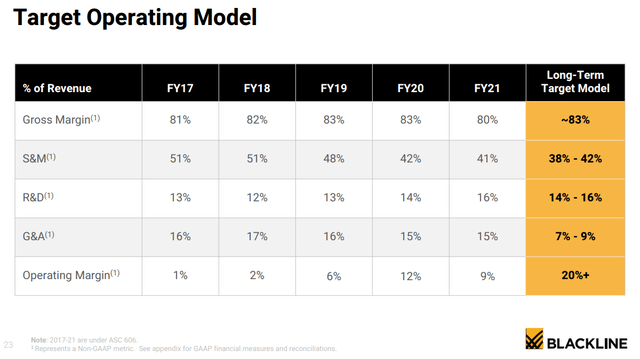

BlackLine’s target operating model calls for a 20%+ operating margin. We believe the company can probably get there eventually, the problem we see is that if it keeps stock-based compensation running at ~15% of revenue, that would translate into very poor GAAP operating margins of ~5%.

BlackLine Investor Presentation

As can be seen below, BlackLine has been consistently increasing its stock-based compensation in absolute numbers. The trailing twelve months SBC is a massive ~$74 million, or roughly 15% of its revenue.

Competitive Moat

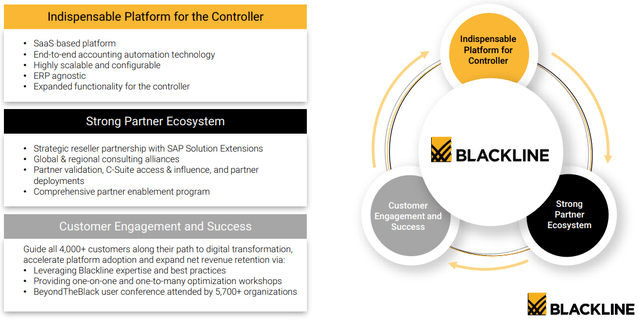

As we mentioned in our previous article, we do believe BlackLine has a competitive business moat. The main source for the moat we believe is the high customer switching cost. It takes a big effort for a customer to integrate BlackLine into their processes, and once they do it would be painful to switch to an alternative solution. A second source for the moat is the strong partner ecosystem, making the solution even more valuable. There is also a flywheel effect strengthening the moat. As it grows its partner ecosystem, it improves the collaborative accounting experience, and it becomes even more indispensable for the financial controller, which leads to more partner opportunities.

BlackLine Investor Presentation

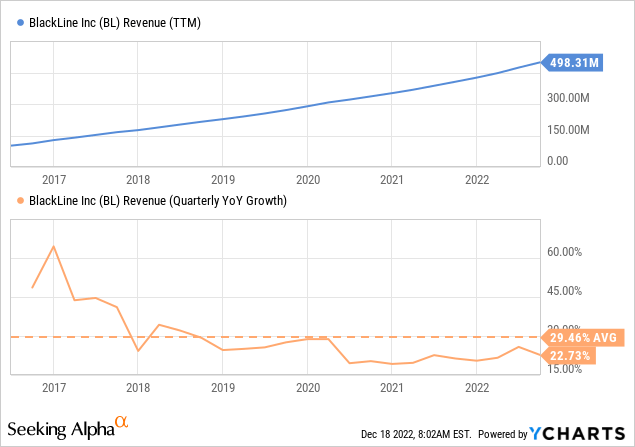

Growth

What attracts many investors to companies like BlackLine is the high growth this type of company delivers. Since 2017 BlackLine has more than tripled its revenue, although the growth rate has decelerated and is currently around 22%. We believe given the huge addressable market that BlackLine has, that it can probably sustain a growth rate in the ~20% for several more years, perhaps even seeing a re-acceleration along the way.

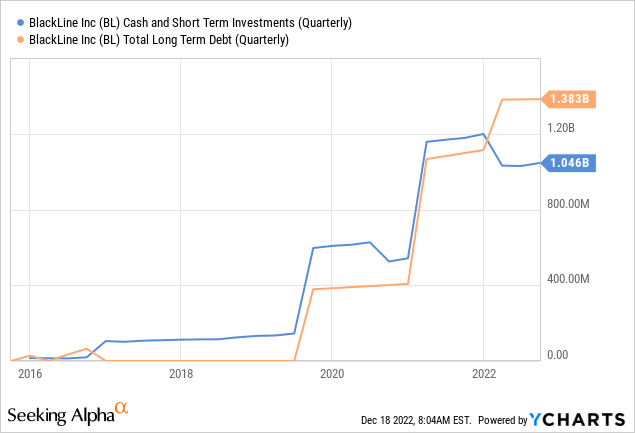

Balance Sheet

One thing to consider is that BlackLine does carry a meaningful amount of long-term debt, even if most of it could be repaid by the cash and short-term investments that the company has on the balance sheet.

Valuation

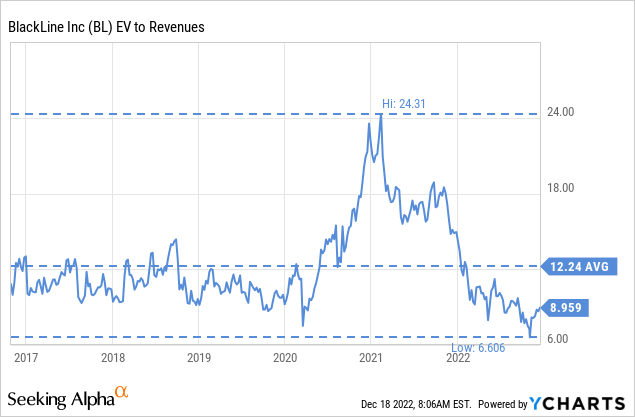

In terms of valuation, a lot of investors will focus on the EV/Revenue multiple arguing that the company is currently optimized for growth and not for profitability. We partially agree, but it is still necessary to consider the future earnings potential to have a realistic valuation of the shares.

Just looking at EV/Revenues, shares are less expensive than the historical average. Still, on absolute terms we believe ~9x is a demanding multiple, especially for a company that has seen its revenue growth decelerate.

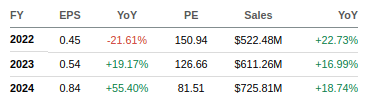

Based on analyst earnings estimates, shares are trading at ~81x expected non-GAAP earnings in fiscal year 2024. This does not appear cheap to us, and we built a simple model to estimate a fair value.

Seeking Alpha

Using average analyst estimates as compiled by Seeking Alpha for 2022-2024, 30% earnings growth until FY 32, a 3% terminal growth rate, and a 10% discount rate, we estimate a net present value of the future earnings stream of ~$39. This is significantly lower than where shares are currently trading. In addition, these are based on non-GAAP earnings estimate, therefore ignoring BlackLine’s massive SBC.

| EPS | Discounted @ 10% | |

| FY 22E | 0.45 | 0.41 |

| FY 23E | 0.54 | 0.45 |

| FY 24E | 0.84 | 0.63 |

| FY 25E | 1.09 | 0.75 |

| FY 26E | 1.42 | 0.88 |

| FY 27E | 1.85 | 1.04 |

| FY 28E | 2.40 | 1.23 |

| FY 29E | 3.12 | 1.45 |

| FY 30E | 4.05 | 1.72 |

| FY 31E | 5.27 | 2.03 |

| FY 32E | 6.85 | 2.40 |

| Terminal Value @ 3% terminal growth | 75.30 | 26.39 |

| NPV | $39.39 |

Risks

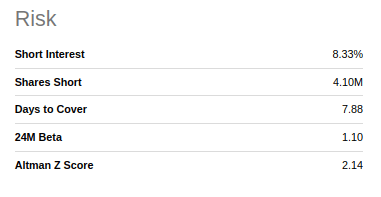

We continue to believe that the biggest risk for BlackLine’s investors is the very high valuation at which shares are trading. Other than that we would note that the Altman Z-score is below the critical 3.0 level, and that BlackLine has a non-negligible level of short interest. Long-term we believe the potential of a big tech company like Microsoft (MSFT) launching a competing product could complicate things for BlackLine.

Seeking Alpha

Conclusion

Despite the massive share price correction, we continue to believe that BlackLine remains overvalued. Especially considering the revenue growth deceleration. We continue to like the company and to believe it has a competitive business moat, but we do not think that is enough to justify the current valuation. We cannot justify the current price even when ignoring the very significant stock-based compensation. As a result we are maintaining our current ‘Sell’ rating, waiting for the company to grow into its valuation, or the share price reaching a more reasonable level.

Be the first to comment