miodrag ignjatovic/E+ via Getty Images

It’s amazing how some legacy software companies continue to limp along, despite a yearslong string of poor results. This is the position that Blackbaud (NASDAQ:BLKB) is finding itself in – each quarter brings fresh disappointment as Blackbaud continues to struggle from anemic organic growth and broader macro headwinds.

Blackbaud, for investors who are unfamiliar with the name, is a software company that specializes in CRM and ERP software for non-profits, educational institutions, and religious organizations. Its primary product is a tool to manage and track donations. Its business got hammered during the pandemic due to the lack of in-person charitable events.

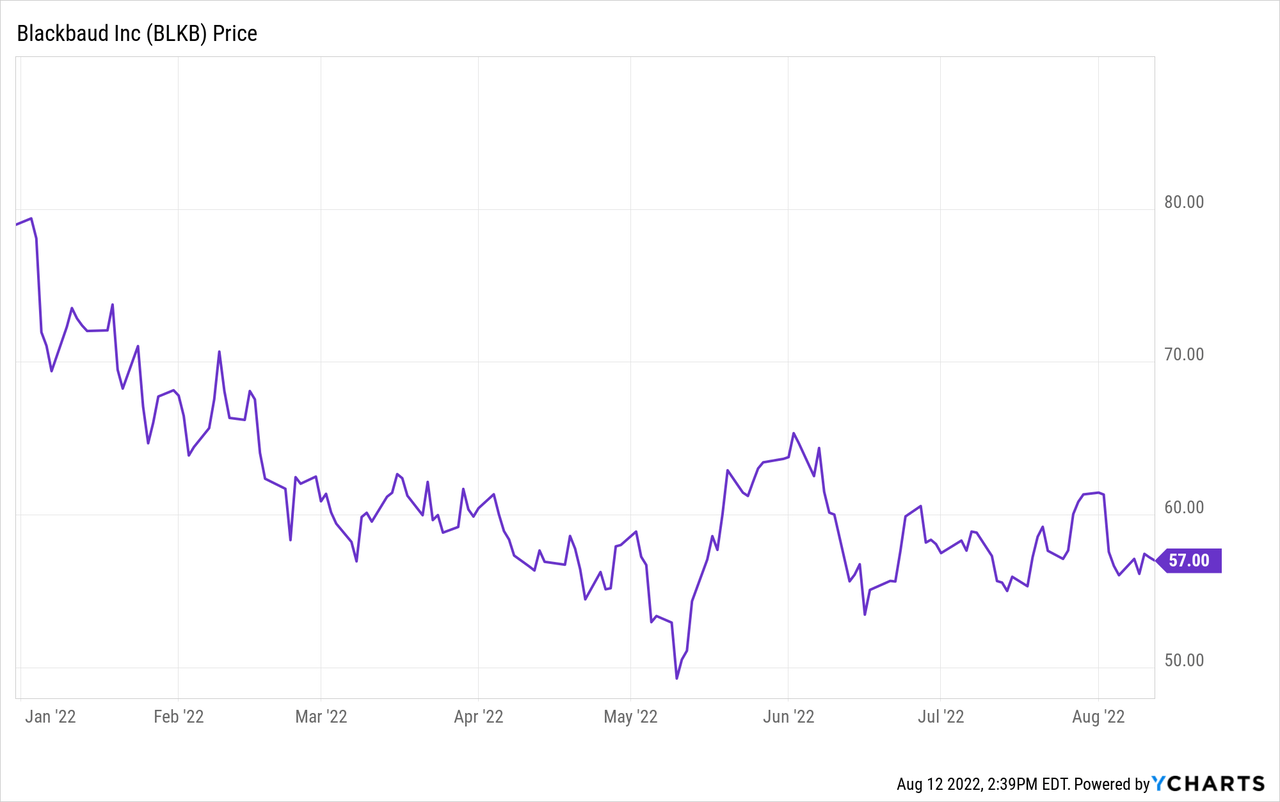

Over the past year, shares of Blackbaud have lost 30% of their value – and in my view, there is more pain to be had.

I remain quite bearish on Blackbaud’s prospects. To me, there are two main considerations at play here:

- Can Blackbaud really distinguish itself as a verticalized software offering versus more generalized software platforms? Salesforce (CRM), for example, has similar tools and functionality to Blackbaud and a much better brand name. Enterprise software buyers care about the strength of the vendor’s brand, as it ensures their software investment can be supported for years to come. With the way Blackbaud’s financials have played out over the past few years, its longevity is far from a certainty.

- Return of in-person events has not spurred the large comeback Blackbaud was hoping for. Blackbaud’s thesis was that the pandemic in 2020 and 2021 held back its growth rates due to the lack of in-person events, and that the return of charitable events in 2022 would drive renewed demand. So far this has not been the case. As Blackbaud’s organic growth wanes, it will continue to lean more into M&A to bolster its reported growth rates.

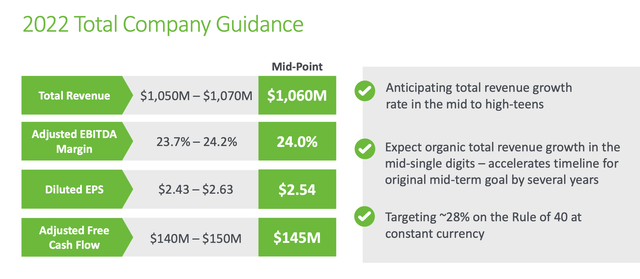

More to the point above: alongside its Q2 earnings, Blackbaud also dropped its full-year outlook, citing weaker demand. The company is now guiding to $1.05-$1.07 billion in revenue for the year, representing 14% y/y growth; versus a prior outlook of $1.075-$1.095 billion or 17% y/y growth. Note that the bulk of Blackbaud’s revenue growth is due to the acquisition of EverFi, which got consolidated into the company’s results starting in Q1. Prior to that acquisition, Blackbaud’s revenue growth had been in the low single digits.

Blackbaud guidance update (Blackbaud Q2 earnings materials)

Unsurprisingly, the company also dropped its full-year EPS forecast to $2.54, a 7% reduction relative to $2.73 in its original outlook.

Given Blackbaud’s organic growth has slowed to near-nothing, I think it’s most appropriate to value this stock on an earnings basis rather than revenue. At current share prices near $57, Blackbaud trades at a ~22.5x P/E versus expected FY22 earnings.

To me, this doesn’t make sense – why pay a premium above the S&P 500’s earnings multiple for a company whose only hope for growth lies in M&A? Note as well that Blackbaud’s balance sheet is saddled with $911 million in net debt, so its firepower for additional deals will be limited going forward.

The bottom line here: Blackbaud already trades at a senseless premium to the broader market, despite virtually no path to recovery in organic growth. Sell off this stock – the correction is only going to get worse.

Q2 Download

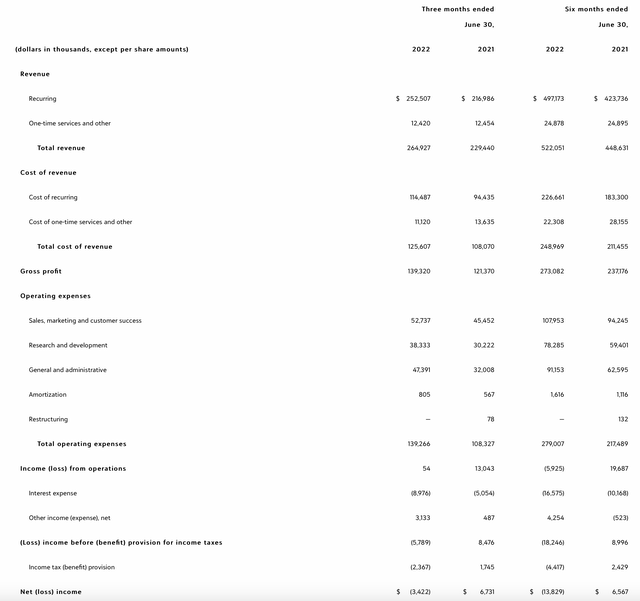

Let’s now go through Blackbaud’s latest fiscal Q2 results in greater detail. The Q2 earnings summary is shown below:

Blackbaud Q2 results (Blackbaud Q2 earnings materials)

Blackbaud’s revenue in Q2 grew 15% y/y to $264.9 million, missing Wall Street’s expectations for $267.1 million (+16% y/y) by a one-point margin. Note as well that Blackbaud’s revenue growth decelerated versus 17% y/y growth in Q1.

Further, as previously noted, Blackbaud’s “growth” is purely a function of its M&A activity. EVERFI, which has no comp in the prior-year Q2, contributed $27 million of revenue in the quarter, which is the overwhelming majority of the y/y revenue increase of roughly $36 million. In the absence of EVERFI, Blackbaud’s growth would only have been 4% y/y.

Management even noted that bookings softness in EVERFI is one of the drivers for the reduction in full-year outlook. Per CEO Mike Gianoni’s prepared remarks on the Q2 earnings call:

We’ve slightly reduced our revenue guidance range by approximately 2% to $1.50 billion to $1.70 billion. Roughly half of this is attributed to unfavorable movement in FX rates, with the vast majority associated with the decline in British Pound, which represents nearly 2/3 of our international revenue. The remainder of the reduced range can largely tied to the continued drag in one-time services revenue, which is a positive mix shift for us over the long-term.

We now expect our overall one-time services and other revenue to be roughly flat for the full year, which represents a continued decline in our core one-time services revenue when normalizing for roughly $15 million of incremental one-time revenue expected from our acquisition of EVERFI.

Lastly, to a much lesser extent, our latest projections suggest some softness in our bookings plan for EVERFI, which has minimal impact on our full year 2022 revenues given ratable revenue recognition and offsetting strength in the rest of the business. We are intently focused on closing the EVERFI bookings gap as we look ahead to 2023. Given the typical seasonality of JustGiving in our services business, we expect a slight sequential quarterly decline in total revenue in the third quarter before picking up again in the fourth quarter.”

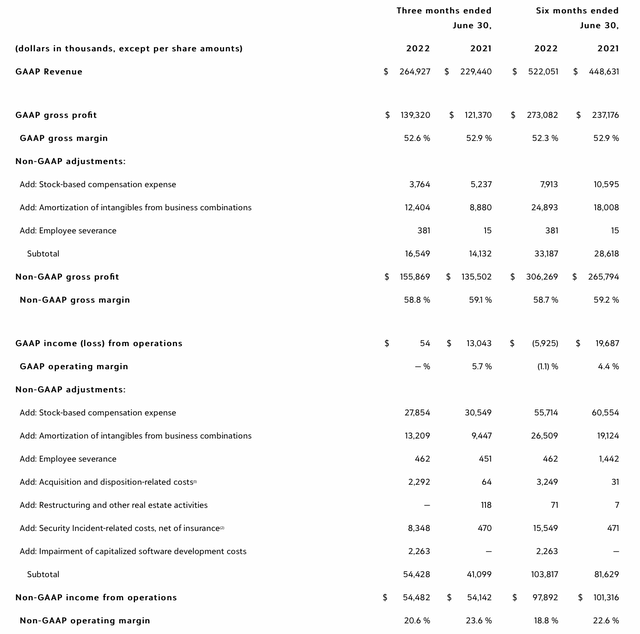

Margin performance has also been soft. Blackbaud, which has long had a deficit to other SaaS peers in its gross margin, saw pro forma gross margins pull back by a further 30bps y/y to just 58.8%:

Blackbaud Q2 margin trends (Blackbaud Q2 earnings materials)

Higher opex costs and M&A integration has also pushed pro forma operating margins down, shedding 300bps to 20.6% in Q2. The company also shaved 30bps off its adjusted EBITDA margin forecast for the year, indicating continued inflationary pressures.

Key Takeaways

Blackbaud had long said that a return to in-person charitable events would help the company rebound; so far, this hasn’t proven to be true. Already trading at a premium to the rest of the S&P 500, Blackbaud will be hard-pressed to find catalysts to rescue it. Steer clear here.

Be the first to comment