grandriver

Black Stone Minerals, L.P. (NYSE:BSM) reported blowout third-quarter results, generating $123 million of Adjusted EBITDA versus the consensus expectation of $111 million. The result marked the best quarterly Adjusted EBITDA performance in BSM’s history.

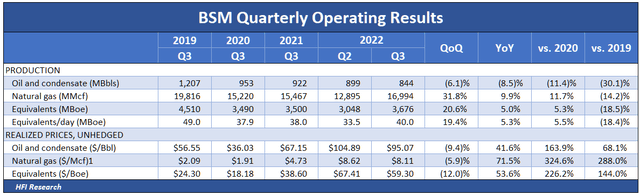

BSM benefitted from a snapback in producer activity on its acreage. During the quarter, the number of rigs operating on the acreage increased from 81 to 92. Since the acreage is heavily weighted toward natural gas, producers rushed to put new gas wells online to take advantage of the high natural gas prices during the quarter.

Natural gas production surged from the previous quarter, in which production disappointed. It is also tracking higher than the year-ago quarter.

The table also shows that BSM was able to post improved results despite realizing lower prices in the previous quarter. Adjusted EBITDA and distributable cash flow (“DCF”) increased by 9% and 8%, respectively, over the previous quarter. The results put BSM on track to hit the top end of management’s full-year 2022 guidance range.

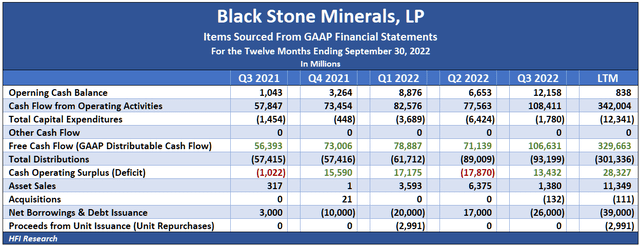

Quarterly Cash Flow Hits A Record

BSM generated a cash flow surplus even after distributing the most cash to common unitholders in a quarter since it came public in 2015. Common distributions during the quarter were covered 1.2-times by free cash flow.

During the third quarter, management allocated surplus cash, along with cash on hand and asset sales, toward paying down debt. By the end of the quarter, long-term debt stood at $60 million, for an ultra-low leverage ratio of 0.33-times. The company continued to pay down debt in the fourth quarter. By early November, long-term debt stood at $19 million.

Distributable Cash Flow Set To Increase In 2023

Despite the record Adjusted EBITDA and distribution payouts during the quarter, BSM’s cash flow continues to be constrained by the company’s programmatic hedging. Over the first nine months of the year, BSM paid $162.6 million in cash to settle derivatives used for hedging.

Nevertheless, BSM management does not intend to waver from its hedging program. For 2023, it has hedged 66% of the company’s oil production at an average price of $80.36 per barrel and 65% of its natural gas production at $5.13 per MMBtu. These hedges are well above its 2022 average hedge prices of $60.14 per barrel of oil and $2.99 per MMBtu of natural gas. BSM’s higher-priced 2023 hedges will boost DCF significantly next year, even if commodity prices remain depressed. As a result, unitholders can rest assured that 2023 cash flows will improve over 2022, even if oil bulls like ourselves would prefer a less stringent hedging program.

For the full-year 2022, BSM is set to pay out a total of $1.57 in common distributions. We estimate total DCF in 2022 to be approximately $1.65 per unit. Retained cash flow not paid out as distributions was mostly used to pay down debt. With little remaining debt left to pay down, management can distribute a greater proportion of total DCF to common unitholders in 2023.

If we use full-year 2022 DCF to value the units, they would be worth $19.41 at an 8.5% yield. If we instead value the units based on a 10% DCF yield, they would be worth $16.50. This range of $16.50 to $19.41 is in line with the units’ trading range from early October.

We use the same DCF yield method to value the units in 2023. Our base scenario for 2023 holds production flat with 2022. It takes the company’s hedges into account and assumes oil prices average $90.00 per barrel and natural gas prices average $5.50 per MMBtu in 2023. In this scenario, BSM generates $2.09 of DCF. If BSM units traded to yield 8.5%, they would trade at $24.64. At a 10% yield, they would trade at $20.94.

In our bear scenario for 2023, we assume flat production, hedges, $75.00 per barrel oil, and $3.75 per MMBtu natural gas. In this case, BSM’s hedges actually improve its performance relative to its unhedged results. It generates $1.76 per share of DCF. At an 8.5% yield, BSM units would trade at $20.71, whereas at a 10% yield, they would trade at $17.60.

Lastly, our 2023 bull scenario assumes flat production, hedges, $100 per barrel oil, and $6.25 per MMBtu natural gas. In this scenario, BSM generates $2.26 per unit of DCF. At an 8.5% yield, its units would trade at $26.59, and at a 10% yield, its units would trade at $22.60.

Based on these 2022 DCF yield estimates, we estimate BSM units to be worth $17.60 on the low end in a bear scenario and as high as $26.59 in a bull scenario. This is a wide range, but it’s par for the course in valuing mineral and royalty companies, in which intrinsic value depends on the course of commodity prices.

We believe there exists potential upside to our scenarios from increasing producer activity and higher production. BSM doesn’t provide full-year guidance until February, but we wouldn’t be surprised if production guidance exceeded 2022 figures. That being the case, we believe the $17.60 price floor for our valuation is conservative.

Longer-Term Upside

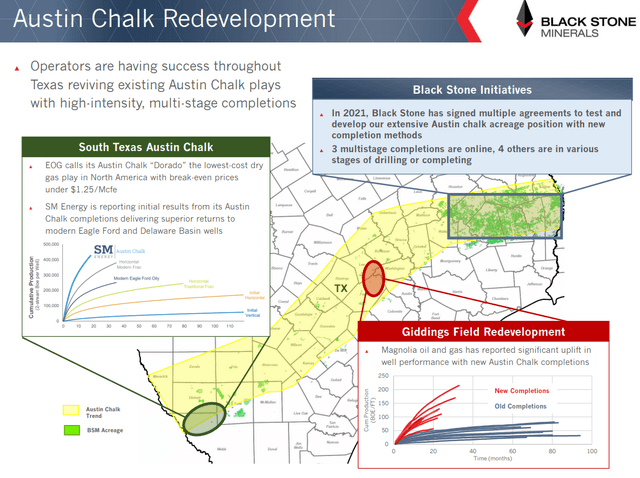

Longer-term, BSM units possess value not recognized in the current unit price from the company’s vast holdings of undeveloped and prospective acreage. BSM’s current effort toward developing this acreage is its Austin Chalk test program in East Texas. BSM has brought in four E&P partners to develop the acreage. So far, these producers have drilled more than 20 wells.

BSM management hasn’t provided detailed well results, but its results have been good enough to continue the test program. The slide below shows BSM’s Austin Chalk acreage.

Our valuation shows BSM units are underpriced even if we assume no contribution from the Austin Chalk acreage. Management hasn’t disclosed enough information for an outside investor to value the acreage, but if the acreage turns out to be economic, the upside in BSM units could be substantial.

We’re encouraged by the fact that BSM’s Chairman, Thomas Carter, has been a regular and large purchaser of BSM units since August of this year. Carter owns more than 10% of BSM common units, and these purchases indicate that he sees long-term value in the units. His purchases may also be a sign that the units’ development upside is likely to be realized.

Conclusion

Black Stone Minerals, L.P. reported excellent quarterly results that showcase its cash generation potential. The results have allowed the company to pay out $0.45 per unit to unitholders in fourth-quarter distributions. Assuming commodity prices remain supportive, as lower-priced hedges roll off, we view this distribution level as sustainable through at least 2023, and likely thereafter, depending on BSM’s production prospects.

With Black Stone Minerals, L.P. units trading at $17.44-below the lower bound of our 2023 value range-we believe they should be bought for the 52.5% upside potential they offer in a bullish oil and gas market over the next year.

Be the first to comment