Kubrak78/E+ via Getty Images

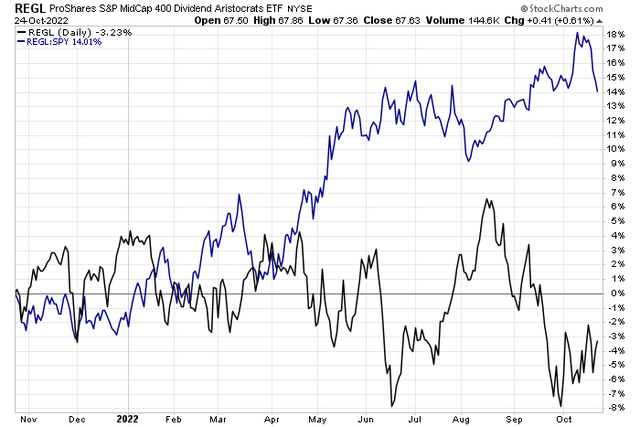

A winning style factor this year has been the unheralded mid-cap dividend aristocrats niche. The ProShares S&P MidCap 400 Dividend Aristocrats ETF (REGL) is down just 3% on the year, beating the S&P 500 ETF (SPY) by a whopping 14 percentage points.

One of the fund’s holdings recently broke its uptrend, but is the stock a buy today? Let’s drill down.

REGL ETF: Impressive Relative Strength

According to Bank of America Global Research, Black Hills Corporation (NYSE:BKH) is a vertically integrated electric and gas utility headquartered in South Dakota. The company is primarily a regulated electric and gas utilities business, with the remainder consisting of long-term contracted power production (269MW) and coal production. The company serves approximately 1.25mn in Colorado, Kansas, Montana, Nebraska, South Dakota, Arkansas, Iowa, and Wyoming.

The South Dakota-based $4.0 billion market cap Multi-Utilities industry company within the Utilities sector trades at a near-market 14.9 trailing 12-month GAAP price-to-earnings ratio and pays a high 3.9% dividend yield, according to The Wall Street Journal.

BKH has near-term headwinds with respect to higher inflation, leading to higher expenses. There is upside potential for increased capex to turn accretive to earnings with its natural gas operations. The Inflation Reduction Act helped some industry players, but not so much for NG focused firms. Higher financing costs as a result of rising interest rates could be problematic for Black Hills, too.

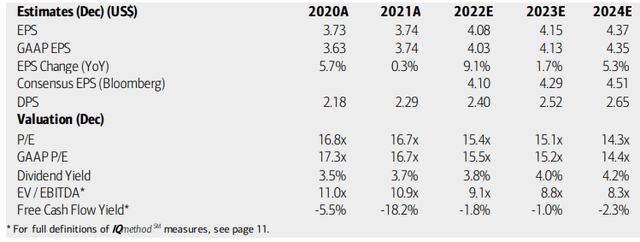

On valuation, BofA analysts see earnings having risen a solid 9.1% in 2022, keeping pace with inflation, but then slowing to just 1.7% in 2023. The Bloomberg consensus forecast is slightly more sanguine while dividends are seen as growing at a steady rate through 2024. Given negative free cash flow and macro uncertainties, the earnings multiple near 15 on both operating and GAAP views appear not particularly cheap.

Black Hills Earnings, Valuation, And Dividend Forecasts

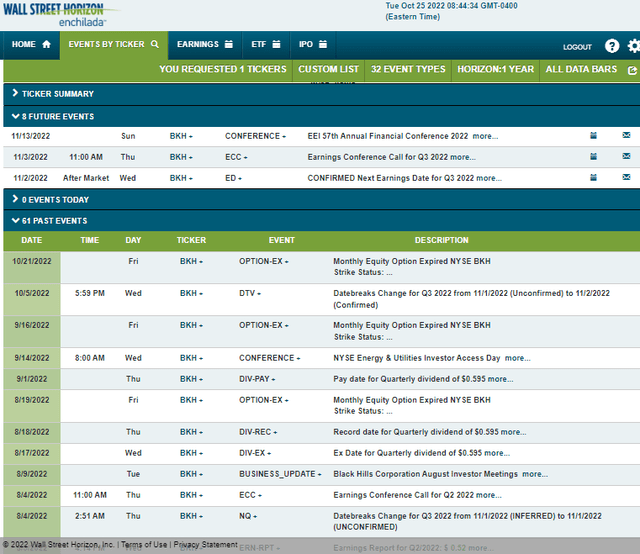

Looking ahead, Wall Street Horizon’s corporate event data show a confirmed Q3 earnings date of Wednesday, Nov. 2 AMC with an earnings call later that morning. You can listen live here. The company’s management team is also slated to speak at the EEI 57th Annual Financial Conference 2022.

Data from Option Research & Technology Services (ORATS) show a Q3 consensus earnings figure of $0.63, which would be a 10% drop from the per share figure earned in the same quarter a year ago.

Corporate Event Calendar

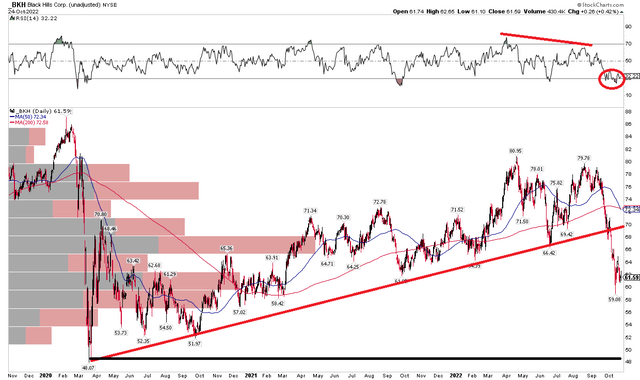

The Technical Take

BKH endured a bearish trendline break in September. The stock had been trending up off its March 2020 low near $48 to a near-double-top pattern around $80 in Q2 and Q3 this year. Given that trendline break, I think shares could go for a test of the March 2020 lows in due time.

Another sign of a change in trend is seen in the stock’s 200-day moving average, which is now falling. Finally, take a look at the RSI indicator at the top of the chart – both price and the momentum reading failed to notch new highs, confirming a topping pattern. Moreover, in the current downturn, the RSI level also confirms a bearish move in price. On the upside, look for resistance in the low $70s based on a confluence of factors.

BKH: Bearish Uptrend Trend Break Confirmed by RSI

The Bottom Line

Black Hills had a strong two-year run, but shares are not all that cheap given the risks, and the stock broke its technical uptrend. I think the stock heads lower and would be a buy under $50.

Be the first to comment