BJ’s Wholesale Club (BJ) reported fiscal 2019 and Q4 earnings Thursday before the open. While the company missed expectations, the stock reacted positively as management laid out its plan to make key investments that should drive greater growth going forward. The stock finished the day up nearly 4% on a day when the S&P 500 closed down more than 3% as investors seemed to like management’s plans on the conference call. While I think the plans are solid and should lead to improvement, I’m rating the stock neutral until I see real results in the numbers from these investment initiatives.

Strategic Growth Initiatives

New CEO Lee Delaney introduced Project Momentum on the call. This is a plan that management has come up with to save $100 million in various costs across the business. This money will then be reinvested in growth opportunities for the company, rather than flow through to the bottom line. The project will address some of the major inefficiencies that management currently believes exist including realignment in the organization and a reduction of duplicative work among employees.

Those savings, along with more investment, will flow to several initiatives to drive growth. The first is the company’s omnichannel business. This includes things such as online sales, online orders to be picked up in the club, and same-day delivery services. I’m inclined to agree with management that these are key areas the company should focus on not only to help growth but also to keep up with the competition.

Second, the company plans to invest in the membership side of the business. BJ’s currently offers annual memberships for $55, undercutting Costco (COST) by $5. BJ’s also offers three add-on members for $30 each annually. BJ’s top tier membership is priced at $110 per year, undercutting Costco by $10. Finally, BJ’s offers an online membership for just $10 per year, which appears to be an interesting way for the company to introduce potential new members to the subscription model with the possibility of converting them to a full membership later on. The company had a retention rate of 87% by the end of 2019, a solid increase from the low 80s in previous years, although still behind Costco’s retention rate, which regularly pushes 90%.

Ultimately BJ’s is going to have to drive almost as much value for members as Costco does, seeing as their pricing is only undercutting Costco by $5 per year. I believe this will be a difficult task for management. Costco has all the advantages that come with scale, which includes stores all over the world, best prices on goods, and more flexibility.

The company also plans to invest in building out services and advertising capabilities. Simply put, I think this is a must for the company. Services have the ability to add significant value for members.

Finally, the company plans to continue opening new stores across the US. In my opinion, locations are crucial to BJ’s success. I think BJ’s could find success if they can be a first mover in locations deprived of the warehouse membership model. It will reduce strong competition and give BJ’s a solid base of high retention members to expand from, rather than trying to leach members off of competitors.

Shares Look Cheap Here

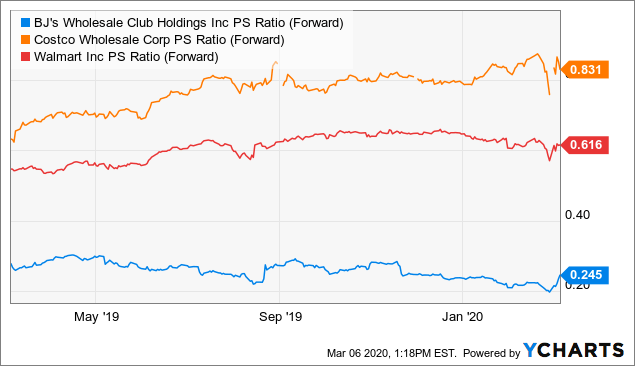

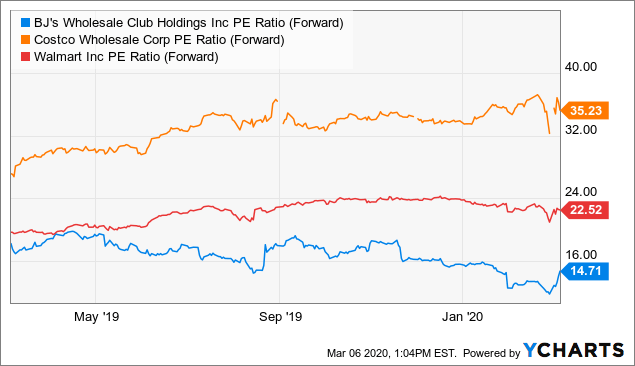

BJ’s is trading well under its peers in Walmart (WMT) (which owns Sam’s Club) and Costco. If management’s growth investments pay off, not only will the company grow, but I think significant multiple expansion is possible as well. This two-part punch could be a solid catalyst for a higher stock price, but management’s plan has to work for this to materialize. Thus I’m rating the stock neutral until I start to see management plans translate to real growth numbers in the financials throughout 2020.

Data by YCharts

Data by YCharts Data by YCharts

Data by YChartsI’ll be writing more articles on BJ’s as well as other great (or sometimes not so great) stocks. If you enjoyed this article and wish to receive updates on our latest research, click “Follow” next to my name at the top of this article. Also, be on the lookout for my upcoming Marketplace service, Superior Smallcaps.

Disclosure: I am/we are long COST. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Be the first to comment