Editor’s note: Seeking Alpha is proud to welcome Greenery Financial as a new contributor. It’s easy to become a Seeking Alpha contributor and earn money for your best investment ideas. Active contributors also get free access to SA Premium. Click here to find out more »

Parradee Kietsirikul

While The ProShares Bitcoin Strategy ETF (NYSEARCA:BITO) is not a spot ETF and doesn’t hold Bitcoin (BTC-USD), it does the next best thing – and that’s to hold near-dated Bitcoin futures contracts that are cash settled. Many folks in the cryptocurrency community are against futures as they fear futures – and thus “the system” or “legacy finance” – will be given control over Bitcoin’s price, which can be the case if futures markets grow to be greater than spot markets. However, this is not really the case, nor is it particularly relevant beyond ideology.

If you’re a hard-core Bitcoin maximalist who is firmly against derivatives, then you probably aren’t reading this. But if you are, you’ll likely want to avoid the ProShares Bitcoin Strategy ETF. That’s because when you buy it they don’t go buy actual Bitcoin, raising Bitcoin’s price. Instead, they just buy futures contracts, which in theory doesn’t always raise the price of Bitcoin.

Otherwise, for the rest of us, BITO is – in our opinion – the best way to invest in Bitcoin, or, rather, track the performance of Bitcoin. It offers a unique opportunity to reduce cost basis and risk via options hedging, as well as margin buying power relief compared to BTC-USD and Grayscale Bitcoin Trust (OTC:GBTC).

Why wasn’t BITO optimal in the past?

Before we get into why BITO is our choice for our portfolio and why we believe it’s the best way to gain exposure to Bitcoin, we feel it’s important to address why BITO wasn’t always our choice – and why it was arguably a bad choice in the past. The primary problem was that the futures contracts BITO used to track the price of Bitcoin were in contango, meaning the further dated contracts were priced at a premium. This caused BITO to buy Bitcoin at a premium every time they rolled the futures contracts held in the fund forward, causing a significant drag on the fund’s performance over the long term.

Beyond all of that, BITO previously:

- lacked liquid options markets;

- required near NLV/notional margin requirements, compared to their relatively relaxed requirements now; and

- lacked general liquidity relative to BTC-USD and Bitcoin futures.

These factors combined to make BITO not particularly appealing. Without options liquidity or reduced margin requirements, you could easily buy spot BTC-USD – actual Bitcoin – and have similar exposure with less long-term performance drag, due to being spot and not suffering from contango-related rolling losses month to month. This is why we personally, and most folks we know, avoided BITO, as it had little material benefits in the past.

Why is BITO optimal now?

Some folks will continue to disagree, such as those with ideological conviction – Bitcoin maximalists – as they do not trust financial markets and want spot Bitcoin only. For the rest of us, BITO is now optimal in most cases.

That’s because BITO now offers:

- the most liquid non-spot Bitcoin exposure (excluding futures);

- the only (regulated) liquid Bitcoin options (excluding futures);

- the lowest margin-maintenance requirements, and thus liquidity and leverage potential for brokerage accounts; and

- the lowest drag (excluding futures/spot) of any similar product.

This means the only downside to BITO now is that it has drag at all. So, if you do not plan to sell covered calls against your position – or invest with hedges, leverage, or anything more complex than buying and holding – then you’re paying a little over 1% drag vs. BTC-USD simply to have the excess liquidity and easy access/management in a brokerage account, as well as for the benefit of eliminating custodian risks.

Overall, as a result we’d argue that BITO is the optimal way to gain exposure to Bitcoin for most folks. It not only has many upsides for sophisticated investors, but for average folks it simplifies custody and eliminates those risks. It also provides extra brokerage-side portfolio liquidity for a low carrying cost of a little more than 1% – not much higher than many emerging market ETFs.

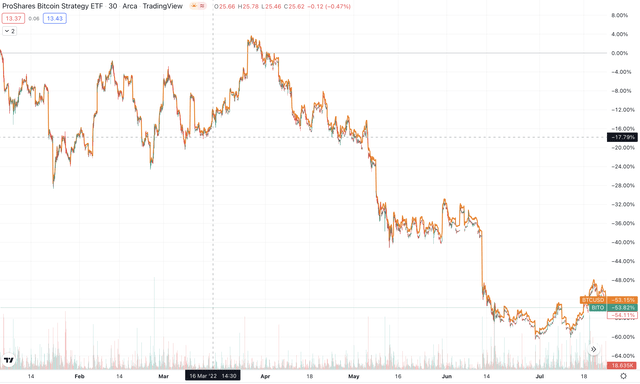

BITO vs Spot BTC-USD (Tradingview Chart Comparison)

Keep in mind the carrying cost is relative to the current contango ratio/cost-to-roll for the fund plus the expense ratio, and not the current share price, which as seen above can actually outperform over certain time periods relative to BTC-USD. Over time, the drag should be around 1%, potentially a little higher when Bitcoin is particularly volatile.

As you can see in the above screenshot, the overall performance of BITO vs. BTC-USD has tracked this nearly perfectly over time, with a YTD (seven months) drag of 0.73%, which annualizes at around 1.25%.

How are we using BITO in our portfolio?

We’ve been Bitcoin bulls for a long time, and are staying that way. However, we shifted our Bitcoin holdings into BITO recently as the contango issues began being resolved and the other factors mentioned above began to occur.

Our current assumption is neutral to slightly bearish for the next month or two. However, we’re long-term very bullish and thus we’d rate BITO according to our “buy” metric, meaning we’re currently hedged long with leverage correlating with the delta of the options/covered calls we sold against the stock. In practice, this looks like going long 100 shares with cash, selling (in this case) a 16-delta call against the stock dated approximately two months out, and then buying another 16 shares with leverage.

What about GBTC?

Initially we opted to go with GBTC, but ultimately decided against it once BITO’s contango losses remained low even as volatility spiked since May, causing us to move our funds from GBTC to BITO. The problem with GBTC and why it’s not optimal compared to BITO is multifactored.

Namely, GBTC:

- lacks entry/exit liquidity (OTC markets, generally thin markets);

- lacks options, making hedging and generating yield unrealistic;

- has a carrying cost of 2%-plus, around 2x the carrying cost of BITO; and

- doesn’t track Bitcoin very well.

Now, you might be thinking, “It’s a trust that holds Bitcoin, of course it tracks it well.” But that’s not the case. GBTC is a trust that holds Bitcoin, but due to it not being an ETF the underlining assets are trapped in the fund rather than being liquid – meaning you suffer from discount risk and volatility.

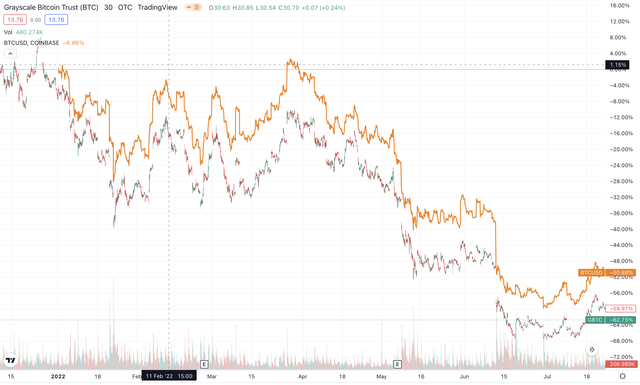

GBTC vs BITO Historic Divergence (Tradingview Chart Comparison)

In short, the above is what happens with GBTC due to the discount effect of trusts. During the same time period as the above chart, the YTD performance of BITO vs. BTC-USD performed within 0.73% of each other, while GBTC underperformed them both by around 12%. And that’s in just the last seven months – truly staggering.

Of course, the discount could decrease and you could outperform BITO by investing in GBTC. However, in our opinion it’s unlikely to close because, as we outlined above, BITO is simply the better vehicle to gain exposure to Bitcoin.

The only way we see GBTC materially closing the discount and outperforming BITO is if they are allowed to convert to a spot ETF. That could be years away still, and in the meantime we’d have to pay 2x the drag and be at risk of extra volatility due to the discount effect, unable to generate yield or reduce basis via options, etc. As such, we simply don’t see GBTC as competitive.

Downsides and risks to BITO

While I’ve outlined why I believe BITO is the best vehicle to gain exposure to Bitcoin, there are some aspects to BITO that could prove potentially problematic in the long term for some investors. The primary one is that like with all futures-based ETFs, there is some level of risk of contango returning, which would hurt the overall performance of the fund in the long term.

There’s also a risk of these funds experiencing increased volatility during debt meltdowns and financial crises, especially if spot-BTC liquidity dries up. It might not be a risk most people believe is likely, but we believe there’s a chance of a 6/7 sigma event taking place in the next 10 years in regard to debt markets. If such an event takes place, there’s no real precedent for the outcome. However, we believe that if such an event occurs it’d be safer to own spot BTC rather than cash-settled derivatives (or ETFs that hold such derivatives, like BITO).

Beyond that, assuming someone has the risk tolerance to invest in a volatile asset like Bitcoin, then we believe that BITO is the best vehicle to do so, excluding black-swan events (such as sovereign debt crises).

BITO vs. unwrapped Bitcoin futures

One final consideration not covered above is BITO vs. the raw Bitcoin futures (/BTC and /MBT). To address this, as we considered opting for the Bitcoin futures, the only edge to the futures is that you can save around .9% of the ~1.2% yearly carrying cost after fees. However, the futures will require extra management and offer less notional scaling and liquidity, and for most brokerages it seems as if the commissions generated would be higher in /MBT positions relative to BITO positions. That would mean the only way, in our opinion, the raw futures could be worth it is if you have the capital to opt for the /BTC (5btc notional) contracts and do not mind the management.

Do note that the margin requirements for both BITO and the raw futures, at this time, appear to be more or less identical for portfolio margin accounts. However, traditional Reg-T margin accounts might benefit margin-wise, at some brokers, by using /MBT v. BITO.

What about XBTF and OBTC?

We didn’t speak explicitly about them above, but neither have liquid options markets, very liquid order books, or any particular advantages. Osprey Bitcoin Trust (OTCPK:OBTC) trades at a discount and is trapped in a similar position to GBTC, making it not particularly attractive namely due to lower liquidity, higher volatility, and no options market. The VanEck Bitcoin Strategy ETF (XBTF) is a futures-based ETF similar to BITO, but lacks the options market BITO offers, has higher maintenance margin requirements on most brokerages, and generally has less liquidity. They might become a viable option in the future, but at this time we would say BITO is the better choice.

Conclusion and final considerations

As demonstrated and detailed above, BITO appears to be the best vehicle to gain exposure to Bitcoin currently – arguably even better than Bitcoin due to the liquid options/hedging markets available with BITO. As a Bitcoin believer, I do hope a spot Bitcoin ETF gets approved and offers similar options and margin/liquidity benefits. But until then, I’m sticking with BITO and Bitcoin futures.

Be the first to comment