4kodiak/iStock Unreleased via Getty Images

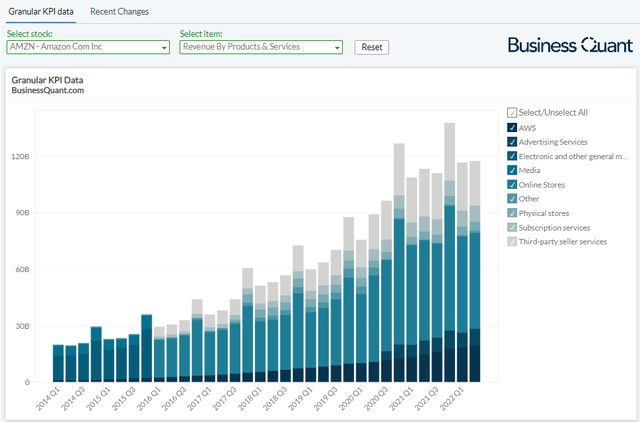

After the bell on Thursday, we received Q2 results from Amazon.com, Inc. (NASDAQ:AMZN). The e-commerce giant’s revenue came in at $121.2 billion for the quarter – its third-highest ever, up 7.2% year-on-year. The figure exceeded the Street’s estimates by $2.04 billion. What’s even more impressive is that Amazon AWS grew at an elevated rate once again, and its management issued a rather upbeat guidance for Q3. This set of solid results makes it clear that Amazon’s growth momentum is intact in spite of the currently prevalent macroeconomic headwinds. Let’s take a closer look at it all.

The Stellar Performance

Let me start by saying that Amazon’s management had originally guided their Q2 revenue to come in between $116 billion and $121 billion. As inflationary pressures started to mount in recent months, mass layoffs became the norm and recessionary concerns piled up, investors were expecting Amazon to miss its revenue guidance. But the e-commerce giant beat its own revenue guidance, as well as the Street’s revenue estimates, with its revenue of $121.2 billion. This suggests that Amazon’s financial situation isn’t as adversely affected, at least not yet, as the Street had previously anticipated.

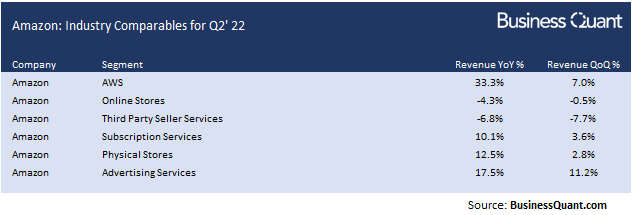

The e-commerce giant’s growth wasn’t powered by one or two segments. On the contrary, Amazon saw 4 of its 6 revenue streams grow in its latest quarter, on a sequential as well as on a year-over-year basis. Given how other growth companies are experiencing slowdowns, I find this to be a commendable feat and an enviable position to be in. Moreover, it reassures Amazon’s investors that their company is being steered in the right direction, towards long-lasting sustainable growth. But the positives of its Q2 report don’t just end there.

BusinessQuant.com

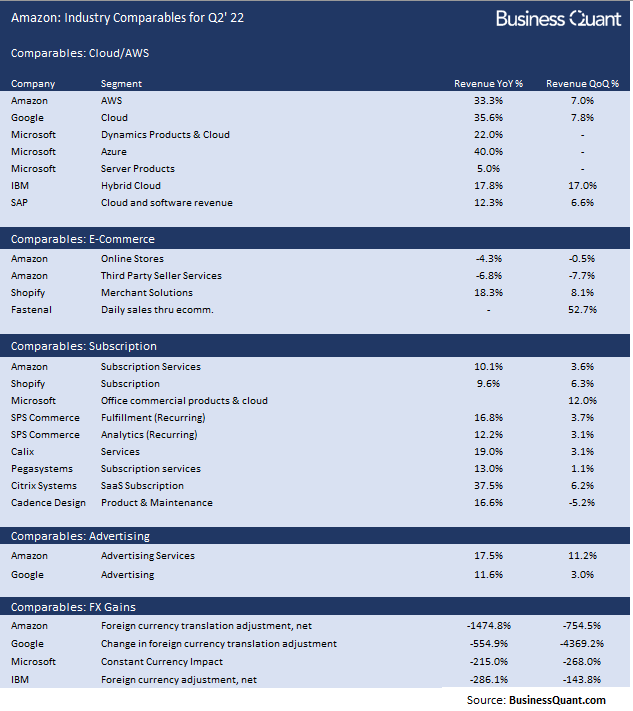

Interestingly, Amazon’s AWS and subscription revenue fared better than industry comparables. Bear in mind that the earnings season has just begun and many of Amazon’s direct counterparts (like Alibaba (BABA, OTCPK:BABAF), Cloudflare (NET), etc.) are yet to report their results. So, we’ve had to make do with whatever companies have reported their Q2 results so far. Per our database at Business Quant, Amazon’s AWS grew at above-average rates during the quarter. Microsoft (MSFT) Azure’s revenue growth rates have considerably slowed down in last 2 years (as seen here) but AWS has managed to maintain its growth trajectory.

BusinessQuant.com

Amazon’s subscription revenue growth was at par with industry levels but its advertising services revenue grew at a considerably faster pace than Alphabet’s (GOOG, GOOGL) comparable revenue stream. Moving on, Amazon’s revenue from online stores and third-party seller services declined during the quarter, but it was more than offset by the other 4 aforementioned revenue streams. So, overall, Amazon posted blockbuster Q2 topline results.

What Lies Ahead

Let’s look at the last section of the table above, which consists of foreign currency impact. As the Fed continues to raise interest rates to beat inflation, the dollar has become stronger against other foreign currencies as a result. This is benefiting U.S.-based importers but hurting exporters (of product and/or services) such as Amazon, IBM (IBM) and Google. These companies are experiencing foreign currency losses as the dollar grew stronger during the quarter – Amazon, apparently, was hurt the most. We just had a 75bps rate hike this week and another one’s lined up for next month, which means the dollar could get stronger even still and Amazon’s foreign currency losses could mount in Q3.

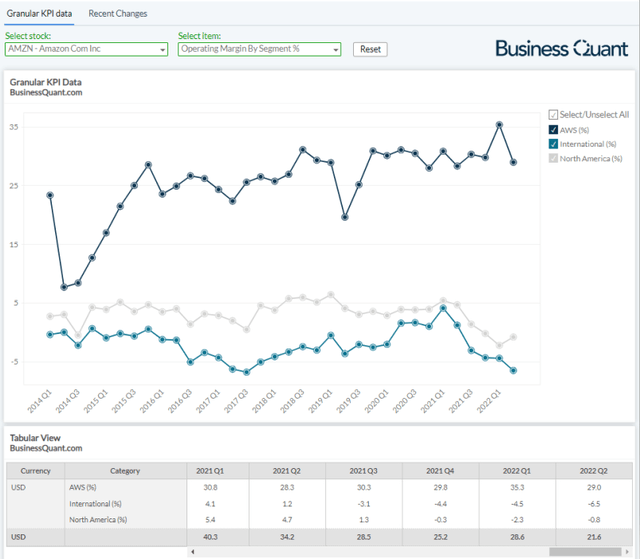

Secondly, with the recessionary environment underway, consumers are likely to cut back on discretionary spending and Amazon’s e-commerce operations are likely to see fewer orders. What this also means is that Amazon’s fulfillment stores may end up being underutilized and overstaffed. So, I expect Amazon to announce mass layoffs sometime in the coming weeks or otherwise post a deteriorating margin profile in its Q3 earnings release. Bear in mind that Amazon already posted margin compression in its AWS and International divisions during Q2, so its management would be under pressure to undertake drastic steps to mitigate the drop in their profitability.

One might argue that such a margin decline may not occur yet as Amazon is a rapidly growing company. While I agree with the general sentiment, the fact of the matter is that the company has already expanded its fulfillment capacity ahead of time. This means it’s already prone to capacity underutilization under normal macroeconomic environment, and reduced consumer spending will only exacerbate the problem. Here’s an excerpt from Amazon’s Q1 earnings call:

… we currently have excess capacity in our fulfillment and transportation network… We estimate that this overcapacity, coupled with the extraordinary leverage we saw in Q1 of last year, resulted in $2 billion of additional costs year-over-year in Q1… We do expect the effects of these fixed cost leverage to persist for the next several quarters as we grow into this capacity…

Moving on, Amazon’s management has guided their Q3 revenue to be between $125 billion and $130 billion. This would mark a year-over-year growth of approximately 15% at the mid-point guidance. However, analysts are forecasting the company’s revenue to be between $106.8 billion and $132.3 billion. This wide forecasted range suggests that the community of professional analysts has an extremely divided opinion about Amazon’s near-term growth prospects.

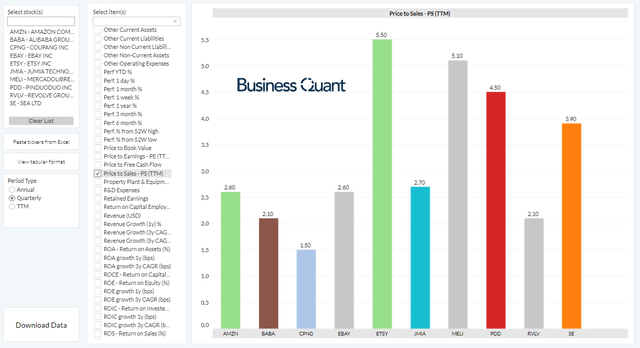

But as far as valuations are concerned, Amazon stock is trading at just 2.6-times its sales at the time of this writing. Its Price-to-Sales (or P/S) multiple is much lower than some of the other rapidly growing stocks operating in the internet retail industry. This relative undervaluation, coupled with the strong set of Q2 results, makes Amazon an attractive investment option for investors with a long-term time horizon.

Final Thoughts

Except for the short-term foreign exchange and margin compression headwinds, Amazon has once again shown that it’s still growing well in its core markets, it remains fundamentally strong and that its business diversification is bearing fruit. Also, the fact that Amazon’s AWS continues to grow at its elevated pace, while Microsoft Azure’s revenue growth slows down, suggests the former is essential to businesses while the latter is more of a backup option. With these factors in mind, Amazon seems like a solid growth investment, and investors with a multi-year time horizon should consider accumulating its shares on potential price corrections. Good Luck!

Be the first to comment