primeimages

The Question

Is the bottom in? Is it safe to begin buying Bitcoin (BTC-USD) now?

I see a lot of analyst speculation on whether the crypto “Enron and Lehman Brothers” moment is over with the Alameda / FTX (FTT-USD) debacle, or the string of failures and bankruptcies will continue.

But even if the crypto contagion is contained and the market stabilizes, there is a larger looming threat from the traditional financial markets. If we see another financial crisis in the next year, all liquid assets — including Bitcoin — will quickly sell off, just like the pandemic panic event in March of 2020.

First, is Bitcoin Going to Die?

I’ve been a Bitcoin fan since 2013. It’s a brilliant assemblage of breakthrough technology that enables secure payment transfers without the need for a middleman. From its origin as a white paper concept, and through many major price crashes and recoveries, Bitcoin has been a fascinating story.

Fun fact: my first Bitcoin article to this publication was submitted in March of 2014, but was turned down because at that time it was a niche topic and there was no appreciable effect on any traditional stock. This was well before Grayscale launched their Bitcoin Trust product (OTC:GBTC) in 2015.

We are seeing a lot of negative press with detractors once again making claims that Bitcoin will go to zero. This is nothing new. Mainstream media outlets have declared Bitcoin dead 466 times between 2009 to 2022, including 21 times in 2022 alone. On average this occurs about 36 times every year.

The European Central Bank recently felt the need to write their own obituary of Bitcoin dismissing any price stabilization as a “last gasp before the road to irrelevance” and publishing the misinformation that it “is rarely used for legal transactions.” Jake Chervinsky, General Counsel, Compound Labs, has responded to similar allegations made by Treasury Secretary Janet Yellen:

“It’s disappointing to hear Dr. Yellen repeat the mistaken view that crypto is mainly used for illicit activities. Her statement is demonstrably false… That said, it’s important to remember that crypto is a relatively small issue compared to everything else the Treasury Department is responsible for, so she likely hasn’t spent time deeply considering it yet.”

Financial processing has always required a clearing house, a trusted third party centralized system to verify transaction validity. Banks clear checks, credit card companies authorize, clear, and settle transactions. But Bitcoin allows direct payment securely on a peer-to-peer basis, with no middleman required. For the first time in human history, this protocol enabled a method of decentralized, distributed trust.

Central Banks like the ECB desire to maintain their status quo by gatekeeping technology and innovation. They believe they are the anointed elite to run financial systems, and nothing should exist outside their authorization and control. Bitcoin threatens this. This was detailed in my earlier article, The Financial Elite: Bitcoin Bad, CBDCs Good, Stablecoins Meh.

But governments and Central Banks could make owning Bitcoin difficult by heavy handed regulation or by outright bans. However, when China banned mining last year, operators simply migrated to friendlier nations. Unless all governments simultaneously criminalize it, a very low probability event, it will certainly live on.

The Current Crypto Environment

In the early days of Bitcoin and Ethereum (ETH-USD) there was no way to leverage any digital assets. Over time this changed until the industry was rife with CeFi lenders who were re-hypothecating customer deposits and making incredibly poor risk management decisions. One example of this is Voyager Digital (OTCPK:VYGVQ), who offered a $650 million unsecured loan to Three Arrows Capital, apparently with little or no due diligence into their operations. As it turns out, Three Arrows was upside down on investments including GBTC.

In this way the crypto industry mimicked TradFi and produced its own version of the Great Financial Crisis of 2007-2008. But instead of the housing bubble collapse as a catalyst, the crypto dry tinder was provided by the price decline of GBTC and fire started with the crash of the algorithmic stablecoin Terra (UST-USD) and its companion token (LUNC-USD). I wrote more on that in my article, USD Coin Stablecoin Interest Update: CeFi Implosion.

Many crypto institutions were probably insolvent early in 2022 but continued to gamble in the misplaced hope they could recoup their losses. This led to the further questionable decision to park funds on the Anchor Protocol because it promised 19.5% yield for Terra stablecoin deposits. When UST and LUNA crashed in May, institutions not only lost the much needed interest payments but were left with massive holes in their balance sheets.

Bottom line, the companies now filing for bankruptcy — Three Arrows, Voyager, BlockFi, and Celsius (CEL-USD) — are all culpable for a lack of risk assessment of counterparties like FTX and Alameda. This is not a problem with Bitcoin, it’s a case of the worst aspects of the TradFi system infesting the marketplace. As Senator Pat Toomey has said, “The code committed no crime” (I can’t give the reference as SA doesn’t allow YouTube links, but check out his podcast with Bankless). BTC is not responsible for poor risk management and fraud. As painful as these wash outs have been, Bitcoin’s value proposition has not been broken and the industry will ultimately be stronger going forward.

How to Avoid Future Rug Pulls and Scams

FTX’s Sam Bankman-Fried was almost universally acclaimed as a genius. Zhu Su and Kyle Davies of Three Arrows Capital were considered the smartest people in any room. They all leveraged their reputations to avoid hard inquiries into their company’s balance sheets.

Alex Mashinsky often proclaimed customers’ money was safer with Celsius than with traditional banks. In contrast, Vermont state officials have recently claimed that Celsius had been insolvent since early 2019.

Some industry pundits and analysts saw the suspicious actions of these players but unfortunately few said anything about it. Many podcasters and You Tubers were paid to promote Celsius, Voyager, BlockFi and FTX. Other prominent voices in the industry who secretly suspected the worst were intimidated into silence by the implied threat of being blackballed.

This raises the question, where can we find honest commentary going forward? Who will alert us about the next set of scams? Here are the best sources for unvarnished questioning of the industry I’ve found.

Cory Klippsten is the CEO of the Bitcoin centered firm Swan.com and was an unflinching critic of both LUNA and Celsius before they collapsed.

Dirty Bubble Media is the alias of a researcher who foresaw the issues with both Celsius and FTX. Please note, he is extremely critical of all crypto, so be prepared to have your basic assumptions challenged.

Stephen Findeisen, aka Coffeezilla, is a YouTuber who exposes crypto scams. Lately he’s been very active investigating FTX and Sam Bankman-Fried.

Finally, FatManTerra is a researcher primarily known for documenting events with Terra. He also calls out other bad actors in the space.

Any other sources you have found valuable in separating the wheat from the chaff in crypto? Let me know in the comments.

The Macro Economic Environment

Although the crypto contagion is not contained and the fate of Genesis Global and Gemini is yet undetermined, there is another huge set of potential challenges. Make no mistake, Bitcoin is still very much tied to the macro economic conditions. If the market panics again as it did early in 2020, all liquid assets including Bitcoin could quickly sell off.

Bitcoin crash in March 2020 (Coingecko)

The next 12 months could be precarious due to the Federal Reserve jamming on the brakes by hiking interest rates for the sixth consecutive time this year. The Fed seems bound to continue this policy until inflation demonstrably slows down or something breaks. What market fragilities might be exposed?

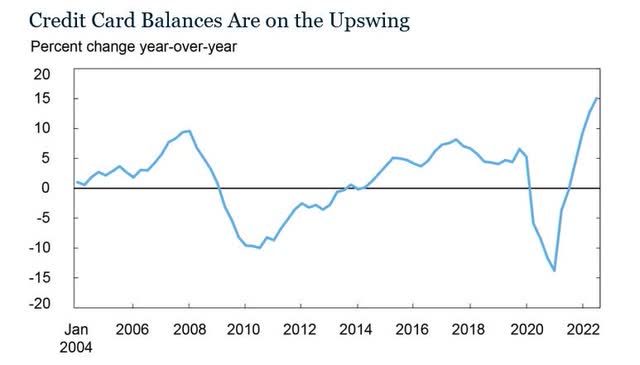

There are some troubling economic indicators beginning to surface. In the most recent quarter ending in September, total consumer credit card balances increased by 15%, the largest year over year increase measured in more than 20 years.

New York Fed Consumer Credit Panel / Equifax

As inflation drives up the cost of basic goods and services, more Americans are forced to use credit cards just for necessities. Worse yet, when interest rates go up, so do credit card rates. A retail store credit card recently notified me the APR was increasing to 29.99%! About 12% of consumers missed a credit card payment this year.

Although 37% say they forgot to make a payment, others cited the following reasons for missing a payment:

Had to pay for food or groceries (31%) Had to pay utility bills (29%) Had to prioritize other forms of debt (26%) Had to pay for an emergency (26%) Had to pay their rent or mortgage (25%) Did not have enough income to make the payment (24%)

Total household debt has reached $16.51 trillion in Q3 2022 as reported by the Federal Reserve Bank of New York.

The Federal Reserve Bank of New York’s Center for Microeconomic Data

All categories showed increases except student loan debt; probably due to the discharged debt from some loan forgiveness programs.

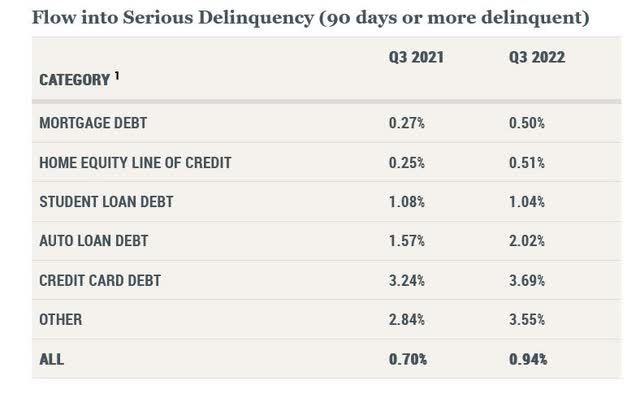

The Federal Reserve Bank of New York’s Center for Microeconomic Data

Serious delinquencies ticked up across the board except for student loans, which are still on repayment pause. But what happens when households with already thinly stretched budgets must begin paying those loans again?

U.S. Bureau of Economic Analysis

The personal savings rate, which looked great during the pandemic, has fallen off a cliff in the past year. Decreasing savings and increasing debt is a problematic combination.

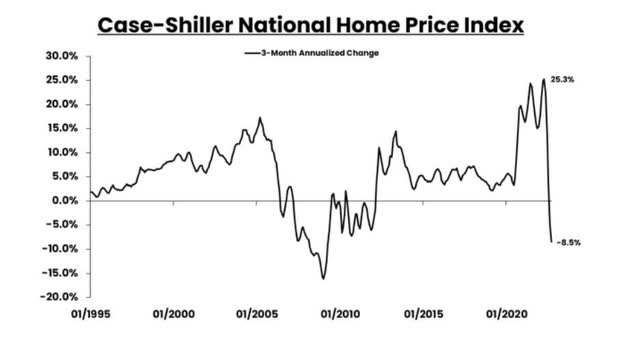

The housing market merits an article by itself but suffice to say the price bubble is beginning to burst. For the quarter ending in September, home prices declined at an 8.5% annual rate. New mortgage applications are also down 46% since this time last year.

Conclusion

So what will break in the economy? Where is the hidden fragility? Black swan events are impossibly difficult to predict but in hindsight we can piece together what led to the Great Financial Crisis in 2007-08. The pattern is familiar, excessive risk-taking by global financial institutions and the bursting of the United States housing bubble.

The crypto industry was also absolutely guilty of excessive and horrendous risk-taking. That coupled with the GBTC premium decline and demise of the Terra LUNA ecosystem brought about the cascading institutional failures. The collapse of FTX and Alameda may cause even more bankruptcies.

The problem with both crypto and TradFi is that risky investments and scams are often hidden during good times. As Warren Buffett famously said, “Only when the tide goes out do you discover who’s been swimming naked.” We must challenge our assumptions and listen to those raising concerns.

For me, Bitcoin is a long term blue chip crypto asset to hold. But over the next 12 months the prudent investor must be vigilant and prepared for a further leg down due to sell pressure from whatever traditional finance crisis is currently brewing behind the scenes. So have we seen the bottom for Bitcoin yet? In my opinion, there’s good reason to believe we haven’t.

Be the first to comment