Dr_Microbe/iStock via Getty Images

A Quick Take On Biostage

Biostage, Inc. (OTC:BSTG) has filed to raise $12.4 million in an IPO of its common stock, according to an S-1 registration statement.

The firm is a pre-clinical stage biotech developing treatments for disorders of the gastro-intestinal system and airway.

When we learn more IPO details from management, I’ll provide an update.

Biostage Overview

Holliston, Massachusetts-based Biostage was founded to develop regenerative-based medicine treatments for conditions of the esophagus, bronchus and trachea organs.

Management is headed by founder, Chairman and interim CEO David Green, who has been with the firm since inception and was previously a brand manager at Unilever and strategy consultant for Monitor before co-founding Harvard Bioscience in 1996.

The firm’s lead candidate, for the treatment of adult esophageal conditions, has been approved by the FDA to commence Phase 1/2 clinical trials which management expects to begin in “early 2023.”

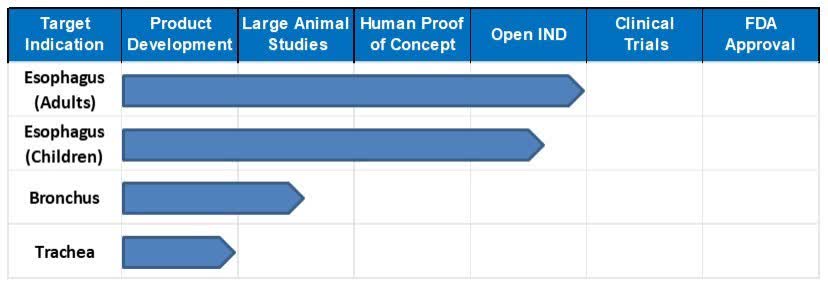

The company’s pipeline status is shown below:

Company Pipeline (SEC EDGAR)

Biostage has booked fair market value investment of $74 million as of March 31, 2022 from investors.

Biostage’s Market & Competition

According to a 2022 market research report by Data Bridge Market Research, the global market for the treatment of Barrett’s esophagus condition [GERD] was an estimated $4.4 billion in 2021 and is forecast to reach $6.5 billion by 2029.

This represents a forecast CAGR (Compound Annual Growth Rate) of CAGR of 4.9% from 2022 to 2029.

Key elements driving this expected growth are changing lifestyles, growing obesity rates and increased alcohol consumption, all of which lead to increased incidence of the condition.

Also, the incidence of esophageal cancers is expected to increase by a CAGR of over 8% from 2019 to 2027, resulting in increased demand for treatment modalities.

Major competitive vendors that provide or are developing related treatments include:

-

GSK (GSK)

-

Novartis (NVS, OTCPK:NVSEF)

-

Bayer (OTCPK:BAYZF, OTCPK:BAYRY)

-

Eli Lilly (LLY)

-

Merck (MRK)

-

Johnson & Johnson (JNJ)

-

Sun Pharmaceutical Industries

-

Pfizer (PFE)

-

Procter & Gamble (PG)

-

Others

Biostage Financial Status

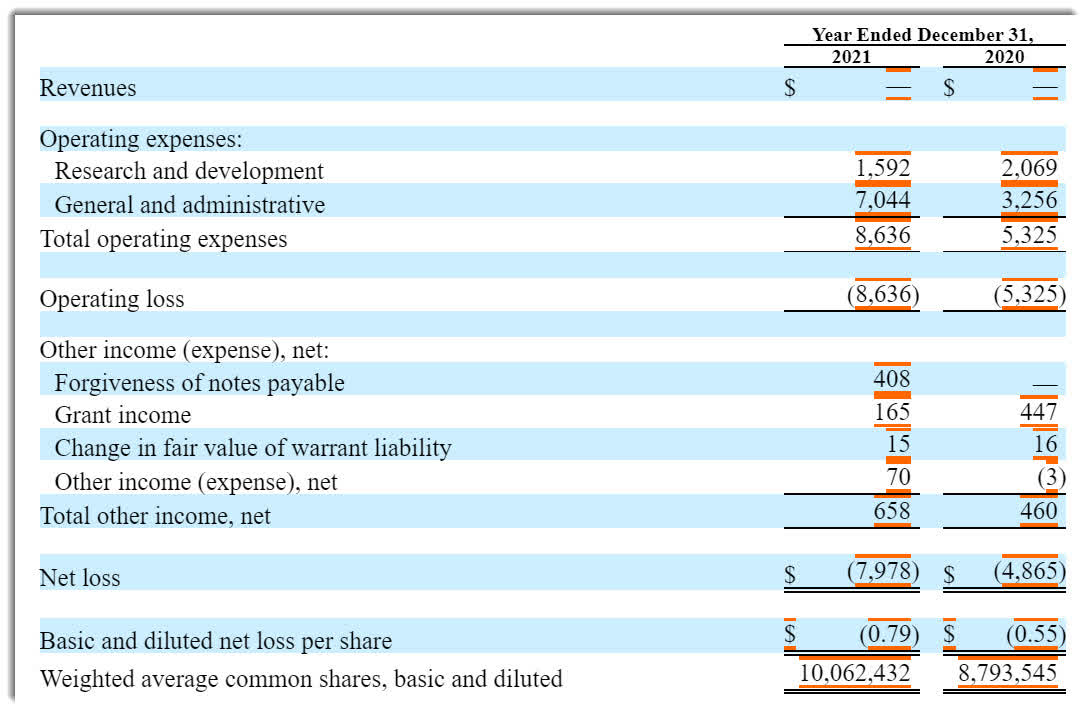

The firm’s recent financial results are typical of a preclinical stage biotech in that they feature no revenue and material R&D and G&A expenses associated with its candidate development efforts.

Below are the company’s financial results for the past two calendar years:

Statement of Operations (SEC)

As of March 31, 2022, the company had $723,000 in cash and $9.2 million in total liabilities.

Biostage IPO Details

Biostage intends to raise $12.4 million in gross proceeds from an IPO of its common stock, although the final figure may differ.

No existing shareholders have indicated an interest to purchase shares at the IPO price, although this element may become a feature of the IPO if disclosed in a future filing.

The firm’s stock is currently quoted on the OTCQB market under the symbol “BSTG.”

Management says it will use the net proceeds from the IPO as follows:

for working capital, research, development, including funding preclinical and clinical trials, business development, sales and marketing, capital expenditures, and other general corporate business purposes.

(Source – SEC)

Management’s presentation of the company roadshow is not available.

Regarding outstanding legal proceedings, management expects to incur $6.0 million in costs in settling a wrongful death claim against the firm for its first-generation trachea scaffold technology which it no longer uses.

The sole listed bookrunner of the IPO is Newbridge Securities.

Commentary About Biostage’s IPO

BSTG is seeking public capital market investment to fund advancement of its pipeline of treatment candidates.

The firm’s lead candidate, for the treatment of adult esophageal conditions, has been approved by the FDA to commence Phase 1/2 clinical trials which management expects to begin in ‘early 2023.’

The market opportunity for treating esophageal conditions is reasonably large and expected to grow at a moderate rate of growth in the coming years.

However, there are a number of major competitors providing existing treatments in the firm’s current focus areas.

Management has not disclosed any major pharma firm collaboration relationships.

The company’s investor syndicate does not include any widely-known institutional life science venture capital firms.

Newbridge Securities is the sole underwriter and there is no data on IPOs led by the firm over the last 12-month period.

BSTG is a thinly capitalized biotech company that is still at a preclinical stage of development, so the IPO will be ultra-high-risk.

When we learn more about the IPO’s proposed valuation and pricing assumptions, I’ll provide a final opinion.

Expected IPO Pricing Date: To be announced.

Be the first to comment