cherezoff

Investment Thesis

Mapping the human genome is described as “one of the greatest scientific feats in history” by the website of the National Human Genome Research Institute. As stupendous an achievement as it may have been, to date, genome mapping has thrown up surprisingly few commercial use cases.

San Diego headquartered Bionano Genomics, Inc. (NASDAQ:BNGO) – the subject of this post – with its ~$640m market cap is a relative minnow in the commercial genome mapping field, when compared to rivals such as Illumina (ILMN), Pacific Biosciences (PACB), and UK-based Oxford Nanopore Technologies, whose market caps are respectively ~$34bn, $2.4bn, and $2bn.

Nevertheless, with its focus on “optical genome mapping” (“OGM”) and “Structural Variation Analysis” Bionano believes that its Saphyr system offers a greater breadth of services and more efficiency than its larger rivals, and believes that its market opportunity stands at ~$4bn, based on existing opportunities within cytogenomics conversion – 4m samples analyzed per annum globally – and complement sequencing – 15k sequencers are currently installed in labs and hospital worldwide – plus a further ~$4bn of market expansion opportunities in cell processing, population genomics, risk assessment in neurological and cardiovascular disease, and newborn screening.

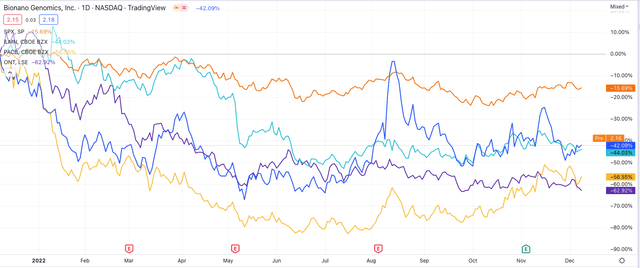

1 year share price performance of genome mapping stocks (TradingView)

As we can see above, the share prices of all 4 of the genome mapping companies mentioned above have been falling over the past 12 months, significantly underperforming the S&P 500 (SP500).

A lack of revenue growth is the underlying issue behind the share price declines. Illumina expects to grow revenues just 1% year-on-year in 2022, from $3.2bn in 2021, whilst PacBio’ revenues in 2019, 2020, and 2021 have been $91m, $79m, and $131m, with $86m generated in the first 9m of 2022, and all financial guidance for FY22 withdrawn. Oxford Nanopore grew revenues from £156m to £181m between 2020 and 2021, and earned £122m in H122.

Although Illumina is profitable, earning net income of $762m in FY22, a goodwill impairment charge of $3.9bn means the company’s EPS in FY22 to date is $(27.13). Pacbio made a net loss of $(181)m in FY21, whilst Oxford Nanopore made a net loss of £(227)m. In fairness, all 3 companies are cash rich, respectively reporting current assets of $2.7bn, $1.1bn, and $1bn.

Bionano finds itself in a similar position to its larger rivals financially, albeit on a far smaller scale. The company earned revenues of just $18m in FY21, up from $8.5m in the prior year, and is on track for $25 – $27m in FY22 (according to a recent corporate overview presentation). Net loss in FY21 was $(72.4)m, and across the first 9m of 2022, it stands at $(94)m.

Although some of the use cases for genome mapping are compelling – Illumina’s GRAIL cancer detection test, for example – and screening for genetic defects present in a host of diseases that can subsequently be targeted with precision medicines, the market has clearly not grown rapidly enough to meet investor’s expectations, which explains why company valuations are falling.

Theoretically speaking, as mapping become faster, cheaper, and applicable to a wider range of services, these companies revenues ought to grow exponentially given the level of insight achievable, but in reality, this situation is not materializing.

The question investors therefore need to be asking themselves is whether genomic mapping companies valuations look cheap at the present time, meaning buying today will reward a patient investor, or whether the dearth of use cases and slow sales will result in even more depressed valuations – and in the case of Bionano – a resource drain that could lead to bankruptcy or delisting.

In the rest of this post I’ll take a deeper dive into Bionano’s past, current and likely future performance to try to answer this question.

Bionano – Recent Performance

Bionano’s year-on-year revenue growth was a respectable 55% in Q322 – the issue is that the bar was set very low in Q321, and Q322 revenues – although the highest in the company’s reporting history – were just $7.2m.

Cost of revenue was $5.4m, whilst R&D came in at $12.7m, and SG&A came in at $21.2m, resulting in a net loss for the quarter of $(32)m. Total current assets were reported as $218m, so there is no immediate danger of Bionano running out of development funds. However, it’s also true that the company can only run these kinds of losses for a few more quarters before it has to find a way to either raise a substantial sum of money in a non-shareholder-dilutive way, or find a way to become profitable – not easy when revenues are <$10m per quarter.

On the Q322 earnings call, Bionano CEO Erik Holmin reported that the company ended the quarter with 217 installed Sapphire systems – up 54% year-on-year – sold 3,975 flow cells, and analyzed 369 samples in its laboratories.

Bionano operates a “razor and blade” business model – the more installed bases, the greater the number of consumables sold – plus there is warranty revenue, maintenance charges, and technical support, which accounted for ~50% of all revenues in Q322 – $3.6m.

Newly launched Bionano Labs, which CEO Holmin described as “a new organization that combines our optical genome mapping data services with the clinical testing services that were previously known as Lineage,” also made a “significant progress” in Q3. It received CLIA certification, which allows Bionano, according to the CEO, to:

offer services to customers who seek to implement optical genome mapping into their clinical routines and for research applications with hospitals, pharmaceutical companies and other groups that require a more robust regulatory structure for their projects.

Execution Of “Elevate” Growth Strategy

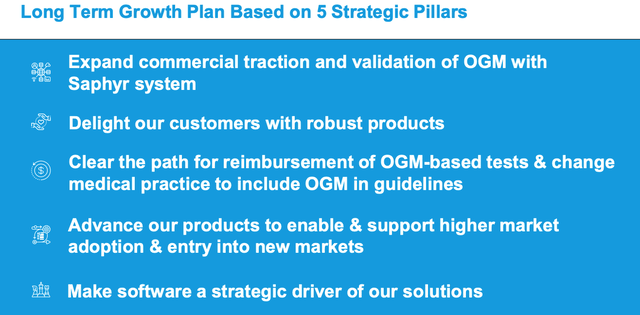

Bionano has been pursuing a long-term growth strategy it has termed “Elevate,” which it has outlined as per the slide below:

ELEVATE strategy (Bionano presentation)

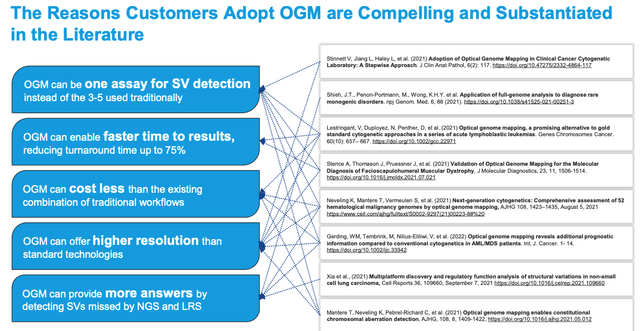

Bionano’s hope is that is that its optical genome mapping (“OGM”) emerges as the market leading approach to genetic testing, and the company provides several compelling reasons why this might be the case, as shown in the slide below:

Reason for customer preference for OGM (Bionano presentation)

Structural Variation (“SV”) is a field in which Bionano believes its Saphry systems have a distinct competitive advantage over its rivals. If the ELEVATE strategy pays off, the prospect of reimbursable OGM testing makes a reasonable case for more widespread adoption, further enabled by add-on software and lab services.

Purigen Acquisition & Strength of Recent M&A

To my mind at least, Bionano’s strategy for growth appears reasonably compelling. Another element of management’s strategy I like is its commitment to bolt-on acquisitions, specifically in the form of its acquisition of Purigen Biosystems, announced at the end of last month.

The cost of the transaction is $64m, with $32m being paid up front – a huge commitment from Bionano, given the reported current assets of $218m as of Q322, and a cash burn of >$30m per quarter.

According to a press release, the Purigen buyout adds proprietary technology – developed at Stanford University – for isolation and purification of nucleic acids, and a Purification System, described as a “commercially available platform for isolation of DNA and RNA from complex biological samples.”

Without being a molecular biologist in charge of a hospital or labs’ annual spending budget, it is difficult to assess what the Purigen acquisition – which will also bring most of Purigen’s staff into the Bionano fold – will do for Bionano’s market share going forward. My understanding, however, would be that it reinforces the OGM thesis, thereby playing to one of Bionano’s core strengths.

This is suggested by a statement in the press release discussing the strategic benefit:

Strategic Benefits of the Transaction: expands Bionano’s Sample Prep Portfolio Capabilities Toward Creating an End-to-End Solution for OGM that May Accelerate Adoption of OGM by Further Simplifying the DNA Isolation Workflow

In recent years, Bionano has also acquired Lineagen – a pediatric neurodevelopment testing company – for ~$10m, and BioDiscovery, in October last year, for ~$100m. BioDiscovery is a clinical software company that has now been integrated with existing OGM software.

To have committed nearly $150m on bolt-on acquisitions that complement and expand its OGM and SV core competences, when revenue generation is <$10m per quarter, is certainly a bold strategy. It suggests management genuinely believes it is on the right track.

What Happens Next – 2023 & Beyond

Put simply, to be successful, Bionano needs to increase the size of its installed base. At present, we know that an installed base of 217 Sapphire systems results in annual revenues of ~$26m (the midpoint of FY22 guidance).

Doing some simplistic math, we can say that each Sapphire system, therefore, generates ~$100k in revenues. By FY22, management says that it expects the number of installed bases to increase to 240, i.e., 23 new systems installed during the quarter.

If Bionano added 23 new systems per quarter in 2023, for example, its installed base would increase to ~310 and revenues may increase to $37m. This is probably what troubles me the most about Bionano’s business model. According to management, there are 15k installed sequencers worldwide – which by my calculations, based on estimated revenue by system, adds up to a market opportunity of ~$1.8bn, not, as management has suggested, ~$4bn, with an additional $4bn in play.

Even with its differentiated OGM / SV approach, realistically, it is hard to imagine Bionano’s share of this market being >15%, which implies a peak revenue opportunity of ~$270m.

That is not quite enough to justify Bionano’s current market cap valuation of ~$650 – a price to sales ratio of >2.5x, and only a slight possibility of profitability – let alone a growing share price.

Management would doubtless counter that its strategy of developing a market around its core competencies can pay off with a steeper growth trajectory than I have outlined above, and exponential growth as more use cases are uncovered as a result of increased use of Saphyr and other systems.

Apparently, there is a commercial launch of a next generation OGM system to look forward to in the New Year, as well as completion of postnatal and prenatal testing study data, but can management persuade a relatively small number of buyers in the market to turn their back on the likes of Illumina, PacBio, and Oxford Nanopore?

At the present time, I am struggling to see how Bionano builds the required momentum to be able to use economies of scale and progress towards profitability.

Conclusion – Management’s Ambition May Not Be Matched By Market Opportunity – At Least Not Yet

In this post, I have taken a closer look at Bionano’s business and market opportunity, as well as its plans to establish itself as a pioneer of new and better technology in a field which is expected to become increasingly significant as we understand more about the power of mapping the genome.

Despite this, I still struggle to answer the question as to whether Bionano may offer value to somebody investing today and prepared to be patient. Whilst I admire management’s ambition, and can make the case for a bold marketing strategy supported by substantial investment in new technology – both internal and external – it cannot be said that Bionano has paid off in 2022 when the company’s revenues will be just $25 – $27m – a price to sales ratio of >25x, which is not attractive, and when losses will be >$100m.

It’s clear – by looking at the fortunes of Bionano’s rivals – that the genome mapping space is not opening up as quickly as the market had expected, but there are still compelling arguments to be made that it will do.

I suspect that Bionano Genomics, Inc. growth may not materialize for several years yet, however. Although, if I were in charge of a lab’s testing budget, I would find Bionano’s pitch persuasive, I am not sure there is a large enough market for Bionano to generate anything but incremental growth for the foreseeable future.

As such, although I plan to maintain a watching brief, I won’t be looking to open a position in Bionano.

The Bionano Genomics, Inc. stock price is volatile and spiked to an all-time high of $14 in early 2021, and $3.6 as recently as August – offering very attractive upside potential – but after making bearish calls on 2 companies of similar size to Bionano, operating in a similar field, being diagnostics – T2 Biosystems (TTOO) and Accelerate Diagnostics (AXDX), and noting that they are down respectively and 95% and 85% over the past 12 months – I will wait for a bona fide market opportunity to present itself before investing in the genome mapping sector.

Be the first to comment