satori13/iStock via Getty Images

A Quick Take On BIOLIFE4D Corporation

BIOLIFE4D Corporation (SAVU) (SAVUW) has filed to raise $17.5 million in an IPO of its units consisting of common stock and warrants, according to an S-1 registration statement.

The firm is developing synthetic heart organs for human transplant use.

Since BIOLIFE4D is still in pre-clinical R&D stage, it will have to go through the full clinical trial process and FDA approval, so management has a very long road ahead of it and will need to raise significantly larger sums of capital if it is to succeed.

When we learn more details about the IPO, I’ll provide a final opinion.

BIOLIFE4D Overview

Buffalo Grove, Illinois-based BIOLIFE4D was founded to develop human heart replacement organs using 3D printing techniques combined with the patient’s own cells, reducing rejection risks in the process.

Management is headed by Chairman and CEO Steven Morris, who has been with the firm since November 2016 and was previously president of Inland Midwest Corporation, a boutique medical supplier to various medical companies in the U.S.

The company is still in R&D stage and is seeking to create a proof of concept ‘mini-heart’ through its bioprinting process.

BIOLIFE4D has booked fair market value investment of $6.8 million as of March 31, 2022 from investors.

BIOLIFE4D’s Market & Competition

According to a 2021 market research report by Verified Market Research, the global market for artificial hearts was an estimated $1.7 billion in 2020 and is forecast to reach $4.9 billion by 2028.

This represents a forecast CAGR (Compound Annual Growth Rate) of CAGR of 13.9% from 2021 to 2028.

Key elements driving this expected growth are increasing demand from an aging population with cardiovascular disease and advancements in artificial heart technologies.

Also, the market will require further development of technologically advanced infrastructure capable of supporting its growth along with the potential for high associated costs.

Major competitive vendors that provide or are developing related treatments include:

-

Thoratec Corporation

-

SynCardia Systems

-

Cirtec Medical Systems

-

BiVACOR

-

MyLVAD

-

CARMAT

-

Jarvik Heart

-

Abbott

-

AbioMed

-

Cleveland Heart

BIOLIFE4D Corporation Financial Status

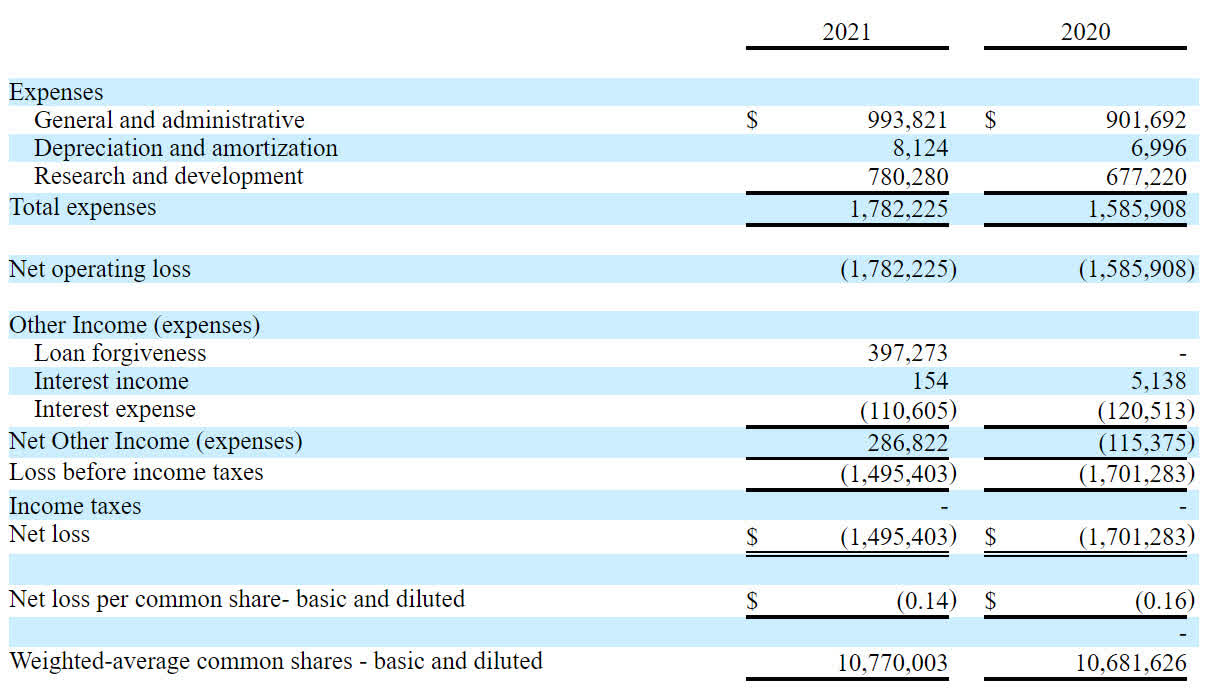

The firm’s recent financial results are typical of a development stage medical device company in that they indicate material G&A and R&D expenses associated with its development efforts.

Below are the company’s financial results for the past two calendar years:

Statement Of Operations (SEC EDGAR)

As of March 31, 2022, the company had $442,297 in cash and $1.5 million in total liabilities.

BIOLIFE4D Corporation IPO Details

BIOLIFE4D intends to raise $17.5 million in gross proceeds from an IPO of its units consisting of common stock (SAVU) and warrants (SAVUW), although the final figure may differ.

The firm is offering one warrant to purchase one share at an as-yet undisclosed exercise price. Usually the exercise price is at some premium to the IPO price (ex., 120%) or sometimes at the IPO price.

No existing shareholders have indicated an interest to purchase shares at the IPO price.

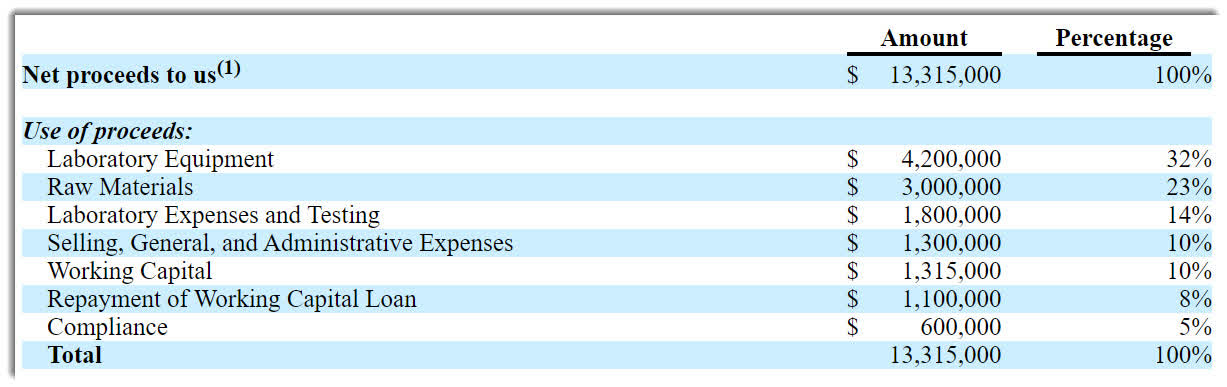

Management says it will use the net proceeds from the IPO as follows:

Proposed IPO Proceeds (SEC EDGAR)

(Source)

Management’s presentation of the company roadshow is not available.

Regarding outstanding legal proceedings, management said the company is a defendant in a breach of contract lawsuit from promissory note holders totaling $600,000.

The sole listed bookrunner of the IPO is Aegis Capital Corp.

Commentary About BIOLIFE4D’s IPO

SAVU is seeking public capital investment to fund further research of its artificial heart technologies.

The firm is seeking to create a proof of concept ‘mini-heart’ through its bioprinting process.

The market opportunity for artificial heart devices is large and expected to grow substantially in the coming years.

However, major medical device companies are in the space and no doubt spending to develop new heart technologies.

Management hasn’t disclosed any major medical device firm collaboration partnerships.

The company’s investor syndicate does not include any well-known institutional medical device venture capital firms or strategic investors.

Aegis Capital Corp. is the sole underwriter and IPOs led by the firm over the last 12-month period have generated an average return of negative (78.8%) since their IPO. This is a bottom-tier performance for all major underwriters during the period.

Since BIOLIFE4D is still in pre-clinical R&D stage, it will have to go through the full clinical trial process and FDA approval, so management has a very long road ahead of it.

When we learn more details about the IPO, I’ll provide an update.

Expected IPO Pricing Date: To be announced.

Be the first to comment