bymuratdeniz/iStock via Getty Images

‘The little problem we didn’t anticipate’ kind of turnaround companies, where the problems are far worse than originally thought. – Peter Lynch

In biotech investing, it’s important that you follow up various corporate developments. After all, the fundamentals determine where your stocks are heading in the future. Accordingly, companies don’t stay the same. Some growth companies will continue to grow robustly; whereas, others will not be able to handle mega growth. As such, keeping up with the investing story will give you an edge over the stock market.

As you can see, I’m a big fan of “fringe biotech” companies. That is to say, I like logistics providers for biotech innovators. Cryoport (CYRX) is one such company that delivered phenomenal results. BioLife Solutions, Inc. (NASDAQ:BLFS) is the other leading company in this niche. In the past few months, BioLife was hit by several fundamental concerns. In response, the company is now undergoing substantial changes in the efforts to turn around. At this “transitioning point,” I believe BioLife has a good chance to make a successful comeback. In this research, I’ll feature a fundamental update on BioLife and provide you with my expectation of this growth equity.

About The Company

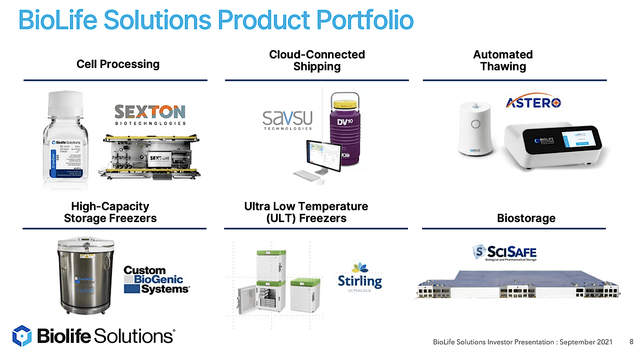

As usual, I’ll present a brief corporate overview for new investors. If you’re familiar with the firm, I suggest that you skip to the next section. Operating out of Bothell, Washington, BioLife is a premier supplier of bioproduction products and a logistics service provider for the cell/gene therapy (CGT) and biopharma sector. As CGT is growing aggressively, BioLife is positioned to enjoy the huge industry tailwind.

Large Market & Robust Customer Base

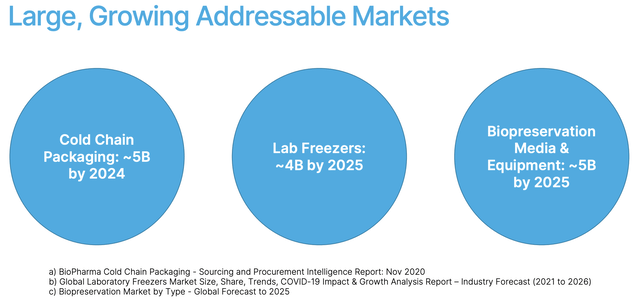

As you can see, the CGT sector is expanding rapidly. As such, various logistic businesses like those mentioned below (cold chain packaging, lab freezers, biopreservation media/equipment) would have enjoyed this great boon. Specifically, the cold chain packaging, lab freezers, and biopreservation media/equipment segments would correspondingly grow to $5B, $4B, and $5B in the next two to three years. With the shift toward CGT, you can anticipate those figures to gap up even faster over time. That’s the beauty of operating in an industry tailwind. A little effort goes a long way toward growth success.

In addition to the large market, BioLife is able to service many stellar and emerging customers such as Kite Pharma (GILD), Celgene Corp (BMY), and Novartis AG (NVS). Asides from supporting developing molecules, BioLife also takes care of approved therapeutics such as Kite’s Yescarta/Tecartus, Celgene’s Breyanzi/Abecma, and bluebird bio, Inc.’s (BLUE) Zynteglo/Skysona. As you can imagine, having brand names customers like Novartis speaks volumes about the business quality. After all, great companies have high expectations of performance.

Robust Business Operations

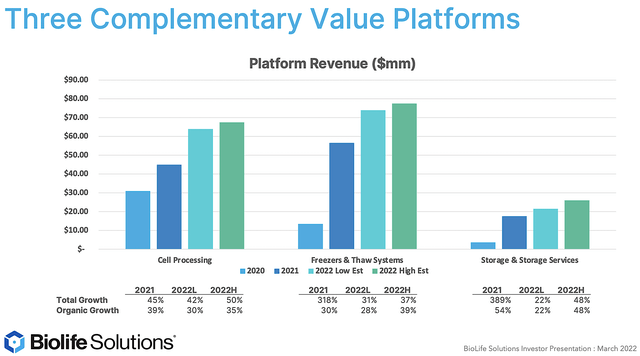

Shifting gears, you should analyze the specific trends in BioLife’s three business operations. Viewing the figure below, all three operations – cell processing (“CP”), freezers/thaw system (“FTS”), storage/storage services (“SSS”) – delivered remarkable revenue increases from Fiscal 2020 to Fiscal 2021.

For this year, you can expect CP, FTS, and SSS to enjoy the 50%, 37%, and 48% growth, respectively. Altogether, Fiscal 2022 should generate approximately $159.5M in the low estimate to $171.0M in the high range.

If you look closer at the figure above, you can see that growth came from established businesses as well as the newly acquired subsidiaries. From my research on Cryoport, you can appreciate that growing by merger and acquisition (M/A) is a highly prudent and powerful approach. After all, it delivers leaping growth in revenues and earnings.

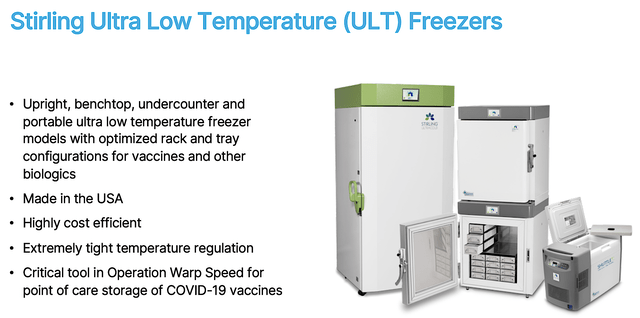

Stirling Ultra Freezer Issue

Though M/A delivers phenomenal growth, not all acquisitions would procure immediate and smooth results. After all, there are integration issues that needed to be resolved. In my opinion, nearly all companies engaging in M/A will run into integration issues. The larger the acquisition, the bigger the problems.

On that note, BioLife ran into issues with its Stirling ULT acquisition integration. That is to say, the company had $1.3M in charges related to operational issues at Stirling. And, this is related to the “supply-chain” constraint. Specifically, the demand for products is extremely strong and Stirling’s sole supplier could not keep pace with the rapid scaling of the business. As you know, COVID also put substantial pressure on the overall global supply chain. As a result, any weakness would break the chain during the height of the pandemic.

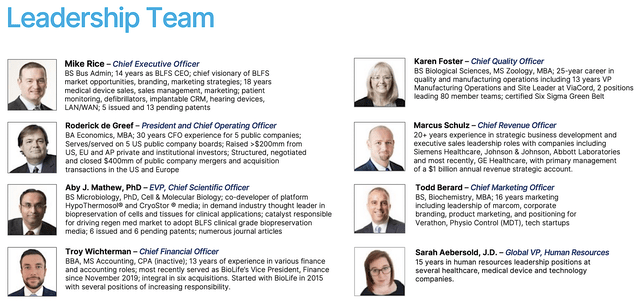

As you know, there will always be more obstacles for a company. What is most important is that the management is open about it. In this situation, the leadership is very clear in the earnings call. Just as important, BioLife Solutions already addressed issues with various solutions (no pun intended here). According to the President/COO (Rod De Greef):

We’ve largely completed the key vendor transition we spoke about on the last call, and we’ll issue that original vendor to support our dual source approach going forward. With respect to the operations organization at Stirling, we have made several key management changes to ensure that the right people are in the right positions, which was not necessarily the case. We’ve added another senior operations team member at the Athens facility and have also reorganized that supply chain team. We have consolidated the management of all critical vendor relationships company-wide, including those at Stirling under our VP of Manufacturing, who has been with the company since 2019, and who has been tasked with implementing the dual source strategy as well as leveraging larger purchasing volumes to target cost savings.

CFO Retirement

Here’s another issue that spooks investors. In September last year, BioLife stated that the former CFO (Rod De Greef) decided to go into retirement. My general rule of thumb is that a management change is very bad for the company. Whenever either a CFO or CEO leaves the company, there are usually some big issues going on behind the doors that we do not know about. As a courtesy, a company would tell you that the executive is either going into retirement or to pursue other interests. Consequently, the market sentiment sours.

When Mr. De Greef left his post and was replaced by a much younger CFO (Troy Wichteman), it was possible that he knew about the extremely complicated issues that would surface in the upcoming months (i.e., Stirling, etc.). You can see that Mr. De Greef had an illustrious career, so it would be better to let the younger guy take the hit. Wouldn’t you want to do the same thing if you were in his shoes? That being said, it’s likely that Mr. De Greef initially thought about completely abandoning this ship.

Had he had left BioLife, you’d be better off selling all your stocks. Nevertheless, Mr. De Greef is still with the company to focus on his new (and very important leadership role) as President/COO. Hence, it seems to me that the senior management is determined to right this ship.

Delayed NASDAQ Filing & Changed Accounting Firm

On March 18, another big issue emerged as BioLife published a release: it stated that the company received a NASDAQ notice regarding a late 10K (the annual report) filing. CFO Wichteman mentioned that the company would file its 10K no later than March 31. The PR also said,

The Notice also disclosed that under Nasdaq rules, the Company has 60 calendar days from receipt of the Notice, or until May 16, 2022, to submit a plan to regain compliance with the Rule. If Nasdaq accepts the Company’s plan, then Nasdaq may grant an exception of up to 180 calendar days from the due date of the Form 10-K, or until September 12, 2022, to regain compliance. However, there can be no assurance that Nasdaq will accept the Company’s plan to regain compliance or that the Company will be able to regain compliance within any extension period granted by Nasdaq. If Nasdaq does not accept the Company’s plan, then the Company will have the opportunity to appeal that decision to a Nasdaq hearings panel.

What I believed to be connected with this NASDAQ debacle is the switching of BioLife’s accounting firm from BDO (a Big Five) to Grant Thornton (a Big Six). Perhaps, there were too many acquisition integrations, so BDO fell behind schedule. As such, BioLife switched accounting firms. It’s also likely that integrating various accounts after a M/A is no simple accounting task.

Despite that albatross, BioLife already has filed their 10K. And, it seems that all overhanging issues from BioLife are resolved. You simply have to wait for the SEC to issue their decision.

Financial Assessment

Just as you would get an annual physical for your well-being, it’s important to check the financial health of your stock. For instance, your health is affected by “blood flow” as your stock’s viability is dependent on the “cash flow.” With that in mind, I’ll assess the 4Q2021 earnings report for the period that ended on December 31.

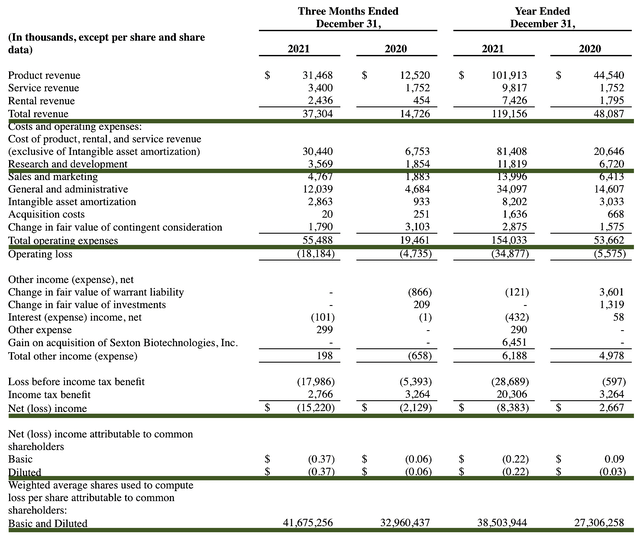

As follows, BioLife procured $37.3M in revenue compared to $14.7M for the same period a year prior. On a year-over-year (YOY) basis, the quarterly revenue grew by 153.7% which is remarkable. If you look at it from the annual standpoint, the revenue ramped up from $48.0M to $119.1M and thereby represents the staggering 148.1% growth rate. Regardless of which metrics you use, the top-line results underlying the strong organic growth as well as growing from M/A operations.

That aside, the research and development (R&D) for the respective quarters registered at $3.5M and $1.8M. I view the 94.4% R&D increase positively because the capital invested today can turn into multi-billion dollars in sales in the future. After all, you have to plant a tree to enjoy its fruits.

Additionally, there were $15.2M ($0.37 per share) net losses compared to $2.1M ($0.06 per share) decline for the same comparison. On a per-share basis, the bottom line depreciated substantially. Now, I’m not concerned here because BioLife committed substantial capital to acquire the related businesses.

About the balance sheet, there were $69.9M in cash and equivalents. Against the $55.4M quarterly OpEx, there should be adequate capital to fund operations for another quarter. On that note, it’s highly likely that the company will raise capital soon. Simply put, the cash position is weak relative to the spending. The new CFO would also need time to get used to the company and thereby raise capital.

While on the balance sheet, you should check to see if BioLife is a “serial diluter.” A company that is serially diluted will render your investment essentially worthless. Given that the shares outstanding increased from 32.9M to 41.6M, my math reveals a 26.4% annual dilution. At this rate, BioLife cleared my cut-off for a profitable investment.

Competitor Landscape

Regarding competition, there are emerging players and established companies. In my opinion, the strongest competitor is Cryoport. Between Cryoport and BioLife, these two innovators capture the most dominant market shares. Client biopharmaceutical companies also give the most business to these two firms due to their strong service and brand.

Given the lucrative profits in this emerging field, you can anticipate that more competitors will enter this niche. As Warren Buffett said it best, you can’t keep the bees out of the honey jar. Regardless of more competition, there will be plenty of space for new innovators.

Valuation Analysis

It’s important that you appraise BioLife to determine how much your shares are truly worth. Before running our figure, I liked to share with you the following:

Wall Street analysts typically employ a valuation method coined Discount Cash Flows (i.e., DCF). This valuation model follows a simple plug-and-chug approach. That aside, there are other valuation techniques such as price/sales and price/earnings. Now, there is no such thing as a right or wrong approach. The most important thing is to make sure you use the right technique for the appropriate type of stocks.

Given that developmental-stage biotech has yet to generate any revenues, I steer away from using DCF because it is most applicable for blue-chip equities. For developmental biotech, I leverage the combinations of both qualitative and quantitative variables. That is to say, I take into account the quality of the drug, comparative market analysis, chances of clinical trial success, and potential market penetration. For a medical diagnostic device, I focus on market penetration and sales. Qualitatively, I rely heavily on my intuition and forecasting experience over the decades.

|

Molecules and franchises |

Market potential and penetration |

Net earnings based on a 25% margin |

PT based on 41.6M shares outstanding and 10 P/E |

“PT of the part” after appropriate discount |

|

Cell Processing franchise (Biopreservation media & Sexton) |

$1B (estimated to procure $67.5M in Fiscal 2022 & $5B biopreservation media/equipment) | $250M | $60.09 | $54.08 (10% discount because uncertainty in market penetration) |

| Freezers & Thaw (CBS, Stirling & ThawSTAR) | $1B (estimated to procure $77.5M in Fiscal 2022 & $4B in lab freezer) | $250M | $60.09 | $54.08 (10% discount because uncertainty in market penetration) |

| Storage & Cold Chain | $500 (estimated to procure $26M in Fiscal 2022 & $5B cold chain packaging market) | $125M | $30.05 | $27.04 (10% discount because uncertainty in market penetration) |

|

The Sum of The Parts |

$135.20 |

Valuation analysis (Source: Dr. Tran BioSci)

Potential Risks

Since investment research is an imperfect science, there are always risks associated with your stock regardless of its fundamental strengths. More importantly, the risks are “growth-cycle dependent.” At this point in its life cycle, the biggest issue for BioLife is whether the company can regain its NASDAQ compliance. There might be more problems than we know due to the change in accounting firm, etc.

Moreover, the other risk is if BioLife’s various solutions for Stirling would abate the supply-chain issue. Furthermore, there is a slight concern about whether the company can maintain its growth trajectory. That aside, not all acquisitions would bear the fruit of synergy. BioLife might also grow too aggressively and thereby run into a cash flow constraint.

Conclusion

In all, I reduced my recommendation on BioLife Solutions from a strong buy to hold with a 4.4 out of five stars rating. Due to the uncertain nature of various fundamental issues, BioLife Solutions shares are trading on a steep decline. Despite the uncertainty in Stirling and NASDAQ compliance, I believe that there is a good chance that the management will right this ship. The management has been quite transparent about the problems. More importantly, they installed solutions to ameliorate the situation. As you can see, COO De Greef is the key in this equation. Given that he’s staying on board, BioLife will likely enjoy a turnaround.

Going forward, I expect the supply chain issue at Stirling to be resolved. Moreover, I anticipate that NASDAQ will confirm compliance. With the strong industry tailwind and the $14B logistics market for cell and gene therapy, BioLife would be able to organically grow its top line. Moreover, the company would also leap in growth with its acquisitions.

Be the first to comment