stevecoleimages

Pharmaceutical giant Biogen Inc. (NASDAQ:BIIB) is a stock witnessing wild price swings on several different Alzheimer drug announcements since 2021. The drama surrounding the company’s ADUHELM injection FDA approval process and whether or not it provides a true slowing (or reversal) in symptom progression, and at what cost in terms of both drug price and abnormal levels of side effects, was the medical news story of last year. With doctors, patients and even the federal government turning their backs on the drug, initial excitement and enthusiasm for Biogen’s stock faded into disappoint and disgust later in the year. The share price was cut in half from over $400 in June 2021 to under $200 by March 2022, despite a number of other promising drugs in development and solid operating profitability from a large existing count of patented pharma inventions.

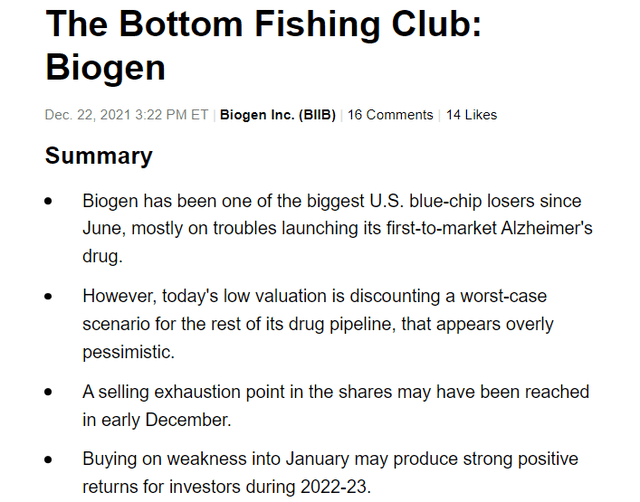

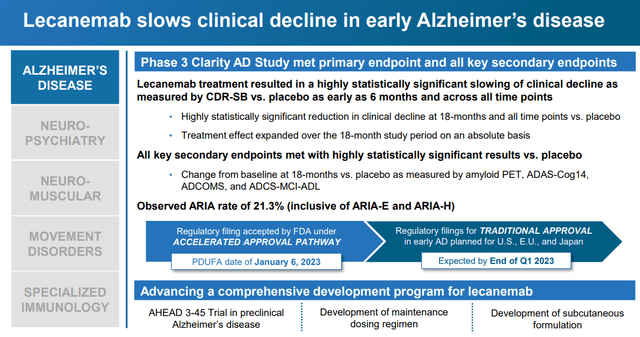

I wrote a bullish take on the company last December here, explaining Biogen’s future drug pipeline was valued at close to zero, with likely blockbuster sellers coming soon. Per usual, my Bottom Fishing Club article was panned by most readers focused on the bad news of the day. However, the late September 2022 release of positive large-scale trial results (1,800 patients) of a second Alzheimer’s drug, LECANEMAB under joint development with Japanese Eisai (OTCPK:ESALY), has rekindled interest in Biogen’s outlook.

Seeking Alpha – Paul Franke, December 22nd, 2021 Article Seeking Alpha – Paul Franke, December 22nd, 2021 Article

Purchasing Biogen on weakness after my last story (and holding for better days) is a great example of how focusing on out-of-favor blue chips can pay handsomely. BIIB has risen +21% from my December article vs. an equivalent -17% S&P 500 change, good for a +38% “outperformance” total over less than a year.

Value Pick in Search of Growth Catalysts

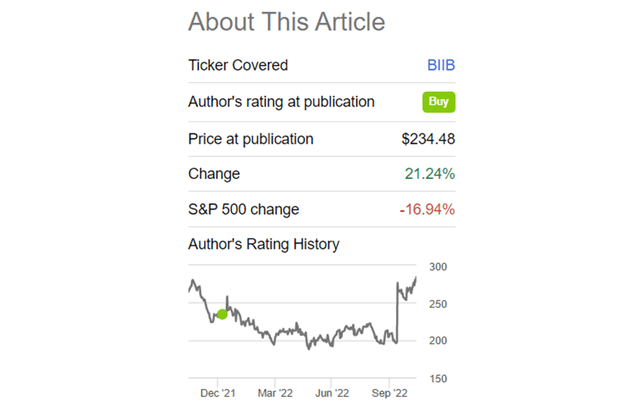

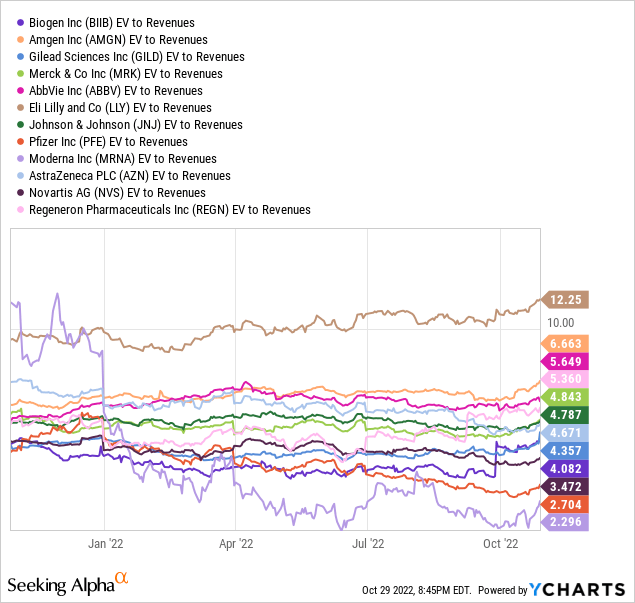

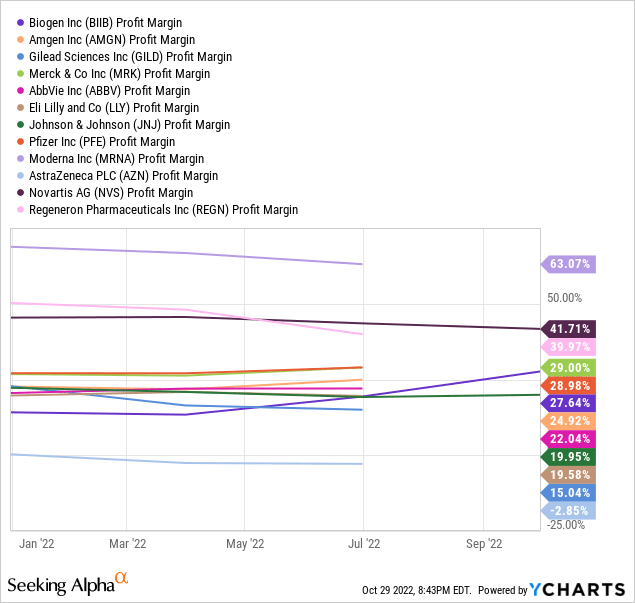

For a smart investment foundation, Biogen today is one of the cheapest Big Pharma choices on current and trailing results. On the graphs below, we can review the undervaluation setup vs. peers and competitors. Included are rivals Amgen (AMGN), Gilead Sciences (GILD), Merck (MRK), AbbVie (ABBV), Eli Lilly (LLY), Johnson & Johnson (JNJ), Pfizer (PFE), Moderna (MRNA), AstraZeneca (AZN), Novartis AG (NVS), and Regeneron (REGN).

On enterprise value (equity worth + total debt – cash holdings), Biogen’s 4x multiple on trailing sales is in the lower third of the peer group. Wall Street is showing some healthy skepticism about the company, as existing drugs are coming off patent, and new revenue sources are awaiting approval.

YCharts – Biogen EV to Trailing Revenues, Since October 2021

EV to trailing EBITDA is also quite inexpensive. The current 10x ratio is a sizable discount to the median average of 13x.

YCharts – Biogen EV to Trailing EBITDA, 5 Years

Yet, despite aggressively spending $2.5 billion annually (30% of revenue) on R&D, Biogen has still been able to report a higher-than-normal profit margin in the industry. The good news is any new blockbuster approval will spike revenues and profits dramatically.

YCharts – Big Pharma Trailing Profit Margins, 2022

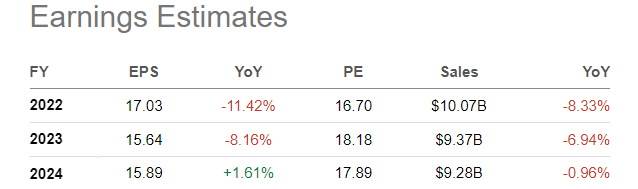

Below is a table of current Wall Street estimates for 2022-24 EPS and sales. Not particularly a standout growth projection for the near term, but also one using low expectations for new drug approvals.

Seeking Alpha – Biogen Analyst Estimates on October 28th, 2022, Years 2022-24

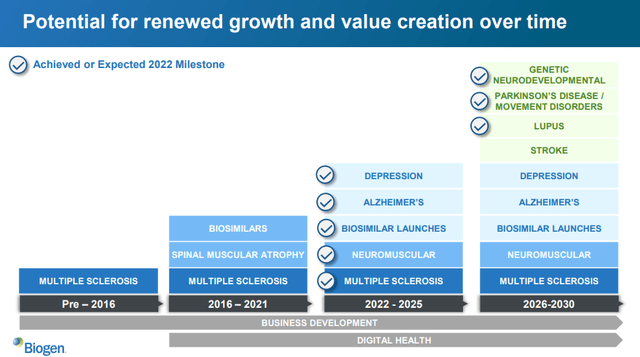

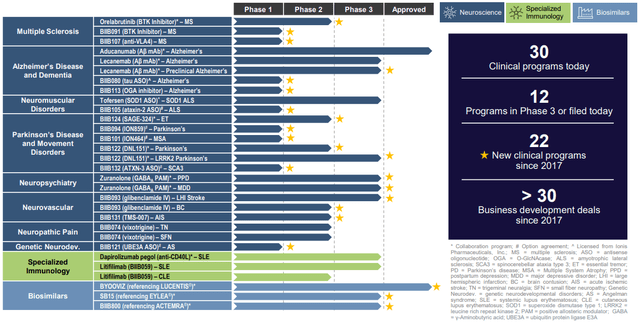

Exciting Drug Pipeline

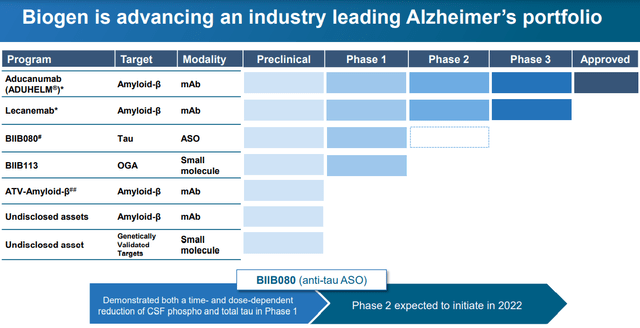

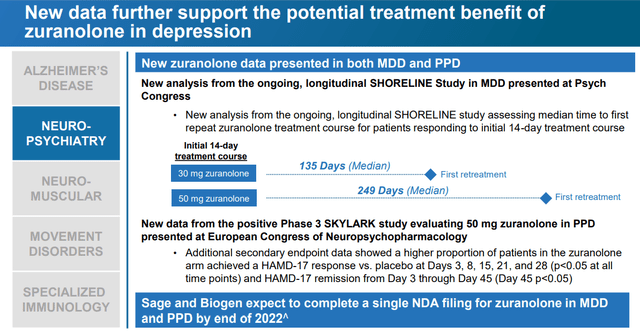

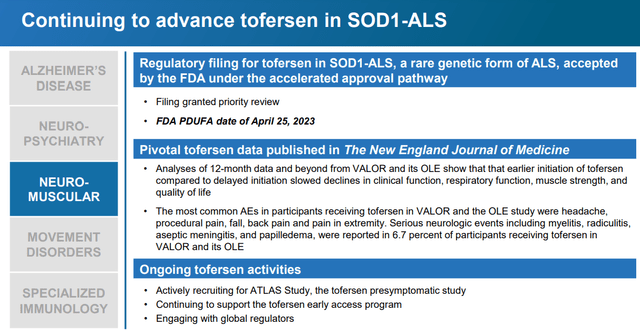

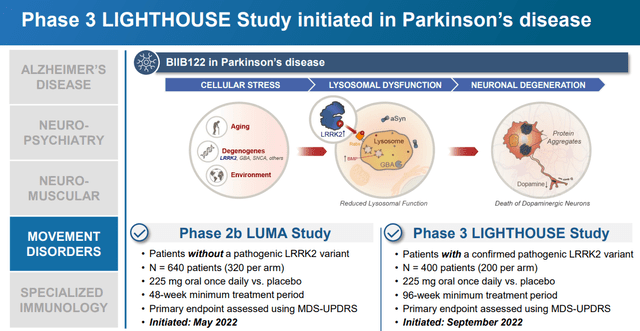

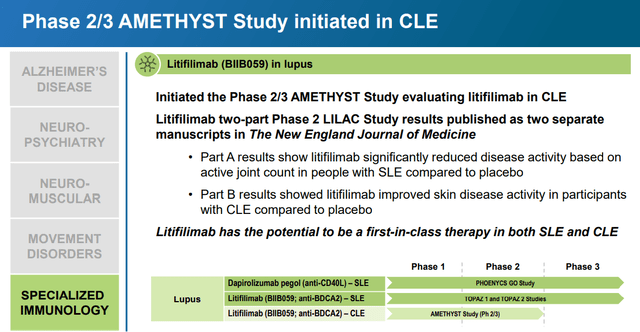

LECANEMAB is one of a number of potential drivers of future earnings and cash flow for Biogen. Below are slides out last week from its Q3 Earnings Presentation describing all the R&D efforts underway. The company is working hard to create treatments for some of the hardest to crack older-age ailments, with immense sales and income potential. Alzheimer’s, depression, Multiple Sclerosis, ALS, Parkinson’s disease, and lupus are the current focus.

Biogen Q3 Earnings Presentation Biogen Q3 Earnings Presentation Biogen Q3 Earnings Presentation Biogen Q3 Earnings Presentation Biogen Q3 Earnings Presentation Biogen Q3 Earnings Presentation Biogen Q3 Earnings Presentation Biogen Q3 Earnings Presentation

New Upside Momentum

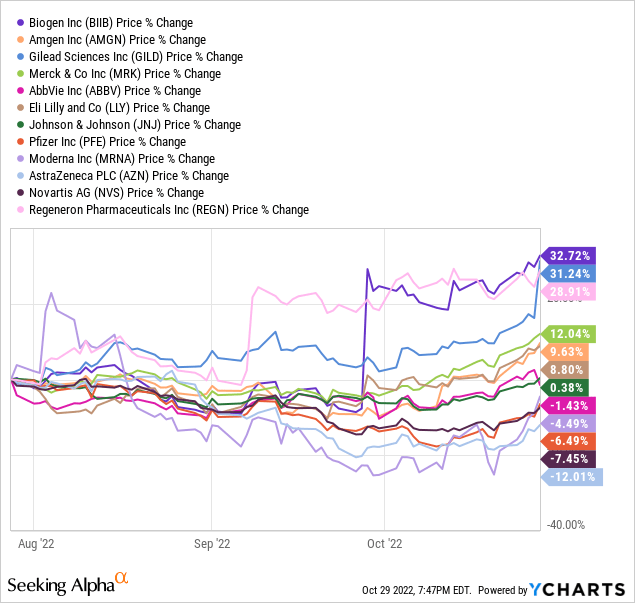

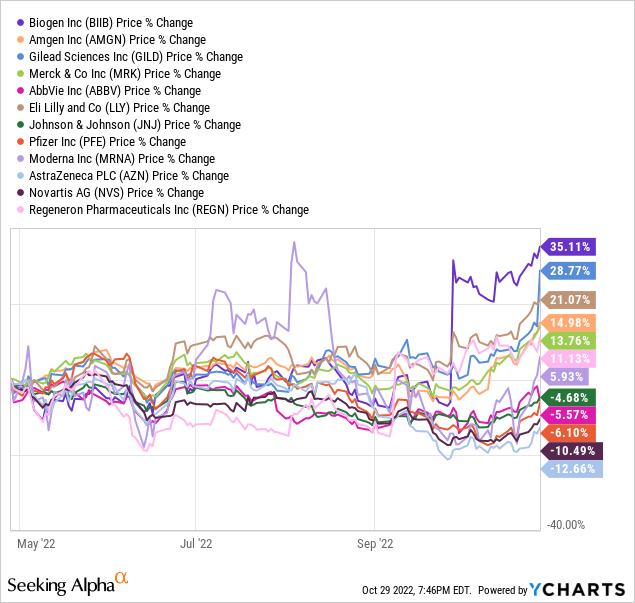

Believe it or not, Biogen now possesses one of the strongest 3-month and 6-month trading momentum scores in the U.S. blue-chip universe, especially outside of a number of oil/gas names. Part of the reason for the spike in price has come on news of the positive trial results for LECANEMAB. A secondary reason is the whole Big Pharma sector on Wall Street has been under accumulation in October because of defensive characteristics during recessions. Investors of all stripes are getting nervous about the economy’s future. Hedge funds, active mutual funds, brokerages, and trading firms are now desperately hunting for businesses that survive best during recession. [I explained the high odds of an interest-rate induced 2023 economic contraction in an article yesterday here.]

Below are 3-month and 6-month graphs of quickly improving performance gains from prescription drug giants of late. At the top of the list is Biogen.

YCharts – Big Pharma, 3 Month Price Change YCharts – Big Pharma, 6 Month Price Change

Other bullish momentum data points are drawn below. Despite a continuing bear market in the vast majority of stocks, Biogen reached a 52-week high on Friday, and is now positioned well-above both its 50-day and 200-day moving averages of price, with trends for the MAs turning higher.

Relative strength vs. the S&P 500 reversed higher all the way back in March (green arrow). The Accumulation/Distribution Line turned higher in May (blue arrow). And, On Balance Volume has been in steady advance since June (red arrow). Pulling the whole momentum picture together, I rate current trend stats as A+ vs. other equities.

StockCharts.com – Biogen, 12 Months of Daily Changes with Author Reference Points

Final Thoughts

I sold my Biogen shares recently on fears of an imminent sharp selloff in the U.S. stock market during November. My goal is to reenter a position ASAP at slightly lower prices ($260-$270), although such a scenario is far from guaranteed. If you are bullish on the U.S. equity market, buying a position in BIIB around $280 a share could prove very rewarding if new drugs are approved in 2023-24.

What’s the downside risk? I am thinking Biogen will be a market average performer or better in 2023. Some retracement in price could be the immediate future, with a 10% to 15% drawdown not out of the question ($250-$260). A stock market crash scenario could push price to refill its gap higher from $225 several weeks ago. However, I believe such a 20% decline is very unlikely, especially if Wall Street gets excited about Biogen’s new Alzheimer drug approval timeline.

Upside could be as high as $400 per share, if several years of strong EPS growth are approaching. Putting a 20x P/E on a forward $20 in annual EPS may be a conservative valuation in 12-18 months. So, risk potential is -20% vs. reward potential of +40% from $284. Nothing spectacular from this defensive asset, but even a +10% gain in 2023 could generate a nice outperformance number against a flat to lower S&P 500 return during a recession. [Note: my analysis suggests buying on weakness to $270 would positively skew the risk/reward 1-year potential into the -15% to +45% range.]

An outlier positive for investors is Biogen remains an attractive takeover target for a larger pharmaceutical firm. A unique and strong growth pipeline with a sound valuation on trailing results is not easy to find.

Thanks for reading. Please consider this article a first step in your due diligence process. Consulting with a registered and experienced investment advisor is recommended before making any trade.

Be the first to comment