peterschreiber.media

Humility must always be the portion of any man who receives acclaim earned in blood of his followers and sacrifices of his friends.”― Dwight D. Eisenhower

Today, we peek in on a small developmental concern that has had a big rally recently on the back of encouraging data from two candidates in its pipeline. However, even with the big rebound, the shares are massively in “Busted IPO” territory. A full analysis follows below.

Company Overview:

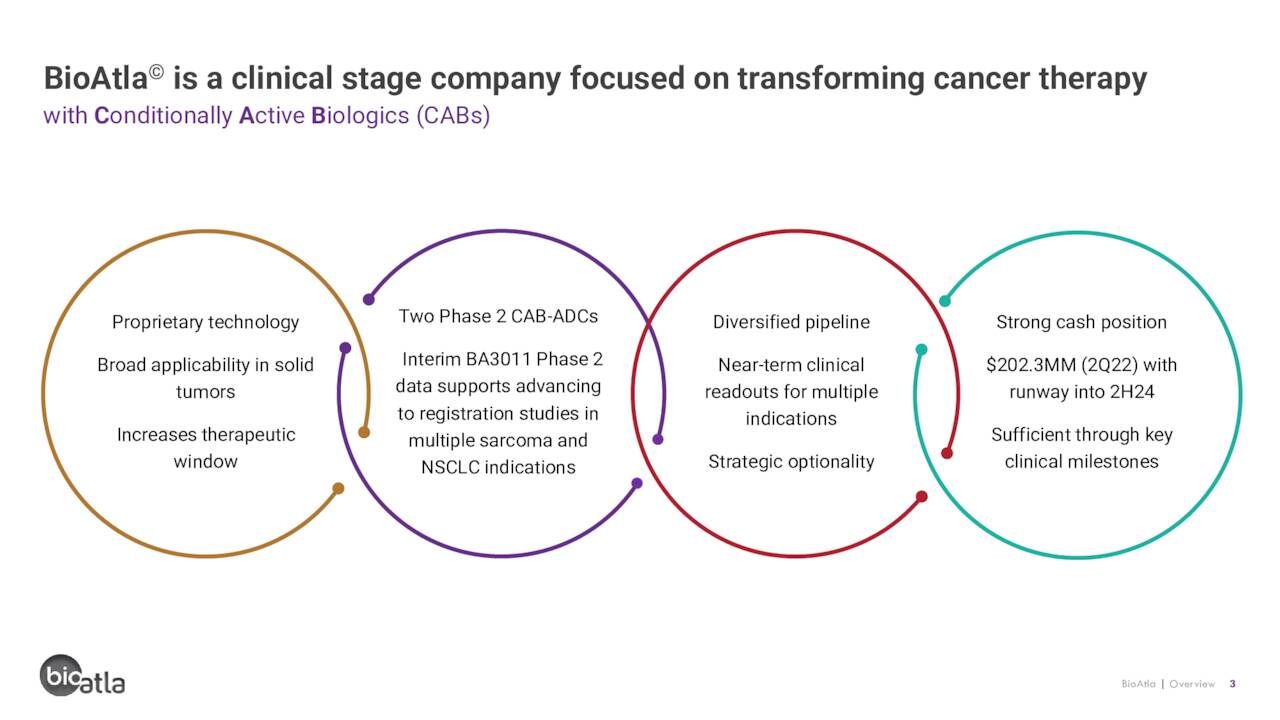

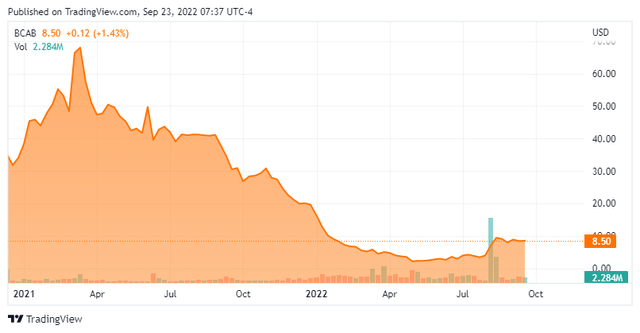

BioAtla, Inc. (NASDAQ:BCAB) is a San Diego-based clinical-stage biopharmaceutical concern focused on the development of highly specific and selective antibody-based therapeutics, known as “conditionally active biologics” (CABs), for the treatment of solid tumor cancers. The company is advancing three product candidates through clinical trials covering multiple tumor types and subtypes. BioAtla was formed in 2007 and went public in 2020, raising net proceeds of $198.4 million at $18 per share. After a 97% slow dive from $76.63 to $2.01 on May 9, 2022, shares of BCAB currently trade around $8.50 a share, translating to a market cap of $325 million.

August Company Presentation

Approach

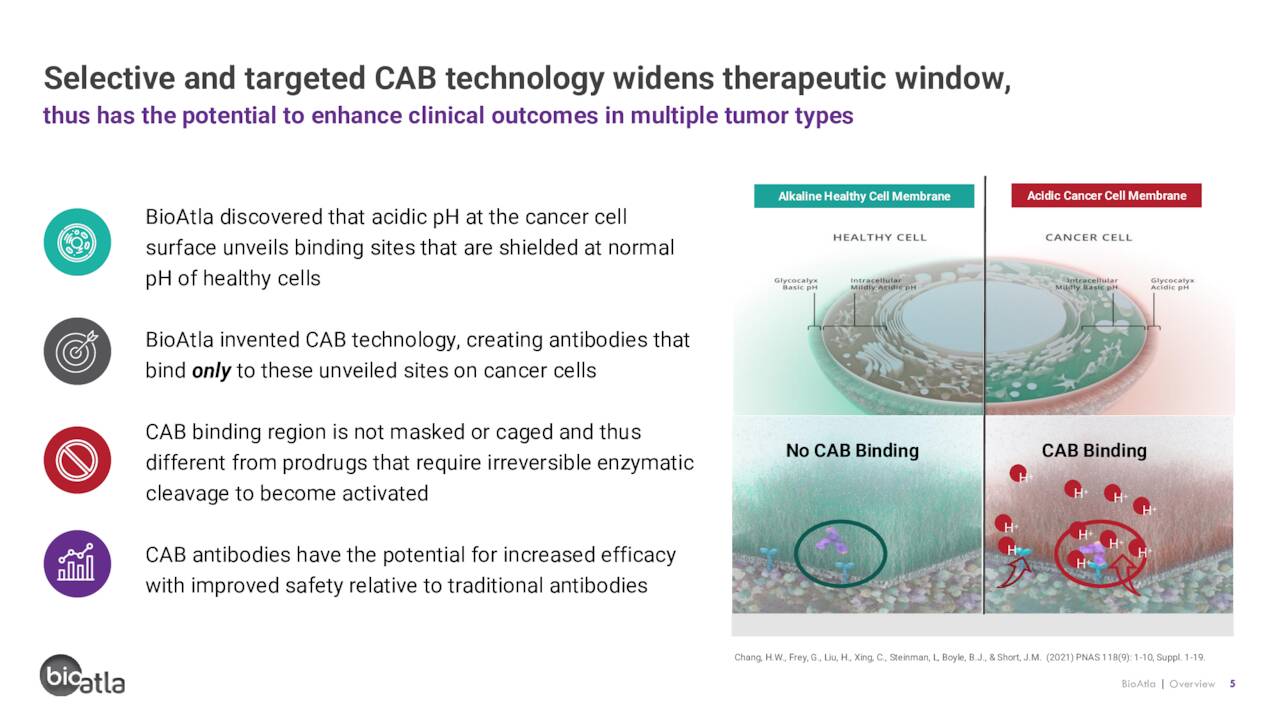

The company has a novel approach to cancer treatment, which has its roots in the tumor microenvironment [TME]. Unlike healthy cells, the TME is distinct with regards to temperature, pressure, chemical composition, and pH level. Specifically, the TME is acidic – i.e., it has a pH below 7.0 and in the case of some cancers as low as 5.8 – whereas healthy cells are near 7.4. This difference is due to tumor cells employing non-oxygen glycolysis (even in the presence of oxygen) to generate energy, which produces lactic acid in the TME. By contrast, healthy cells use oxidative phosphorylation to generate energy.

BioAtla designs antibodies that only bind to targets on cancer cells under acidic conditions. As such, the activity of its CABs is reversible, meaning they don’t bind to healthy cells when outside the TME, eliminating (in theory) the chance for off-target toxicity while increasing the half-life of the active ingredient in its therapies. It also means that a more potent dosage can be administered with a reduced chance of adverse events. Furthermore, the company’s potentially disruptive technology can be applied to generate any antibody-based biologic, including monoclonal, bispecific, antibody-drug conjugates [ADCS], and chimeric antigen receptor T cells.

August Company Presentation

As an aside, in the mid-2000s Dr. Tulio Simoncini, an oncologist from Rome, pioneered sodium bicarbonate therapy as a means to treat cancer and attained excellent success. Although Simoncini’s treatment approach is steeped in his theory that tumors spread due to the presence of fungi, its demonstrated effectiveness is most likely due to the fact that fungi thrive in acidic conditions and sodium bicarbonate neutralizes the TME with its alkaline pH of 8.4.

Pipeline

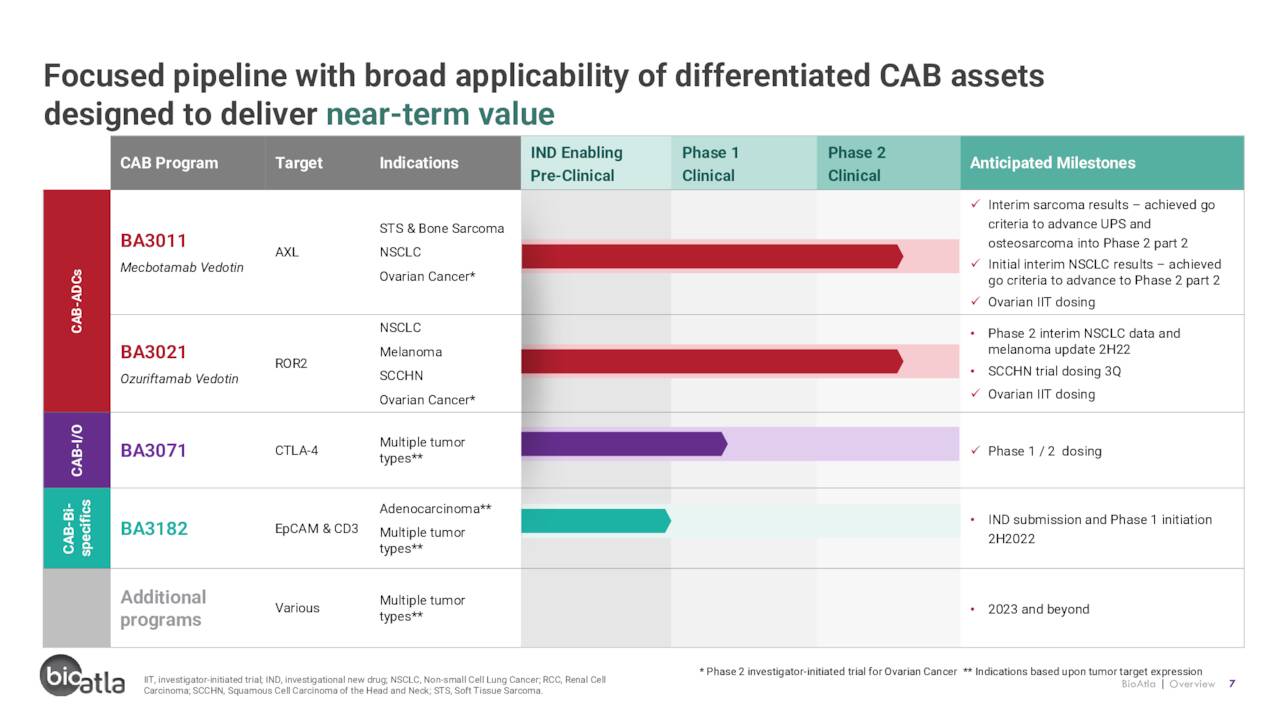

Armed with this novel approach, BioAtla has three CAB candidates in the clinic under evaluation in five trials for multiple solid tumor indications.

August Company Presentation

BA3011 (mecbotamab vedotin). The company’s lead candidate is BA3011, a CAB-ADC that targets AXL, a protein kinase receptor highly expressed on the surface of many tumors, including soft tissue and bone sarcomas, as well as non-small cell lung cancer (NSCLC). AXL is also a driver of many cellular processes that proliferate tumors. ADCs are modified antibodies with (normally) chemotherapy agents attached to them to enable a more targeted chemo treatment of a tumor. In the case of BA3011, that agent is monomethyl auristatin E (MMAE). Once BA3011 has reversibly attached to AXL, it enters the cancer cell, at which point MMAE is released, killing the cancer cell.

In a Phase 1 study, BA3011 demonstrated some promise as four of seven sarcoma patients with an AXL Tumor membrane Percent Score [TMPS] >70% achieved a partial response (PR). Furthermore, only two of the 26 patients (8%) in the study discontinued therapy due to an adverse event, comparing favorably to non-CAB ADC trials.

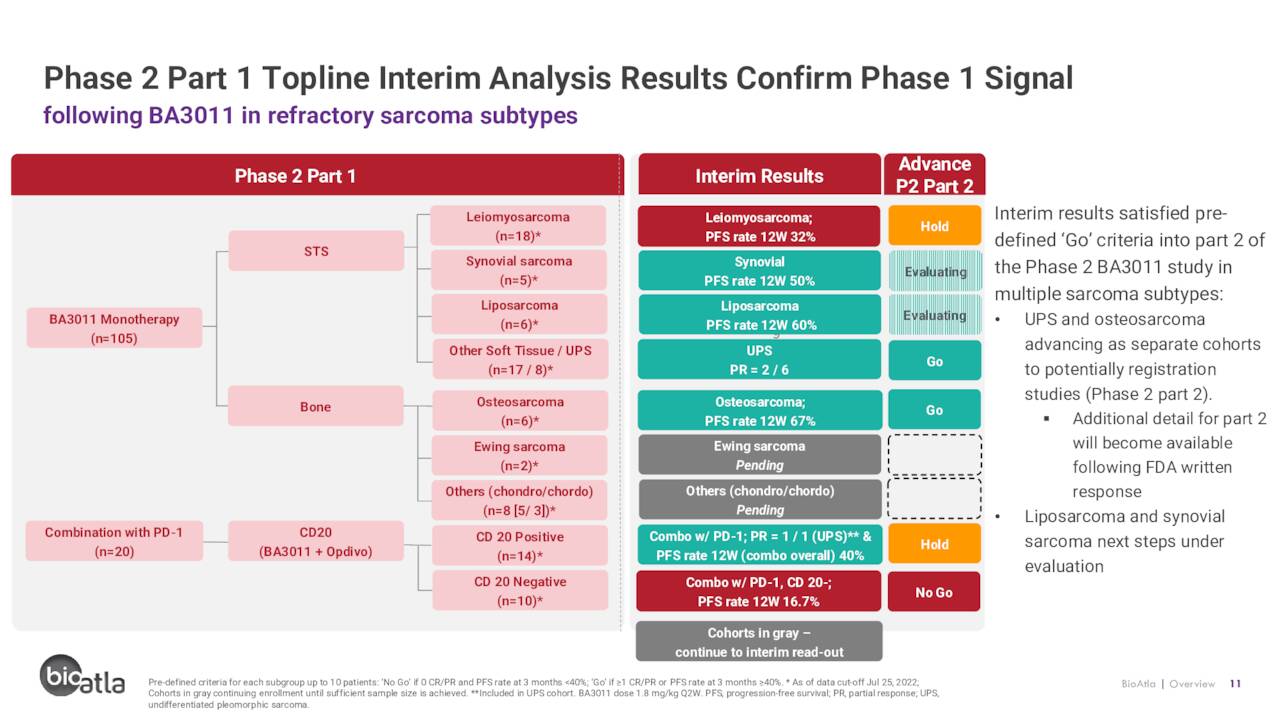

Off of these results, BioAtla initiated potentially registration-enabling Phase 2 trials for BA3011 in treatment-refractory sarcoma with AXL TmPS >70% and treatment-refractory NSCLC with AXL TmPS >50%. Part 1 of the sarcoma study involves evaluation of BA3011 as both a monotherapy (n=105) and in combination with a PD-1 inhibitor (n=20) across at least nine soft tissue and bone sarcoma subtypes with interim data dictating which indications will be targeted in the potentially registrational Part 2 phase. To date, the sarcoma data are somewhat underwhelming with two PRs obtained from six undifferentiated pleomorphic sarcoma [UPS] patients and twelve-week progression free survival [PFS] demonstrated in four of six osteosarcoma patients – both as a monotherapy.

August Company Presentation

When first presented in May 2022, these were the only two subtypes that had so far satisfied the Part 2 ‘go’ criteria – i.e., at least one PR or complete response [CR] per subtype or a PFS rate of 40% at three months – for further evaluation in greater patient populations. Part 2 enrollments for both subtypes are expected to initiate in 4Q22. If approved, there are ~6,000 AXL positive UPS and osteosarcoma patients (in sum) annually in the U.S. and over 12,000 globally, amounting to a commercial opportunity of $1 billion. With the corporate update on August 9, 2022, management indicated that BA3011 had also now achieved ‘go’ criteria for liposarcoma and synovial sarcoma, with PFSs of 60% and 50%, respectively.

It should be noted that only 2 of 71 patients (3%) had discontinued the study due to adverse events (both Grade 2 neuropathy) as of May 16, 2022.

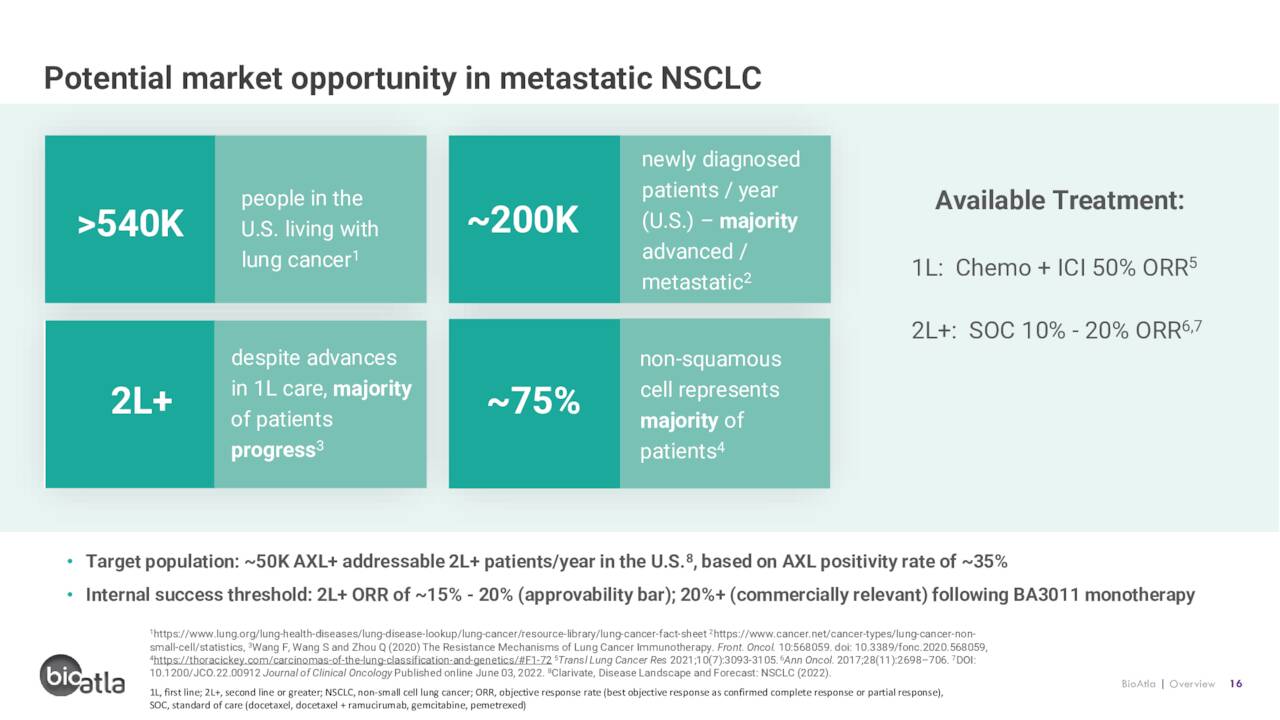

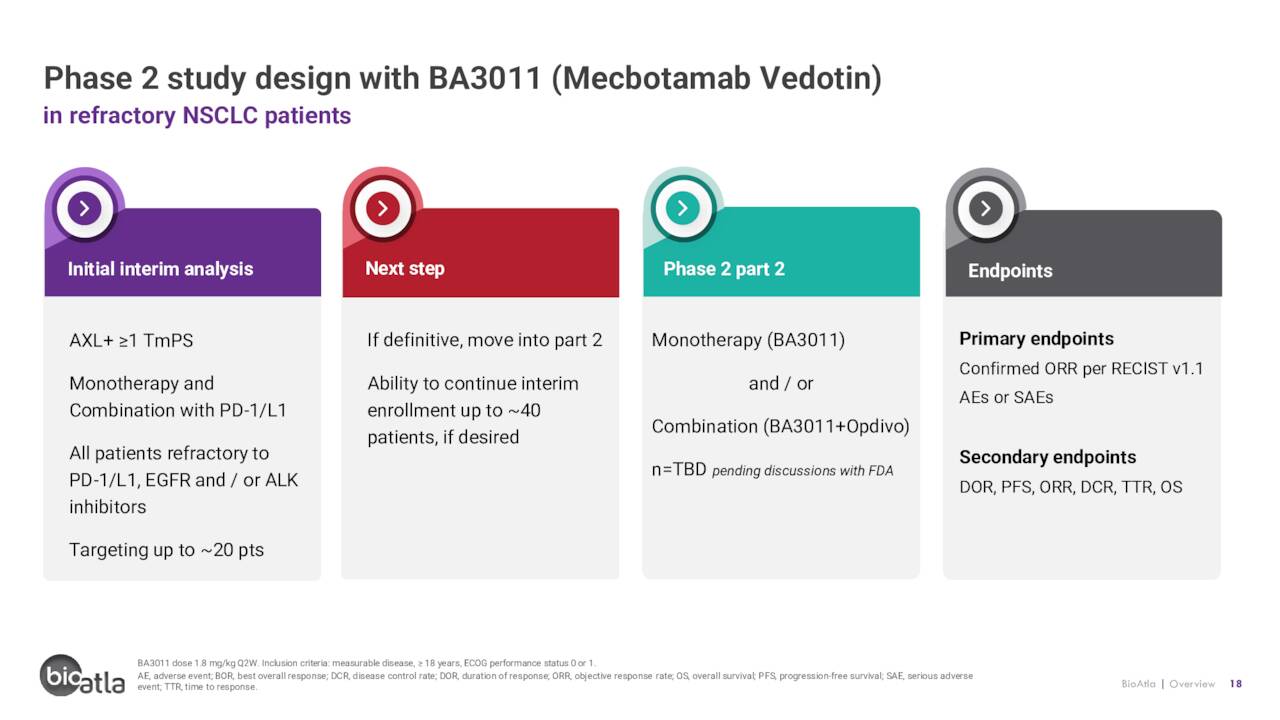

For the NSCLC indication, after a partial response was achieved by the one high-AXL patient in a Phase 1 study – a patient who had failed multiple chemo treatments and Merck’s (MRK) Keytruda therapy – BA3011 was entered into a two-part Phase 2 trial. That study is evaluating it as both a monotherapy and in combination with Bristol Myers Squibb’s (BMY) PD-1/L1 blockbuster Opdivo in the treatment of AXL-positive patients who had previously failed PD-1/L1, EGFR, or ALK inhibitor therapy. The initial data from the seven evaluable patients in the non-squamous group were encouraging, with two PRs achieved as a monotherapy (overall response rate (ORR) of 50%) and one complete response [CR] observed in combination (ORR 33%). Consistent with the sarcoma data, BA3011 was well tolerated both as a monotherapy and in combination. A full interim data set of ~20 patients is expected before YE22, but the early returns are supportive of moving into the potentially registrational Part 2 phase.

August Company Presentation

If eventually approved, management estimates a target market of 40.000 to 50,000 AXL-positive NSCLC patients annually in the U.S. and 100,000 worldwide, representing a global opportunity of $2.5 billion to $3.0 billion.

BA3021 (ozuriftamab vedotin). BioAtla’s second clinical asset is BA3021, a BAC-ADC targeting receptor tyrosine kinase like orphan receptor 2 (ROR2), which is overexpressed in many solid tumors and observed to be further enhanced upon treatment with PD-1 inhibitors. After four of five ROR2+ and PD-1-refractory solid tumor patients achieved at least PRs (one CR) in a Phase 1 study, BA3021 entered Phase 2 trials for NSCLC, melanoma, and squamous cell carcinoma of the head and neck (SCCHN). A preliminary interim update in NSCLC is anticipated in 2H22 while the melanoma study enrollment is ongoing. It should be noted that one patient in the Phase 2 melanoma study has achieved a CR, bringing the total (if Phase 1 is added in) to two out of two CRs for this indication. The first SCCHN patient is expected to be dosed in 3Q22. There are no other ROR2 inhibitors either approved or in the clinic, providing BioAtla first-in class potential with BA3021.

August Company Presentation

Also, both BA3011 and BA3021 is undergoing evaluation in combination with PD-1 inhibitors in investigator-initiated Phase 2 trials for patients with platinum-resistant ovarian cancer. A first patient was dosed in May 2022 with enrollment for each candidate expected to reach 20 patients.

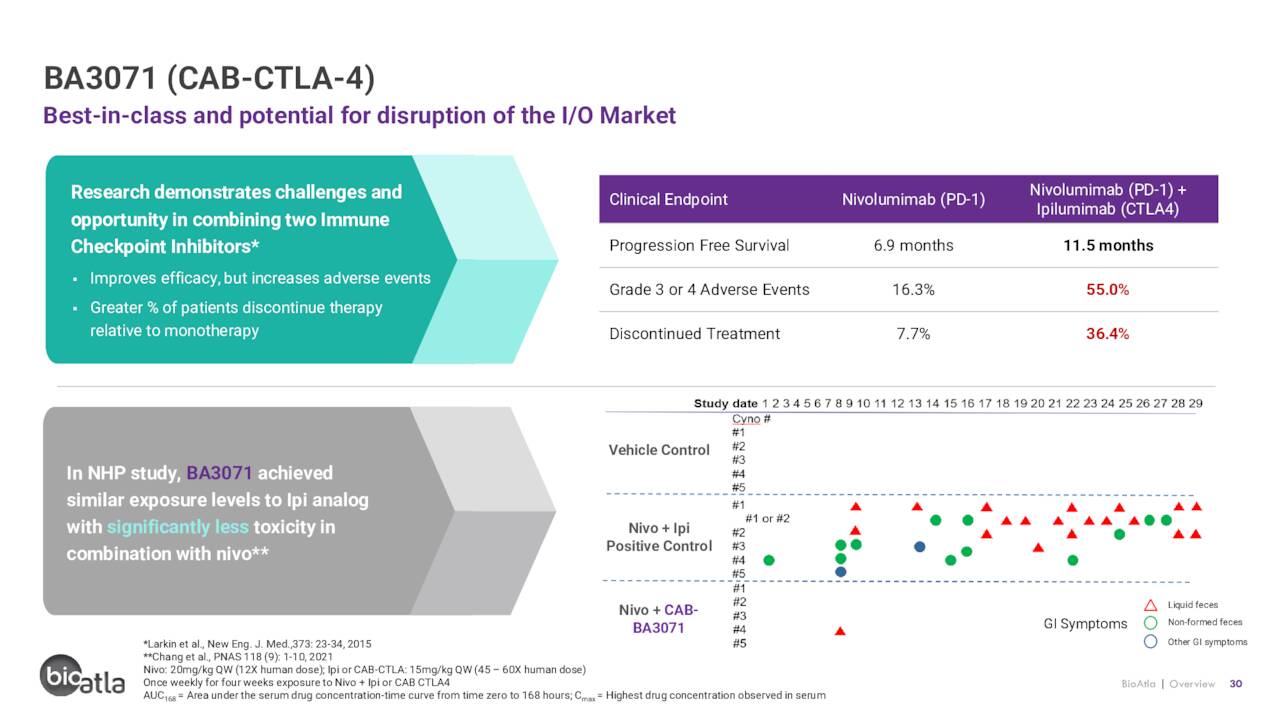

BA3071. BioAtla’s third CAB is BA3071, which targets protein receptor cytotoxic T-lymphocyte-associated antigen 4 (CTLA-4). The goal of this program is to develop an immuno-oncology agent that is as effective as Bristol Myers’ Yervoy (ipilimumab) but with significantly reduced toxicity. Yervoy is the only anti-CTLA-4 monoclonal antibody approved by the FDA, primarily in combination with its fellow Bristol cancer drug Opdivo (nivolumab) in the treatment of many solid tumor cancers (and as a monotherapy for melanoma). However, it’s riddled with adverse event issues, leaving an opportunity for BioAtla. BA3071 just entered the clinic in a Phase 1/2 dose-escalation study across multiple solid tumor types.

August Company Presentation

BA3182. BioAtla also anticipates filing and IND for a CAB bispecific antibody targeting EpCAM and CD3 in 4Q22.

Balance Sheet & Analyst Commentary:

For these clinical endeavors, the company held cash and equivalents of $202.3 million and no debt as of June 30, 2022, providing it a runway to 2H24.

Since BioAtla’s IPO, six Street analysts have proffered commentary, with one outperform and four buy ratings outpacing one hold recommendation. However, the 2022 commentary has been less sanguine with Credit Suisse analyst Tiago Fauth downgrading shares of BCAB from an outperform to a hold after the underwhelming BA3011 sarcoma data in May 2022. Of further note, he slashed his price objective from $35 to $5. Furthermore, HC Wainwright lowered its price target from $25 to $20 on August 10, 2022, one day after BioAtla’s most recent corporate update.

That said, Co-Founder and CEO Dr. Jay Short purchased 26,350 shares of BCAB at $7.84 on August 12, 2022. Another director added just over $25,000 to his holdings last week.

Verdict:

After racing to $76.63 a share in March 2021, BioAtla’s stock began a death march to $2.01 by May 2022, with almost all of the decline (to $4.08) accompanied by small volume and little market moving news. The uninspiring BA3011 sarcoma data on May 4, 2022 triggered a one-day 41% decline (to $2.40 a share) in the subsequent trading session, but in comparison to the gradual 95% value destruction that preceded this news, the move seemed trite. By contrast, the BA3011 NSCLC update on August 9, 2022 sparked an 83% rally in the subsequent trading session and shares of BCAB have retained most of that rise.

This volatility points out the promise and the lack of large data sets from BioAtla. With NSCLC interim data for both BA3011 and BA3021, as well as a melanoma interim update for BA3021 due in 2H22, the data sets will get more robust. The underrated aspect of the company is the fact that its technology can be applied to any antibody-based biologic, opening up significant market opportunities. And it is for this reason that BioAtla is worthy of a small watch item position or a “speculative buy” as another article on Seeking Alpha also concluded last month.

It’s a kind of arrogance to be so certain you’re past redemption.”― Ellis Peters

Be the first to comment