unoL/iStock via Getty Images

Bio-Rad Laboratories Inc. (NYSE:BIO) (NYSE:BIO.B) has benefited from pandemic spending, having generated $580MM in COVID-related sales in 2020-2021, more than offsetting the impact on their other products. The company is forecasting only $70MM in COVID generated revenue for 2022 and the shares are 32% off of their 52-week high. Investors using stock screeners to identify market opportunities may be missing out on Bio-Rad because their return on invested capital is reported on many websites as being < 3%, which doesn’t accurately reflect the underlying business. The discrepancy is the result of an equity investment the company made two decade ago.

Sartorius Holdings Skewing Numbers

Bio-Rad purchased a 23% stake in Sartorius AG (OTC:SUVPF) (OTCPK:SARTF) over the course of 2003 and 2004 for $21.4MM and Bio-Rad now owns 33% of the company, valued at just under $10B. That valuation is down from over $13B at the end of 2021 as Sartorius shares have declined by over 24%. Bio-Rad’s balance sheet at the end of 2021 showed $14.39B in other investment assets and $17.8B in total assets, meaning the Sartorius position is by far their largest asset. Sartorius is calling for robust 14-18% revenue growth in 2022, so its importance to Bio-Rad will continue to grow. The Sartorius stake is so large that Bio-Rad listed the potential of being deemed an investment company as a risk in their 10-K.

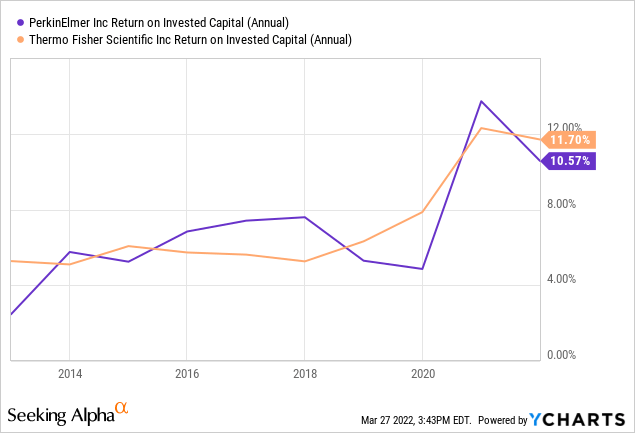

Many data sources are including the Sartorius equity stake when calculating return on capital calculation and using Bio-Rad’s $489.4MM operating income and 21.9% tax rate, resulting in a ROIC of ~2.7%. If one were to add $115MM worth of look-through earnings from the Sartorius stake, the ROIC would increase to a still rather underwhelming 3.4%. However, take out the Sartorius impact on equity and income and you arrive at ~ 11% ROIC, a respectable return for a life science company.

For example, Thermo Fisher Scientific (TMO) and PerkinElmer (PKI) had ROIC of 11.7% and 10.6% last year. It should be noted that returns on capital in the diagnostic space have been elevated the last two years due to revenue from pandemic-related products and will likely moderate in the coming years.

It is hard to say how Bio-Rad’s relationship with Sartorius will evolve over time. The company had a deferred tax liability of $3.16B at the end of 2021 that is largely the result of gains on the Sartorius investment, so the loss of capital due to taxes would be significant. Sartorius is a family controlled business, as is Bio-Rad, so a merger would depend as much on family dynamics as economic considerations. Bio-Rad co-founder Alice Schwartz still serves on the board of directors at 95, so the family obviously remains personally invested in the business.

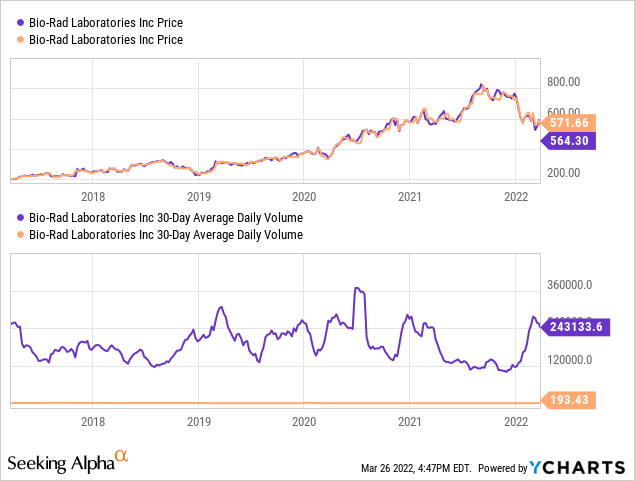

Two Classes of Shares

Bio-Rad Chairman and CEO Norman Schwartz is the son of the company’s founders, and the family owns a controlling stake in the company through the B shares. Class A shares receiving one-tenth of a vote while the class B shares receive one vote per share, but they have an equal equity claim. The A shares have a 10-day average volume of 190,000, while there are many days that no B shares trade hands. The B shares currently trade at a slight premium and they have historically traded in a narrow band relative to the A shares. The B shares can be converted to A shares on demand, so the low liquidity is not a major concern for long-term investors.

We might expect the management team to make decisions that are in the best interest of the company in the long-term given that the founding family is firmly in control. A closer look at the company’s capital allocation history will give us a better idea if those long-term views are actually paying off.

Capital Allocation

The company recently provided a €400 loan to Sartorius-Herbst Beteiligungen II, payable by January 31, 2029. The money will be used to buy out the interest of a beneficiary of the Sartorius family trust. Bio-Rad will receive annual interest payments of 1.5% along with value appreciation rights on the underlying securities that are being purchased with the loan. While the funding will help to deepen ties with the Sartorius family, it doesn’t otherwise make sense given that Bio-Rad’s most recent debt issuance yields an average of 3.57%.

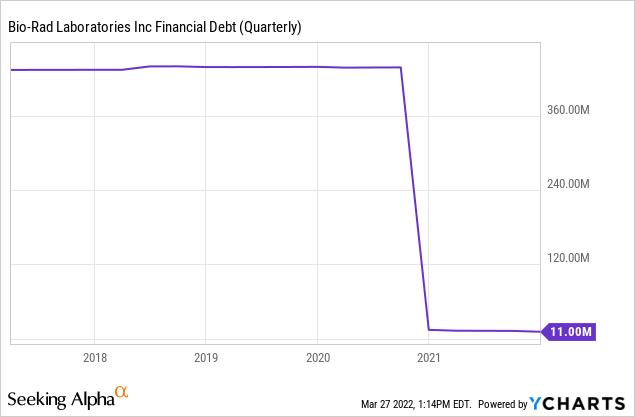

Debt Management

The company had reduced their outstanding debt by $211.6MM since the beginning of 2018 before they issued $1.2B in bonds at the end of February. The company stated in the registration that the money would be used for general corporate purposes; the company called out investment in organic growth and acquisitions as being a priority in their investor relations presentation. Given that the company has only spent $318MM on property, plant, and equipment in the last three years and the company only carries $491MM of PP&E on the balance sheet, it would be a pretty good bet that a large chunk of the funds will be used to make one or more acquisitions.

M&A

The company spent $125.5MM to acquire Dropworks in October of last year. Dropworks is developing a digital PCR product that they hope will reduce the cost and complexity of running quantitative PCR tests. The purchase is well aligned with Bio-Rad’s existing products and came after Bio-Rad settled a patent infringement lawsuit against Dropworks, so there should be very few surprises in the integration process.

The company purchased Celsee, a maker of single cell analysis tools, in April of 2020 for $99.3MM. Celsee had negligible revenues prior to the purchase and it is not broken out from the rest of the life science business, so investors will likely have to wait until next year to see how much Bio-Rad pays for an earnout clause in the purchase agreement. Former Celsee shareholders can earn up to $60MM in contingency payments, depending on how well the product line sells between the start of 2021 and the end of 2022.

Although Fluidigm (FLDM) is currently at a crossroads with a private equity funding offer up for vote, it would be a nice complement to Celsee and the other single cell products that Bio-Rad is developing. However, Fluidigm has many issues that I have previously covered, and Bio-Rad may want to find a simpler acquisition target.

Organic Growth

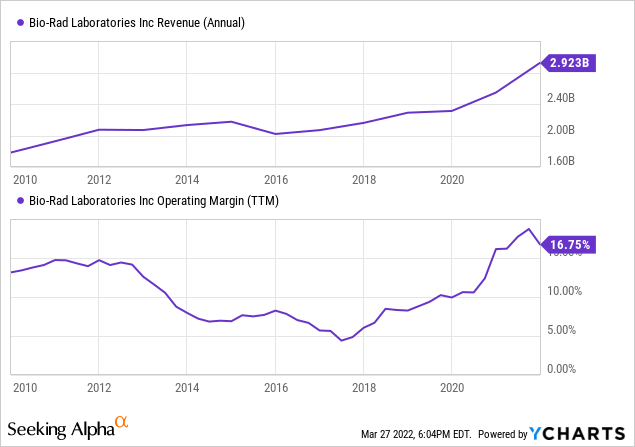

In terms of organic growth, revenues grew at a CAGR of 2% from 2010 to 2019, before the pandemic-driven growth hit. Growth was picking up before the pandemic, with 3.8% CAGR from 2016 to 2019, at the middle of their 2017-2020 goal of 3-5% CAGR. Operating margins were essentially flat prior to the pandemic as well; however, the company was able to generate 8.2% CAGR in operating cash flow between 2010 and 2019.

The company recently laid out financial targets for 2025 at their 2022 investor day. Bio-Rad is targeting 9% CAGR of core revenue and an adjusted EBITDA margin of 28%, up from an adjusted EBITDA margin of 24.1% in 2021. The company is forecasting revenue growth of 1% to 2% in 2022 and operating margins declining to ~19% from 19.8%, implying earning will be essentially flat. Raw materials shortages, logistics, and aggressive bidding on multi-year contracts by competitors are the primary drivers of the margin compression. The pressures will be somewhat offset by shifting manufacturing from Europe to Asia and the elimination of some positions.

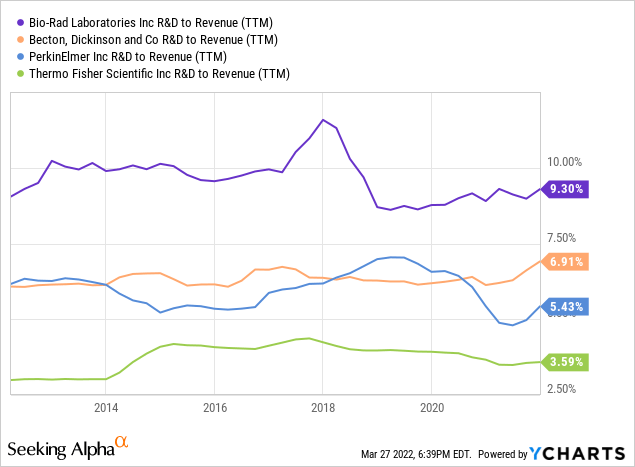

Bio-Rad’s R&D spend as a percentage of revenue has historically been significantly higher than competitors and they spent $271.1MM on R&D last year. The modest growth coupled with high R&D spend implies either a narrow moat business that has to spend to maintain the status quo or an inefficient R&D organization. Bio-Rad may try to sell off some of their less attractive businesses, like they did with their informatics group in 2020, in order to improve R&D efficiencies.

Dividends & Stock Repurchase

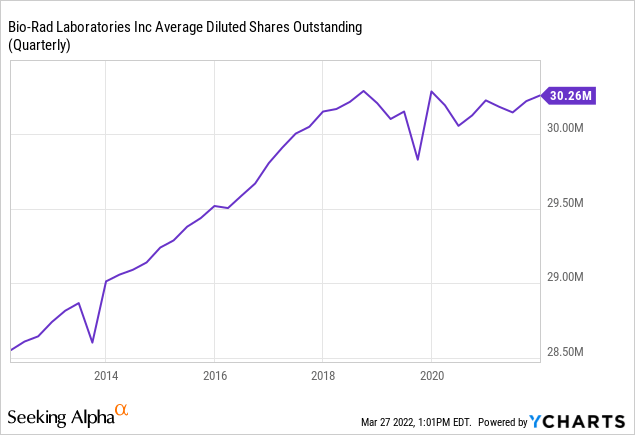

Bio-Rad does not pay a dividend and they have no plans to initiate one (10-K, page 24). The company had $223.1MM remaining to spend on a share purchase plan as of December 31, 2021. Bio-Rad has authorized $450MM in total share repurchases since November 2017. The repurchase plan has kept the outstanding share count flat over the last five years, which is somewhat disappointing given that the expenditures have accounted for almost 15% of the $1.53B of free cash flow the company has generated since the beginning of 2018. The company spent $100MM under the repurchase program in March of 2020 at an average share price of $342.55, near the low for the year, so at least they didn’t make the mistake many companies do by stopping purchases when the market corrects.

Overall, Bio-Rad appears to do a decent job of allocating capital and I would be willing to put money into it at the right price.

Valuation

Bio-Rad had a market cap of $16.9B as of the market close on March 25. The company’s position in Sartorius is currently valued at ~$10B, meaning the core business is being valued at $6.9B. That equates to a valuation of 11x 2021 operating cash flow and 14x free cash flow on the core business after accounting for the Sartorius dividend. Alternatively, if we add Bio-Rad’s portion of Sartorius’ cash flows, then shares are trading at 21x 2021 operating cash flow and 25x 2021 free cash flow.

Summary

Bio-Rad is facing a wind-down of COVID revenues, but the company anticipates the shortfall will be made up by growth in the core business. Bio-Rad shares offer investors the opportunity to buy into Sartorius’s growth story at a lower price, as Bio-Rad’s core business appears to be undervalued relative to peers. I will be keeping my eye on the shares and may initiate a position once I have done a more thorough evaluation of Sartorius.

Be the first to comment