Astrid Stawiarz

One of the best-performing asset classes this year has been farmland. Here is what the biggest farmland REIT, Farmland Partners (FPI), noted on their recent conference call:

Land appreciation has been extremely strong over the past 9 months and was even stronger in 2021. We think, in 2023, the rate of appreciation may slow but it will continue to be a strong year for farmland values.

Nationwide, farm real estate values went up 12.4% in the last year, 20.3% in the last 2 years. So these are — just a couple of reminders, these stats are really for all types of farm real estate so all quality tiers. And our anecdotal evidence that we see in the marketplace is that perhaps the upper tiers of farmland values and quality are actually appreciating even at that faster than that.

Talk about a safe haven!

Farmland Partners

Farmland is up 12.4% over the past year, and that’s just the average, which includes the bad, the average, and the good farmland. The highest quality farmland is actually up closer to 15-20% over the past year.

That’s very impressive when you consider all the uncertainty that we are dealing with:

- Inflation is high

- Interest rates are surging

- We are nearing a recession

- The pandemic still isn’t over

- And we are close to a third world war

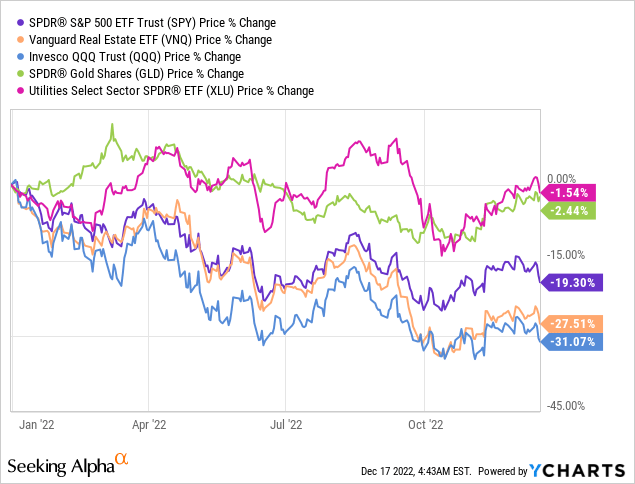

And it is even more impressive when you compare this performance to that of the rest of the market. The S&P500 (SPY) is down 20%… REITs (VNQ) are down 27%… Tech stocks (QQQ) are down 31%… And not even the traditional safe havens like Gold (GLD) or Utilities (XLU) were able to provide any meaningful real return:

So farmland investors are looking pretty good right now. They have outperformed the S&P500 by 30-40% in 2022 alone.

This has led me to wonder:

Who are some of the biggest farmland investors?

What’s their thesis for investing in farmland?

And finally, how can I also gain some exposure?

I was surprised to learn that a lot of the world’s richest and most successful investors hold significant investments in farmland. This includes Warren Buffett, Bill Gates, and even Michael Burry of “the big short” movie.

After making a fortune shorting the housing market in 2008, Michael Burry explained in an interview that the little investing that he does today is mainly focused on farmland, which represents a large portion of his net worth.

Bill Gates, the co-founder of Microsoft (MSFT), has also made some significant investments in farmland in recent years and even became the largest private owner of farmland in the US.

And then, of course, there is also Warren Buffett, founder of Berkshire Hathaway (BRK.B) and arguably the best investor of all time, who has repeatedly touted the benefits of farmland investing, and often used it as an example of a great investment when comparing it to things like gold and Bitcoin (BTC-USD).

But why are they buying farmland even as most of the rest of the world remains under-allocated to it?

I think that there are 3 main reasons to invest in farmland today:

Reason #1: Insurance Against Black Swans

We live in a very uncertain world right now and there is nothing better than farmland to protect you from black swans.

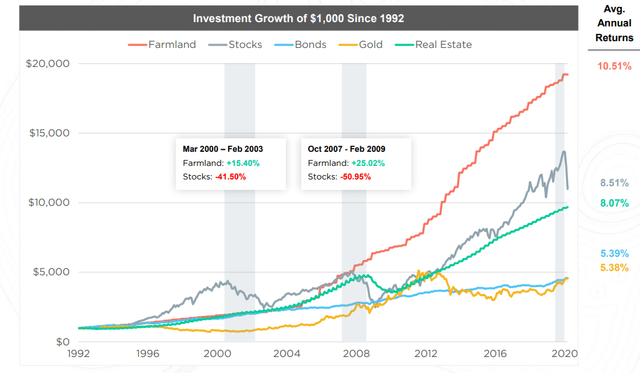

Farmland values remained stable even despite the dot-com crash of 2000, the great financial crisis of 2008, the pandemic in 2020, and the crash of 2022:

FarmTogether

Farmland is so incredibly resilient because of a simple reason: people need to eat. It provides the most vital of commodities: food. Whether the economy is booming or collapsing, people need to eat. Moreover, the population is growing rapidly, particularly in Africa, and the world is expected to hit nearly 10 billion people by 2050. Meanwhile, the supply of farmland is slowly declining due to better-use conversions and global warming in some cases.

Naturally, this causes the value of farmland to rise, even despite occasional crises.

In some cases, crises may even benefit farmland. As an example, Russia’s invasion of Ukraine increased the value of farmland in the US because suddenly, the supply of vital commodities was heavily disrupted and US farmland became even more important to feed the rest of the world.

Reason #2: Inflation Protection

Farmland is not just an insurance against black swans, it is also a great hedge against inflation, which is particularly important today.

We can print more money, but we cannot print more farmland or replace it with anything else. Farmland is a particularly good inflation hedge because food prices quickly adjust to higher inflation and it then results in higher profits for farmers and higher rents/property values for land owners.

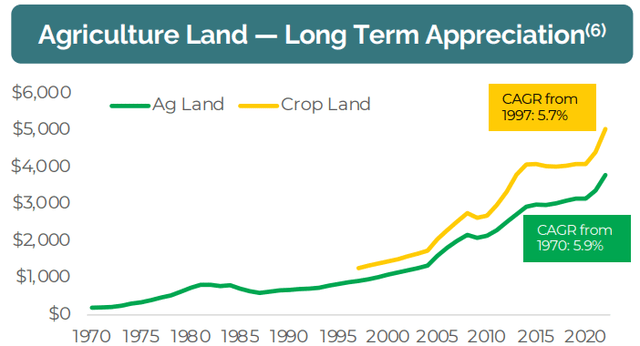

Farmland Partners is currently hiking its rents by 15% across its entire portfolio. This explains why farmland has gained so much value in 2022 and also why they expect farmland to keep appreciating at 5-6% per year in the long run, which is roughly in line with historic averages:

Inflation is a particularly strong catalyst for farmland because you can leverage it with a mortgage.

The mortgage is getting inflated away even as your land gains in value, resulting in exponential gains on your equity.

Reason #3: Real Diversification Without Sacrificing On Returns

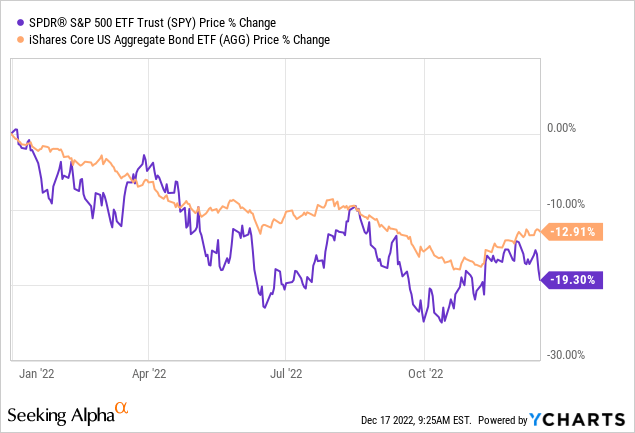

Today, the markets are increasingly correlated and it has become very difficult to meaningfully lower the risk of a portfolio through diversification.

This year as an example, bonds failed to protect investors and dropped nearly as much as stocks, resulting in some of the worst returns ever for a traditional 60/40 portfolio:

Similarly, REITs dropped even more than stocks, despite historically having been a lot more resilient to recessions and rising interest rates.

But farmland still provides real diversification benefits, and best of all, investors don’t have to sacrifice long-term returns to lower the risk of their portfolio.

Historically, farmland has actually outperformed stocks, bonds, gold, and real estate, generating 10.5% average annual returns since 1992.

So to recap:

- #1: Farmland is a form of insurance for black swans.

- #2: Farmland greatly benefits from inflation.

- #3: Farmland provides real diversification benefits and strong returns.

It may then seem like a no-brainer for all of us to include at least some in our portfolio, and yet, most don’t do it.

This is largely because until recently, it was almost impossible for an individual investor to invest in farmland.

You would have needed to have $10s of millions to build a well-diversified portfolio by geography and crop type, which is important to mitigate risks like the weather.

But recently, some new alternative investments have opened the doors to individual investors.

The two main options are publicly listed REITs and crowdfunding platforms.

I use both and they each have pros and cons.

REITs can be attractive because they allow you to buy an interest in a well-diversified portfolio that’s liquid and professionally managed. The downsides are that REITs can be quite volatile and there are today only 2 publicly listed farmland REITs in the US, Farmland Partners and Gladstone Land (LAND), and they each present some issues that may make them uninvestable to some investors.

LAND is priced at a premium to its net asset value, which essentially means that you are overpaying for its assets, and the company is externally managed, which can lead to some conflicts of interest.

FPI is discounted and we are bullish on it, but it is not a pure-play farmland investment since it also has brokerage, auctioning, and asset management businesses.

This brings us to the other option, which is crowdfunding. There are today a few platforms that allow you to invest as little as $15,000 in farmland investments and they then manage them for you. It is very easy to create an account and start building a diversified portfolio of farmland.

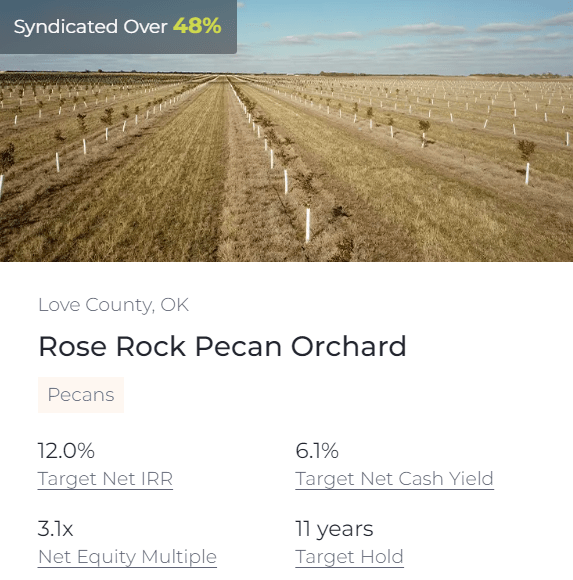

My favorite platform is FarmTogether, but note that I am somewhat conflicted because I am also an angel investor in the company. They are currently offering a deal with a 6.1% yield and a 12% targeted IRR for pecan farmland:

FarmTogether

This is probably the closest thing to farmland investments that you could make as an individual investor. It is not volatile like a REIT, it provides real diversification benefits, and it pays significant income.

But here also, there are some downsides. The biggest one is illiquidity. As you can see above, this deal, like most others, has a 10+ year-long term. That is fine if you are long-term-oriented, but it also means that you may not be able to get out before that. So it is not for everyone, but it can nicely complement a stock and bond portfolio if you are long-term oriented.

Bottom Line

Billionaire investors are buying farmland and you probably should too.

It is a form of insurance against black swans, it is also an inflation-hedge and it provides meaningful diversification benefits without sacrificing on returns.

I invest in farmland via Farmland Partners (REIT) and FarmTogether (Crowdfunding).

Be the first to comment