Michael Vi

As macro conditions tighten and the market continues to search for direction, I continue to emphasize that prudent stock-picking is the best way to navigate the current environment. I have a favorable view of the market indices in a 9-12 month window, but I think investors can capitalize right now by overweighting beaten-down tech stocks. The question is which.

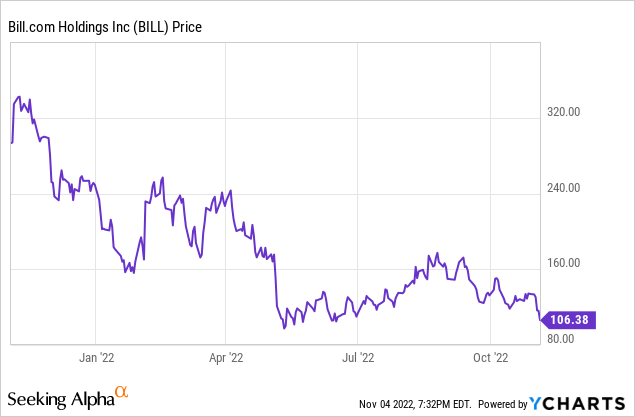

Bill.com (NYSE:BILL) has long been a very expensive, high-performing software stock. The company provides payment automation solutions, primarily targeted at SMB customers that don’t have full-on financial suites and specialized finance departments. Like its fellow SaaS peers, Bill.com stock saw a massive YTD correction to the tune of ~55%, helping to partially solve a persistent overvaluation problem.

Owing to the stock’s massive tumble despite relatively healthy fundamentals so far, I’m shifting my stance on Bill.com from bearish to neutral. Though I wouldn’t race to buy this stock just yet, I think this stock is worth adding to your watch list: and then entering at the appropriate price (more on that in a second).

What gives me pause is that Bill.com, due to its heavy exposure to SMB customers, is far more sensitive to the macro environment than fellow SaaS companies that are predominantly supported by enterprise clients. The company has seen spending trends within its customer base weaken, as CFO John Rettig noted on the recent fiscal Q1 earnings call:

During Q1, Bill stand-alone TPV per customer, excluding the FI channel, declined by 3% sequentially. In Q4, we saw mid-market businesses beginning to moderate their spending, and that trend is now visible with our micro and SMB customers as well.”

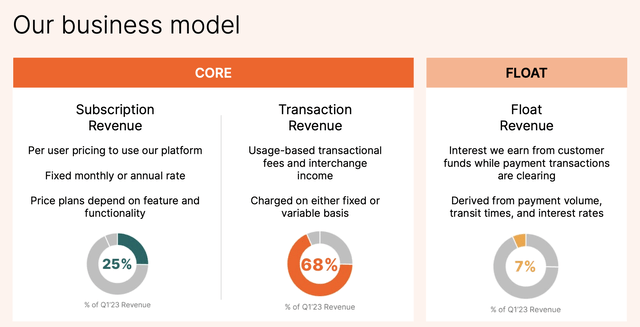

And not only will customers spend less, but weaker small businesses may also shrivel up and fold if a protracted recession happens. Transaction-based revenue makes up slightly more than two-thirds of Bill.com’s revenue, which means its revenue base is going to be more variable during an economic downturn than other software companies:

Bill.com revenue split (Bill.com FQ1 earnings deck)

At the same time, however, I don’t think it’s a purely doomsday scenario for Bill.com. There are a couple of positive drivers that we have to appreciate in this company, such as:

- So far, growth is holding up. Partially boosted by acquisitions, as well as by organic growth in paid customers, Bill.com is still growing at an enviable pace for a company at its roughly ~$1 billion annual revenue scale. Another small contributor here is float revenue, which made up 7% of Q1 revenue: as interest rates rise, so will Bill.com’s yield.

- Ample profitability. Bill.com has notched positive pro forma operating margins as well as positive FCF, in spite of its rapid growth rates.

- Huge cash balances. Bill.com has $2.64 billion of cash on its balance sheet (purely net of funds it holds on behalf of customers), which gives it a nice cushion to withstand even a protracted downturn.

Bill.com’s valuation is far from cheap, but it’s also now much more reasonable than in the past. At current share prices near $106, Bill.com trades at a market cap of $11.23 billion. After we net off the $2.64 billion of cash and $1.78 billion of debt on the company’s most recent balance sheet, its resulting enterprise value is $10.37 billion.

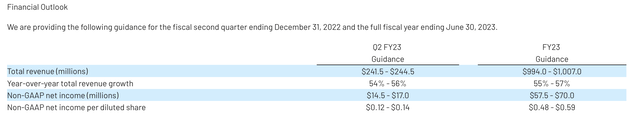

For the current fiscal year, Bill.com has guided to $994 million – $1.01 billion in revenue, representing 55-57% y/y growth:

Bill.com outlook (Bill.com FQ1 earnings release)

At the midpoint of this estimate, Bill.com trades at 10.4x EV/FY22 revenue. I continue to think a single-digit, 9x revenue multiple is a safer entry point for Bill.com – hence, my watch list entry point for Bill.com stands at $93, which represents a 9x FY23 revenue multiple and ~12% downside from current levels. Given marked volatility over the past few weeks, the stock may hit these levels quite suddenly – keep a close eye out for that entry point.

Q1 download

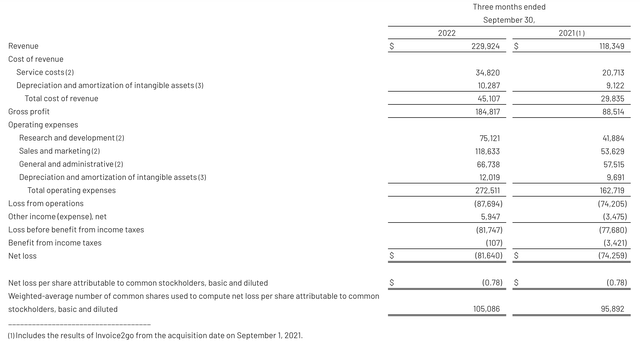

Let’s now go through Bill.com’s latest fiscal Q1 (September quarter) results, which were released in early November, in greater detail. The Q1 earnings summary is shown below:

Bill.com FQ1 results (Bill.com FQ1 earnings deck)

Bill.com’s revenue grew at a 94% y/y pace to $229.9 million, beating Wall Street’s expectations of $210.9 million (+78% y/y) by a sixteen-point margin. Reminder again that not all of Bill.com’s growth is organic, as the Invoice2Go acquisition closed mid-quarter during Q1 of last year.

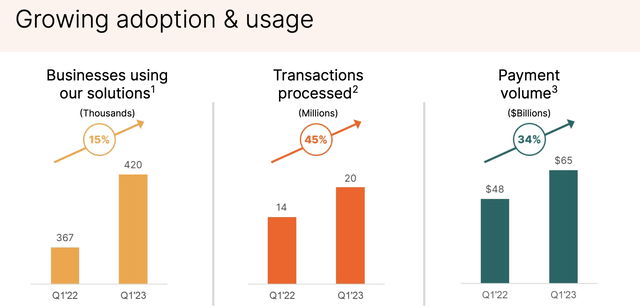

Still, many of Bill.com’s key metrics held up well. The company grew the number of businesses using the Bill.com platform by 15% y/y to 420k, while payment volumes also increased 34% y/y to $65 billion. We will need to continue to keep a close eye, however, on how payment trends by customer behave as macro conditions tighten.

Bill.com key metrics (Bill.com FQ1 earnings deck)

Float revenue in the quarter was $15.3 million, or 7% of revenue – versus just $0.8 million in Q1 of FY22, demonstrating the boost from last year’s near-zero interest rates. The company’s net yield in Q1 was 192bps, and with rates trending much higher post-September, I expect float will continue to be a major driver of y/y revenue growth in Q2 and beyond (which will be key to offset the optical growth deceleration from Bill.com’s major acquisitions now being fully comped from Q2 onward).

Bill.com is acknowledging the compressing environment, but it’s also important to recognize that the company is not explicitly modeling a severe downturn for its FY23 guidance. Per CFO Rettig’s remarks on the Q1 earnings call:

In the near term, the macro environment appears to be increasingly challenging for businesses. We anticipate the trends we’ve observed with businesses moderating their spend will continue throughout fiscal 2023. And we expect that this will translate into lower year-over-year payment volume growth in the quarters ahead.

At the same time, in this environment, the value proposition of our platform is resonating more than ever with SMBs, and we have seen strong engagement from existing customers continued high retention and healthy new customer demand. Now more than ever, businesses need our solutions to navigate the uncertain environment, and we believe this is an opportune time for us to invest in our business. We believe we can accelerate the positive impact we’re having for SMBs globally while monitoring the external environment and proactively balancing growth and non-GAAP profitability.

Now turning to our outlook. A couple of notes upfront. First, our outlook does not assume a severe economic downturn.”

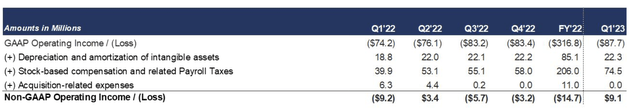

On the profitability side, we like the fact that Bill.com is generating $9.1 million of positive pro forma operating income in the quarter, representing a 4% pro forma operating margin – versus an operating loss of the same magnitude in the year-ago Q1. A two-point increase in pro forma gross margins to a sky-high 86% was the key driver here, helped by economies of scale, a favorable revenue mix, and the “free” contribution from higher float revenue.

Bill.com profitability (Bill.com FQ1 earnings deck)

Key takeaways

In my view, Bill.com is quickly approaching a buy point. Be mindful of the deteriorating macroeconomy which may have an outsized impact on Bill.com, but if you’re more long-term oriented, I think buying Bill.com at a sub-double digit forward revenue multiple is a smart buy-and-hold play.

Be the first to comment