Michael Warren

Investment Thesis: While Biglari Holdings (NYSE:BH) has seen revenue growth across segments other than restaurant operations, it remains to be seen whether such growth can compensate for the decline across the company’s restaurant operations.

Biglari Holdings is an American holding company which is known for its operation of major subsidiaries including Steak n Shake Inc, First Guard Insurance, and Western Sizzlin Corporation.

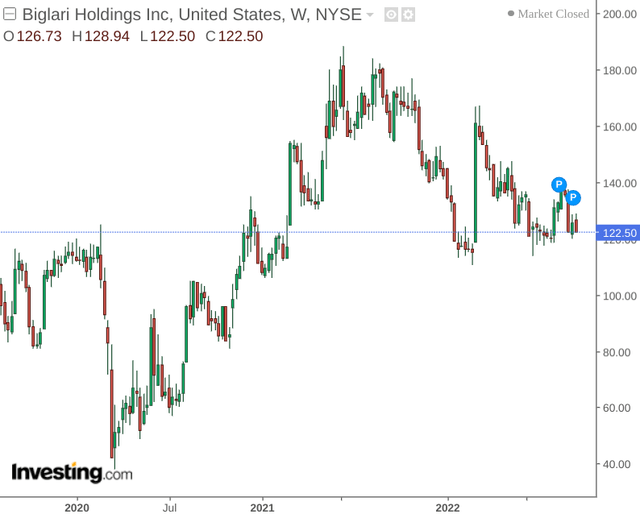

While the stock had seen significant upside in light of the March 2020 stock market crash – price has seen a decline since the latter half of 2021.

The purpose of this article is to determine whether Biglari Holdings has the potential to see upside once market conditions become more stable.

Performance

From a balance sheet standpoint, we can see that the quick ratio (as measured by current assets less inventories over current liabilities) has increased significantly from June 2019 to the most recent quarter:

| June 2019 | June 2022 | |

| Current assets | 87747 | 150427 |

| Inventories | 5166 | 3458 |

| Current liabilities | 149284 | 138284 |

| Quick ratio | 55.32% | 106.28% |

Source: Figures sourced from Biglari Holdings Q2 2019 and Q2 2022 Quarterly Reports. Quick ratio calculated by author.

This indicates that the company is in a better position to service its short-term debt obligations.

From a revenue standpoint – we can see that the size of the company’s Restaurant operations segment has shrunk significantly. While we see that revenue has decreased across this segment – so too have Restaurant cost of sales. This is primarily due to the company’s closure and subsequent re-franchising of numerous Steak n Shake restaurants during COVID-19.

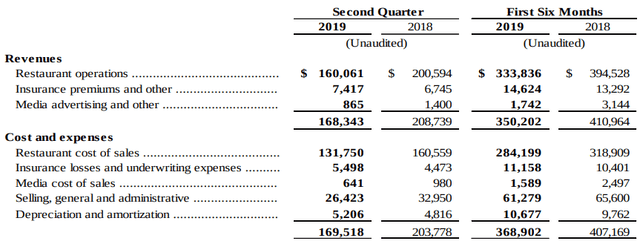

Q2 2019

Biglari Holdings Q2 2019 Quarterly Report.

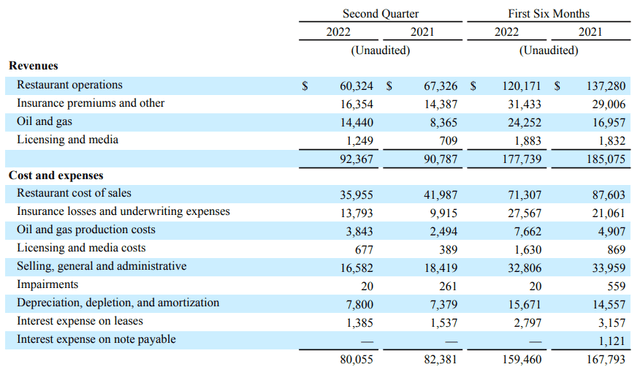

Q2 2022

Biglari Holdings Q2 2022 Quarterly Report.

For the first six months of 2019 – Restaurant operations accounted for 95% of total revenue, while this had decreased to 68% of total revenue for the first six months of 2022.

From this standpoint, the business model of Biglari Holdings has become more diversified, and less reliant on the Steak n Shake and Western Sizzlin subsidiaries to bolster revenue – with an increasing portion originating from insurance premiums and oil and gas.

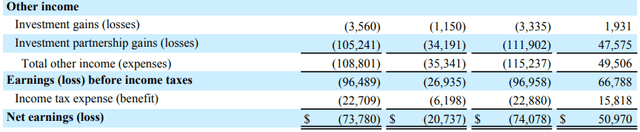

While we have seen that the company made a net loss of over $74 million for the first six months of 2022 – this was in large part down to losses on investment partnership gains.

Biglari Holdings Q2 2022 Quarterly Report.

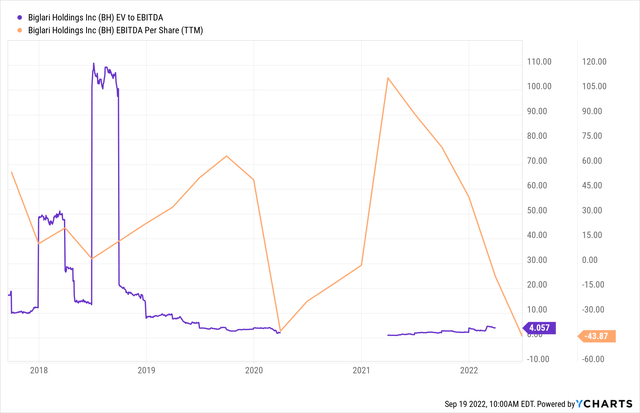

From an earnings standpoint, while we see that the company’s EV to EBITDA ratio is trading near a five-year low – the fact that recent earnings came in negative indicates that it would not be prudent to attempt to value the company from an earnings standpoint at this time.

Looking Forward

Going forward, inflation is likely to be a concern for the restaurant business as a whole heading into the winter months.

As a result, we could see a decline in Restaurant operations revenue for the latter half of this year. However, the fall in revenue could be partially compensated for by a potential uptick in revenues across insurance premiums and oil and gas.

With First Guard insurance operating in the truck and accidental insurance services segments – the industry as a whole has seen a decline in the number of companies willing to operate across this segment as a result of the rising cost of servicing crash payouts. Additionally, we can expect that claims will increase as traffic continues to return to pre-pandemic levels.

However, should the company manage to grow its insurance premiums and strengthen its position in the industry – then this could be a good sign going forward. Moreover, with insurance demand more likely to increase as a result of higher accident costs – we could see revenue over this segment grow from here.

With regards to the Oil and gas segment – Southern Oil, which operates properties across the Gulf of Mexico – has seen strong growth in revenue, aided by an increase in natural gas prices.

Holistically, Biglari Holdings has been taking steps to diversify itself from restaurant operations. While revenue growth across other segments has been encouraging, it is likely to take some time before we see revenue across other segments compensate for the decline that we have been seeing across restaurant operations.

Conclusion

To conclude, while Biglari Holdings has been diversifying its business away from restaurant operations – it is likely to only be over a longer-term period that investors will ultimately see whether or not revenue across other segments can compensate for the move away from restaurant operations.

For this reason, I take the view that the stock will see limited growth in the short to medium-term.

Additional disclosure: This article is written on an “as is” basis and without warranty. The content represents my opinion only and in no way constitutes professional investment advice. It is the responsibility of the reader to conduct their due diligence and seek investment advice from a licensed professional before making any investment decisions. The author disclaims all liability for any actions taken based on the information contained in this article.

Be the first to comment