Vladimir Vladimirov/E+ via Getty Images

While BigCommerce Holdings (NASDAQ:BIGC) has an interesting business model, the company continues to appear like a small brother to Shopify (SHOP). The company offers e-commerce platform solutions providing attractive access to complicated solutions allowing customers to avoid using Amazon (AMZN) and bypass building their own solutions. My investment thesis is slightly Bullish on BigCommerce, though the company still has a lot to prove to the market in order for the stock to rally.

Shift To Enterprise

As with most e-commerce companies, BigCommerce saw a revenue boost during 2021. As e-commerce growth has slowed, revenue growth has started to slip. In addition, the company is making a push towards Enterprise merchants potentially allowing some non-Enterprise ARR to dip leading to a headwind in the business in the short term.

For Q3’22, BigCommerce saw revenues grow just 22% YoY to $72 million. The growth rate has slipped from the 50% level to end 2021 to guidance for only 13% organic growth in Q4’22.

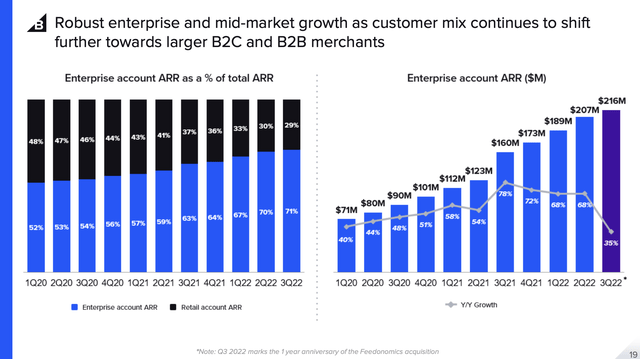

The company is shifting towards an Enterprise account focus in the last year with 70% of Q3 ARR from these key accounts. On this front, ARR growth collapsed to $216 million for 35% growth.

Source: BigCommerce Q3’22 presentation

After the big leap in ARR in Q3’21, growth rates have normalized in the last year. Even the Enterprise ARR growth rate dipped to 35% in the last quarter, down from 68% in the prior quarter and a peak growth rate of 78% last Q3.

BigCommerce needs Enterprise ARR to hit $225 million in Q4’22 in order to maintain just a 30% growth rate to end the year. Total ARR growth was already down to 20% at only $305 million and management forecast the non-Enterprise ARR is likely to dip from current levels.

The company has a strong subscription focused model with Q4 subscriptions of $53.2 million, up 26% from last Q3. BigCommerce is less tied to short-term volume growth in e-commerce sales.

The e-commerce platform saw GMV surge during Cyber Week in a strong sign of the positive customer dynamics, though as mentioned above this drives subscription renewals and not quarterly revenue fluctuations. BigCommerce saw GMV surge 31% on Black Friday with another 23% growth on Thanksgiving Day.

Shopify reported the holiday weekend sales grew 19%. Unfortunately, the company reported sales from Black Friday through Cyber Monday making the data hard to compare, though both data points point towards a strong future for these e-commerce platforms.

Smaller Brother

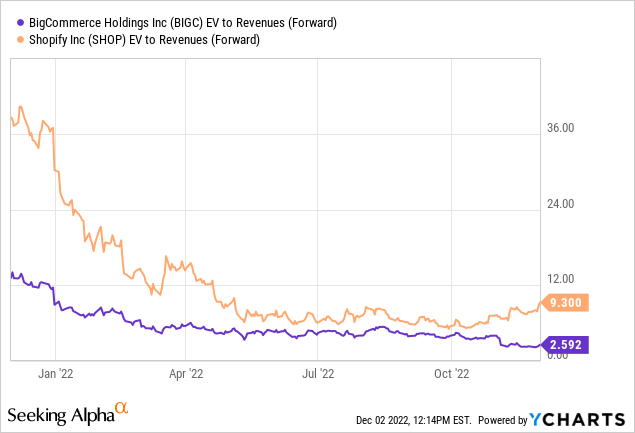

BigCommerce remains the small brother to Shopify in the e-commerce tools sector. The stock trades in such a manner with Shopify trading at 3.5x the forward EV/S multiple of BigCommerce.

Regardless, the company has such a small revenue base and limited growth making the valuation difficult here. BigCommerce is guiding towards flat revenues for Q4’22 at $73.2 million with a large operating loss of $13.3 million.

The company has a cash balance of $308 million not providing the massive capital to compete in a tough sector with annual loss run rate of $57.2 million. Considering the growth rate is slowing to start 2023, BigCommerce is difficult to aggressively get behind here.

BigCommerce has the following EV/S multiples assuming $50 million in cash burn each year:

- 2.9x EV/FY23 revenue

- 2.3x EV/FY24 revenue

Once the management team makes more progress towards eliminating the large losses, BigCommerce turns relatively cheap. Until that point likely towards the end of 2023, the stock is difficult to own at any valuation.

The market has a way of favoring one player over the other and Shopify is the category leader at this point. If the market dynamic were to change, BigCommerce could close the valuation gap, but Shopify is very expensive not at nearly 10x forward sales.

Takeaway

The key investor takeaway is the global e-commerce platform market is massive at a target 2023 TAM of $7.9 trillion. BigCommerce has plenty of market share to grab with a minimal revenue base of only $300 million now. The company has to eliminate the large relatively losses with slowing growth before the stock becomes an aggressive buy here.

Be the first to comment