NanoStockk

Why invest in Chinese stocks?

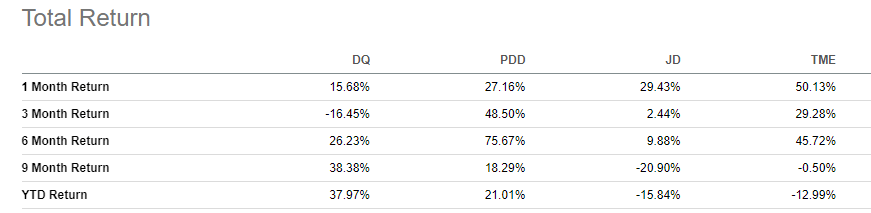

Despite the global volatility we’ve seen over the past two years, there’s a substantial investment opportunity in China’s market. And although the MSCI USA Index is outperforming the MSCI Emerging Markets Index, with China accounting for nearly 30% of the Index and S&P China ETF (GXC) down 29% YTD, China has 1.4 Billion people ready to resume consumption. The four Strong Buy Quant China ADR stocks being recommended have outperformed the S&P 500 and the S&P China ETF this year and have also surged over the last four weeks.

Four Fired-Up Chinese ADRs

Four Fired-Up Chinese ADRs (S&P Global, Seeking Alpha)

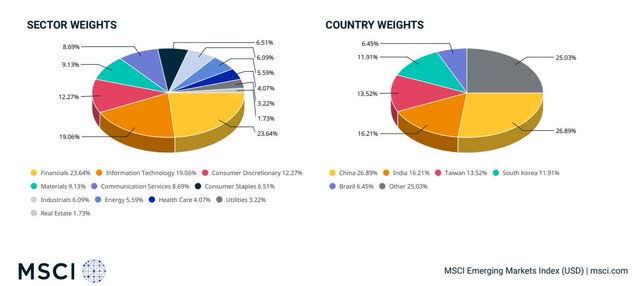

China is one of the biggest and fastest-growing economies in the world, accounting for more than 26% of the MSCI EM Index. China’s economy and market have a strong presence in the IT sector and Consumer Discretionary. Over the last two years, both sectors have deteriorated significantly, but now show signs of a re-emergence.

MSCI Emerging Markets Index Sector & Country Weights

MSCI Emerging Markets Index Sector & Country Weights (MSCI.com)

It’s hard to ignore the potential opportunity for the Chinese market. As the second-largest economy with a nearly $18 trillion GDP and the biggest population in the world, the Chinese market is ripe for growth. There are many reasons to invest in China, including:

-

Market Size

-

Growth Potential

-

Human Resources and Infrastructure

-

Innovation

-

Manufacturing

-

Emerging Industries

As noted in China Briefing,

“One unique advantage for data-fueled innovation in China is the size of its internet-using population. China has close to a billion internet users, which is more than the US and EU combined. About 800 million people in China use mobile payments on a daily basis – over eight times more than the US – leading to a world-leading fintech industry.”

Not only is China a leader in technology and manufacturing, but a substantial portion of China’s population is also of working age. In the 1980s, China established Special Economic Zones (SEZs) to support special economic functions like free-trade areas. SEZs have stimulated development within the nation while changing conditions and spurred innovation. Greater freedoms in policies and a market-oriented economy have led to the creation of +30 million jobs, increasing incomes for participating farmers, and accelerating industrialization, agricultural modernization, and urbanization. SEZs have contributed to 22% of China’s gross domestic product and are fostering an environment that makes China more attractive for foreign nations to trade and invest. The combination of population size, technology, and world-class infrastructure contributes to the attractiveness of Chinese stocks. But with investing in China, there are also risks.

Risks of Investing in China

There are many risks to consider when investing in China. As we’ve seen over a few years, COVID lockdowns had a major impact on China and global economies. Shipping ports were locked down, resulting in supply chain constraints. China has experienced weak real estate, deglobalization trends, and geo-political, to mention a few. Since the pandemic, a strong dollar has also limited the appeal of investing in China and has contributed to investor fear. While the US Federal Reserve continues to tighten monetary policy, the U.S. dollar could likely maintain its relative strength against other global currencies, perhaps even increase in value. Notably, this creates a resulting negative impact on foreign-denominated securities. However, in the last few weeks, we witnessed the move of the USD following the latest softening CPI figures. Any inclination of a Fed pivot from quantitative tightening seems to result in the fall of the USD, which turns a headwind for a nation like China into a tailwind.

The markets were ready to rally, and when you factor in the recent Xi-Biden meeting going well, it adds combustion to the sentiment. We do not want to get too far ahead of ourselves, and these events need to be taken with a grain of salt. While Xi may be willing to forge a path forward, if history indicates any further geopolitical tension, it will very likely bring volatility back to Chinese stocks, and a reversal in the gains experienced this last week. And the risk of delisting on the US stock exchange becomes a much more realistic possibility. But these risks are well known and baked into stock prices, easing the fears of delisting. The opportunities that must be considered are some stocks have strong fundamentals, good valuation frameworks, and excellent growth prospects.

MSCI China Index Performance (in USD)

MSCI China Index Performance (in USD) (MSCI.com)

There is an opportunity for investors that want to diversify their portfolios to consider putting their money in stocks housed in one of the fastest-growing economies in the world. There’s a long history of international stocks outperforming U.S. stocks, which I mentioned in a recent article titled 5 Best International Stocks Under $10. And while headwinds can challenge any market and index, I believe the MSCI China may have experienced a bottom in 2021 that is now slowly gearing up for recovery. In doing so, I believe some Chinese stocks may be gearing up for a rally.

My Top 4 Chinese Stocks

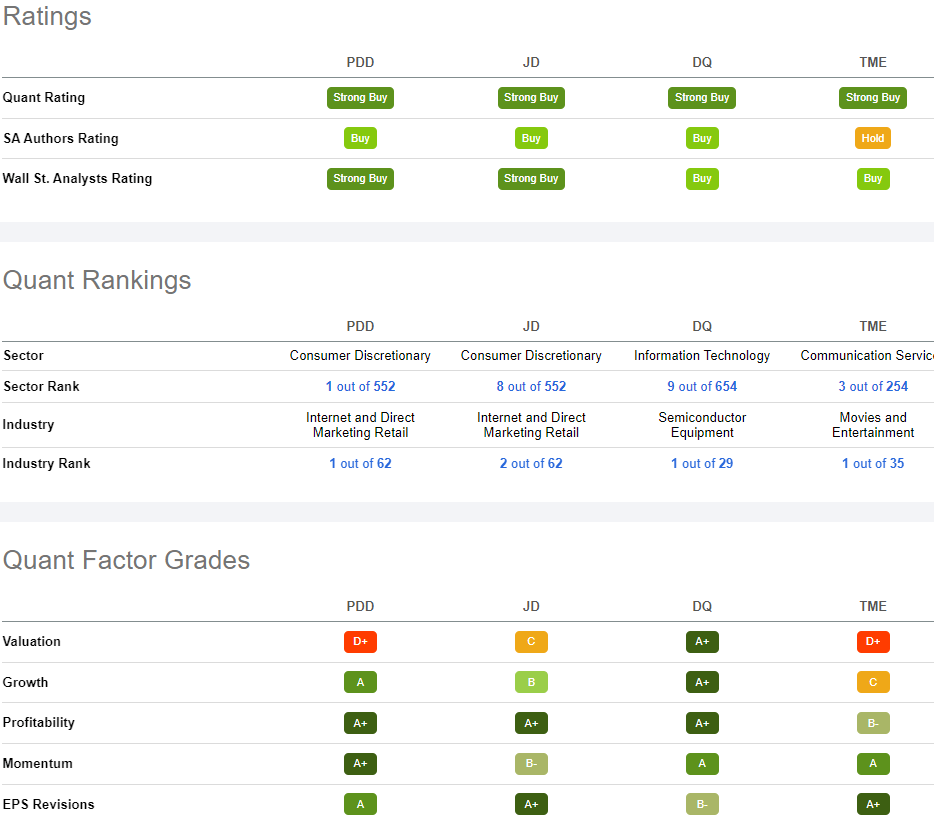

With clear diversification benefits, one of the biggest and fastest-growing economies known for advanced tech industries and varying products and services, Chinese stocks may be a worthwhile consideration for a portfolio. Each of the four Chinese stocks below is selected using my quant-rating system and possesses solid combinations of collective metrics, including growth, momentum, and EPS revisions.

My Top 4 Chinese Stocks

My Top 4 Chinese Stocks (Seeking Alpha Premium)

As China’s equity market, which has been heavily reliant on exports, shifts to a more consumption and innovation-driven economy, consider one or all of these stocks in diversifying your portfolio.

1. Pinduoduo (PDD)

-

Market Capitalization: $89.73B

-

Quant Rating: Strong Buy

-

Quant Sector Ranking (as of 11/17): 1 out of 552

-

Quant Industry Ranking (as of 11/17): 1 out of 62

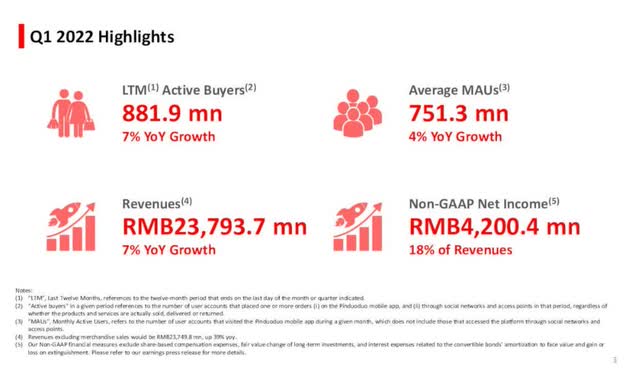

With more active users than Alibaba (BABA), Pinduoduo is an e-commerce platform in the People’s Republic of China, giving major platforms like BABA and JD.com (JD) a run for their money. PDD engages in “search-based” ecommerce. A business strategy that takes a social approach focused on user experiences, games, and Ai-driven algorithms for product recommendations and services, China’s consumer-to-manufacturer retail model is dominating online commerce, rivaling U.S.-based Amazon (AMZN). In an English-translated YouTube video, Pinduoduo asks:

“Shopping in real life is interactive because whether you’re grabbing the essentials or perusing the latest trends, you’re bound to interact with others, discover surprises, and maybe even enjoy some entertainment. So why can’t shopping online be just as fun and interactive?”

PDD Active Users (PDD Q1 2022 Investor Presentation Highlights)

With more than 750 million users and nearly 900 million Active Buyers and rallying Chinese stocks after the Biden and Xi Summit, I’m adding four Chinese stocks to consider for a portfolio, with PDD at the top of my list.

PDD Valuation & Momentum

Despite a D+ valuation grade, with a forward P/E ratio of 27.39x compared to the sector medial 14.64x, an 87.11% difference to the sector. Despite the lackluster overall valuation grade, PDD has a B+ forward PEG of 0.65x that showcases a -50.60% discount to the sector – this is an attractive valuation metric. With tremendous growth, profitability, and momentum, while the stock may not come at the ideal price point, its other fundamentals indicate opportunistic room for upside.

PDD Momentum Grade (Seeking Alpha Premium)

As we look at PDD’s bullish momentum, the stock is trending higher this week, with heavier than usual trading volume. The Xi-Biden Summit at G-20 may have something to do with the heavier-than-usual volume, as Cold War tensions may have simmered down. The positive volume suggests that more buying of PDD shares is taking place. Although the stock is -21% over the last year, it’s picking up momentum and is +26% YTD. As evidenced in the table above, PDD continues to outperform its sector peers quarterly. Given its consecutive earnings beats, Pinduoduo’s focus on the buying experience is fueling its growth while entertaining the masses with its buyer-engaging videos.

PDD Growth & Profitability

Buying online has never been so cool. After launching its U.S. online shopping website called Temu, e-commerce leader Amazon better watch! Pinduoduo and other Chinese e-commerce leaders, like my next stock pick JD.com, are grasping hold of international markets. PDD offers live-streaming videos to add to buying experiences and boost sales, which is changing the way people shop.

Pinduoduo Live Streaming (ECommerce China Agency)

Adding to PDD’s growth and profits, Pinduoduo’s Q2 EPS of $1.09 beat by $0.68, and revenue of $4.55B beat by $1.11B, 27.80% Y/Y. As a company in high growth, PDS is experiencing a ramp-up in brand partners that aided in its 8% increase in non-GAAP sales and marketing compared to Q2 2021. With its largely active 882 million buyer base, PDD uses subsidies to attract consumers into purchasing in categories they do not typically buy. Another differentiator is PDD’s high mix of agricultural produce and grocers. To tap the low online penetration of agricultural products, PDD announced a CNY 10 Billion Agriculture Initiative for agricultural modernization in August of 2021, which it continues to implement, aiding its diversification and long-term shareholder value and growth.

2. JD.com (JD)

-

Market Capitalization: $85.07B

-

Quant Rating: Strong Buy

-

Quant Sector Ranking (as of 11/17): 8 out of 552

-

Quant Industry Ranking (as of 11/17): 2 out of 62

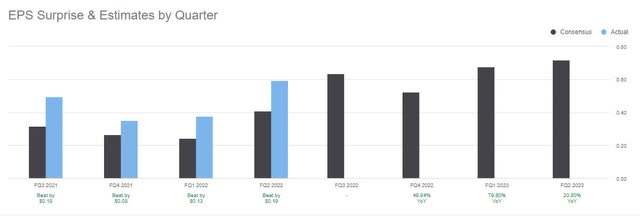

Like Pinduoduo, JD.com, among other Chinese stocks, has experienced gains since the G-20 Summit. The stock is up 25% in the last 4-weeks. Ahead of Q3 earnings reported on November 18th, the Beijing-headquartered e-commerce giant rose +8%. With a consensus EPS of $0.63 and consensus Revenue Estimate of $34.61B, analysts anticipate a consecutive earnings beat following stellar Q2 earnings that topped results and added nearly 50M customer accounts over 12 months.

The Chinese tech giant, whose spin-off logistics company JD Logistics, has partnered with Douyin, a short video app, has been affected by complaints and returns. With a positive track record and serving more than 10,000 businesses, JD will offer non-stop deliveries which should contribute to its revenue and customer acquisitions. In addition to a healthy balance sheet and more than $7.63B cash on hand, plus significant year-over-year cash flow growth, JD.com comes at a relative discount with bullish momentum.

JD Valuation & Momentum

Pandemic lockdowns affected companies worldwide, and like many headquartered in China, they were hit even harder. The easing of coronavirus restrictions has increased consumer spending, allowing e-commerce players to recover. In July, I wrote about JD.com in an article titled Bull In A China Shop. Since its writing, the stock has moved from a Buy to a Strong Buy rating.

With a C- valuation grade, JD comes at a relative discount. Although its forward P/E ratio of 67.17x is trading well above the sector median of 14.64x, its forward PEG of 0.88x is a -32.58% difference to the sector, and forward EV/Sales of 0.48x indicate a -57.87% discount compared to its peers.

JD Revisions Grade (Seeking Alpha Premium)

JD has bullish momentum, and shares of the stock have been actively purchased, driving its price higher. With a sharp rebound over the last few weeks, JD’s stock prices have been +30% over the previous month. As analysts prepare for its earnings announcement, 31 analysts have revised up in the last 90 days, with zero downward revisions indicating that JD could see tremendous growth and profitability.

JD Growth & Profitability

As China’s biggest online and overall retailer, JD possesses diversified income streams that include e-commerce, logistics, and technology, and it is a member of the Fortune Global 500. As showcased for Q3, JD Non-GAAP EPADS of $0.88 beat by $0.25, and revenue of $34.2B was missed by $270M. Trading slightly down after Q3 earnings announcements, the company is still laser-focused on efficiencies and driving growth. Although the previous Q2 earnings spelled a 15th consecutive earnings beat for the company despite China experiencing a slowing economy, with JD’s well-establish supply chain infrastructure, we believe its revenues will look better going forward in Q4.

For Q2, Product revenues increased by 3% YoY and service revenues by another 22% for the same period. With a continued user base of 581M driven by 10M new active retail business, JD continues to strategize in improving logistics and its other services, resulting in 38% YoY growth in Q2.

JD.com EPS Surprise Estimates (Seeking Alpha Premium)

With its heavy investment in supply chain management and integrated warehouses, JD can see improving results and gross profit margins.

“Notably, our largest growth category, supermarket, continued to see its order volume growing over 25% year-on-year, and it serves users daily needs anytime and anywhere. We are also encouraged to see revenues for health care, home goods, sports and outdoor, cosmetics, and MRO recording double-digit growth and outpacing the sector. The trends reflected our expanding user mind share across many of our emerging categories…we continually pursue long-term growth opportunities through technology, innovation, and our new — and new business models, where we may adjust our pace of investments from time to time based on market conditions.” –Sandy Xu, JD.com CFO.

Offering the largest supermarket in China and massive nationwide distribution and fulfillment networks, it’s no surprise that JD is rated a Strong Buy.

3. Daqo New Energy Corp. (DQ)

-

Market Capitalization: $4.31B

-

Quant Rating: Strong Buy

-

Quant Sector Ranking (as of 11/17): 9 out of 654

-

Quant Industry Ranking (as of 11/17): 1 out of 29

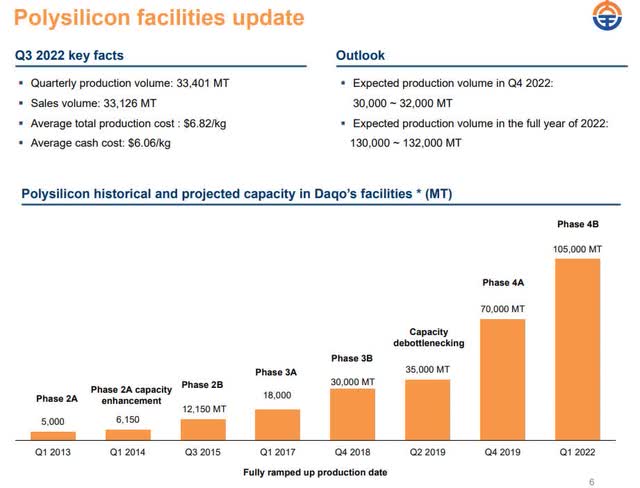

Headquartered in Shanghai, China, and ready to capitalize on its $700M stock buyback, Daqo, a low-cost semiconductor equipment company used for high-purity solar power solutions, is on an uptrend. Daqo’s subsidiary Xinjiang Daqo received approval from the China Securities Regulatory Commission for a private A-share offering to be used for expansion earlier this year. Xinjiang Daqo had plans to announce a 2023 dividend.

“Daqo receives the dividend as a majority owner and redistributes it to U.S. shareholders through dividends or buybacks. Against all odds, Daqo’s board of directors decided to start a new share buyback program earlier, without waiting on the dividend of Xinjiang Daqo. This not only signals that the management team thinks the company is highly undervalued but also indicates that U.S. shareholders are also a priority to get rewarded…this fully covers the share incentive plan which diluted shareholders in Q3” –Friso Alenus, Seeking Alpha Contributor.

Not only does this signal that Daqo is on solid footing despite the stock being down 18% over the last year. Its unique polysilicon material is selling like hotcakes!

Daqo Production Updates (Daqo Q3 Investor Presentation)

Daqo’s polysilicon capacity is selling out. After ramping up production, Daqo has signed multiple contracts recently for a combined 821,000 MT polysilicon, with two additional five-year deals in November. Not only has it secured 6.3x annual production for the next five to six years, but its Q3 earnings were also solid, with an EPS of $7.70 beating by $0.42.

DQ Growth & Profitability

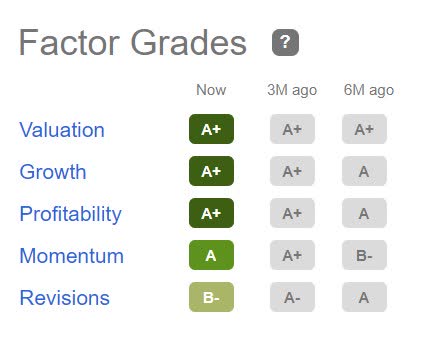

Ranked #1 in the semiconductor equipment industry according to our quant ratings, with lower production costs and gross margins that improved to 80% from 76% from the prior year, Daqo reached record-breaking production in September for its mono-grade polysilicon. With renewables top-of-mind for the company, low production costs allow Daqo to maintain its competitive advantage. Over the last 90 days, five analysts provided FY1 Up revisions and some of the nicest Factor Grades one could ask for.

Seeking Alpha Factor grades rate investment characteristics on a sector-relative basis. As you can see, there are nearly all ‘A’s across the board for Daqo. Trading at a tremendous discount with an A+ valuation grade and A+ Profitability and Growth Grades, Daqo offers excellent fundamentals compared to the sector.

DQ Factor Grades

DQ Factor Grades (Seeking Alpha Premium)

Although the China-Taiwan tensions increase risks to the usual geopolitical concerns when investing in Chinese stocks, semiconductors have been headline news. Considering that the overall outlook remains strong for DQ, with bullish momentum and trading at a discount, let’s dive into those metrics.

DQ Valuation & Momentum

Year-to-date, DQ is +32% and severely discounted relative to its peers, possessing a forward P/E ratio of 2.08x, a more than 91% discount, and maintains a trailing PEG of -96.58% difference to the sector. With quarterly price performance that beats the sector median significantly over six- and nine-month periods, this stock and my next pick are worth considering.

4. Tencent Music Entertainment Group (TME)

-

Market Capitalization: $9.85B

-

Quant Rating: Strong Buy

-

Quant Sector Ranking (as of 11/17): 3 out of 254

-

Quant Industry Ranking (as of 11/17): 1 out of 35

Tencent is China’s leading music and audio platform. The stock is up 40% in the last 4-weeks. If there is a short-term pullback and the stock price settles down, investors may want to use it as an opportunity to acquire shares. Tencent Music Entertainment Group is rocking and rolling following better-than-expected Q3 results by offering an interactive online stage for performers to showcase their talents, karaoke, live streaming, and music entertainment services. Tencent Chief Strategy Officer Tony Yip said:

“We’re very pleased with our subscriber growth this quarter. We continue to record high teens percentage year-over-year growth rate in terms of our subscriber growth. And that’s a trend that we expect to continue in the near term, within the one year or so, give or take, one or two quarters. Our near-term goal is to reach the round number 100 million subscriber base.”

Given a strong Q3 performance despite a YTD share price down nearly 13% and over -26% over one year, now may be the time to consider it for a portfolio, especially given its recent introduction of Class A shares on the Hong Kong exchange. Although the company was involved in China’s crackdown for alleged monopolistic conduct that appeared to be more like the government’s market manipulation, Tencent was fined. With its Hong Kong listing, there should be a reduced risk of delisting, and its business should continue to grow.

Tencent Growth & Profitability

Listed and traded on the New York Stock Exchange, the popular Chinese stock had a top-and-bottom-line Q3 earnings beat. EPS of $0.12 beat by $0.02, and revenue of $1.05B beat by $65.30M.

TME Revisions Grade (Seeking Alpha Premium)

Better-than-expected results led to 13 analysts’ Up revisions in the last 90 days, with zero downward revisions. Not only is Tencent focused on its platform strategy to enhance its interactive experiences and offer new interfaces, but the company is also adding more virtualization, plus 19% YoY subscription revenue growth, with momentum to boot.

Tencent Valuation & Momentum

Although TME is -26% over the last year, the stock is strongly bullish, with investors actively purchasing shares. As a result, many analysts call the stock Overbought, currently trading at $5.96 per share.

TME Momentum Grade (Seeking Alpha Premium)

Despite this momentum and outperforming its sector peers quarterly, TME still comes at a relative discount. Possessing a D+ valuation grade, its forward PEG of 0.78x is a -36.10% difference to the sector, and its forward Price/Book of 1.24x is a -34.16% difference to the sector. Some prudence is required when purchasing Tencent at this price point. Still, with China’s economy beginning to stabilize and the company having solid growth and strong profitability, this large communications company is one to consider, along with the other three picks, as a diversification option for a portfolio.

Should I buy Chinese stocks?

Whenever you talk about investing in China, you must consider the risks. One central but less mentioned risk is the Chinese government intervening and manipulating the markets as they previously did with technology stocks, primarily Alibaba and Tencent. While this is a fear you must consider when investing abroad, namely in a communist country until they adopt a free-market system, there are risks associated. But PDD, JD, DQ, and TME are 4 Chinese stocks whose buy ratings are justified based on their fundamentals and quant ratings, and avoiding Chinese stocks altogether may be a serious oversight. In the long term, diversification minimizes risk and maximizes returns. China is the second-largest economy with the largest population in the world. From a pure market perspective and weighing risk to reward, it’s a no-brainer to consider Chinese stocks as a diversification strategy.

Although the markets have been volatile, risk can bring rewards. Investing in Chinese stocks can have more risks due to currency fluctuations, limited liquidity, government regulations, and other geopolitical factors. Look for fundamentally strong companies with excellent profitability, solid valuation frameworks, and growth prospects. If you’re uncomfortable with international stocks, consider some of Seeking Alpha’s Top Rated Stocks. The key is to make well-informed investment decisions, using tools that help take the emotion and fear out of investing.

Be the first to comment