temizyurek/E+ via Getty Images

Investment Thesis

As my wife and I are reviewing our accounts and preparing for our earlier retirement, an idea like BHP Group (NYSE:BHP) really sparked our interest. Inflation is your #1 enemy in the long term, period. In 40 years, you will need more than $314k to maintain the same purchasing power of a current $100k income IF inflation averages the same as that during 1980 to 2020 (averages 2.92% per annum). It is a big IF because the inflation rate between 1980 and 2020 is relatively mild – it is more of an exception than the norm. By shifting the timeframe by 10 years to 1970 to 2010, the average inflation rate would be 4.45%, and then more than $562k would be needed to maintain the same purchasing power of a current $100k income.

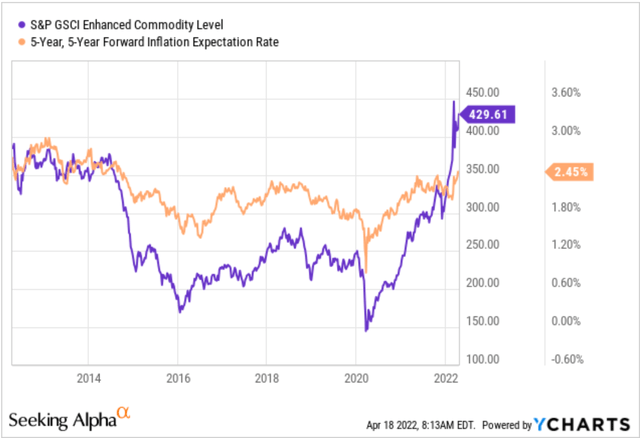

With the roaring inflation and negative real interest rates, hedging against inflation should definitely become a top priority for investors. Elon Musk’s recent tweet is timely and fundamentally sound, “it is generally better to own physical things like a home or stock in companies you think make good products than dollars when inflation is high.” Indeed, commodities have outperformed all major asset classes during the 9 Fed hikes. The following chart below shows that the latest cycle that started around 2021 is no exception.

Seeking Alpha and YCharts data

Under this general background, the thesis is BHP not only hedges against inflation but also helps investors fight it for the following reasons:

- As a leading commodity stock, BHP has outperformed commodities in the past. And I expect the past trend to continue given its scale and efficiency.

- Commodity stocks go through cycles and have been disfavored by the market in the past decade. Now it seems the beginning of a new cycle and BHP’s valuation is still low. As such, it is well poised to deliver an outsized 10%+ return in the new cycle, beating the expected inflation by a wide margin.

- Finally, a large part of the total return will be in the form of current dividends (the dividend yield is almost 7.7% as of this writing), adding further potency against inflation and also downside protection.

BHP Is Superior To Commodities

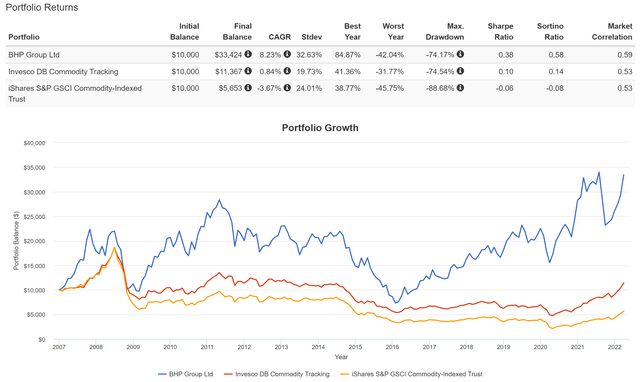

There is nothing wrong with directly owning commodities. However, a leading commodity stock like BHP can do better. It has outperformed commodities in the past as you can see from the following chart. Furthermore, if you own commodity funds, you would have to generally pay a much higher expense ratio and at the same time won’t be able to collect dividends.

Source: www.portfoliovisualizer.com

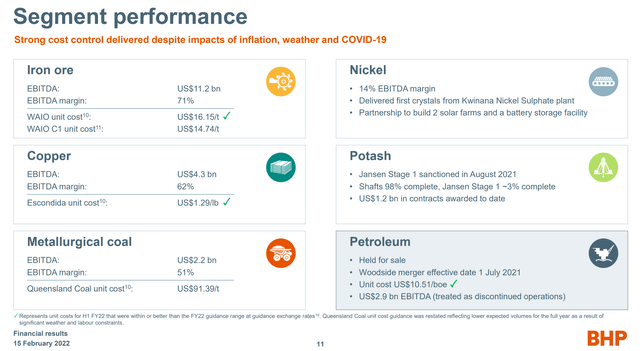

Besides the fee and the dividends, BHP is also a superior investment vehicle to commodities because of its scale, diversity, and efficiency. As shown in the chart below, BHP produces a wide variety of commodities, including crude oil, natural gas, iron ore, nickel, copper, diamonds, and various types of coal. Besides the diversification across different commodities, the company also offers geographical diversification. It has extensive assets and operations throughout Australia, as well as in several other countries, including Chile, South Africa, and the United Kingdom.

In the meantime, the business maintains its commitment to its disciplined Capital Allocation Framework and boasts a strong balance sheet with a revised net debt target range. I expect the financial position and capital allocation flexibility to further improve in the near future given the strong profitability to be discussed next.

Superb Profitability

The business enjoyed superb profitability and delivered strong shareholder returns. The profitability metrics are strong across the board. The business generated free cash flow of $8.5B in the first half of FY2022, a whopping 43% increase against H1 FY21 on a continuing operations basis. EBITDA margin expanded by 400 basis points to 64% YoY.

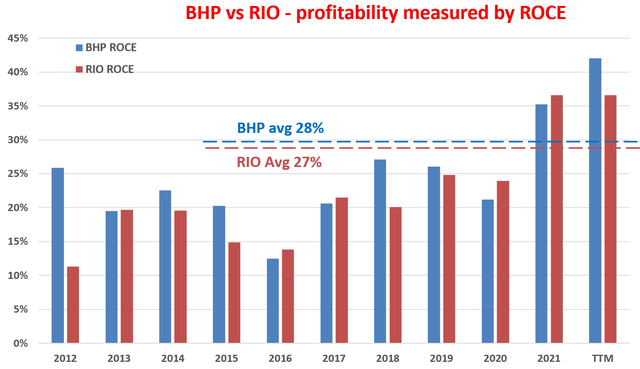

Probably it is most telling to compare its profitability against its closest peer, Rio Tinto Group (RIO). As seen, their ROCE (return on capital employed) have tracked each other closely with no surprise over the years. In these results, I considered the following items of capital actually employed as detailed in my earlier article: A) Working capital, including payables, receivables, inventory, B) Gross Property, Plant, and Equipment, and C) Research and development expenses are also capitalized. Both leaders were able to maintain a very healthy ROCE over the long term as seen. In recent years, their average ROCE has been almost identical around 27% to 28%. Note that BHP’s ROCE in H1 FY2022 is higher than the average and also RIO by a good margin.

Looking forward, I am optimistic that such superb profitability will continue for several reasons:

- The business will enjoy a stronger balance sheet and more flexibility in capital location. Its net debt has decreased to $6.1B in H1 FY2022, a 49% decrease YoY.

- The company will continue to benefit from high commodity prices including copper, coal, and iron ore, et al. The continued economic recovery, the spending on infrastructure, and the war in the Russian/Ukraine region all provide catalysts to support the commodity prices.

Attractive Dividends And Valuation

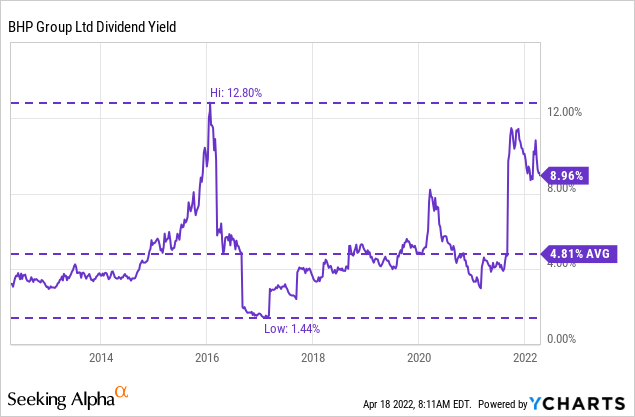

Despite the strong profitability and bright outlook, the stock is attractively valued as measured by a range of metrics, and the next chart uses its dividend yield as one of such metrics.

For stocks that consistently pay dividends, dividends serve as the most reliable approximation for owners’ earnings. As seen, Its dividend yield started at around 4% at the beginning of the decade. And the dividend yields have risen to the current level of about 8%. So in terms of dividend yield, its valuation has contracted by almost half over the past decade. The valuation bottomed in 2021 when the dividend yield reached almost 12%, marking the end of the last cycle and the beginning of the new cycle in my view.

Looking forward, assuming a valuation reversion to the mean (say a dividend yield around 5%) in the next 5 years or so, valuation expansion would contribute about 8% of return. Given its scale, long-term pricing power, and the current inflation, adding a bit of an inflation escalator would easily push the annual total return into the double-digit range and beat the expected inflation by a wide margin.

Furthermore, given the current dividend yield of around 8%, most of the total return is supported by a current dividend, adding another layer of safety to fight inflation.

Conclusion And Risks

This is a good time to buy BHP for a few good reasons:

- Commodity stocks have been disfavored by the market in the past decade. BHP’s valuation bottomed in 2021 when its dividend yield reached almost 12%, marking the end of the last cycle and the beginning of the new cycle in my view.

- It is well poised to capitalize on the next commodity cycle thanks to its scale, high ROCE, and effective capital allocation. These drivers are expected to deliver an outsized return in the decade ahead. And the total return is expected to easily exceed the worst expectation of inflation.

- Finally, given the current dividend yield of around 8%, most of the expected return is supported by a current dividend, adding an extra margin of safety and potential to fight inflation.

There are a few risks to consider though:

- BHP is under the pressure of inflation itself and costs control remains crucial. Due to a combination of the COVID pandemic and inflation, BHP is dealing with labor shortages, higher energy costs, higher operation expenses, et al.

- Investment in commodity stocks entails large short-term price volatilities. Commodity prices are volatile enough themselves, and the price volatility of BHP is even larger than commodities. If you recall from the second chart in this article, you would see that BHP stock prices suffered a larger standard deviation and also a larger worst-year performance than the commodity funds.

Be the first to comment