DNY59

Thesis

BlackRock Core Bond Trust (NYSE:BHK) is a fixed income closed end fund that focuses on Treasuries and investment grade bonds. The CEF has current income as a primary objective. The fund was started in 2001, and it seeks to achieve its primary objective by investing primarily in a diversified portfolio of investment grade securities, including corporate bonds, U.S. government and agency securities and mortgage-related securities. At least 75% of its total assets will be invested in investment grade bonds. Up to 25% of its total assets may be invested in bonds that at the time are rated Ba/BB or below.

Given its mandate and current portfolio set-up, the fund is mainly driven by rates and the Fed policy. The fund is a very leveraged play (~40% leverage for this CEF) on Treasuries and Investment Grade bonds. As long as rates rise, the CEF will lose value since the underlying collateral experiences lower pricing. We do not think we have seen peak Fed Funds, and the below section outlines our view on inflation and a Fed “pivot”. BHK will only have bottomed when rates peak.

Fed Rate Hikes – Are We There Yet?

The Fed fell behind this year as inflation spiked, and it has played catch-up ever since. Powell and Co. are looking for sequential prints with lower core PCE levels before even starting to think about pausing rate hikes. We are expecting a 75 bps hike in September, which has been well telegraphed by the WSJ. Nick Timiraos is rapidly becoming the Fed’s “trumpet“, after his well-timed article calling for a July 75 bps move.

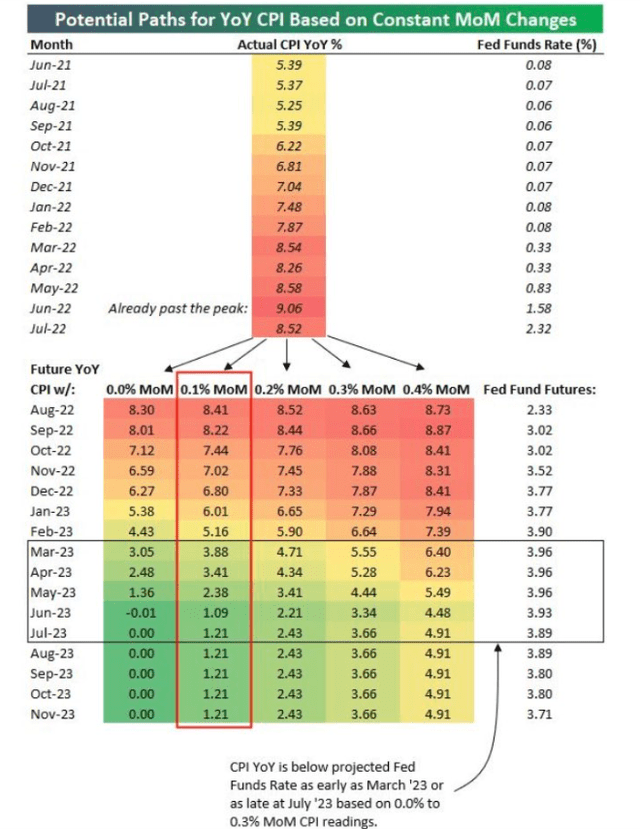

The market discussions center around the fact that the Fed will not consider turning on rates until CPI year-on-year is below the Fed Funds rates:

If we look at the above table, courtesy of Macro A., we can see that in very benign inflation scenarios y-o-y CPI does not go below the projected Fed Funds rates (implied from the futures market) until Q1/Q2 of next year. The Fed will need a consistent CPI below Fed Funds prior to any pivots.

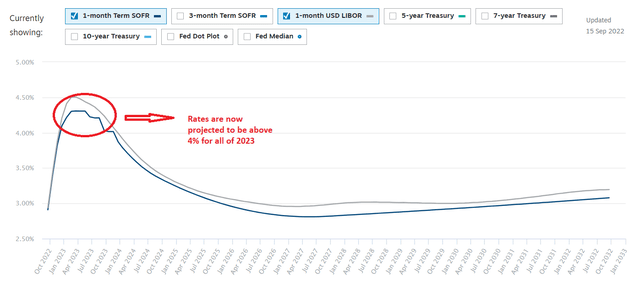

The market is now starting to price this in, with the SOFR and LIBOR curves above 4% for the entire 2023 now:

Given the latest CPI prints, banks are revising their hike projections, with Goldman (GS) now expecting the Fed to hike by 75 basis points this month, 50 basis points in November, up from their previous forecasts of 50 basis points and 25 basis points respectively. They expect another 25 basis points hike in December to top off 2022.

Some market participants, namely Ray Dalio, are calling for much higher rates. Mr. Dalio actually estimates a 4.5% to 6% range for Fed Funds in the next few years:

The Bridgewater Associates founder said the Federal Reserve will seek to curb inflation by hiking interest rates from around 2.5% today, to between 4.5% and 6% over time.

We do not think rates much above 4% are feasible for the United States government given their high debt burden and interest rate payments, but the fact that some market participants see such high levels should tell you that there is a significant “thought dispersion” on the correct levels.

We need to see lower inflation and the market pricing in the top in rates, but we are not there yet.

Holdings

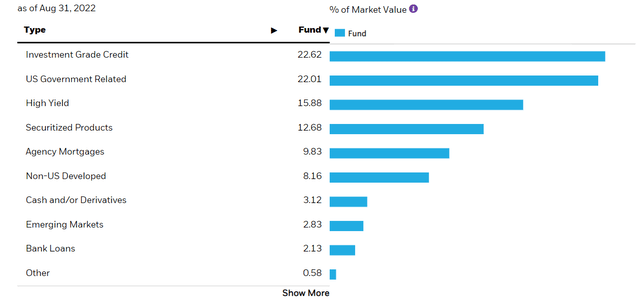

The fund is overweight Treasuries and investment grade corporate bonds:

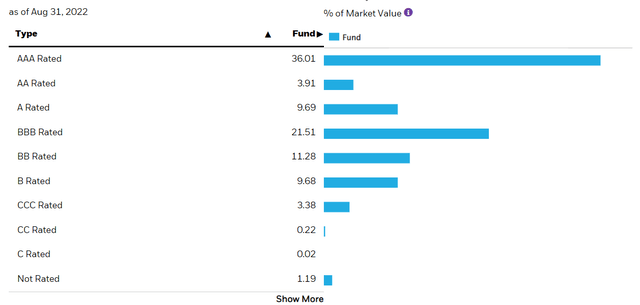

The portfolio holdings set-up explains the large AAA bonds concentration:

Bond Concentration (BlackRock)

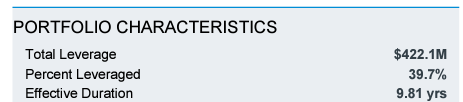

The fund has a long duration of almost 10 years and a high leverage:

Portfolio Characteristics (BlackRock)

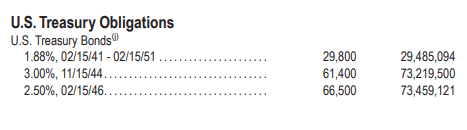

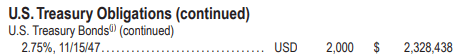

The treasuries holdings are exposed to the very long end of the curve via their long tenors:

Holdings (Annual Report) Holdings (Annual Report)

We can see from the above snippet from the Annual Report that a large portion of the treasuries holdings have 20 years plus duration profiles. Given their duration profile, these bonds are hit the worst as rates rise.

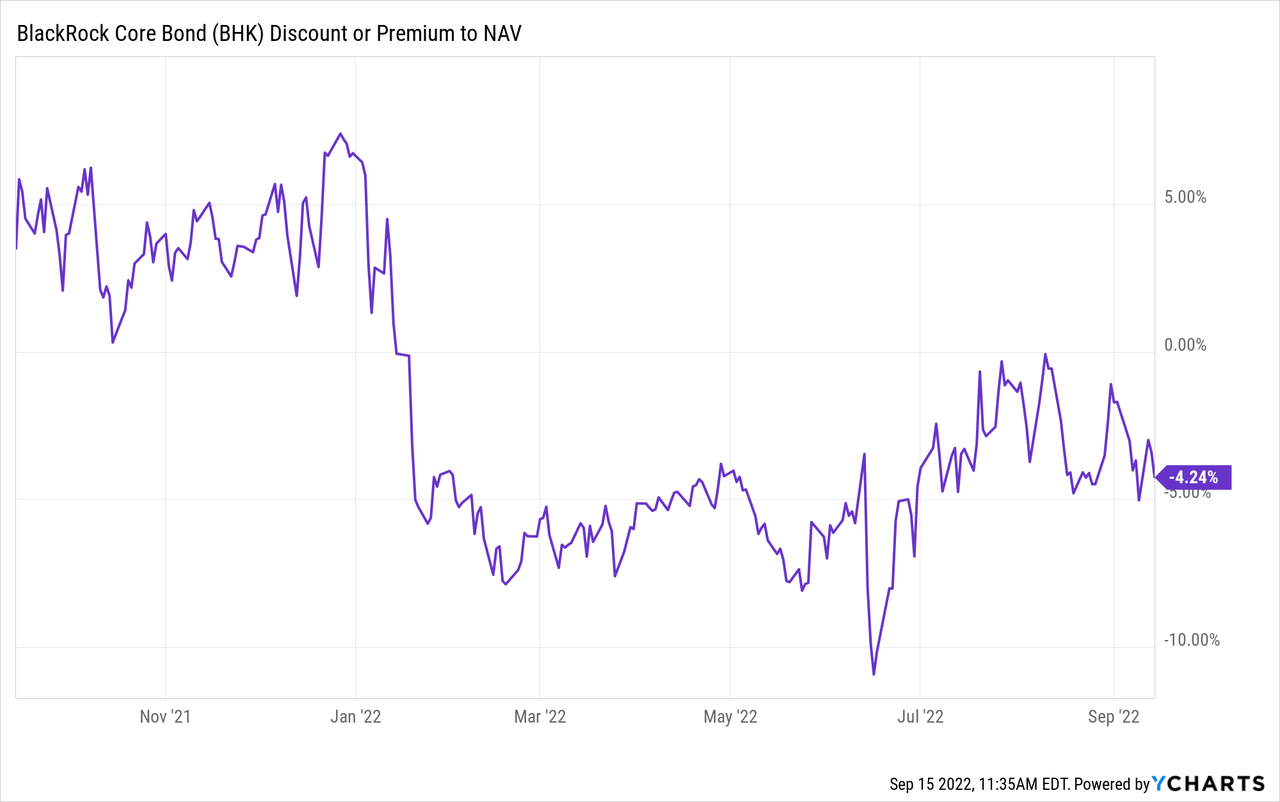

Premium/Discount to NAV

2022 has not been easy on BHK:

Unlike other risk-on/risk-off moves in the discount to NAV for CEFs, the market understands that BHK will be under pressure until the rate cycle is over, hence it has kept the fund at a discount. We expect it to stay there until there is clarity on the Fed path. For equity CEFs or fixed income ones, we have seen the propensity for the funds to move to a discount during market sell-offs and then revert to a premium when the VIX levels move down. Not here.

Conclusion

BHK is a very leveraged play on Treasuries and Investment Grade bonds (the CEF has a ~40% leverage ratio). The vehicle, via its composition, is overweight AAA securities and has a high duration of 9.8 years. Do not expect a bottom in BHK until the rates cycle is over. Rates/Fed Funds are inflation dependent and, similarly to Goldman, we expect another 150 basis points in hikes in 2022. If inflation moderates and establishes itself on a firm downward path by the end of the year, we expect the Fed to enter a ‘wait-and-see’ mode, otherwise expect more hikes in 2023. Under the current projections year-on-year, CPI is set to fall below Fed Funds in Q1/Q2 2023. If you think we have seen the lows in BHK, think again. We are not there yet.

Be the first to comment