Spencer Platt

Investment Thesis

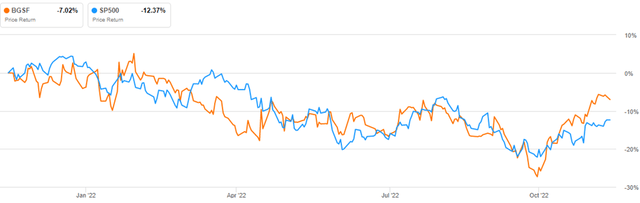

BGSF, Inc. (NYSE:BGSF) is a corporation established in the United States that offers labor solutions and placement services. Human resource is one of the industries hit hard by the pandemic, and the company is not immune to the difficulties it has spawned. Due to the challenges related to Covid 19, the company experienced a sharp decline in share prices from $21.55 in December 2020 to $6.13 in March 2021. With economies now recovering from the effects of Covid 19, the company is also showing a strong rebound. Since October this year, it has been on an upward trajectory outperforming the market with a margin of more than 5%.

As indicated by the firm during the Q3 conference call, the robust demand for personnel is mainly responsible for the upward trend that, in my view, represents the beginning of the company’s return from its abysmal performance. Given the optimistic forecast for the industry, I anticipate the company’s upward trajectory to continue. The company is in good financial shape overall, but it faces difficulties with its liquidity, and cash flow that I believe are tied to Covid 19 effects.

I recommend buying the stock because of the sector’s bright future and the company’s healthy financial position.

Industry Outlook

As a result of the 2020 coronavirus pandemic, the human resources and staffing sector experienced a slump. Reduced corporate profit and layoffs resulted from company closures and work-from-home mandates. Companies will feel more comfortable recruiting people for permanent roles as social distance requirements decrease and the pandemic is brought under control. Demand for temporary and permanent workers will increase, creating good prospects for staffing and personnel management organizations.

A growing number of businesses are moving away from the traditional employment model by increasing their use of temporary and contract workers to boost their competitiveness and agility while also decreasing their personnel expenses, such as benefits, payroll taxes, and other associated costs with hiring permanent employees. According to the U.S. Department of Labor [DOL], the employment services sector will expand steadily over the next few years. More than three million Americans are currently employed on a contract or temporary basis, which is expected to rise. The need for businesses to cut costs and compete globally has increased the use of contract and temporary labor. In the near future, contingent workers may make up more than half of the workforce at Fortune 500 businesses, say experts in the staffing sector [up from 20 to 30 percent in the past]. These changes bode well for the future of companies providing employment services like staffing and recruiting.

Financials

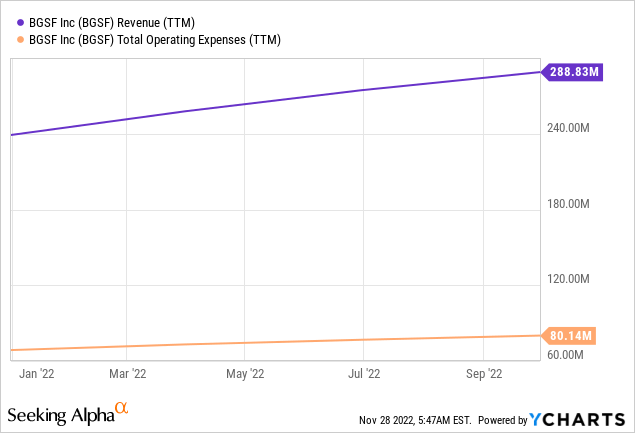

The financial situation of BGFS seems to be in good shape despite the consequences of Covid 19, although it requires some improvements to reverse the pandemic’s effects. Concerning the top line, revenues fell from $219.76M in 2019 to $207.13M in 2020. But as limits on Covid 19 were lifted, the company responded positively, and by 2021, its sales had increased to $239.03 million. I am confident that the company will meet or exceed its sales forecast of $290.60M because its year-over-year revenue increase is 69.64%, which is relatively healthy and backed by a positive industry outlook.

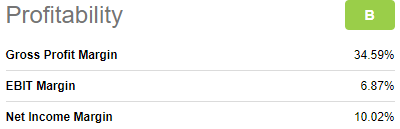

In terms of profitability, the company’s margins are appealing. They have a gross profit margin of 34.59%, an EBIT margin of 6.87%, and a net income margin of 10.02%.

Seeking Alpha

In my view, these margins are healthy, and to back up this claim; I am comparing the margins of the company to the industry medians. With industry medians of 29.20% and 6.74% in gross profit margin and net income margins, this not only makes the company’s profitability healthy but also very impressive in relation to its peers. In addition, the company has a return on total assets of 19.39% compared to an industry median of 5.29%, further confirming how efficient the company is in relation to its peers.

In general, the company’s healthy profit margins result from the high and growing revenues compared to its low total operating expenses.

Moving to the balance sheet, the company has a debt of $30.18M which is 0.22X their market cap of $139.70M. The low debt leaves the company deleveraged, which I believe is very healthy, especially when inflation is high and a recession is very likely in 2023.

Generally, BGSF’s financial status is healthy, but they need to improve liquidity and cash flows. First off, with a cash balance of $44.51K, the company comes up approximately short on an equivalent amount to meet its total operating expenses of $80.1M [TTM]. This figure explains how important it is for the company to work on its liquidity. Additionally, its cashflows are negative, but cashflows from investment. I believe the cash flows are negative due to the high outflow used to cope with Covid 19. I am confident the situation will improve and boost the company’s liquidity.

One More Thing: A Strong Q3 2022

Looking at the company’s Q3 results, they lend credence to my bullish case. Below are some of the major highlights of the quarter.

- According to BGSF’s quarterly report for 2022’s third quarter, the company’s success thus far has carried over from the year’s first half. For the third quarter, they recorded record revenues of $78.5 million, an increase of 22.3% year over year.

- In addition to year-over-year gains, both sectors grew between Q2 and Q3. Real estate sales rose 11%, and professional sales rose 3%. IT and Momentum Solutions grew double-digit in the professional market.

- Gross profit rose 27% year-over-year to $28 million due to revenue growth and increased spread in all sectors. Total gross profit rose 140 bps to 35.7% of revenue.

- Selling, general and administrative expenses improved by 60 bps to 26% of revenue. SG&A climbed $3.3 million or 19.5%, which lagged sales growth. Third quarter net income from continuing operations was $4.7 million or $0.44 per diluted share, up from $3.7 million or $0.36 per diluted share last year. ’21 net income included a $974k gain from contingent consideration.

- The company’s continuing operations generated $17.4 million in adjusted EBITDA, or 7.9% of revenue, up from $9.9 million, or 5.8%, in the prior year. Effective tax from continuing activities was 24.5% year-to-date, up from 17.9% a year ago.

Above are some of the major highlights of the Q3 results. Besides the solid financial results, the company expressed optimism that the market is favorable and especially the real estate sector. Following the increasing demand for contract employees, which is very competitive, the company is offering avenues to reskill its employees to remain competitive in the market. This move will guarantee them loyalty from their clients by providing very skilled and competent employees. Given this information, I concur with the management that they will remain competitive and reliable. This move further supports my bull argument.

Conclusion

The effects of Covid 19 on BGSF were felt in the company’s finances and stock values. Covid 19 was a significant setback for the corporation, but post-Covid, sales, and share prices have been rising, especially since October of this year. The company’s current financial situation is healthy, but some aspects, such as liquidity, require improvement. Considering the bright future of this sector, I have faith in the company’s ability to expand successfully. As a concluding point to my bullish thesis, I would like to call the attention of investors to the prosperous third-quarter performance. The encouraging outcomes provide credence to my bullish thesis, and as such, I am giving the business a buy recommendation.

Be the first to comment