Drew Angerer

Mr. Market loves disruption. I will go out on a limb to say that investors love disruption more than anything else – not even years of solid financial performance can receive the same love disruption enjoys. I don’t consider this love story between investors and disruption a good thing, but nor do I look down on this relationship. As a growth-oriented investor, all I know is that I need to acknowledge this market characteristic to hopefully exploit some market anomalies in the future.

Beyond Meat, Inc. (NASDAQ:BYND) made waves in the market in 2019 when it debuted, and its stock price shot up from just $25 to $235 in less than three months. Reason? The market loves disruption! Beyond Meat is a company that promised – still does – to revolutionize the global food industry and the way we consume proteins. As John Eldredge once said, every story has a villain, and when it comes to the love story between disruptive companies and Mr. Market, the villain is a slowdown in growth/adaption.

Even though Beyond Meat is not the only company under pressure because of investors abandoning high-growth stocks this year, the demand for its plant-based meat substitute category has stalled and competition is increasing. The company’s biggest challenge is that customers perceive alternative meat protein as premium products, and with inflation running high, consumers are cutting back on what they consider to be premium products. In addition to supply-chain issues and high input costs, stalling demand can continue to hurt the company’s profitability. Beyond Meat’s partnerships with big franchises and restaurants are also not producing healthy returns at the moment for us to believe that Beyond Meat will fight inflation admirably.

Beyond Meat was founded in 2009 by Ethan Brown to revolutionize the meat supply chain and offer a portfolio of groundbreaking plant-based meats that are good for people and the environment. The company sells plant-based beef, meatballs, ground meat, sausage links, and patties made from simple ingredients that are free of GMOs, hormones, antibiotics, and cholesterol. The company’s products are available in over 90 countries through supermarkets, mass merchandisers, and retail channels, as well as restaurants and food service outlets. As of June 2022, Beyond Meat branded products were available in about 183,000 retail and food service establishments globally. The company is the first-mover in many of its target markets and so far has been able to maintain a dominant market position in many of its key markets by partnering with McDonald’s Corporation (MCD), KFC, Pizza Hut, and Taco Bell. However, as plant-based alternatives transform the food sector, major retailers and restaurant chains have begun to experiment with meat-substitute products as well, bringing much-needed competition to this sector.

After revisiting Beyond Meat, I believe the company has a chance to dominate the plant-based meat market in the long run, which should open the doors for Beyond Meat to reward its shareholders handsomely. There are a lot of questions to be answered, however, as the company is yet to show evidence of long-lasting competitive advantages that stem from its first-mover advantage. I do not believe this is the right time to invest in BYND stock.

The plant-based meat sector enjoys multiple tailwinds

Covid-19 has accelerated the pace at which individuals are becoming concerned about their health, and as a result, the food industry is seeing several changes in dietary choices. Consumer lifestyle choices, living standards, and diets are changing, and the food industry is making a long-term shift toward healthier, eco-friendly products. One such movement is alternative meat, which has grown in popularity in recent years as more people choose not to support industrialized animal agribusiness. In addition to animal cruelty, meat production contributes significantly to greenhouse gas emissions since animals require large amounts of land and water, and cattle are noted as methane emitters. According to the United Nations Food and Agriculture Organization, animal agriculture is responsible for 14.5% of global greenhouse emissions, with beef and dairy livestock accounting for 65% of those emissions. As a result, more consumers are moving to vegetarian or vegan products.

Alternative meat is often known as “plant-based” meat because it is made from plant protein and does not contain any other animal products. New entrants in the plant-based meat market are developing faux meat products with improved smells, texture, extended shelf life, and high nutritional content. By offering the flavor of the meat while simultaneously providing nutritional benefits from plants, alternative meat provides consumers with the best of both worlds. Another factor driving the expansion of plant-based foods is the rise of animal protein allergies. According to Research & Markets, the worldwide meat substitute market is predicted to reach $234.7 billion by 2030, growing at a compounded annual growth rate of 42.1% from 2022 to 2030.

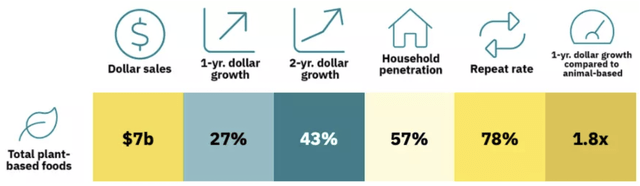

Exhibit 1: Plant-based food market sales data (2021)

Good Food Institute

Source: Good Food Institute

People’s dietary preferences will evolve as they get more familiar with plant-based items and new initiatives. Furthermore, limited resources, rising population, and the increasing risk of climate change necessitate considerable modifications in product design toward more sustainable and environmentally friendly options. According to Bloomberg Insights, meat alternatives will make up a significant share of the plant-based product market by 2030, increasing from $4.2 billion to $74 billion over the next 10 years. The “meatless meat” market has a lot of room to grow with rising demand for healthy and clean-label products and increased R&D investments.

Losses continue to accumulate while the future looks challenging

With its IPO in 2019, Beyond Meat quickly established itself as the industry leader in plant-based meat substitutes. Before 2021, the company’s sales were expanding at triple-digit rates, but this has slowed significantly due to rising prices, and Beyond’s plant-based meats remain expensive compared to traditional meat. As a result, the company reported a larger-than-expected second-quarter loss and management slashed the guidance for the full year as well.

On August 4, the company announced its second-quarter results, reporting a loss of $1.53 per share against the expected loss of $1.18 per share. Revenue in Q2 came to $147 million, a decrease of 1.6% year-over-year owing to the sale of inventory to liquidation channels and list price reductions in the EU, changes in foreign exchange rates, and increasing trade discounts. The company reported a gross loss of $6 million. Beyond Meat also stated that low sales of Beyond Jerky, a shelf-stable product launched in collaboration with PepsiCo, Inc. (PEP), have resulted in lower profit margins.

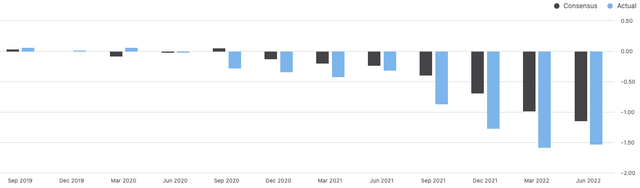

Exhibit 2: The streak of earnings misses

Seeking Alpha

Source: Seeking Alpha

The company slashed its sales forecast as its operational environment remains impacted by continued economic challenges such as inflation, supply chain interruptions, rising interest rates, and concerns about a potential recession. Beyond Meat cut its sales outlook for 2022 to between $470 million and $520 million, a 1% to 12% year-over-year increase from the earlier estimate of $560 million to $S620 million, a 21% to 33% increase. Beyond aims to reduce its staff by 40, or around 4% of its workforce, to cut costs. This is projected to save approximately $8 million on an annual basis.

Partnerships that look better on paper than in action

In early 2021, McDonald’s and Beyond announced a three-year agreement. McDonald’s launched McPlant burgers made of Beyond Meat’s patties that are now available in several countries, including Sweden, Denmark, Austria, the Netherlands, and the United Kingdom. However, a McDonald’s McPlant test in the U.S. revealed that the demand for the Beyond burger in the domestic market is low. According to analysts, McPlant sales were disappointing. Beyond Meat CEO Ethan Brown stated in May that McPlant is doing well in the United Kingdom and Austria, but this does not appear to be appealing to investors.

Beyond Meat also collaborates with Yum! Brands, Inc. (YUM) to co-develop alternative meat products for exclusive menu items in Yum’s restaurants. Beginning this year, the company debuted in KFC restaurants owned by Yum and said on January 5 that plant-based chicken nuggets would be available on menus by mid-month, which moved the stock marginally higher back then. KFC was the first national U.S. fast food restaurant to introduce plant-based chicken to consumers in a limited test run in August 2019 in collaboration with Beyond Meat, and the collaboration was expanded to several other cities in 2020. However, CNBC recently reported that Yum’s Taco Bell is testing a proprietary, plant-based meat alternative, in Birmingham, Alabama. This pilot program is the chain’s third test of protein alternatives, and it also demonstrates that the co-development agreement with Beyond Meat is not yielding the desired positive results.

In the ideal scenario, Beyond Meat would have been able to leverage these partnerships to build on its first-mover advantage. However, this does not seem to be the case today.

Takeaway

Beyond Meat’s stock has been volatile this year due to lackluster financial performance, declining demand amid inflationary pressures, failing partnerships, increased competition, and pessimism toward growth stocks. Although the plant-based meat market appears to offer enticing investment opportunities, Beyond Meat’s future remains highly unpredictable. Beyond Meat has failed to convince me of its ability to dominate the plant-based meat market for long enough to enjoy financial rewards, and for this reason, I will not be investing in the company today.

Be the first to comment