Drew Angerer

In our previous article on Beyond Meat (NASDAQ:BYND), published in May, we have highlighted three reasons to avoid the stock.

These three reasons were:

1.) Financials: declining revenue, margin contraction, increasing net loss

2.) Overvaluation, based on the P/S multiple

3.) Diluting shareholders by share issuance

Now, three months later, we reiterate our sell rating on the stock, despite the sharp stock price increase in the last three months.

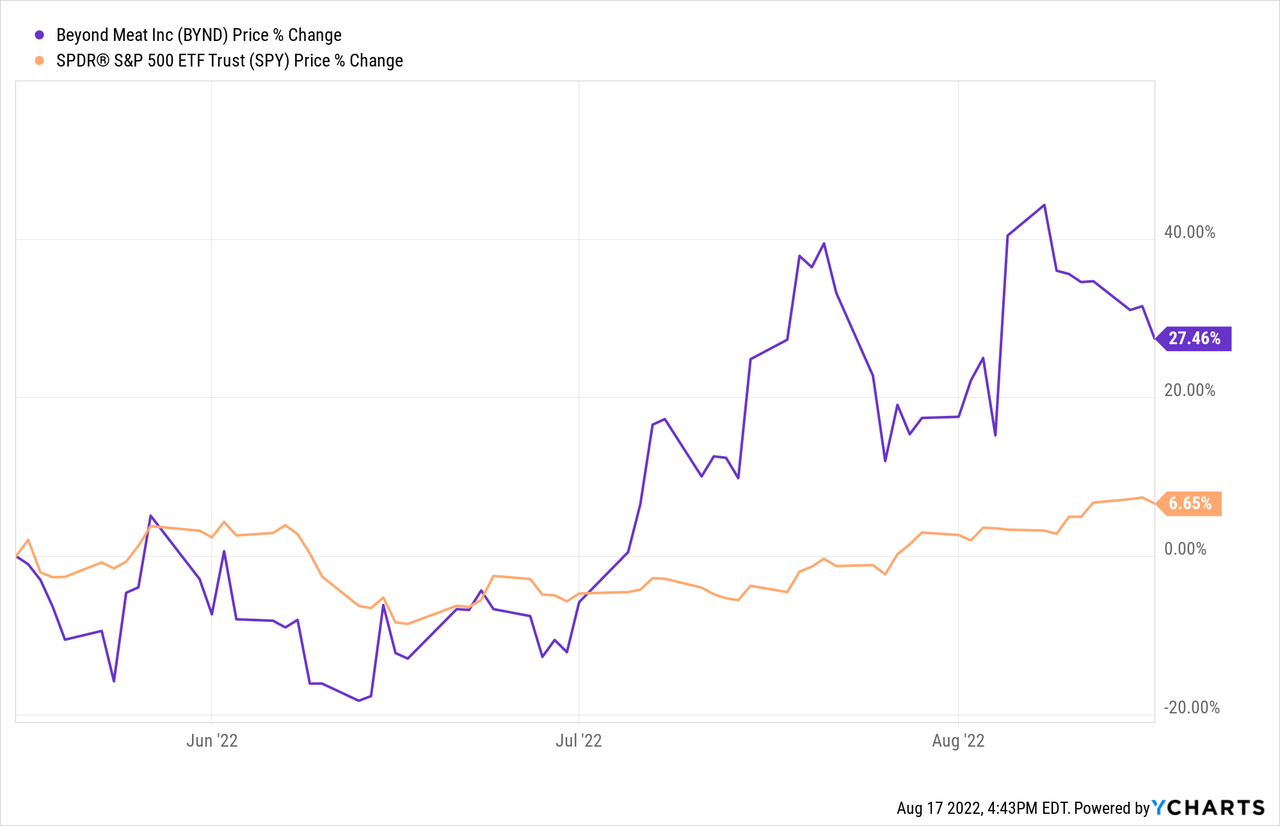

While year-to-date the stock is still down by almost 50%, in the previous 3-month period the market value of BYND has increased by more than 27%, substantially outperforming the S&P500.

We believe that this sharp price increase is not justified and in this article we will elaborate on why we maintain our sell rating on the stock.

Let us start with the latest quarterly results.

1.) Second quarter financial results

Beyond Meat has reported quarterly results earlier in August. The reported figures were however below expectations.

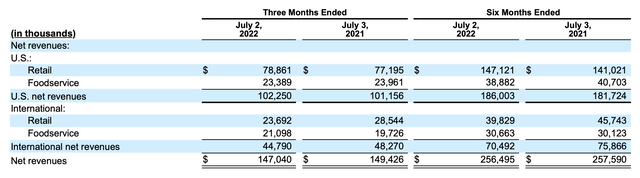

Net revenue has kept declining both on a “three months ended” and “six months ended” basis.

Revenue (Beyond Meat)

The primary driver of the revenue decline was the foodservice segment in the United States and the retail segment internationally.

In our opinion, the weakening consumer sentiment contributes also significantly to the declining demand. Consumer confidence is a leading economic indicator, which is often used to predict potential changes in the spending behaviour of consumers. A low consumer confidence is normally expected to impact the demand for durable, discretionary, non-essential items. Food products are normally not impacted. However, we believe that the case is slightly different for Beyond Meat. BYND’s products are niche and relatively expensive. Also, there is a wide range of alternatives that people can choose from. The switching costs are low and as BYND is a relatively new firm with new products, customer loyalty is not so strong yet. We believe that for these reasons, consumers are likely to switch to lower cost alternatives, in order to save more in times of uncertainty.

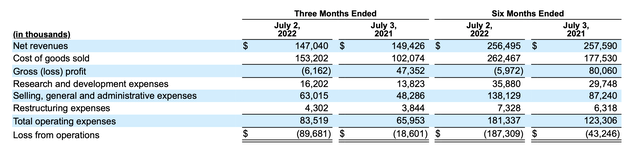

Together with the declining revenue, costs have skyrocketed, resulting in a substantially higher loss from operations than in the year ago quarter.

Results of operations (Beyond Meat)

Cost of goods sold and selling, general and administrative expenses were the primary drivers of the cost increase.

Although SG&A is expected to increase in a growing company, we believe that combined with the declining revenue it is quite concerning. On the other hand, the firm is aiming to take actions to reduce these costs in the rest of 2022:

We expect SG&A expenses for the remainder of 2022 to decrease from the levels in the first half of 2022, as we focus on reducing and optimizing non-people expenses. On August 3, 2022, we announced a reduction-in-force affecting approximately 4% of our global workforce. The reduction-in-force is expected to result in total annualized savings of approximately $8 million, excluding one-time separation costs of approximately $1 million, which we expect to incur in the third quarter of 2022.

Cost of goods sold has been impacted and likely to be impacted in the future by a wide range of factors:

Subject to the ultimate duration, magnitude and effects of COVID-19, inflationary pressures and other factors impacting our business, we continue to expect that gross profit improvements will be delivered primarily through improved volume leverage and throughput, reduced manufacturing conversion costs, greater internalization and geographic localization of our manufacturing footprint and finished goods, materials and packaging input cost reductions, tolling fee efficiencies, end-to-end production processes across a greater proportion of our manufacturing network, scale-driven efficiencies in procurement and fixed cost absorption, diversification of our core protein ingredients, product and process innovations and reformulations, cost-down initiatives through ingredient and process innovation and improved supply chain logistics and distribution costs. We are also working to improve gross margin through ingredient cost savings achieved through scale of purchasing and through negotiating lower tolling fees. We intend to pass some of these cost savings on to the consumer as we pursue our goal to achieve price parity with animal protein in at least one of our product categories by the end of 2024.

All in all, we believe that the current macroeconomic environment, including rising inflation and declining consumer confidence, is creating significant headwinds for BYND’s business. Beyond Meat is not only struggling on the demand side (declining revenue), but is also facing difficulties on the cost side (rising input costs, higher SG&A expenses). In our opinion, these headwinds are likely to remain for the rest of 2022 and continue to affect the firm’s performance negatively.

2.) Disappointing McPlant test results

One of Beyond Meat’s most promising collaborations was thought to be firms potential partnership with McDonald’s (MCD), which was expected to potentially boost sales volumes. However, according to recent news, the test did not go as well as previously hoped.

“We believe that McDonald’s … has broadly discontinued its US test of the McPlant burger,” analyst Ken Goldman, who has an Underweight rating on BYND, wrote in a note.

McPlant has been tested at 25 locations across North America. None of these locations have McPlant on the menu anymore. The main reason cited for removing the product from the menu was the lack of interest and low sales volumes.

Several analysts have even admitted that initial expectations were just probably too high:

“Our recent franchise checks indicated the McPlant market tests at McDonald’s were disappointing, coming in at or below the low-end of sales projections, and the product won’t be launched nationally in the second-half of the year,” BTIG analyst Peter Saleh told clients on Thursday. “Given this development, coupled with slowing category sales and declining selling price, we believe management’s sales guidance and our initial estimates were just too high.”

McDonald’s has also not confirmed any of its plans for the McPlant so far.

3.) Disappointing partnerships

Beyond the MCD partnership, there are several other possibilities for potential fast-food partnerships, including an alternative-meat deal with Yum! Brands (YUM). However the partnership with Yum also appears to be progressing slowly and not as successfully as initially predicted.

Notably, KFC’s chicken nugget rollout was delayed and Taco Bell has yet to test BYND’s carne asada in a single restaurant after the fast-food chain was reported to be dissatisfied with samples.

The newly emerging vegan products of rivals like Hormel (HRL) could also be troubling for Beyond Meat in the years to come. In our view, the increasing competition from well-established players with well-recognized brands is one of the primary risks that could affect BYND’s sales. A failure to effectively differentiate their products could have long term consequences for the firm.

We believe that due to the lack of demand for their products and the not-so-successful partnerships, the bullish thesis on BYND’s stock is rather weak. One could ask, what would be needed that our view on the firm became more bullish? For a company like Beyond Meat, we would like to see that the demand for their products is growing – meaning, steadily increasing sales volume and increasing revenue. We would like to see that they can effectively differentiate their products from their competitors and prove that they have advantages in certain areas. If partnerships with large fast-food chains improved and the firm could profit from these partnerships, it would be also a positive indication that the firm is moving to the right direction. An improvement in consumer confidence may also give some boost to the firm’s financial performance. Unfortunately, right now, we do not see any of these signs.

Key Takeaways

Declining revenue, and widening loss from operations are concerning, especially in the current macroeconomic environment.

The so-far disappointing partnership results with MCD and YUM are making the bullish thesis on this “growth” stock rather weak.

For these reasons we reiterate our “sell” rating.

Be the first to comment