Kirill Smyslov/iStock via Getty Images

The price of oil has rallied to a 13-year high level thanks to the tight supply from OPEC and the recent invasion of Russia in Ukraine. As OPEC seems unable or unwilling to cover the current deficit between global oil demand and supply, North American oil producers are likely to grow their production significantly in the upcoming months. As Precision Drilling Corp. (NYSE:PDS) generates the vast portion of its revenues from the U.S. and Canada, it will greatly benefit from such a development.

However, its stock price has more than tripled in the last 12 months while the company is also facing some secular headwinds. Therefore, investors should be aware of the risk of PDS stock before purchasing it.

Business overview

Precision Drilling offers drilling rigs and services to onshore producers of oil and gas. The company generates the vast portion of its revenues in the U.S. and Canada. More precisely, 44% of its rig utilization days come from the U.S., 50% of its rig utilization days come from Canada and the remaining 6% come from international markets.

Precision Drilling has incurred excessive losses for seven consecutive years, with the exception of 2019, when the company posted a minor profit per share ($0.45). Notably, U.S. oil production kept climbing to new all-time highs during this period, with the exception of 2020 due to the pandemic. Investors are justified to wonder why Precision Drilling incurred hefty losses amid record U.S. oil production.

The reason behind this discrepancy is the great technological progress that has taken place in the production of oil. Thanks to this progress, oil producers are now able to extract more oil from a fixed number of wells. This is great for oil producers, but it provides a strong headwind to the business of Precision Drilling, which generates lower revenues at a given production level than it did in the past.

It is also important to note that North American oil producers have become much more conservative in their budgets in recent years. In the downturn of the energy sector that was caused by the collapse of the price of oil from $100 in mid-2014 to $26 in early 2016, some oil producers went bankrupt. Consequently, the survivors became much more conservative and tightened the budgets significantly, trying to operate within the limits posed by their cash flows. Their tight budgets provided another headwind to the business of Precision Drilling.

Fortunately for Precision Drilling, its outlook has greatly improved this year. Thanks to the tight supply from OPEC and the invasion of Russia in Ukraine, the price of oil has rallied to a 13-year high. This rally provides a strong incentive to North American oil producers to boost their production. Indeed, the active rig count in the U.S. and Canada has consistently increased for several weeks in a row. This trend will greatly benefit Precision Drilling, whose revenues are strongly tied to the underlying drilling activity.

As long as the conflict between Russia and Ukraine remains in place, the oil market is likely to remain tight and hence the oil price will remain elevated. In other words, as long as Russia and Ukraine fail to put a stop on their bleeding process, Precision Drilling will enjoy favorable business conditions and may finally become profitable, after seven years of poor results.

On the other hand, the ongoing war is devastating for both Russia and Ukraine. The U.S. and Europe have imposed so many sanctions to Russia that the indirect cost of the war is devastating for the economy of Russia. In addition, the country is facing unexpected resistance from Ukraine and thus the daily death toll and the direct cost of war are too high. The war is devastating for Ukraine as well, as some cities have been destroyed and many people have been killed. As a result, one can reasonably expect the two countries to end the war at some point this year, either promptly or towards the end of the year in the most pessimistic scenario.

Whenever the war comes to an end, the global oil market will become much healthier than it is now, as barrels from Russia will begin to flow with much fewer restrictions while the U.S. and Canada will have increased their production levels amid favorable prices. Moreover, the oil market is infamous for its high cyclicality. Whenever the price of oil is high for a considerable period, some producers raise their output and lead total supply to exceed demand at some point, thus initiating a downcycle. As there has been no exception to this rule in the history of the oil market, it is reasonable to expect history to repeat itself in this case as well.

Analysts seem to agree on this view. Despite the rally of the oil price this year, they still expect Precision Drilling to post a loss per share of -$2.87 this year. As there is always a lag between oil prices and drilling activity, analysts essentially imply that the increase in drilling activity expected later this year will not be sufficient to offset the losses of Precision Drilling in the first half of the year.

On the bright side, analysts expect Precision Drilling to turn a profit per share of $0.95 next year. However, such a profit is too low to justify the current price of the stock. To be sure, Precision Drilling is currently trading at 74.4 times its expected earnings in 2023.

Of course, if the price of oil remains around its current level for years, it will provide a great incentive to North American oil producers to boost their drilling activity. In such a case, Precision Drilling will probably achieve much greater profits beyond 2023. However, as mentioned above, the price of oil has never remained at such high levels for years due to the cyclical nature of the oil market. Therefore, investors should not base their investing thesis on an extremely bullish scenario, which has never materialized in the history of the oil market.

Debt

Precision Drilling carries a significant amount of debt. On the bright side, the company has drastically cut its capital expenditures in the last five years. Its average annual capital expenses in 2017-2021 have amounted to only $97 million. This amount is 86% lower than the average annual capital expenditures of $677 million in 2012-2015. As a result, the company has posted positive free cash flows for five consecutive years.

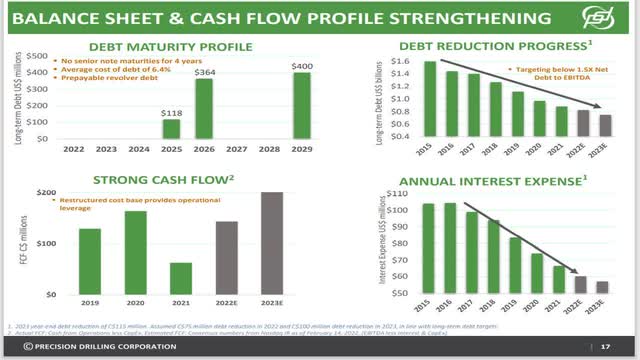

The benefit from the positive free cash flows is evident below:

Precision Drilling Debt (Precision Drilling Presentation)

According to its financial statements, Precision Drilling has reduced its long-term debt from $1.9 billion in 2015 to $1.1 billion and its annual interest expense from $146 million in 2016 to $91 million now.

However, the company still has a long way to go to render its balance sheet strong. Its net debt (as per Buffett, net debt = total liabilities – cash – receivables) currently stands at $1.2 billion. This amount is 125% of the market capitalization of the stock and hence it is undoubtedly high. As long as the price of oil remains high, Precision Drilling is likely to continue servicing its debt without any problem. On the other hand, whenever the next downcycle of the oil price shows up, Precision Drilling is likely to be vulnerable due to its material debt load.

Moreover, the drastic cuts in capital expenses in the last five years signal that the company has hardly invested in its business during that time. This raises a red flag over the future prospects of the company, especially given the aforementioned secular headwinds.

Final thoughts

The rally of the price of oil to a 13-year high is ideal for the business of Precision Drilling, as it will significantly increase drilling activity in the U.S. and Canada. However, the stock of Precision Drilling has more than tripled in the last 12 months. Moreover, the company is facing some secular headwinds, which are likely to return to the front stage whenever the war between Russia and Ukraine comes to an end and global oil supply stabilizes. Overall, the stock seems to have much greater downside than upside in the long run.

Be the first to comment