CHUNYIP WONG

Blackstone (NYSE:BX) is among the world’s most successful money managers but keep in mind that success in that world is not determined by the returns provided to investors, but rather by the magnitude of AUM.

Blackstone’s 2Q22 earnings conference call revealed a company hellbent on raising AUM at all costs. They utilize a discrepancy in performance reporting between private and public to suggest an extraordinary amount of alpha to the tune of 3000 basis points. Fundamentally, however, their real estate fund performance was probably about in-line with public REITs.

Based on the tone of the call they seem to be making hay while the sun is shining – using the temporary alpha as a means to pump inflows. It is working as per the conference call where Jonathan Gray said:

“overall in retail, we had $15.5 billion of inflows, very remarkable. In the 3 products, primarily BREIT and BCRED”

This article is a warning that now is a terrible time to invest in BREIT, BCRED or most private real estate vehicles. Frankly, public REITs are a much better investment right now. I Will elaborate further below, but to summarize this argument consists of 3 premises

- The alpha achieved at BREIT is misleading and will almost certainly reverse

- Private real estate is consistently at NAV

- Public real estate is at a deep discount to NAV

Once fully fleshed out, I will demonstrate that these premises suggest public REITs will outperform private real estate vehicles going forward.

Misleading alpha presentation

Stephen Schwarzman on Blackstone’s 2Q22 earnings conference call.

“In real estate, while the public REIT index fell 17% in the quarter, our Core+ funds were up 2.3%. I’ll do that again for you. The index is down 17%, we were up 2.3%.”

He went on to brag

“For the first 6 months of the year, our real estate strategies appreciated 9% to 10% versus a 20% decline in the REIT index, equaling an outperformance of roughly 3,000 basis points. I don’t know many asset classes that outperform indexes by 3,000 basis points.”

Wow 3000 basis points in 6 months is amazing.

Here’s the problem….

This is not kosher performance reporting. It is apples to oranges.

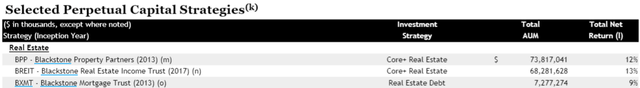

He is comparing the NAV and dividend return of BREIT to market price movement of public REITs. If one digs into the supplemental, the performance is more precisely disclosed. The table below shows BREIT with a 13% annualized return since 2017, but more importantly, it has a footnote L.

BX

Footnote L says the following:

“Unless otherwise indicated, Total Net Return represents the annualized inception to June 30, 2022 IRR on total invested capital based on realized proceeds and unrealized value, as applicable, after management fees, expenses and Performance Revenues. IRRs are calculated using actual timing of investor cash flows. Initial inception date of cash flows occurred during the Inception Year”

The key part of this footnote is that performance is realized proceeds and unrealized value. That means they are valuing the real estate owned by these funds at some sort of calculated value such as an NAV.

I think this approach for valuing their own funds is reasonably fair. For the most part, NAV can be calculated to some degree of accuracy using net operating income (NOI) which is a known figure and cap rates of comparable transactions which is known within a range.

So I fully believe that BREIT generated a 9-10% return in the first 6 months of 2022 as suggested by Schwarzman on the call.

The problem comes with the unfair comparison to the REIT index. If you are using NAV as your basis of valuation you should use NAV for the comparison.

It is unfair to compare NAV to market prices and call that alpha because market prices float on whims, fears, and noise.

The implication of using this comparison and suggesting 3000 basis points of alpha is that BREIT’s asset selection is so vastly superior that their assets are winning while everything else is failing.

Well, if you use an apples to apples comparison it turns out the rest of the stuff is winning too.

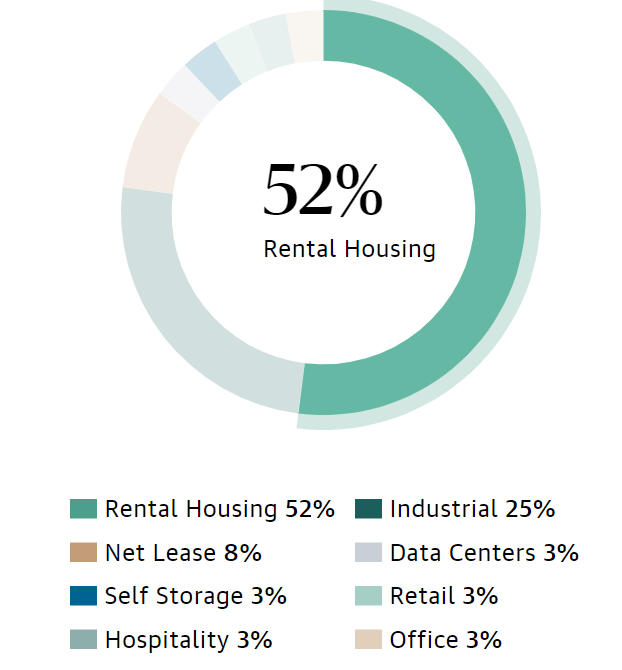

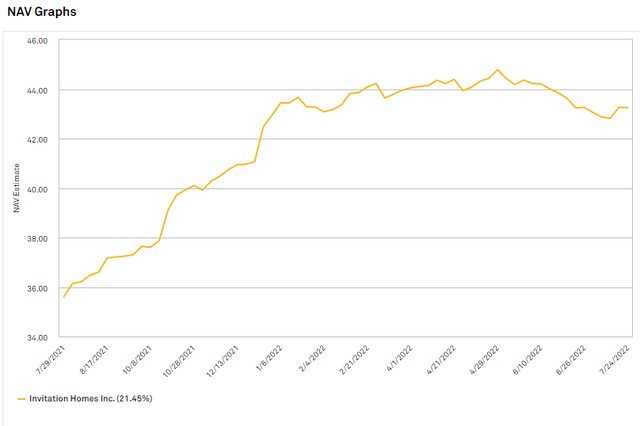

BREIT consists largely of rental housing and industrial properties.

BX

Let us take a look at the NAV of the publicly traded REITs in those sectors.

Rental housing consists of mostly apartments and single family rental. Apartment REITs have gained quite a bit of NAV due to rental rate increases. Camden (CPT), for example, has grown its NAV from about $130 to about $170.

S&P Global Market Intelligence

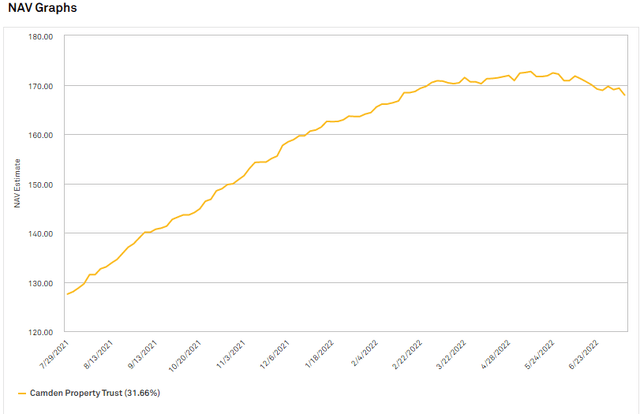

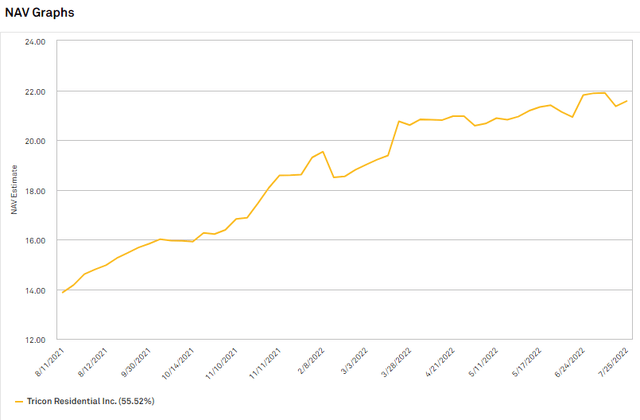

Single family rental REITs Invitation Homes (INVH) and Tricon Residential (TCN) have both gained significantly in NAV.

S&P Global Market Intelligence

S&P Global Market Intelligence

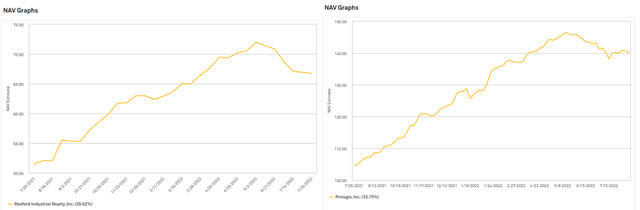

NAV increases are prevalent across the industrial sector too with Rexford (REXR) and Prologis (PLD) showing substantial gains.

S&P Global Market Intelligence

To me this looks like BREIT is performing in-line with its peers. Real estate is performing well. It doesn’t matter if it’s public or private. The only difference is the public real estate is colloquially measured by the fickle barometer of market price.

All the supposed alpha is just a matter of comparing NAV to market price. NAV to NAV there is not a substantial difference.

Going forward there is a difference

Private market real estate essentially auto-resets to be priced at NAV. When an investor buys BREIT, they are functionally putting their money into a pool that will eventually buy properties at NAV or slightly above NAV since there are some fees.

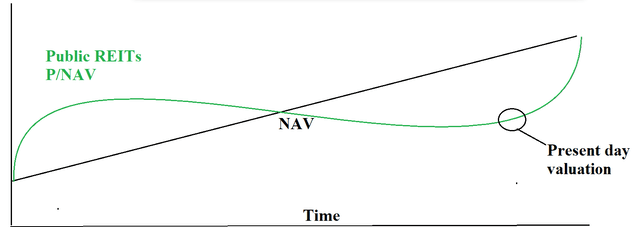

Public market REITs are priced at wherever market prices are.

If public REITs are below NAV they are a better deal than private and if they are above NAV they are a worse deal.

REIT market prices tend to track NAV over time, but due to the noise of the market can deviate by a significant amount in either direction.

Author Generated

It might be better to buy private real estate when publicly traded REITs are at a premium to NAV because then you can buy it at NAV. Today, however, it seems foolish to buy at NAV when REITs are trading at a huge discount.

The mean publicly traded REIT is priced at 82.5% of NAV and the median is 82.3%.

Why pay $100 plus fees with BREIT when you can buy similar properties for $82.30?

The irony of Blackstone’s BREIT pitch to raise AUM is that it is precisely the 3000 basis points of “alpha” that will cause BREIT to underperform public REITs going forward.

That alpha was nothing more than public REITs getting cheap and when public REITs inevitably return toward NAV they will claw back that performance.

Perhaps an even better approach is to buy heavily discounted REITs and then sell them to Blackstone at full price.

Buy the REITs that are about to get bought by Blackstone

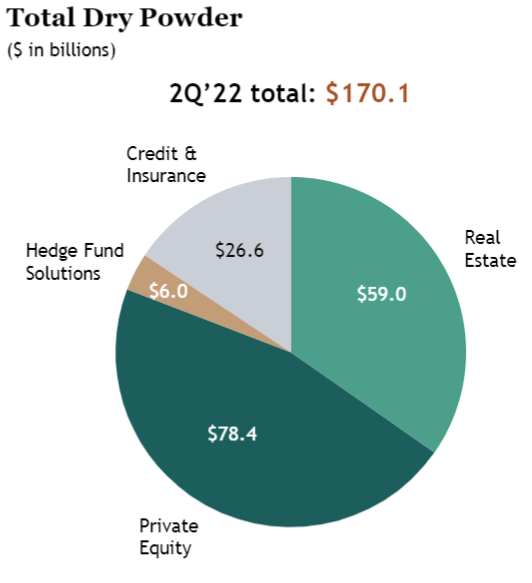

Blackstone’s capital raising has been so remarkably successful that their inflows are outpacing their acquisitions. This has left them with an unprecedented $170 billion of dry powder.

BX

$59 Billion of this is earmarked for real estate. They will be buying properties from REITs and in many cases straight up buying public REITs.

They already have bought quite a few REITs. Off the top of my head

- Public Storage Business Parks (PSB)

- Extended Stay America (STAY)

- Bluerock Residential (BRG)

- Preferred Apartment Communities (APTS)

- American Campus Communities (ACC)

- QTS Realty Trust (QTS)

More will almost certainly be bought. In each case, the target gets a nice premium over market price so it is much better to own the target than to be the buyer.

Based on Blackstone’s pattern of purchases in the past, these are the REITs that I think are most likely to be bought by Blackstone:

- Tricon Residential: Blackstone already has a toe-hold position in TCN.

- Apple Hospitality (APLE) and Chatham Lodging (CLDT): We know BX likes extended stay hotels.

- NexPoint Residential (NXRT), BRT Apartments (BRT), Independence Realty (IRT) and BSR REIT (OTCPK:BSRTF) appear to be next in line after APTS and BRG.

I particularly like NXRT, BRT, BSRTF, and TCN because these are fundamentally strong companies trading at attractive valuations that can deliver a strong return to investors with or without a buyout.

Clarification on thesis

I am bearish on BREIT, not necessarily bearish on Blackstone (BX). As an asset manager Blackstone benefits from the fee income generated by BREIT and its other vehicles. Even if those vehicles underperform going forward as I anticipate they will, BX can still perform well. Thus, I view BX as a hold and my warning is related strictly to private real estate vehicles like BREIT.

Be the first to comment