Chalabala

A Quick Take On Better Choice

Better Choice (NYSE:BTTR) went public in June 2021, raising approximately $40 million in gross proceeds from an IPO that priced at $5.00 per share.

The firm sells premium pet food and related animal health products through a variety of brands.

Until the firm can make meaningful headway to operating breakeven while retaining growth and improving its cash position and cash flow, I’m on Hold for BTTR in the near term.

Better Choice Overview

Tampa, Florida-based Better Choice was founded to develop and sell premium and super-premium pet food products through an omni-channel approach.

Management is headed by Chief Executive Officer Scott Lerner, who has been with the firm since January 2021 and was previously CEO of Farmhouse Culture and CEO of Kernel Season’s.

The firm sells its products through the following channels:

-

E-commerce

-

Brick & Mortar

-

Direct to Consumer [DTC]

-

International

The firm pursues an omni-channel approach in order to reduce channel conflict and meet prospective customers where they prefer to shop.

Better Choice’s Market & Competition

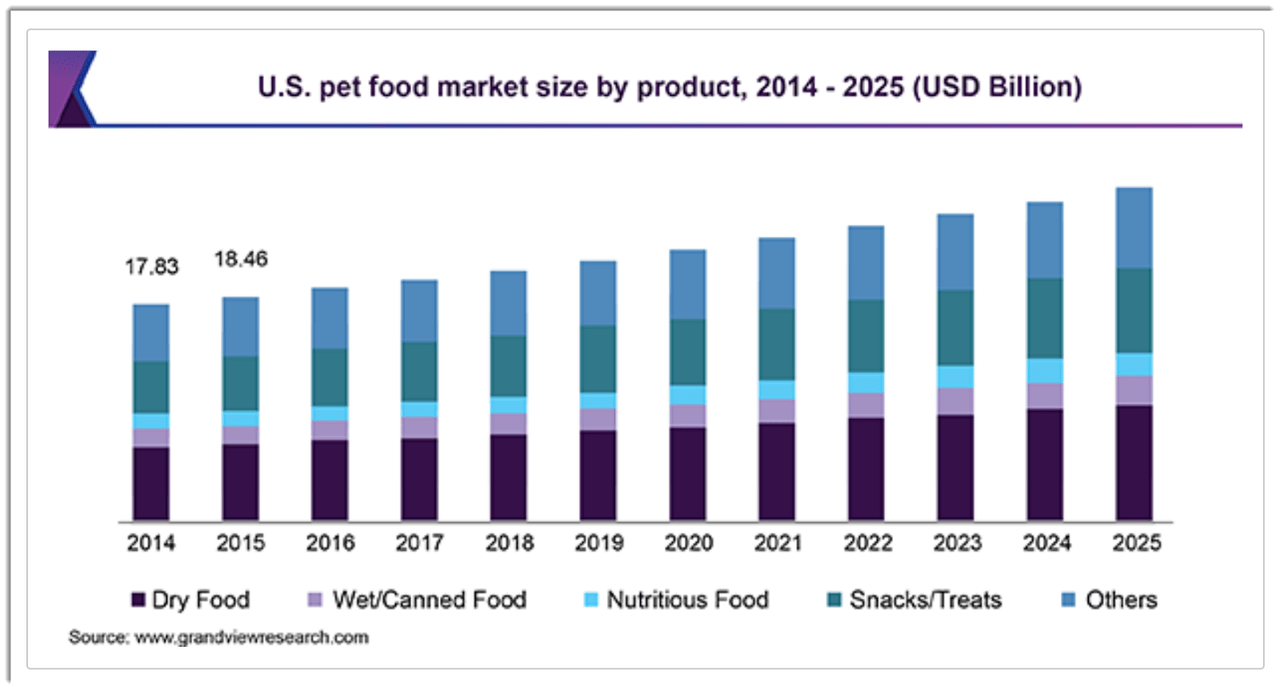

According to a 2019 market research report by Grand View Research, the global market for pet food of all types was an estimated $83 billion in 2018 and is forecast to reach $113 billion by 2025.

This represents a forecast CAGR of 4.5% from 2019 to 2025.

The main driver for this expected growth is an increasing awareness among consumers regarding pet food options for more natural products that can be healthier for their pets.

Also, below is a chart showing the historical and projected future growth trajectory of the U.S. pet food market by product type:

U.S. Pet Food Market (Grand View Research)

Major competitive or other industry participants include:

-

Mars

-

Nestle

-

Big Heart Pet Brands

-

Blue Buffalo

-

Wellness

-

Fromm

-

Orijen

-

Merrick

-

Stella

-

Chewy

-

I and Love and You

-

Freshpet

Better Choice’s Recent Financial Performance

-

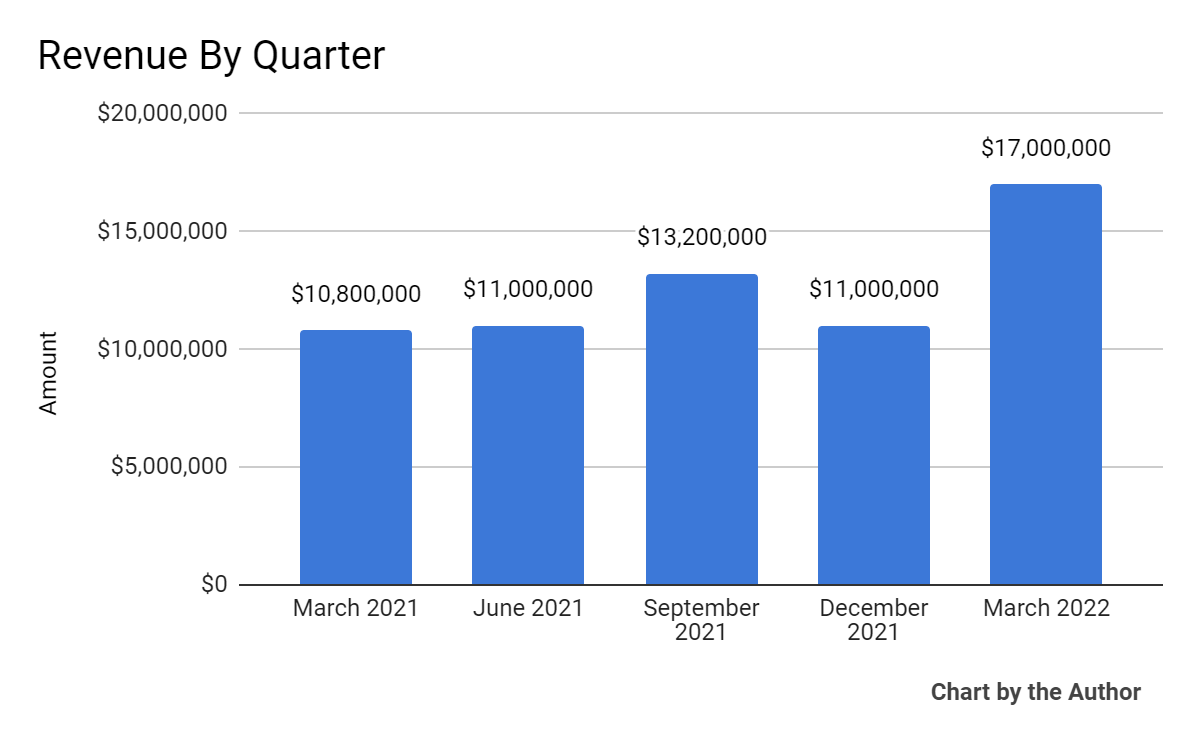

Total revenue by quarter has generally grown over the past 5 quarters:

5 Quarter Total Revenue (Seeking Alpha)

-

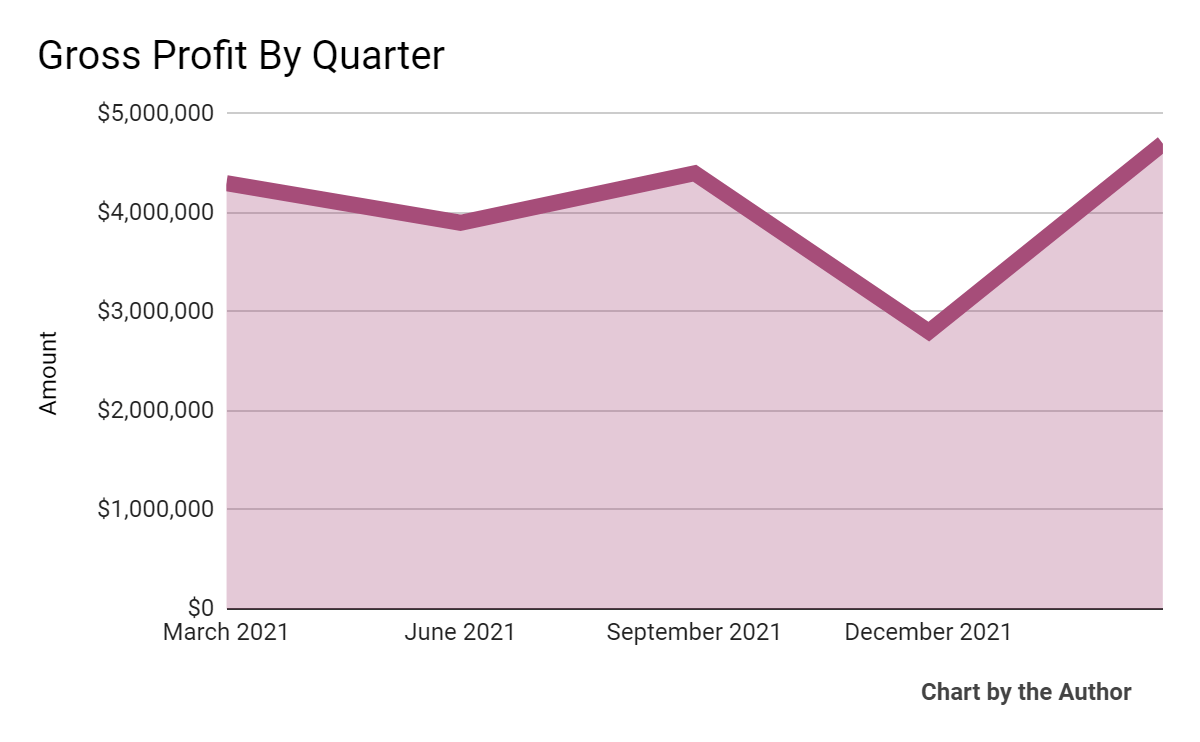

Gross profit by quarter has followed roughly the same trajectory as that of total revenue:

5 Quarter Gross Profit (Seeking Alpha)

-

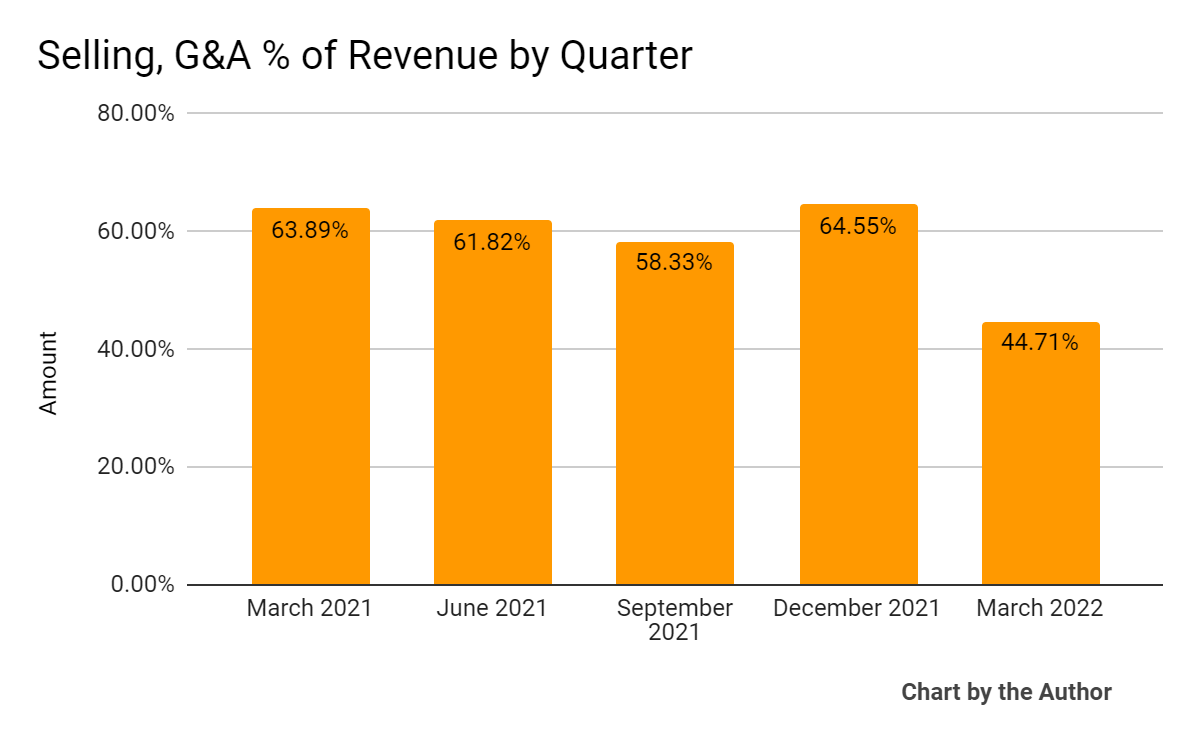

Selling, G&A expenses as a percentage of total revenue by quarter have trended lower as the chart shows here:

5 Quarter Selling, G&A % Of Revenue (Seeking Alpha)

-

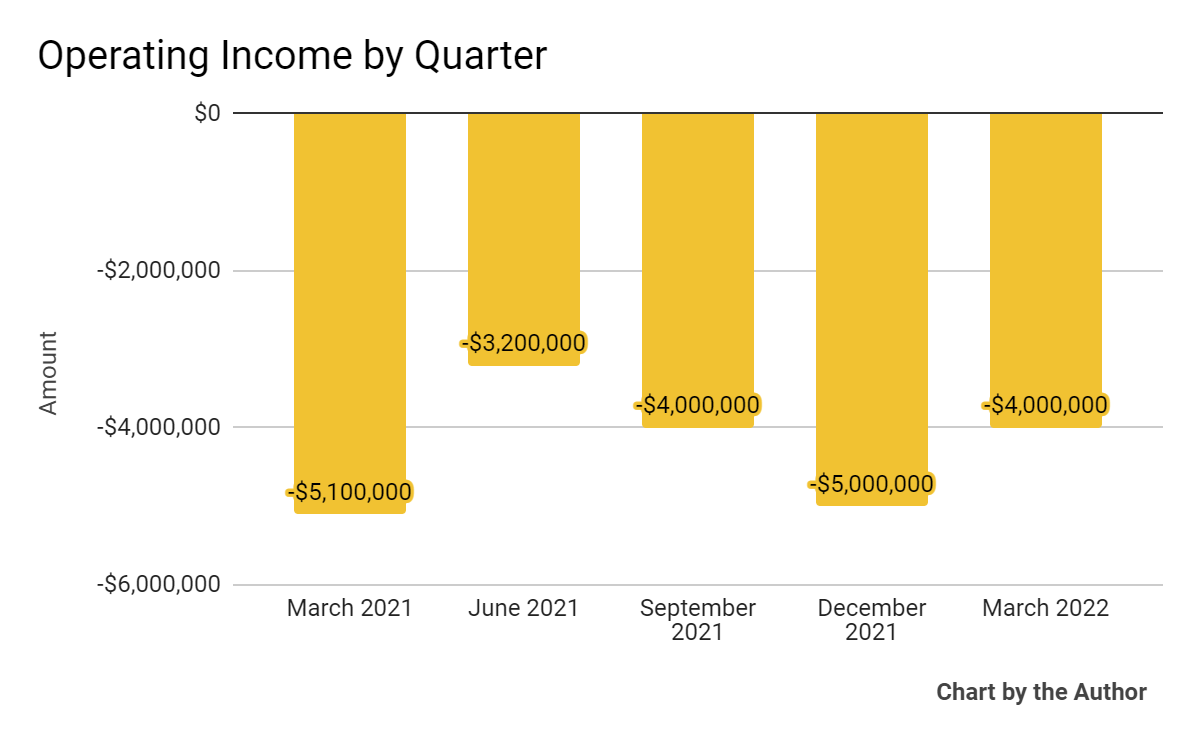

Operating losses by quarter have remained substantial:

5 Quarter Operating Income (Seeking Alpha)

-

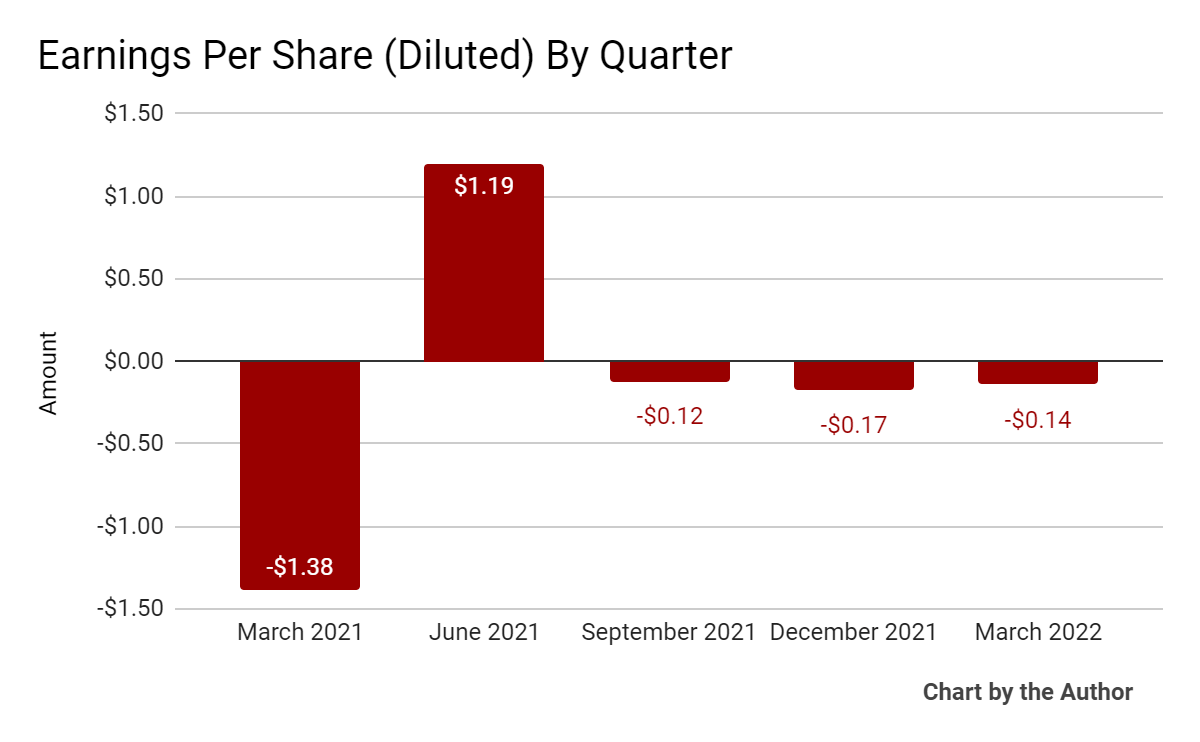

Earnings per share (Diluted) has remained negative in four of the last five quarters:

5 Quarter Earnings Per Share (Seeking Alpha)

(All data in above charts is GAAP)

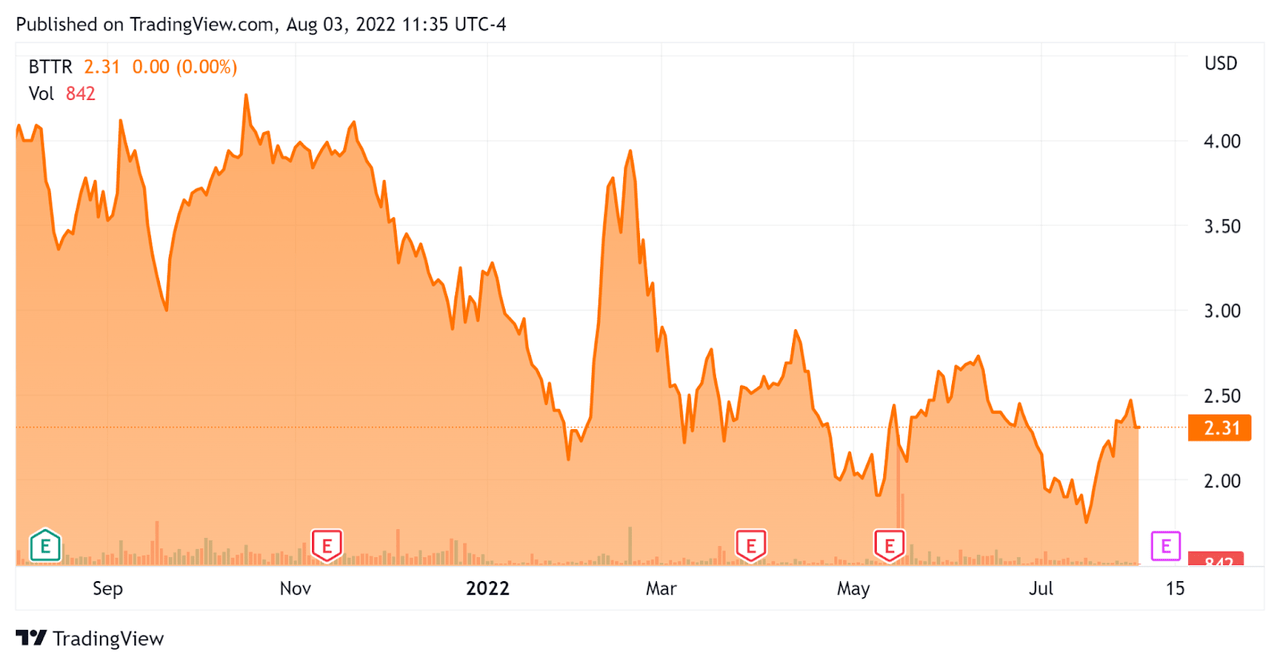

In the past 12 months, BTTR’s stock price has fallen 32.7% vs. the U.S. S&P 500 index’s drop of around 6.4%, as the chart below indicates:

52 Week Stock Price (Seeking Alpha)

Below is a table of relevant capitalization and valuation figures for the company:

|

Measure |

Amount |

|

Enterprise Value |

$64,000,000 |

|

Market Capitalization |

$67,830,000 |

|

Enterprise Value / Sales [TTM] |

1.23 |

|

Revenue Growth Rate [TTM] |

26.69% |

|

Operating Cash Flow [TTM] |

-$17,200,000 |

|

Earnings Per Share (Fully Diluted) |

$0.76 |

(Source – Seeking Alpha)

Commentary On Better Choice

In its last earnings call (Source – Seeking Alpha), covering Q1 2022’s results, management highlighted its growing relationship with Petco and Pet Supplies Plus purchasing its recently launched Halo Elevate products, driving revenue growth.

The company instituted price increases, which will become effective at the beginning of the second quarter to offset rising costs.

BTTR aims to reach $100 million in gross sales by 2023 by targeting the millennial pet parent through its omni-channel approach, an ambitious goal.

The firm aims to avoid competing in every pet category, succumbing to price pressures. Rather, management is focusing on ‘specific channels to prevent margin erosion across’ its portfolio of products.

Harmonizing its twin goals of reaching $100 million in sales in 2023 with a more targeted approach may be difficult.

As to its financial results, topline revenue grew to a record $17 million, while gross margin improved sequentially to 28%, from 25% in Q4, ‘without any benefit from price increases.’

However, BTTR continued to produce material operating losses, with no real move toward operating breakeven, so it’s no surprise the stock has been punished by the market.

For the balance sheet, the company ended the quarter with $23.4 million in cash, restricted cash and equivalents while using $7.9 million in free cash use as it increased inventories and spent on marketing initiatives.

Looking ahead, management sees ‘more normalized inventory levels in the back half of 2022’ and hopes to ‘collect cash from outstanding receivables’ to improve its cash position.

Regarding valuation, the market is currently valuing BTTR at an EV/Revenue multiple of 1.23x, which is less than online pet food retailer Chewy (CHWY) (1.85x) as a partial comparable.

The primary risk to the company’s outlook is a continued rise in wage and materials costs, although management says it has worked hard over the past 12 months on its supply chain.

A potential upside catalyst to the stock could include strong growth in its net sales.

However, the market continues to punish money-losing companies, even those that are growing quickly.

Until the firm can make meaningful headway to operating breakeven and improve its cash position and cash flow, I’m on Hold for BTTR in the near term.

Be the first to comment