Tast Nawarat/iStock via Getty Images

FOMC and Inflation

What is the Federal Open Market Committee (FOMC), and when do they meet? “Monetary policy” is constantly discussed in the news. The Federal Reserve (aka the Fed) is the central bank of the United States and controls the supply of U.S. dollars or money. A part of the Fed’s responsibility is to aid economic growth; adjust the money supply and interest rates; promote maximum employment and stable prices in pursuing economic goals.

While this month started strong, showcasing signs of economic growth with U.S. employers adding 390,000 jobs in May, it was still the slowest growth rate since April 2021. Wages in May saw an increase of 5.2% compared to the previous year, but:

“This being the “good news,” it also contributes to the “bad” news. The U.S. economy and the U.S. labor market are showing enough strength that the Federal Reserve System has enough justification to continue its push to fight the inflation in the economy,” writes Seeking Alpha Contributor John M. Mason.

Last week’s CPI figures showcased a year-over-year increase of 8.6% in May, up from 8.3% in April. The market has assumed that the Fed will continue with aggressive tightening, and it’s almost a foregone conclusion from the market’s perspective that the next three FOMC meetings (June 14-15, July 26-27, and September 20-21) will consist of 50-basis point hikes. Additionally, Reuters writes following a poll of Reuters economists, “No respite from Fed rate hikes this year, chances rising of four 50 bps in a row.” Given the recent CPI figures and economic outlooks, the U.S. Federal Reserve is likely to hike its key interest rate by 50 basis points in June, July, and possibly September. There’s an off-chance and fear of Fed Chair Jerome Powell reversing course with a 75-basis point hike back on the table. At the end of the day, gas and food prices are a nagging reality that is creating an even wider wage gap and negatively impacting low to middle-income earners, as they feel the effects at a much higher rate. The issues causing inflation and supply chain disruptions are the exhaustion of events like the pandemic and recent shutdowns in China and Asian countries. Then factor in the Russia-Ukraine war, as countries that depend on oil, agricultural goods, and food imports from both European nations are scurrying to find backup options. These are all exogenous events causing inflation in the U.S. that monetary policy can’t fix. However, the Fed feels it needs to continue tightening when perhaps it may not and has tightened enough. And while the need to control inflation or ramp down inflation is ever-present, the future tightening of monetary policy, in addition to the fiscal cliff that we just went off of in terms of government spending could lead to a recession. As Bloomberg’s headline puts it: Powell Facing Choice Between Elevated US Inflation and Recession. As such, we believe it’s key to consider stocks in recession-resilient sectors in the battle against inflation and the unknown as we move towards the next few FOMC meetings.

Top 3 Stocks to Buy In the Battle Over Inflation

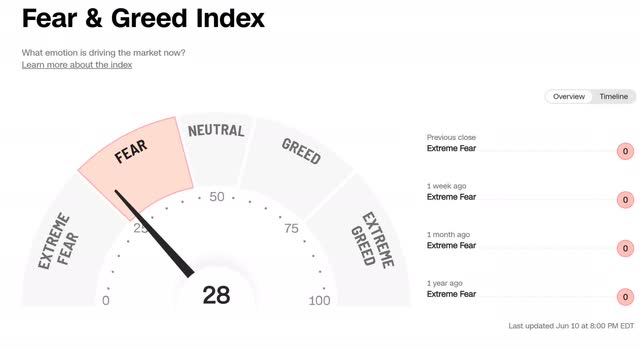

Fear in the markets is running rampant, as we’ve seen throughout the first half of 2022. The volatile market swings between fear and extreme greed have the pendulum moving, and following the most recent 40-year inflation high figures, intense fear has the markets down, ending the week with the S&P 500 -2.91%, NASDAQ -3.52%, and DOW JONES -2.73%. As of Friday and indicated in the fear & greed index below, fear is the emotion most driving market reaction.

Fear and Greed Index (CNN Fear and Greed Index)

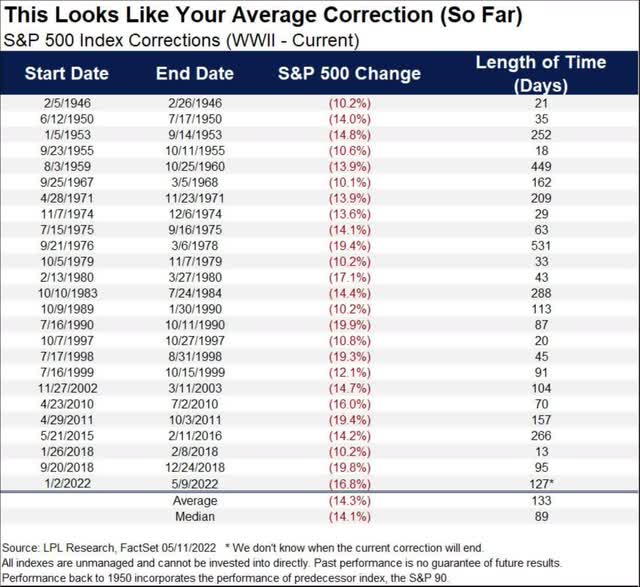

“If you’ve ever doubted that investing can feel like riding a rollercoaster, the last few years have likely made you a believer. Long, drawn-out climbs give way to sudden — sometimes terrifying — drops. Rinse. And, repeat. When one of those drops is between -10% and -19.9% from the recent high, markets are said to be in a ‘correction.'” -Taylor Muckerman, Seeking Alpha

S&P 500 Index Corrections (WWII to Current) (LPL Research, FACTSET)

As we look at the market data from LPL Financial above, the average S&P 500 correction lasted for 133 days, which we surpassed in May. Stock picks in the following sectors: commodities, including energy and agriculture, stand to benefit, given the macroeconomic backdrop, and should offer safety during uncertain times.

Top Energy Stock

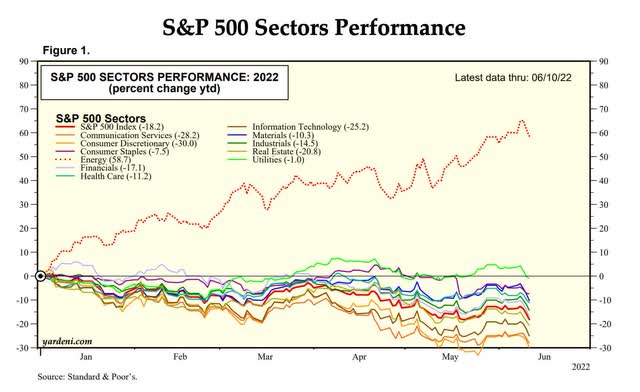

Energy stocks have substantially outperformed the broader market in the first half of 2022, as showcased in the chart below, with food, shelter, and fuel as the most significant contributors.

S&P 500 Sectors’ YTD Performance (Yardeni Research/Standard & Poor)

Tight fuel supplies and continued demand could make this a summer of pain, as gas is averaging $5/gallon, but still not high enough, according to Goldman Sachs, to curb demand. Although consumers are feeling the pain at the pump, companies like Valero Energy Corporation (NYSE:VLO) benefit from the crisis and the impacts of skyrocketing prices. As we hear about investors cashing in on the rally and the likes of Warren Buffett doubling down investments in oil in anticipation of a continued rise in prices, an interesting question among investors has arisen. Are oil stocks the new FAANGs? Only time will tell, and Seeking Alpha’s continued strong buy rating for Valero is why we believe it is a top energy stock for portfolios as we move toward FOMC decision days.

1. Valero Energy Corporation

-

Market Capitalization: $58.53B

-

Quant Rating: Strong Buy

-

Quant Sector Ranking (as of 6/10): 7 out of 250

-

Quant Industry Ranking (as of 6/10): 1 out of 23

Crude oil jumped to $122 per barrel early this month, and some declare that we are nowhere near fuel peaks. As fuel prices continue to rally, surpassing a national average price of $5.00 per gallon, it should be no surprise that our first stock pick is oil and gas refining company Valero Energy Corporation. Headquartered in San Antonio, Texas, Valero stands to benefit from high demand and even higher prices. The summer months are upon us with travel plans underway for many Americans, and Valero is also in a perfect position to capitalize on demand from its neighbor, Mexico. As I discussed in a recent article titled Best Energy On The Dip:

“The U.S. Energy Information Administration, despite its status as a large crude oil exporter, Mexico is a net importer of refined petroleum products. Declines in domestic production of liquid transportation fuels have increased Mexico’s use of foreign sources of refined petroleum products.”

Valero is a petrochemical company that sells, manufactures, and transports fuel worldwide. Operating in three segments: refining, renewable diesel, and ethanol, Valero stands to continue benefiting from disruptions in the worldwide oil and product markets amid the uncertain outlook of Russia’s invasion of Ukraine. Spiking natural gas prices in Europe, refinery closures, and sanctions that have curtailed the export of crude oil from Russia have exasperated shortages yet provide strong tailwinds for U.S. refiners and cost advantages.

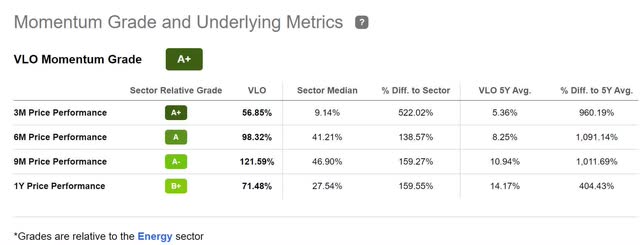

Although the stock’s valuation grade of C- is not ideal, we still consider the company fairly valued given its large Gulf Coast footprint, bullish momentum, and the strong conditions that should benefit shareholders. Year-to-date, the stock is +82%, and over the last year, it has been +71%. Valero’s quarterly share price performance is excellent, as evidenced by the A+ momentum grade.

VLO Momentum Grade (Seeking Alpha Premium)

Steady quarterly increases in overall price-performance have enabled the company to outperform its sector peers. In addition to the company’s solid balance sheet, high demand for oil products and limited supplies should position VLO well for greater shareholder returns and future growth and profitability. VLO resumed repurchasing shares in Q1 2022 and declared a cash dividend of $0.98, another positive in considering this stock for portfolios.

VLO Growth And Profitability

Fuel remains at record highs. Thus, energy stocks stand to gain from the increasing prices. Although speculators believe that energy and oil may have peaked or are approaching peaks, we think that given current supply-demand dynamics, there is more room for upside, and fuel has not reached its peaks. Even if the Fed manages to curtail inflation which would likely dampen demand, we believe Valero is a name worth investing in for the long-term in the sector. The energy sector continues to trend up, especially when comparing other S&P 500 sectors, and energy is always in demand as a necessity rather than a discretionary item. With 17 analysts’ upward revisions in the last 90 days, given VLO’s strong growth prospects, profitability metrics, and overall financials, VLO is one of my Top 5 S&P 500 Stock Picks to Buy Now.

VLO’s year-over-year revenue growth is strong, outperforming its peers by more than 50%. Q1 2022 resulted in top-and bottom-line beats; EPS of $2.31, beating by $0.66, and revenue of $38.54B, beating by $6.31B. In addition to a reduction in long-term debt by $750M, Valero’s refining segment also generated $1.45B of operating income in Q1 2022, and 73% of its sales were generated in the U.S.

VLO Growth Grade (Seeking Alpha Premium)

May data showed continued declines in China’s oil exports. As China tightens its stranglehold, “data suggests US refiners will enjoy record margins until China elects to export their strategically valuable refined products, Russia ramps oil product export volumes, or the West works to undo decades of energy policy.” This, among other factors, should benefit Valero’s profits and long-term dividend growth.

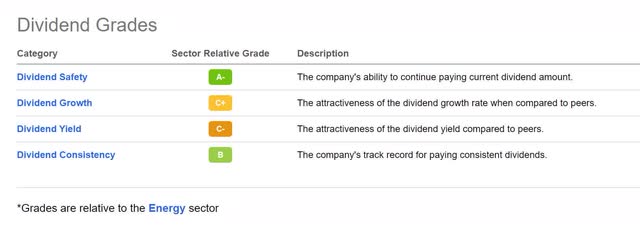

VLO Dividend Scorecard (Seeking Alpha Premium)

High-quality assets are in demand. Valero is an excellent option for investors looking for a solid income stream. With an A- dividend safety rating, 2.79% forward dividend yield, 24 consecutive years of dividend payments, and strong fundamentals.

“Dividend growth investors are in a terrific spot as the company’s balance sheet is recovering quickly, leaving room for high dividend growth and accelerating share buybacks,” writes Seeking Alpha Contributor Leo Nelissen.

Although fear is moving the markets, consider adding stock like Valero to a portfolio, given its attractive metrics.

Commodities and Agricultural Stocks

Depending on the upcoming FOMC meeting, the outcomes for commodities may or may not crater demand and take the boom to bust, given they have a target on their back from the Fed, which wants to control inflation. The most significant unknown will be oil because there’s so much uncertainty around “green initiatives” restricting traditional fossil fuel investments; the war between Russia and Ukraine; and the Eurozone being forced to look for outside resources given supply chain issues impacting the supply-demand dynamics.

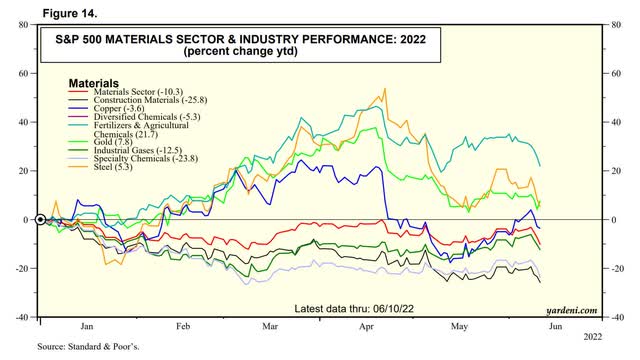

S&P 500 Materials Sector YTD Performance (Yardeni/Standard & Poor’s Research)

Nevertheless, the appetite for commodities is bustling despite inflation and headwinds, with the fertilizer and agricultural industry +21.7% YTD. As such, our next two stock picks showcase why their strong buy ratings make them great considerations for a portfolio.

2. Mosaic Company (NYSE:MOS)

-

Market Capitalization: $19.42B

-

Quant Rating: Strong Buy

-

Quant Sector Ranking (as of 6/10): 11 out of 274

-

Quant Industry Ranking (as of 6/10): 4 out of 13

Leading potash producer and ranked in the top five potash producers globally, the Mosaic Company, through its subsidiaries, markets the potassium-rich salt mined from seabeds used in fertilizers to support crop yields. Making up approximately 50% of its profits, and as the world’s biggest phosphate producer, Mosaic’s vertical integration of phosphate assets allows it to mine its own phosphate rock as a key feedstock ingredient.

One of the advantages of Mosaic’s vertical integration is it provides a cost advantage. When rock prices are high, Mosaic is a price maker rather than a price taker. Because fertilizer companies are shattering records to keep up with demand, Mosaic is a Top Stock for a Fed Rate Hike to watch.

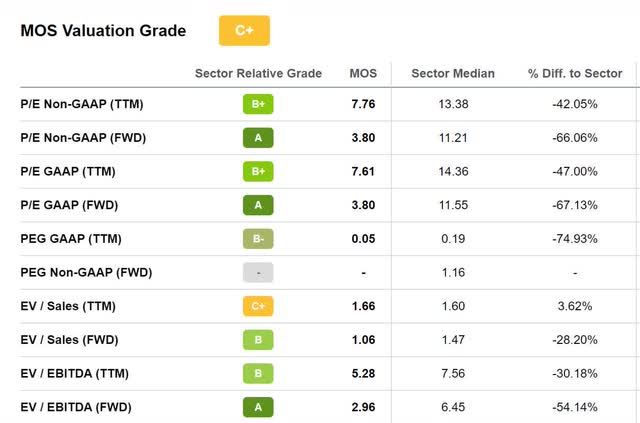

Mosaic Valuation & Momentum

Mosaic has a C+ valuation grade when trading at a relative discount, and near the middle of its 52-week range, Mosaic has a C+ valuation grade. MOS’s forward P/E of 3.80x is at a 67% discount to its sector peers.

MOS Valuation Grade (Seeking Alpha Premium)

MOS has forward EV/Sales of 1.06x, a -28% difference to the sector, indicating that it is relatively undervalued with tremendous quarterly price performance.

Over the last year, Mosaic’s momentum has been extremely bullish, with its share price activity outperforming the sector median nearly ten times over six- and nine-month periods.

MOS Momentum Grade (Seeking Alpha Premium)

Mosaic is one of the top performers in its sector and industry and has an excellent runway and A+ momentum grade. As we look to the future of MOS, consider its incredible growth and profitability.

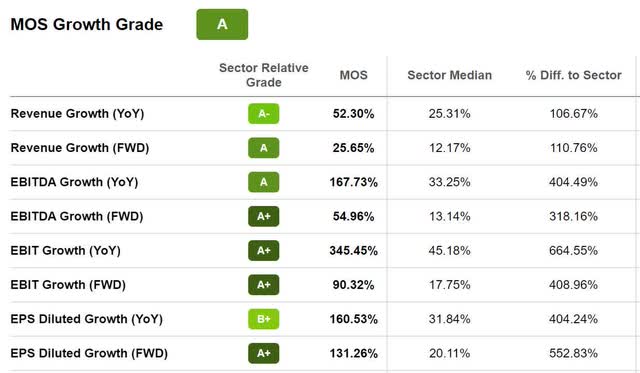

Mosaic Growth & Profitability

Agricultural prices are at multi-year highs with no shortage of demand, yet many fertilizers piling up in Brazilian ports could indicate a price drop. Brazil imports approximately 85% of its fertilizers, and despite the surge in prices, market volatility, and last week’s decline, farmers are holding out on purchases. “Farmers have the expectation that prices will keep falling after declines last week and in the previous one. So they’ll wait for further decreases to buy,” according to Marina Cavalcante, Bloomberg Green Markets analyst. Despite this “strategy,” people have to eat, and farmers will have to continue purchasing at some point.

Mosaic is focused on increasing production because it has been the benefactor of the conflict abroad, serving as a means of inflation-proofing investment. Referring back to the Figure 14 chart above, fertilizers and agricultural chemicals are up more than 21% YTD, which is why Mosaic has taken steps to be more operationally efficient, benefitting from its cost position, strong cash flow, and ramping up production at its new K3 mine at Esterhazy.

MOS Profitability Grade (Seeking Alpha Premium)

Given the recent CPI of 8.6%, even if farmers are successful in waiting for price declines and food inflation experiences slowing, the annual rate for 2022 will be the highest since 2008, posing some of the sector’s most significant gains, hence, our strong buy recommendation for MOS. As we look at the profitability and growth grades, this company is sitting pretty, despite headwinds and an EPS miss in Q1 of $2.41 by $0.01 and revenue of $3.92B, missing by $125M.

MOS Growth Grade (Seeking Alpha Premium)

Strong pricing in the sector allowed MOS to offset input costs, and the need for crop nutrients should persist because fertilizers and agricultural chemicals are at the forefront of supply chains, food shortages, and rising prices.

“Phosphate segment adjusted EBITDA totaled $632 million, reflecting the impact of strong pricing, which more than offset higher input costs. Potash also benefited from higher prices, as well as the transition to Esterhazy K3, and the elimination of brine inflow management costs. As a result, segment-adjusted EBITDA totaled $651 million…Looking forward, we continue to see agricultural market strength extending well beyond 2022,” said Joc O’Rourke, Mosaic President & CEO.

As we await the Fed’s upcoming decisions and inflation continues to leave its mark, Mosaic maintains its discounted price, has tremendous fundamentals, and can pass costs onto consumers while increasing its profits. Mosaic is virtually inflation-proof, encompassing food as a necessity. As sanctions persist throughout Europe, potash and nitrogen-producing companies like MOS are capitalizing, like our final stock pick, Nutrien.

3. Nutrien (NYSE:NTR)

-

Market Capitalization: $48.90B

-

Quant Rating: Strong Buy

-

Quant Sector Ranking (as of 6/10): 22 out of 274

-

Quant Industry Ranking (as of 6/10): 6 out of 13

Canadian-based fertilizer and agricultural chemical company Nutrien Limited is the world’s largest crop nutrient company by capacity and the largest agricultural retailer in Australia and North America. Like Mosaic, Nutrien offers potash, phosphate, and other products and benefits from strong global demand and continued food shortages worldwide. As a result of the scarcity, NTR is focused on increasing production, its acquisition strategy, and expansion, including the recent announcement of plans to build the world’s largest clean ammonia plant in Louisiana.

Nutrien has tremendous momentum. As one of the world’s largest potash and nitrogen fertilizer producers, high prices are likely to remain above marginal costs of production unless the sticker shock and buyers’ refusal to pay astronomical prices continue to send nitrogen prices down. If parts of the world are unwilling to pay, how will they sustain themselves? But given that companies like NTR and MOS are essential in growing food – MOS and NTR seem to be unphased, with NTR announcing last week that it’s boosting production and planning a $2B buyback of shares.

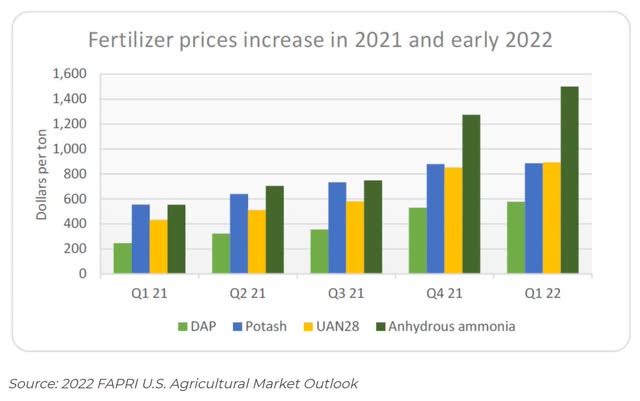

2021 to 2022 Fertilizer Price Increases

2021 to 2022 Fertilizer Price Increases (AGweb.com)

It’s clear that fertilizer prices have experienced a rally, and with the Russia-Ukraine conflict unclear, Nutrien is seeing some of its most significant gains. The above chart highlights the change in fertilizer prices from 2021 to 2022 and the benefits to companies in the industry.

“Russia’s invasion of Ukraine has brought about a massive amount of logistic disruption to what was already a tight market, with low inventories and high prices. Moreover, the recent sanctions facing Russia have complicated how Russia’s businesses could be paid for their potash and crops, not to mention Belarus’ ability to feasibly export potash out of the country. Given this context, together with the fact that Nutrien is providing investors with compelling 2022 guidance makes this investment highly compelling.” –Michael Wiggins De Oliveira, Seeking Alpha Contributor.

The compelling guidance makes very clear why we believe NTR is a strong buy and why its bullish momentum persists.

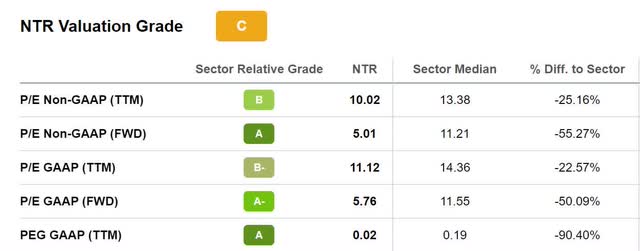

NTR Momentum & Valuation

Nutrien maintains bullish momentum, with an overall A momentum grade. The stock is among the top performers in its sector and industry, significantly outperforming its sector median peers, as evidenced by the figures below.

NTR Momentum Grade (Seeking Alpha Premium)

Nutrien has maintained a strong buy rating for nearly one year, and given its relative discounted price, adding it to a portfolio given its momentum could pay dividends.

Nutrien’s valuation is fair and at a relative discount to its peers. The stock’s current forward P/E of 5.76x is at a 50% discount, and NTR has a PEG (TTM) ratio of 0.02x, a -90.40% difference to the sector, indicating that it is undervalued. This stock is priced fairly at the current price point and upward trend over several quarters.

NTR Valuation Grade (Seeking Alpha Premium)

As we look to the future of NTR, consider its incredible growth and profitability, including increased 2022 EBITDA guidance by 47% amid food shortages and strong global demand.

Nutrien’s Profitability & Growth

With cost advantages around potash and nitrogen production, coupled with the tailwinds of global supply chain disruptions, this stock offers a solid outlook and limited demand slowing. Agricultural prices are at multi-year highs, and European competition is being crippled. Nutrien can ramp up production to compensate for shortages at better costs, which should translate into significant profits.

NTR Profitability Grade (Seeking Alpha Premium)

NTR has substantial cash from operations, sitting at $3.98B. As production continues to ramp up and nations worldwide experience declines in arable land, this bodes well for Nutrien as growers will have to seek out companies with the proper nutrients and tools to increase their yields.

NTR Growth Grade (Seeking Alpha Premium)

Possessing excellent profitability and growth, Nutrien Ag Solutions delivered a record Q1 adjusted EBITDA of $240M and has experienced year-over-year revenue growth of 45.60%. Forward EBIT growth is an A+ at 117.98%, more than a 564% difference to its sector. Although Q1 2022 EPS of $2.70 missed by $0.08 and revenue of $7.45B missed by $173.40M, given some of the demand disruptions, demand rationing, and changes to trade patterns given geopolitical conflicts. However, it is making adjustments and has increased its guidance.

“Given the significant changes in market fundamentals, we have increased our 2022 adjusted EBITDA guidance to $14.5 billion to 16.5 billion. At the midpoint, this represents a nearly 50% increase from our initial full-year guidance in February…We are projecting retail adjusted EBITDA between $1.8 billion and $1.9 billion, as crop nutrient and crop protection margins are expected to be stronger than previously anticipated. Crop prices had risen materially since the beginning of the year, and we expect growers will be incentivized to maximize yields, which typically contributes to strong in-season demand for crop protection in specialty nutritional products. Similar to previous years, we expect 60% to 65% of retail’s adjusted EBITDA to be generated in the second quarter. We significantly increase our Potash adjusted EBITDA guidance due to the expectation for higher realized prices, and increased sales volumes.” –Pedro Farah, Nutrien CFO.

As Nutrien continues to ramp up for growth and profitability, consider this stock pick which remains at a discount, along with Mosaic and Valero.

Concluding Summary

There’s no telling what the Fed will decide at the upcoming FOMC meetings. Will fear continue to move the markets? Will there be a recession? Whatever the Fed’s decision on monetary policy, it’s crucial to be on alert for tips and investments that can prepare you for periods of downturn or upside.

There are many sectors to consider when inflation- and recession-proofing a portfolio. Our three strong buy recommendations, VLO, MOS, and NTR are not luxury goods – rather essential – and stand to benefit from price increases. They possess great outlooks and collective characteristics, with tailwinds for continued momentum, growth, and profitability.

Elevated prices are foreseeable. As we wait in suspense for the upcoming FOMC decisions and whether there will be similar, lower, or higher, rate hikes, one thing is for sure. Commodities – energy and agricultural companies – have been rallying. These sectors and stocks should continue to experience tailwinds to outperform major asset classes and serve as hedges against inflation. There is no clear understanding of when the conflict between Russia and Ukraine will end, which bodes well for our stock picks.

Each of our strong buys plans to ramp up production, and we expect them to take advantage of rising prices and shortages sweeping the globe. NTR, VLO, and MOS are undervalued and can pass costs onto consumers, increasing their profits and maintaining bullish momentum. While demand destruction, either from increased prices or a recession, is one of the largest risks, we believe that elevated prices are likely to persist, even with the Fed’s help to curb inflation.

Finding knowledgeable investment resources is a great way to be a successful investor in volatile markets. Consider using Seeking Alpha’s ‘Ratings Screener’ tool to help you find stocks that achieve diversification into desired sectors you like.

Be the first to comment