Best Buy Co. (NYSE:BBY) is a renowned retail stock, which I believe has proven to be a winner, despite immense challenges thrown its way, and therefore is a clear buy. Where many assumed the COVID-19 pandemic would be the grim reaper for BBY, the stock has exceeded analysts’ expectations and risen to the top. I believe this is a clear indication of the stock’s perpetual rise to the top, which no shock or threat has managed to slow down.

Eoneren/E+ via Getty Images

Overview

Best Buy Co is a North American tech retail giant, employing over 100,000 individuals across all its locations in the US and Canadian markets. Best Buy has become synonymous with consumer electronics and has proven itself to be a clear market leader in the lucrative American consumer market. It was incorporated in 1966 under the name ‘Sound of Music’ and has transformed over the decades from its early beginnings as a successful stereo supplying business.

BBY’s Market Sustainability

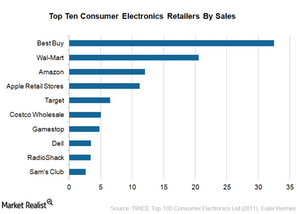

Best Buy holds a unique position in the electronics consumers market as an established player with a brick-and-mortar business model in a world where the mainstream is increasingly defined by e-commerce services. Focusing on the US market alone, in 2011 the company held the highest market share amongst competitors that included giants such as Amazon (AMZN) and Walmart (WMT).

Market Realist

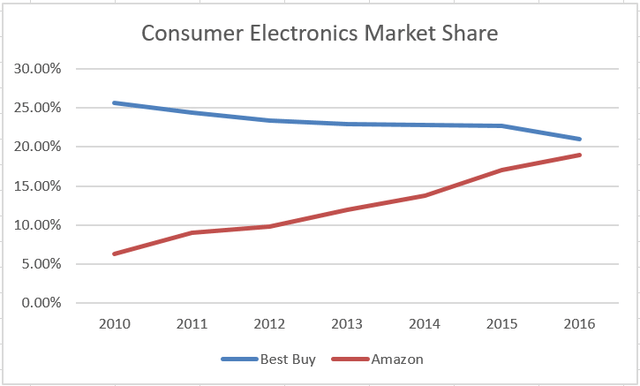

The 2010 however was a dynamic period for the retail industry with technological advancements pushing for e-commerce to advance beyond the fringe market, setting its sights on the mainstream. This advancement can be observed in the relative market share movements comparing Best Buy to Amazon up towards 2016. A major driver behind this shift had been dynamic shifts in the market, owing to the mainstreaming of digital services, social media, and a broader acceptance of tech-oriented solutions to conventional problems. Players such as Amazon, Alibaba.com (BABA), and others were keen to cash in on the opportunity, with brick-and-mortar stores such as Best Buy increasingly being pushed to undertake significant shifts to continue their status in the dynamically shifting markets.

The COVID-19 pandemic acted as a catalyst for this transformation, which temporarily jolted industries into an entirely new digital and contactless domain. The impact had been felt on BBY stock price, falling from over $90 to almost $50, in a single month. This panic-induced mass sell-off had proven to be temporary and stabilized following clarity on the company’s financial sustainability and ability to strategically adapt to face off the disruptive innovation threatening its prospects.

The stock has climbed by 83% in the two years that followed its low during the outbreak of the COVID-19 pandemic in March 2020. It had managed to surpass analysts’ earnings expectations despite the disruptions that had been brought about as a result of the COVID-19 pandemic. One primary reason as to why the stock saw a recovery was due to its strategy to shift toward a more modernized, and digital era-appropriate business model, as far back as 2016. Same-day delivery became a core commercial strategy for the business by 2017 after it had enhanced the number of metro areas, more than doubling the figure from 13 to 27. The degree to which these strategic initiatives have proven successful in retaining its position as the market leader is reflected in its financial performance over the years.

The impacts of the COVID-19 pandemic were a wake-up call for Best Buy which, in many ways, forced a strategic realignment of its commercial approach. At the immediate onset of the pandemic, the company decided to move to a contactless model, which included curbside-only sales, and a temporary suspension of in-home deliveries and consultative services. These measures were subsequently withdrawn, as COVID-related restrictions eased with increasing vaccination numbers.

The nature of the Best Buy business model is such that it has ensured exposure to the growing tech innovations that dot the various markets. By establishing a brand name as a tech consumer retail giant, Best Buy is likely to cash in on developments that take place in the tech sphere. The company acts as a go-to link ensuring consumer access to rapid market developments. Analysts further point out that BBY is extremely well-positioned to win big in the emerging metaverse phenomenon, which could push the company as a retail tech leader in the coming years.

Best Buy’s Financial Assessment

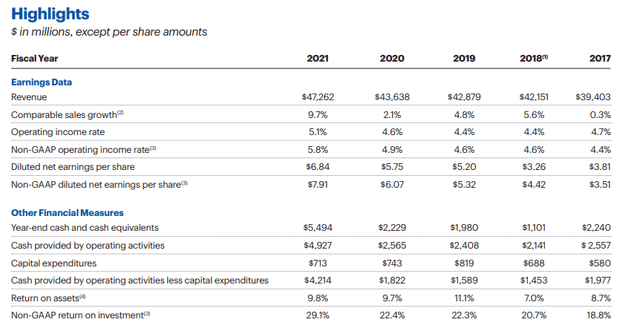

To ascertain the impact of the COVID-19 pandemic, and the ability of Best Buy to strategically adapt to shifting dynamics, we can take a look at how the company’s financial performance has fared over the years.

On an annual basis, 2021 delivered the highest revenue growth rate of 9.7% for the year 2021. The relaxation of COVID-19-related restrictions had translated into higher volumes of customers for the company. Similarly, BBY’s operating income rate was also at its all-time high for 2021, signaling a comeback for the stock, from an earning’s standpoint.

Similarly, Best Buy has consistently managed to improve its liquidity position over the years, despite the global shockwaves, and economic disruptions it had faced throughout the years. This portrays the low level of credit risk the company holds, indicating BBY to be a relatively safe investment. This liquidity boost had come about because FY21 had proven phenomenal for the company, delivering a record level of $4.9 billion in cash from operating activities This amount came at a 92% increase from the 2020 figure of $2.5 billion.

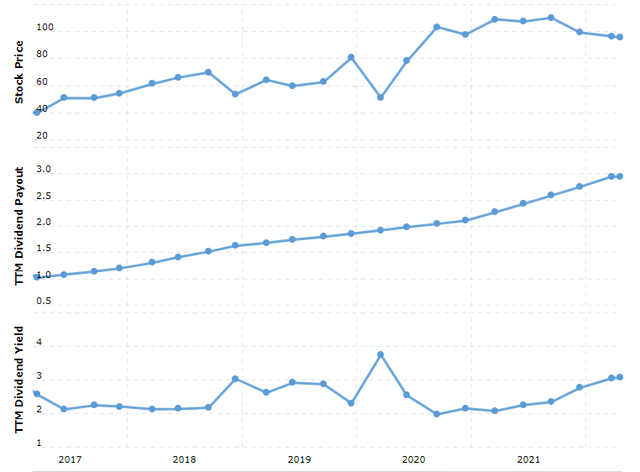

Moreover, the stock’s increasing performance over the years, despite macroeconomic and market challenges faced, has consistently shared in on these gains with its shareholders. This can be reflected in the dividends yield trend seen across the years.

The dividend payout has consistently risen, with its dividend yield as of April 2022 being marked as 3.68%, with its TTM dividend payout calculated at $3.52 per share.

These indicators point to Best Buy’s financial sustainability standing unaffected owing to the threats of dynamic shifts. This success is in large part attributable to the company’s growth strategy which has managed to refocus its business model and commercial activities in line with broader changes.

Current Market Share Scenario

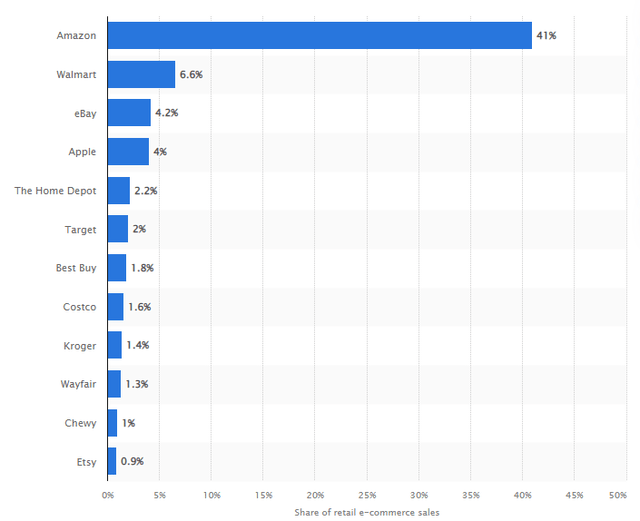

Looking towards the present market share scenario, Best Buy holds a market share of 1.8% within the US market. Whilst this does indicate a substantial shift from its position as a market leader in 2011, it simultaneously indicates the company’s resilience and remarkable financial performance. Despite the dynamic shifts of the previous decade, BBY still stands as a significant player amongst the top 7 in the retail market in terms of e-commerce sales. This does not include the primary portion of Best Buy revenue, which is carried out in the company’s physical stores.

As a company that is just beginning to realize the potential of the e-commerce domain, Best Buy has a tremendous growth spurt yet to achieve. The company’s brand reputation as America’s giant electronics retailer will most likely act as a core strength in achieving this strategic vision.

Valuations & Competitive Analysis

|

Ticker |

Company |

Industry |

Market Cap ((B)) |

Forward P/E |

P/S |

Dividend Yield |

EPS ((TTM)) |

Institutional Ownership |

Return on Investment |

Price |

|

BBY |

Best Buy Co., Inc. |

Specialty Retail |

21.6B |

8.95 |

0.42 |

2.97% |

9.85 |

84.60% |

58.00% |

94.40 |

|

AMZN |

Amazon.com, Inc. |

Internet Retail |

1,606.9B |

42.46 |

3.42 |

64.71 |

60.40% |

9.50% |

3,079.96 |

|

|

CONN |

Conn’s, Inc. |

Specialty Retail |

411.5M |

7.66 |

0.26 |

3.6 |

91.30% |

11.80% |

16.54 |

|

|

GOED |

1847 Goedeker Inc. |

Internet Retail |

145.91M |

6.32 |

0.4 |

-0.43 |

34.10% |

4.20% |

1.39 |

|

|

GME |

GameStop Corp. |

Specialty Retail |

11.4B |

– |

1.89 |

-5.19 |

26.90% |

-22.60% |

148.50 |

|

|

WMT |

Walmart Inc. |

Discount Stores |

439.66B |

21.93 |

0.77 |

1.40% |

4.88 |

32.60% |

14.30% |

159.63 |

To determine the degree of the company’s market standing, we need not look further than BBY’s relative position against similar businesses models, each of which stands in direct competition with Best Buy.

BBY has a forward PE ratio of 8.95 which is substantially lower than that of giants such as Amazon and Walmart, each of which is a direct competitor to Best Buy. This indicates that a single dollar of future BBY earning is far less costly than the same metric for Amazon ($42.46) and Walmart ($21.93). This suggests BBY as being potentially undervalued.

With a price-to-sales ratio of just 0.42, BBY is dirt cheap compared to the S&P 500 average of 2.85 and rivals, such as Amazon, which trades for 3.42x.

Similarly, BBY’s EPS of $9.85 per share stands second only to Amazon, which has a market share that is over 70 times higher than that of Best Buy. On EPS, BBY surpasses Walmart with its EPS of $4.88 per share, and GameStop with its -$5.88 per share.

Looking toward institutional ownership, BBY holds the highest proportion of 84.6%, further indicating it as being a relatively safe investment, with a sustainable business model, as deemed by the rigorous evaluation criteria of institutional investors. From an investment standpoint alone, the ROI figure of 58% is far above that of any comparable stock, with the closest competitor being Walmart with its figure of 14.3%. This highlights that BBY is by far the most efficient business model amongst comparable options.

These comparative metrics reinforce the notion that Best Buy has not only managed to survive the dynamic shifts of the last decade, catalyzed by the COVID-19 pandemic but has managed to thrive in many respects to its direct competitors.

Conclusion

Best Buy is a company that has proven well prepared to face its challenges head-on and thrives despite the threat of disruptive innovation. Having prepared for the dynamic shifts of the e-commerce phenomenon, rising in the 2010s, the company stood well prepared to excel, despite the severe COVID-19 challenge, that brought global industries to a standstill. For these reasons, I strongly feel that buying BBY is a wise investment decision, which would ensure long-term growth, on a perpetual basis, whilst delivering efficient returns for shareholders.

The nature of the Best Buy business model positions it to capture gains from technological developments. It does this by providing consumers with retail access to a wide range of tech products. This phenomenon is likely to continue on a perpetual basis, with the launch of new products in the constantly evolving and innovating tech space. The brand name, which was established by Best Buy in the 1960s gives it a robust advantage in this domain, making it a go-to platform for tech consumers.

I believe the company stands immune to the threat of the mainstreaming of e-commerce, and the company’s track record proves it can adapt to shifts. For this reason, I anticipate long-term growth for BBY, which is likely to persist, given the nature of its business, and the strength of the Best Buy Brand.

Be the first to comment