RiverNorthPhotography/iStock Unreleased via Getty Images

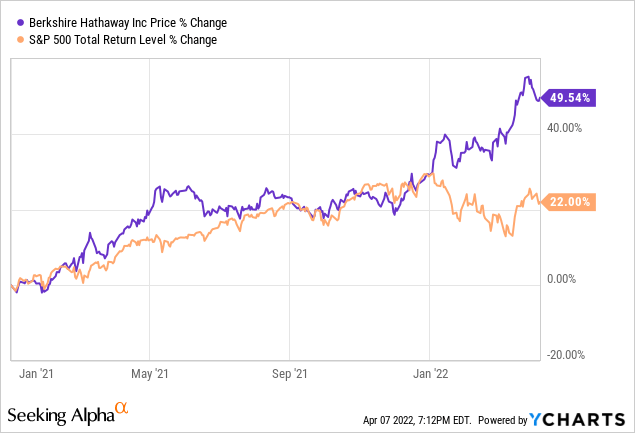

Berkshire Hathaway (NYSE:BRK.A) (NYSE:BRK.B) seems to finally be getting the respect it deserves. Berkshire rose 18% in Q1, significantly beating the S&P 500 which fell 4.6%.

More impressively, it jumped this much without a lot of help from its equity holdings, which were up less than 1%.

Q1 Holdings Update

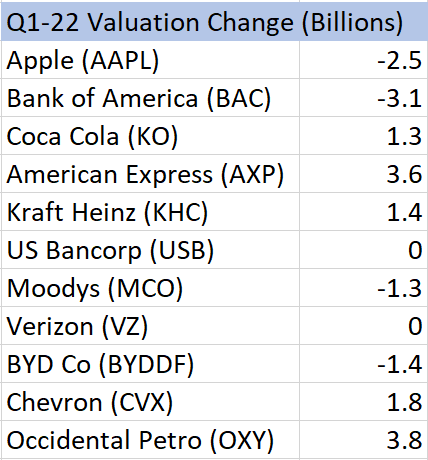

The value of Berkshire’s investments in equity securities excluding Kraft Heinz (KHC) was up less than 1% to $337.2 billion from $334.5 billion last quarter, with strength from Occidental (OXY), Chevron (CVX), and American Express (AXP) offsetting weakness from Apple (AAPL) and Bank of America (BAC). This is good performance for Berkshire’s portfolio with the S&P 500 down nearly 5%.

Author

From the $2.7 billion gain, after increasing the liability for future income taxes on the balance sheet as “income taxes, principally deferred” and subtracting 21%, we see a net book value gain of $2.2 billion for Q1.

Q1 Operating Earnings

Insurance underwriting should produce a gain. Lingering claims from Hurricanes Ida and Harvey should be done, auto claims may have dipped slightly as Omicron extended work from home and slowed travel.

I’ll estimate a $650 million gain for this quarter.

Insurance investment income should come in around $1.25 billion. The billion dollar headwind on short-term debt will now be a tailwind. Investment income should steadily rise this year as the $147 billion in cash will be earning more in future quarters.

Railroad, utilities, and energy should show gains from last year. Railway volumes at BNSF intermodal carloads are down slightly and Q1 is one of the weaker seasonal periods for BHE.

I estimate $2 billion in earnings from this group.

Other businesses containing dozens of companies like Precision Castparts, Lubrizol, Marmon, and other industrial businesses, should continue to show gains, although I expect supply chain disruptions and higher commodity prices will impact profitability again this quarter.

I’ll estimate $2.5 billion in earnings again from this group.

Other should produce a $500 million gain as equity earnings from Kraft Heinz and Pilot, plus continued strength in the US Dollar, offset the usual expenses (mostly amortization from past acquisitions.)

In total, I expect Q1 operating earnings around $6.9 billion.

Current Book Value

As reported in Berkshire’s 2021 10-K book value as of December 31, 2021 was $506.2 billion.

Adding the net gain of $2.2 billion from the equity investments to $6.9 billion in operating earnings, I project Q1-22 book value at $515.3 billion.

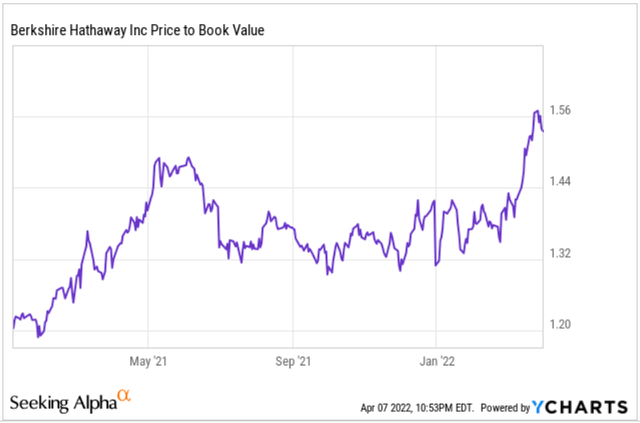

Author/yCharts

Berkshire’s market cap as of March 31st was $780 billion. Dividing this by $515.3 billion yields a Price/Book Value of 1.51x for Q1.

2022 Outlook and Recommendations – Predicting a Berkshire dividend in the next 12 months

At the end of last year, I commented that Berkshire traded around ~1.5x book for much of 2017-2019 and that we may revert back to that range in 2022. It didn’t take long – we’re there already.

I had also long suspected that Buffett would have preferred to repurchase far more than he was doing, but was running into limits based on Berkshire’s relatively low trading volume and the “diamond handed” nature of many long time owners. Buffett confirmed my suspicion in the annual report.

During the past two years, we therefore repurchased 9% of the shares that were outstanding at year-end 2019 for a total cost of $51.7 billion. That expenditure left our continuing shareholders owning about 10% more of all Berkshire businesses, whether these are wholly-owned (such as BNSF and GEICO) or partly-owned (such as Coca-Cola and Moody’s).

I want to underscore that for Berkshire repurchases to make sense, our shares must offer appropriate value. We don’t want to overpay for the shares of other companies, and it would be value-destroying if we were to overpay when we are buying Berkshire. As of February 23, 2022, since year-end we repurchased additional shares at a cost of $1.2 billion. Our appetite remains large but will always remain price-dependent. It should be noted that Berkshire’s buyback opportunities are limited because of its high-class investor base.

Berkshire confirmed that it had quite the appetite to repurchase at 1.3x book value, but I’m not sure how they will feel at 1.5x book value. Note again the following comment

As of February 23, 2022, since year-end we repurchased additional shares at a cost of $1.2 billion.

$1.2 billion in 7 weeks is a deceleration from the previous pace, and in those 7 weeks, the stock was under $310. It’s at $346 now. Perhaps this is not a level where Berkshire will stop repurchases entirely, but Berkshire is certainly closer to fully valued now than it was last year. I suspect we are near the ceiling for repurchases.

Maybe the broader market will decline and Berkshire will put its cash to use. In the past few weeks, Berkshire has spent $4.2 billion on HP (HPQ) shares and $11.7 to acquire Alleghany (Y), as well as more Occidental (OXY). But barring that or a significant decline in Berkshire’s value, I think Buffett may finally consider initiating a small dividend.

Time will tell. As a long term owner, I have mixed feelings about the recent surge in share price, as I was a big proponent of the repurchases. I look forward to Buffett’s outlook at the shareholder meeting on April 30th, where I’m sure this will be a topic of discussion.

Be the first to comment